We’re back for show number two of this week.

We discuss:

- Corporation inequality

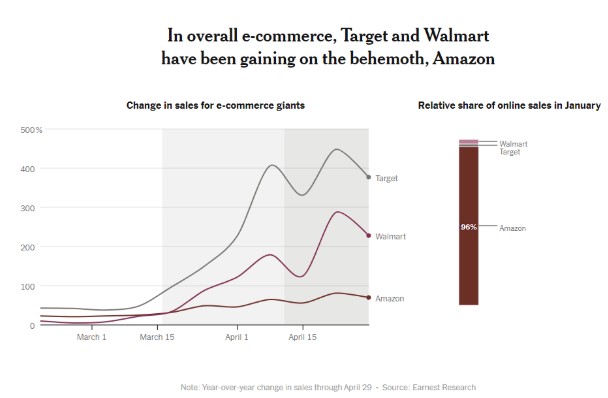

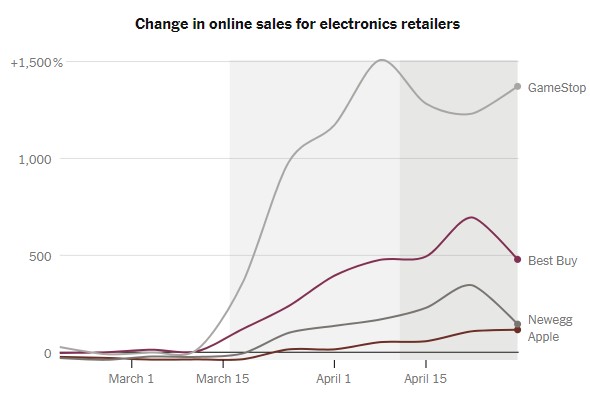

- Retail spending is making a massive shift to online shopping

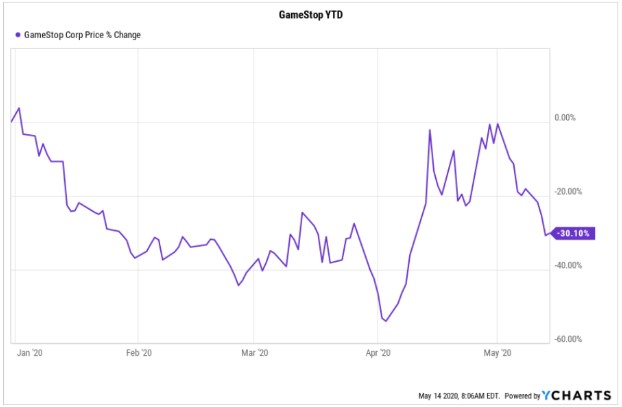

- Why aren’t video game company stocks up more?

