This week’s Animal Spirits with Michael & Ben is supported by YCharts:

Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service.

We discuss:

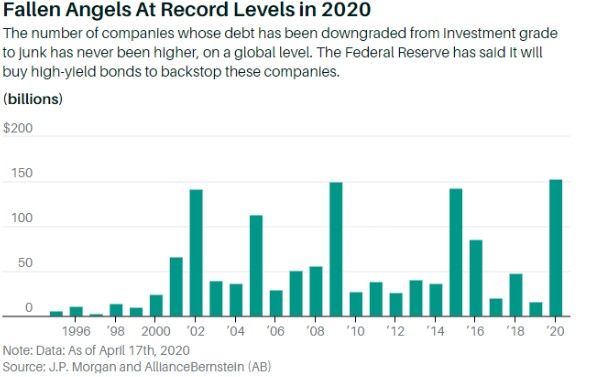

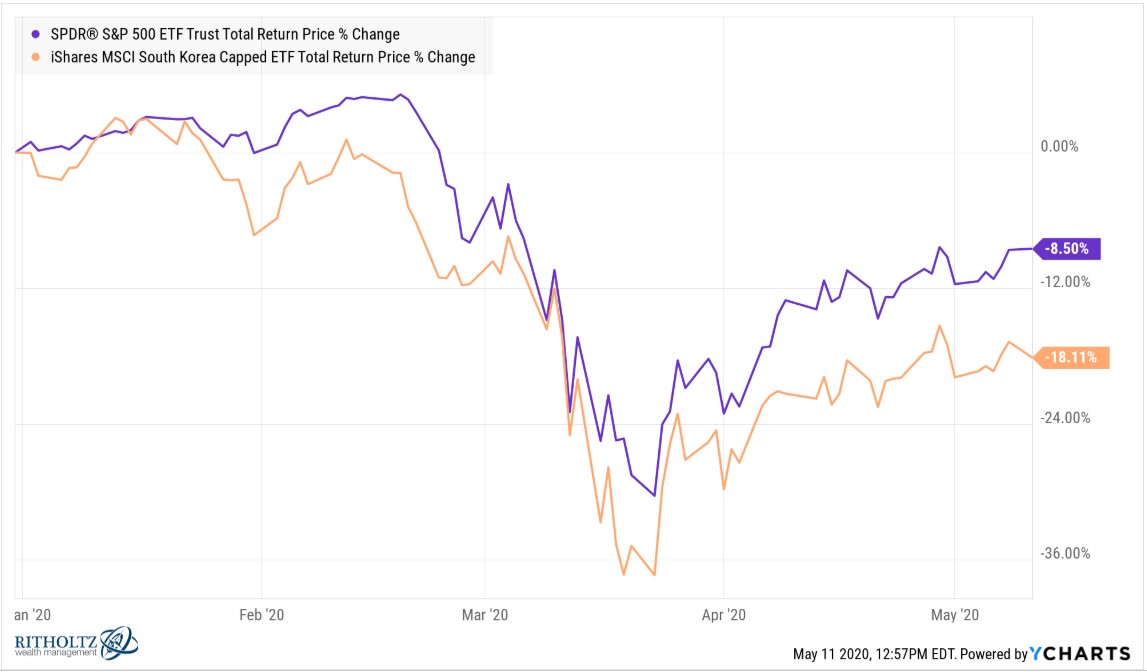

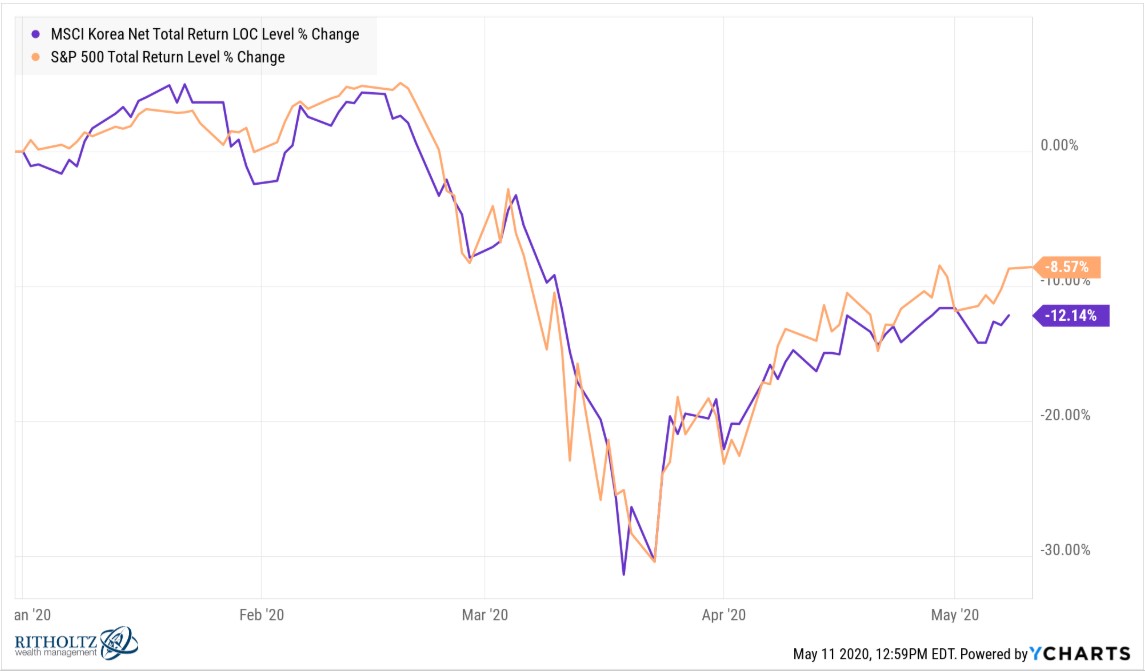

- Why aren’t stocks doing better in countries with a better virus response?

- Why portfolio managers hate the Fed

- Does it matter if the Fed buys ETFs?

- How are the airlines going to survive?

- Finding some gray area in the crisis data

