Market prices are created by millions of different opinions, time horizons, risk appetites, investment styles and personality types.

These differences are what make a market. Otherwise, there would be few transactions and a lack of liquidity.

Investor sentiment is often based not only on what’s going on in the markets but also how people position their portfolio and view the world.

Based on market trends and my interactions with readers, podcast listeners, clients, family and friends here are 5 types of investors right now:

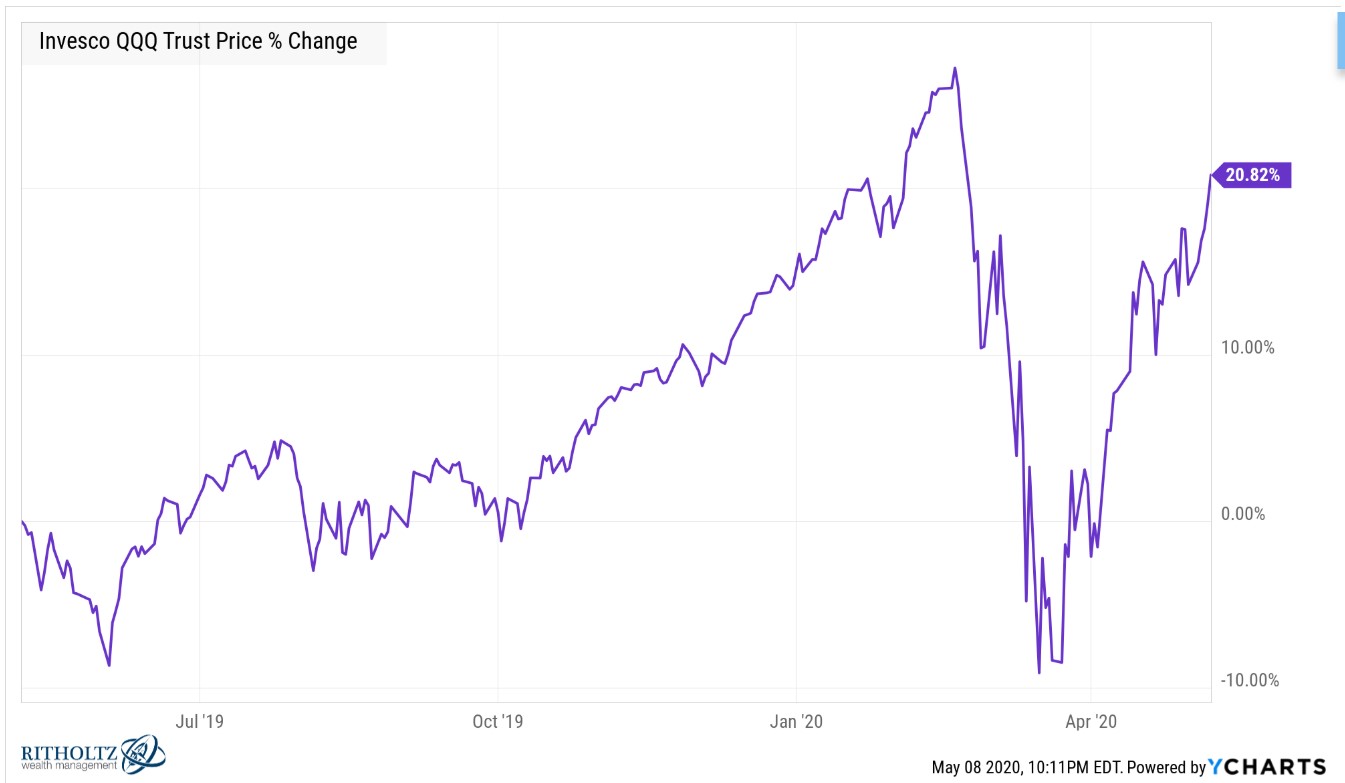

1. Why own anything else? The Nasdaq 100 has barely even noticed the pandemic. Yes, it was down close to 29% from peak-to-trough but this index of mostly tech stocks (Microsoft, Amazon, Apple, Facebook and Google make up nearly half of the index) is now showing a 6% gain in 2020 and is up an extraordinary 20.8% over the past year:

Tech stocks were already crushing it leading up to the pandemic and have only strengthened their position at the top of the food chain during the crisis. Every one of the 5 biggest stocks in the Nasdaq 100 is now up for the year with gains ranging from 4% to 29%.

‘Why own anything but tech stocks?’ is a drumbeat that grows louder by the day.

These are the biggest, best companies in the world. They’re only going to get stronger because of this crisis and there’s nothing anyone can do to slow them down. Why own anything else?

2. Why own anything? The unemployment rate hit nearly 15% on Friday. It’s probably much higher than that in reality.

We’re in the midst of a depression. 30 million people have filed for jobless claims. Businesses of all shapes and sizes are toast. Who knows if or when many of these businesses will be back up and running at full capacity. Most will never come back.

I understand why so many people are frustrated the stock market keeps rising in the face of this economic disaster.

There are many investors who can’t shake the feeling that this is a second coming of the Great Depression. If that’s the case, why invest in anything at all besides a huge mattress for the purposes of stuffing all of your cash under it?

I see no scenario where the economic situation improves for the foreseeable future. It’s only a matter of time until the markets roll over again and get absolutely anhiliated. There is no need to invest in anything but canned food and ammo for the next few years. Why invest in anything?

3. Why do I own this? Diversified investors understand the S&P 500 or Nasdaq mega-cap stocks don’t tell the entire story about what’s transpiring in the market.

Small-cap stocks are still down more than 20% from all-time highs. Emerging markets, foreign developed countries and value stocks have all badly lagged the biggest growth stocks in the U.S. for a number of years now.

And things have only gotten worse during this downturn and subsequent upswing. AQR’s Cliff Asness noted last week this is the widest valuation gap between value and growth stocks in history!1

I never thought we would see things blow out like they did during the dot-com bubble but here we are.

Why do I diversify my portfolio? I have assured myself there will ALWAYS be something in the portfolio I hate. Life would be a lot easier if I could just invest in the best-performing stocks/sectors/strategies on a consistent basis.

4. I wish I would’ve owned that. Tail risk strategies got plenty of pub following the March disaster because they’re designed to profit from a blow-out in volatility.

Now investors are looking at stocks that are benefitting from the stay-at-home orders and social distancing — Peloton, Zoom, Slack, Netflix, etc.

These trends, and thus stocks that take advantage of them, all seem obvious in hindsight. This is basically a Peter Lynch “invest in what you know (about the pandemic)” market.

I saw this coming. Why didn’t I invest in those stocks when this all started? It was so obvious. I wish I would have owned all those stocks that were designed to profit from a situation like this.

5. I have no idea what I own or why. There are a number of investors who have discovered during this crisis they don’t have a plan or strategy, just a portfolio of holdings. There’s a huge difference between a smattering of individual securities or mutual funds and an investment plan.

The market’s recovery has given every investor who has been holding on for dear life a reprieve to figure out an asset allocation that fits their willingness, ability and need to take risk.

If you don’t know what you own and why you own it, a bear market is a bad place to find out.

I have no plan of attack with my portfolio. My broker/advisor/brother-in-law suggested I buy a handful of funds and individual names but I have no rhyme or reason to my portfolio construction. I just hope everything keeps going up.

*******

*These investor types are subject to change based on what transpires in the market. Price tends to drive sentiment more than anything.

Further Reading:

What Kind of Investor Are You?

1Where history is defined as going back to the 1960s when the data on individual companies is clean enough.