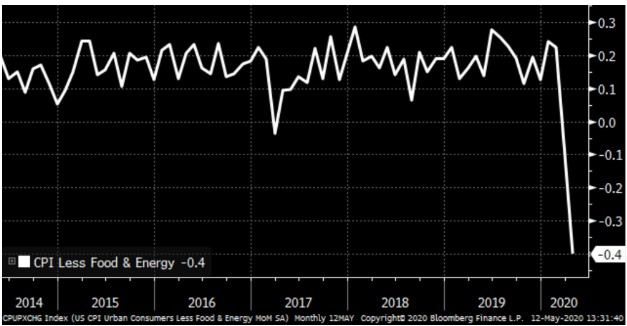

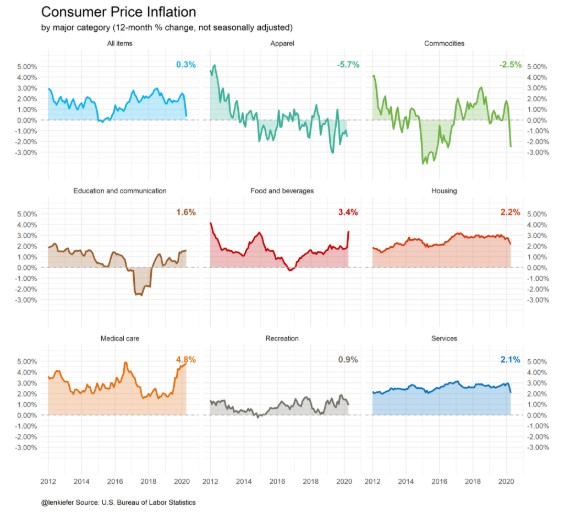

- Deflation is here

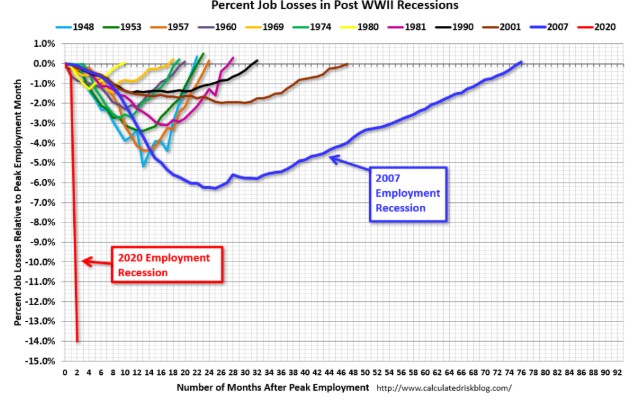

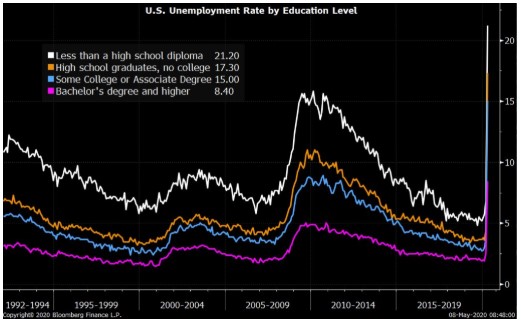

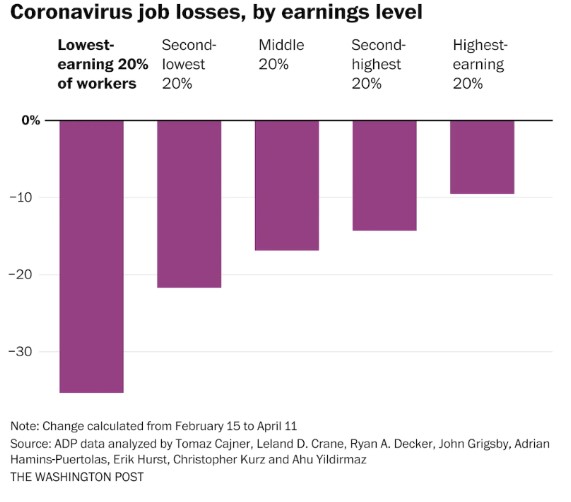

- Inequality in the unemployment numbers

- Pain for even the very best restaurants

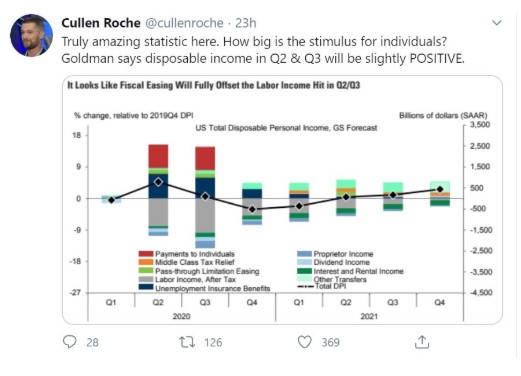

- Why the government needs to extend unemployment benefits and send more checks

- Why are housing prices rising during the pandemic?

- Will there be an exodus from big cities?

- Are the banks in trouble?

- Why it’s impossible to take investing advice from billionaires

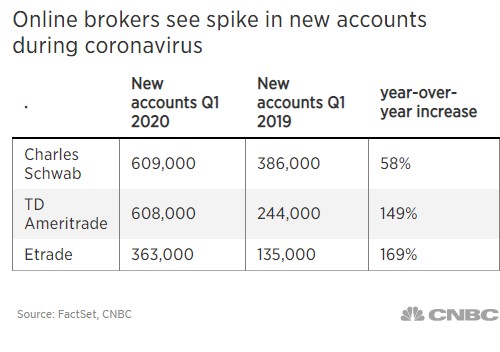

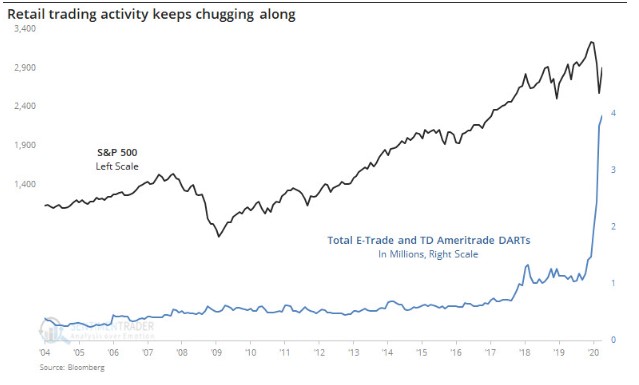

- Young investors are piling into the market. Good thing or bad thing?