- Is there price gouging going on for food delivery?

- Are white collar layoffs coming?

- Working out from home

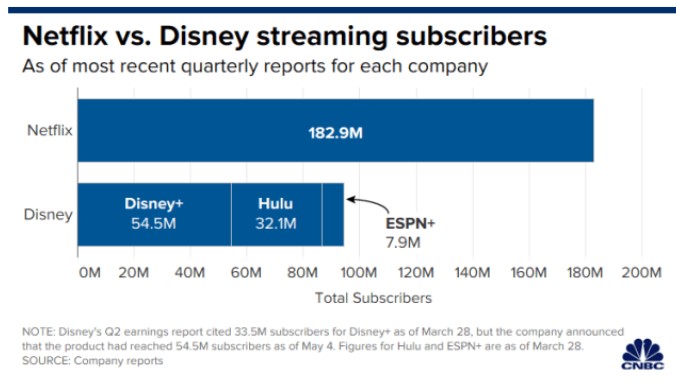

- Why-didn’t-I-invest-in-that stocks

- What if we don’t get any inflation from all this government spending?

- Why didn’t more small businesses get a loan?

- Preparing for meat shortages

- Will there be any money left for millennials for social security?

- Who lost when oil prices went negative?

- How are schools going to adapt to online learning and more

Listen here:

Stories mentioned:

