Meet Sam. Sam’s entire family has terrible luck when it comes to the timing of their retirement. Sam’s great-grandparents retired at the end of 1928. Over the ensuing three years or so the stock market would drop close to 90% while the U.S. economy would contract nearly 30% in the Great Depression. In 1937, the…

How Hard is it to Become a 401(k) Millionaire?

The current retirement system leaves much to be desired. There are a decent number of people taking advantage of tax-deferred savings vehicles but it’s a fairly small number that ever reaches millionaire status in these accounts. In Fidelity’s defined contribution plan, there are roughly 157,000 people who have saved at least $1 million in their 401(k). There…

Animal Spirits Episode 78: The Re-Readables

This week’s Animal Spirits with Michael & Ben is sponsored by YCharts: Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service. We discuss: Is inflation dead? Does a more mature U.S. economy mean lower interest rates and inflation for the foreseeable future? What should we call our new podcast…

The 3 Levels of Wealth

Slack is a lot like Twitter from my vantage point. It’s a service I use all the time. It’s become an integral part of my life from both a work and social perspective. Every time I talk to someone else who uses the service they share my love for the platform. And it’s almost impossible to explain its usefulness…

A Bad Year in the Bond Market is a Bad Day in the Stock Market

A podcast listener asks: I was hoping you could try and explain the bond bubble risk. A third of my portfolio is in a Vanguard bond fund. If there is a bubble, what could I stand to lose in % terms? Here’s a short video Michael and I did on this one: The idea that…

What a Strange Round Trip It’s Been

Well that was pretty quick. Since peaking in late-September the S&P 500 ETF (SPY) now has a slightly positive total return, wiping out a nearly 20% loss: It’s hard to believe how quickly sentiment in the market can go from “the world is coming to an end and a recession has already started” to “everything’s…

Recessions vs. Bear Markets

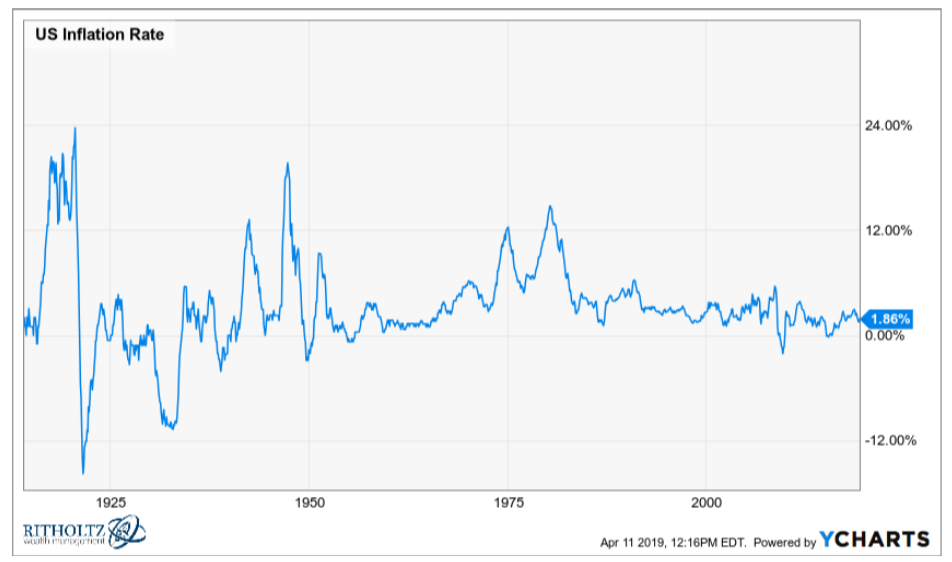

It may not feel like it after living through the Great Recession but the U.S. economy has become far more stable over time. Just look at the inflation rate over the past 100 plus years: And the contraction in GDP in each of the past 15 recessions: The Great Recession was an epic financial crisis…

Animal Spirits Episode 77: Money Made By Chance

This week’s Animal Spirits with Michael & Ben is sponsored by YCharts: Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service. We discuss: Why dividends don’t matter as much as they used to for the stock market The guy who bet $85k to win $1.2 million on Tiger winning…

The Stephen A. Smiths of Personal Finance

It was reported earlier this month that Stephen A. Smith is in line to become the highest paid on-air talent in ESPN history when he signs his new contract. He could earn between $8 to $10 million a year. People on the Internet love to point out how wrong Smith’s takes can be at times….

Why We’ll Never All Be Happy Again

There are two things people need to understand about humanity: (1) Things are unquestionably getting better over time. (2) People assume things are unquestionably getting worse over time. I love this chart from Our World in Data: This data doesn’t quite jibe with how happy people report they feel today. You can see the trend…