Well that was pretty quick.

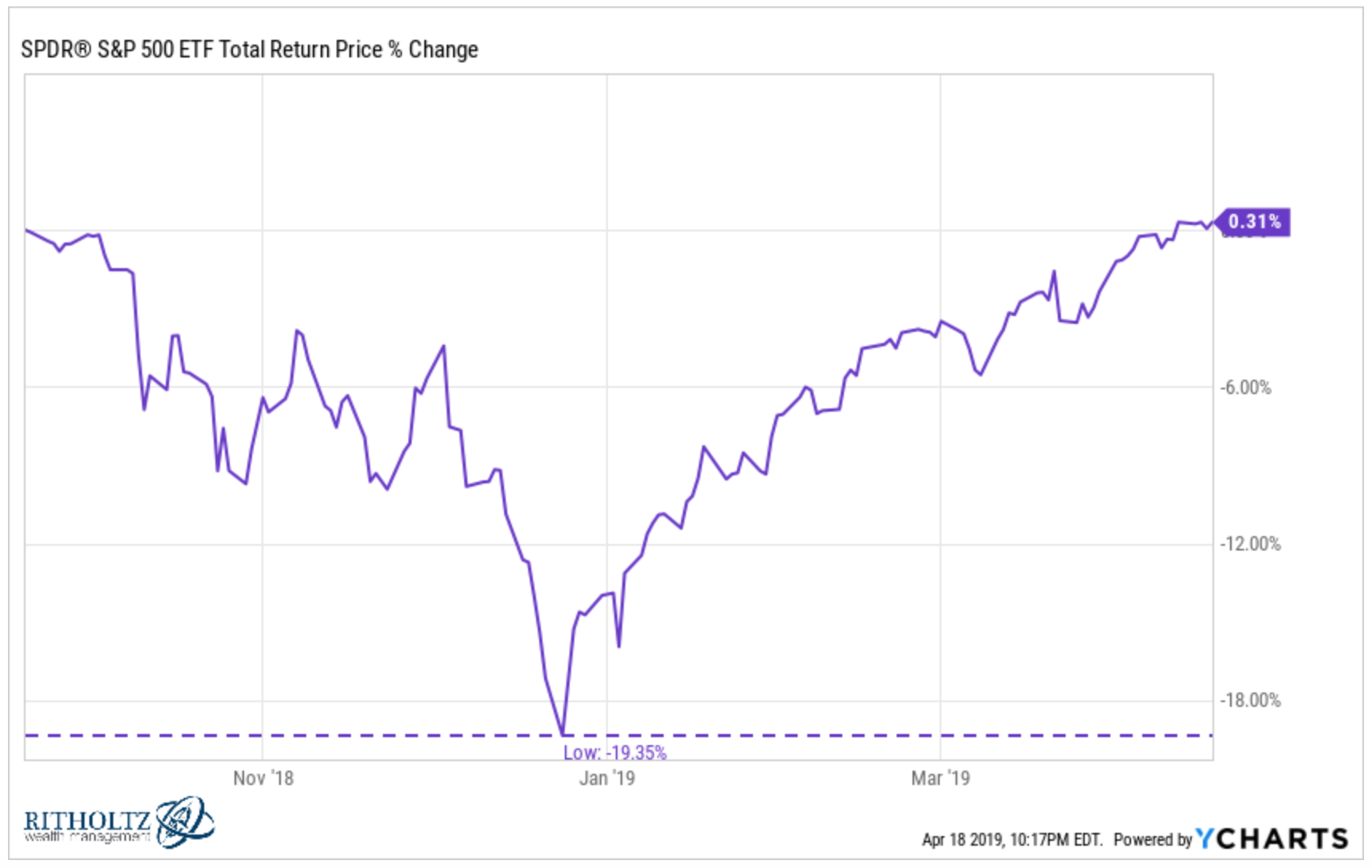

Since peaking in late-September the S&P 500 ETF (SPY) now has a slightly positive total return, wiping out a nearly 20% loss:

It’s hard to believe how quickly sentiment in the market can go from “the world is coming to an end and a recession has already started” to “everything’s fine, that was nothing to worry about.”

Price has a funny way of changing the narrative.

There have been three other times in recent history where the S&P 500 fell 19% and change in a relatively short period of time — 1990, 1998, and 2011.

In 1990 it took 86 trading sessions to breakeven from the bottom. In 1998, it took just 35 trading days. And in 2011 it took 92 trading sessions to break into the black coming off the bottom.

This time it took the S&P just shy of 80 days to breakeven from the depths of the drawdown.

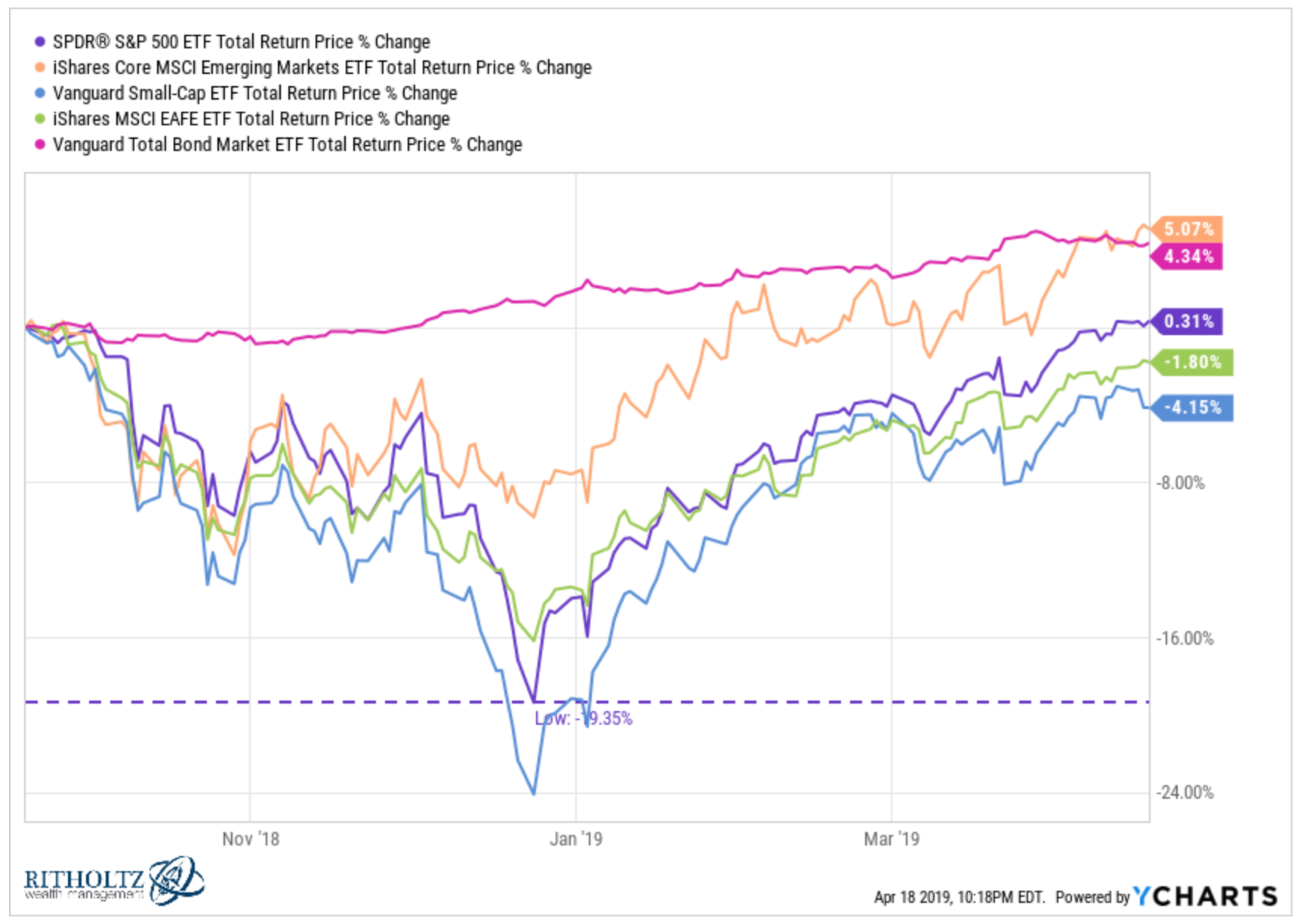

Now here’s how some of the other asset classes (foreign stocks, emerging markets, small caps, and bonds) have looked over the same time frame:

Small caps remain more than 4% below their late-September levels, but they also fell further than the S&P 500 during the downturn.

Bonds proved to be the steady hand during the stock market sell-off, which is one of the reasons you own bonds as an investor.

Emerging markets have finally outperformed, although this time period is so short trying to come up with concrete conclusions is fruitless.

Market cycles aren’t always this neat but this past six months or so are a nice microcosm of how things typically work during a downturn. Everything gets killed besides cash and bonds, no one knows when the bottom will hit, nor when the losses will be made whole, but patience is generally rewarded.

Sometimes these recoveries will take much longer. Sometimes the depths of the losses will be even worse. Surely this wasn’t the best curveball the market has to throw at us.

If you’re still in the accumulation stage of the investor’s lifecycle these periods should be welcomed with open arms. In fact, you should hope they last much longer than this period because it would allow you to buy even more shares at lower prices.

Markets don’t always bottom this quickly but this is a good reminder of the fact that putting money to work in a down market can lower your cost basis, and thus, increase expected returns when things eventually bounce back.

Lots of people assumed the end of the world was nigh in late-December. The Rasputin bull market doesn’t seem to want to give up that easily.

The big one will hit eventually but this one was not it.

Further Reading:

- Twitter should pay us (Ramp Capital)

- A study in the psychology of gambling (Novel Investor)

- 10 behavioral advantages amateurs have over professionals (Behavioural Investment)

- 8 people who will never buy your online product (Growth Labs)

- Why did we all give Tiger a second chance? (The Ringer)

- Changing behavior takes a long time (Abnormal Returns)

- Investing in the real world (Irrelevant Investor)