- The airline business is terrible

- Shanghai Disney tickets sellout for opening day

- A message from Brian Chesky

- Airbnb booking data

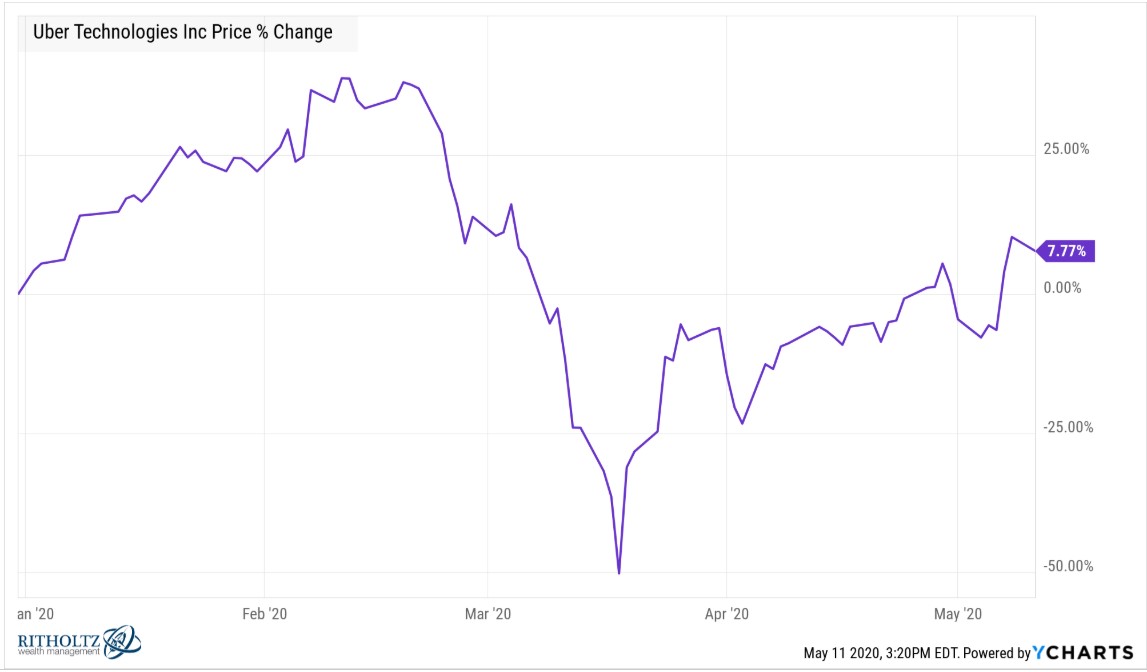

- Uber to lay off 3,700 employees

- People are panic-buying Pelotons

- The 5 types of investors in this market

- NBC Universal to cut senior management by 20%

- US Treasury expects to borrow $4.5 trillion

- Demand for small business loans cools

- Meat shortages hit restaurants

- The dumbing down of the American restaurant

- Can millennials count on social security in financial planning

- Oil crash busted broker’s computers and inflicted big losses

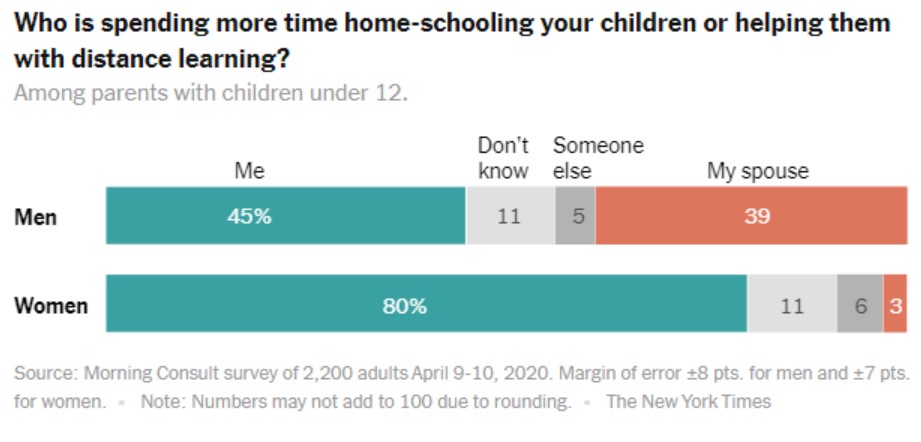

- Nearly half of men say they do most of the homeschooling. Only 3% of women agree

Books mentioned:

Charts mentioned:

Video mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on Shuffle.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: