This week’s Animal Spirits with Michael & Ben is sponsored by YCharts:

Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service.

We discuss:

- Why dividends don’t matter as much as they used to for the stock market

- The guy who bet $85k to win $1.2 million on Tiger winning the Masters

- How it feels when someone other than you gets lucky in the markets

- Ray Dalio’s plan to save capitalism

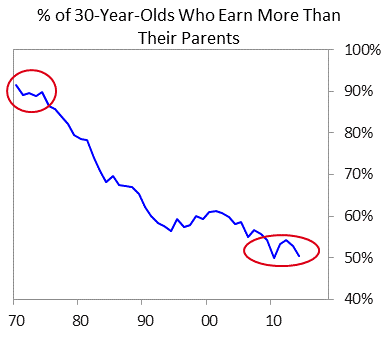

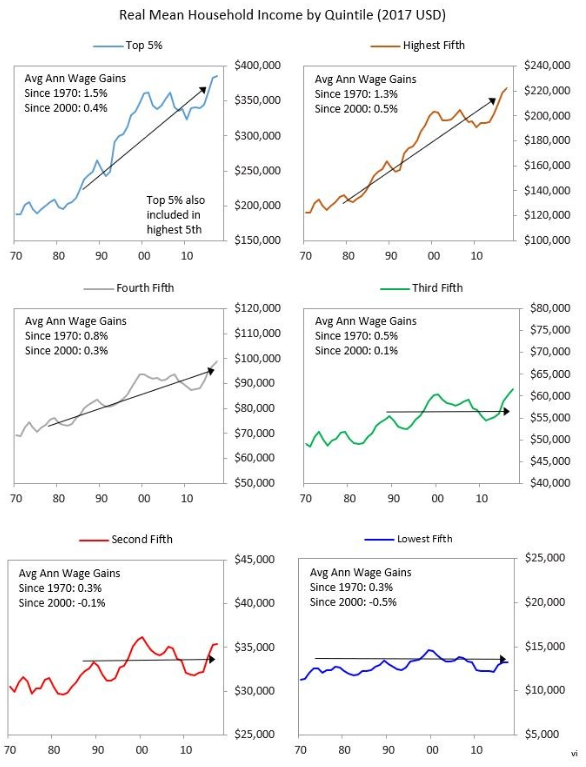

- Are we really worse off than previous generations?

- Investing in college grads

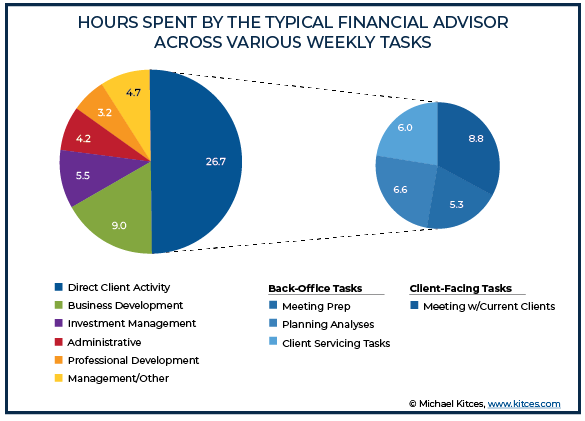

- How do advisors spend their time?

- Is Amazon really taking over the retail sector?

- How voice technology could make us screen-less in the future

- The perfect set-up for the blogger of the future

- Disney Plus is going to be huge

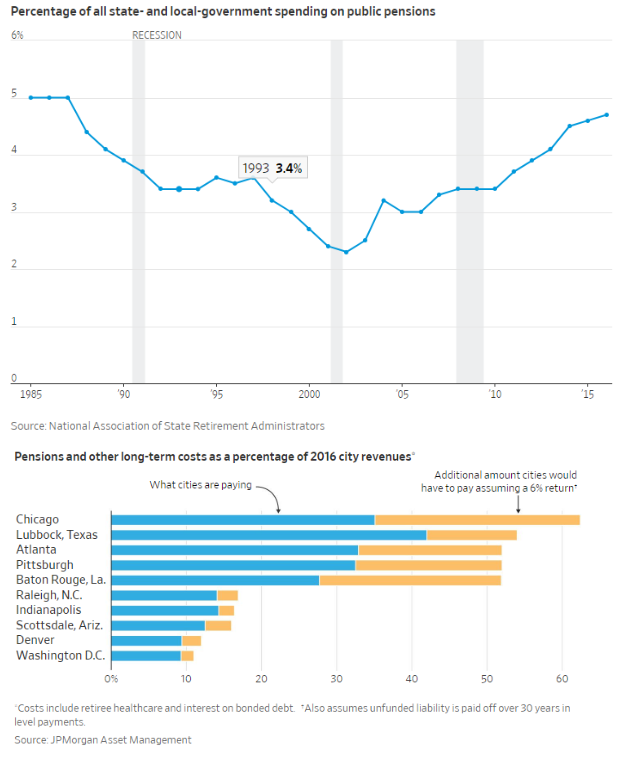

- Why didn’t the bull market help pensions more?

- Why we need more house flippers

- Where and when active management works

- When the real world throws a wrench in your investment plan

- When is the right time to meet with a financial advisor?

- The new personal finance czar

- A bad take for everything and much more

Listen here:

Stories mentioned:

- Dividends don’t matter as much as they used to

- Gambler who won $1.2 million betting on Tiger Woods

- My friend is beating me

- Why & how capitalism needs to be reformed

- College grads sell stakes in themselves to Wall Street

- Retail store closings in 2018

- 2018 Amazon Shareholder Letter

- I didn’t write this column. I spoke it

- Why the bull market didn’t fix pensions

- House flipping is back to pre-crisis levels

- Where active management has actually worked

- Don’t pay too much for dividend stocks

- $590 million Powerball winner sues advisor

- Investing in the real world

- A dad’s advice about buying a Peloton

Books mentioned:

Charts mentioned:

TV Shows/Movies/Podcasts Mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook and Instagram

Subscribe here: