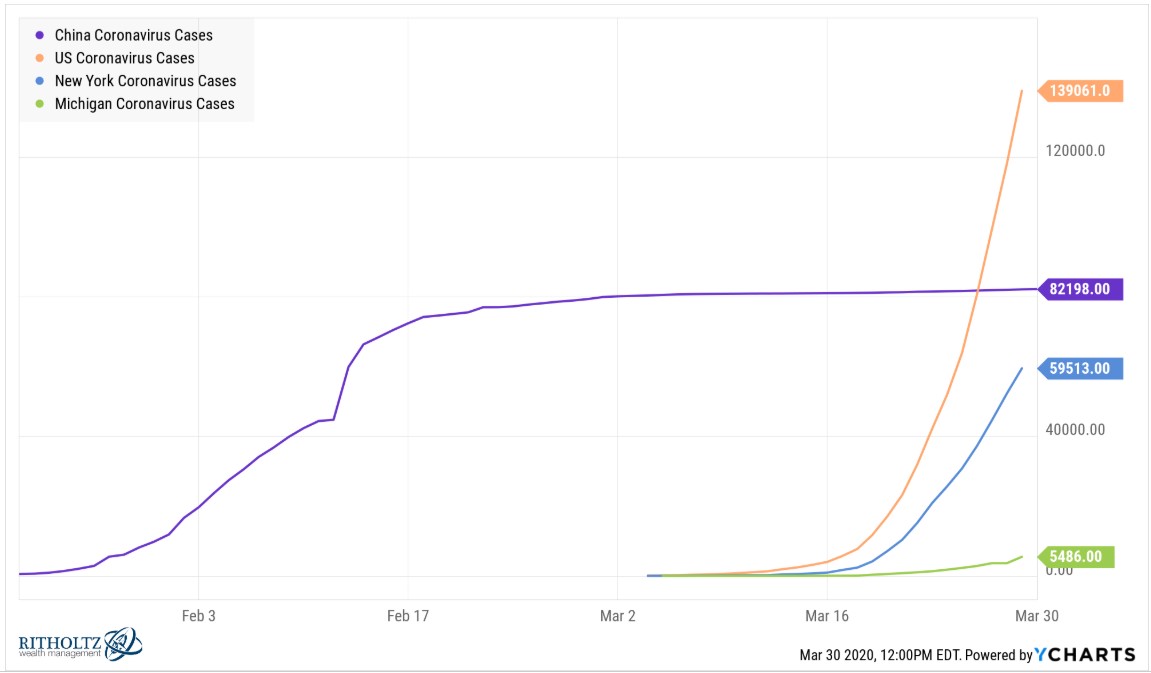

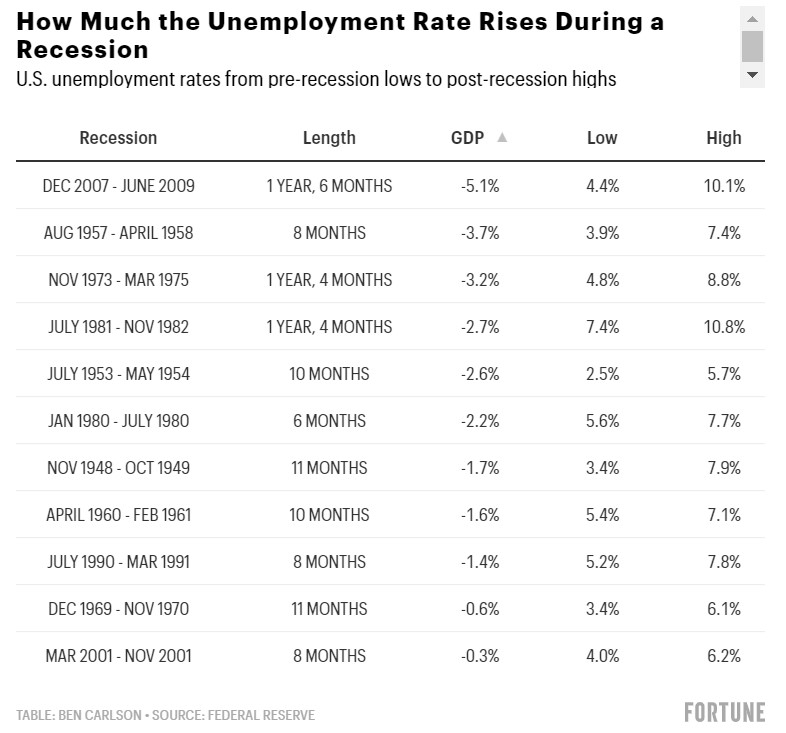

Still plenty of stuff to talk about so we’re doing two shows for the foreseeable future. We discuss: Fear and anxiety coming in waves How long until we get a vaccine? The massive collaboration in science going on March was the most volatile market ever Should we really expect companies to prepare for something like…