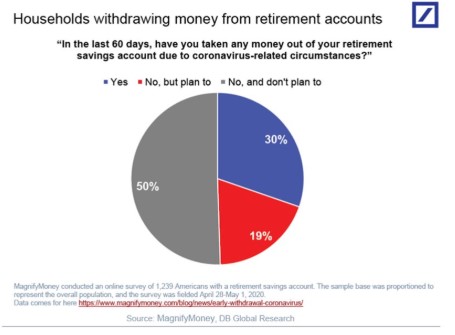

We discuss: What would a vaccine mean for the markets? Is the vaccine a sell-the-news event? Could we potentially see a stock market bubble when this crisis is over? Why is Uber’s stock price up this year? Why people are so angry at the stock market Is private equity a retail killer? What happens to…