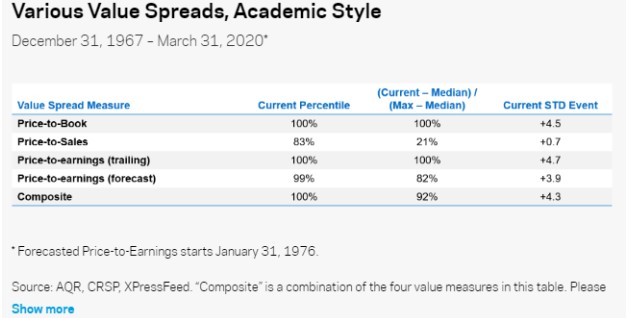

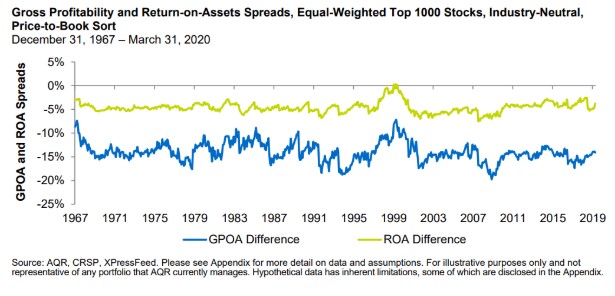

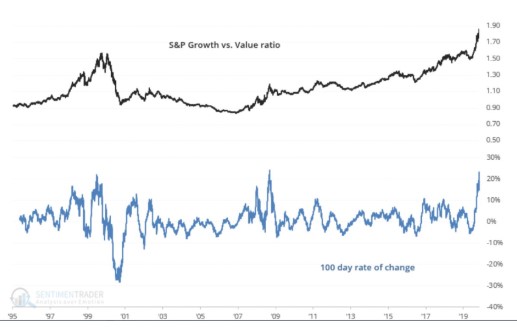

- Is value really dead this time?

- Are ratios losing their relevance in the markets?

- Are valuations worthless right now?

- How credit card companies keep people in debt

- Globalization is making it hard to determine winners and losers from this crisis

- Will anyone want to go into a dressing room after this?

- Comedy at the Oscars and much more

Listen here:

Stories mentioned:

- Americans keep clicking to buy

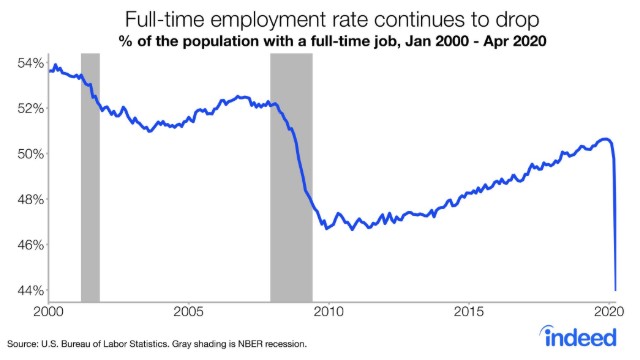

- April employment report

- Too small to fail: restaurant closures

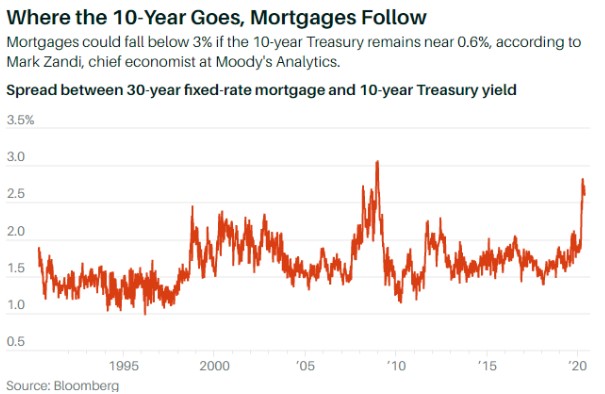

- Why home prices are rising during the pandemic

- Home prices are likely to hold up just fine

- How will the crisis impact housing prices?

- Coronavirus escape to the suburbs

- The mortgage market never got fixed after 2008

- Stanley Druckenmiller offers a bearish warning

- You are not Stanley Druckenmiller

- Tepper says stock market most overvalued ever outside of ’99

- Young investors pile into stocks

- Is systematic value investing dead?

- Absolute value vs. relative value

- Does value investing still make sense?

- The S&P 500 sector quilt

- Devil’s advocate: the bull case

- Against the rules

- AT&T boss retires with $274,000 a month for life

- Taiwan never needed to shut down its economy. It’s stalling anyway

Books mentioned:

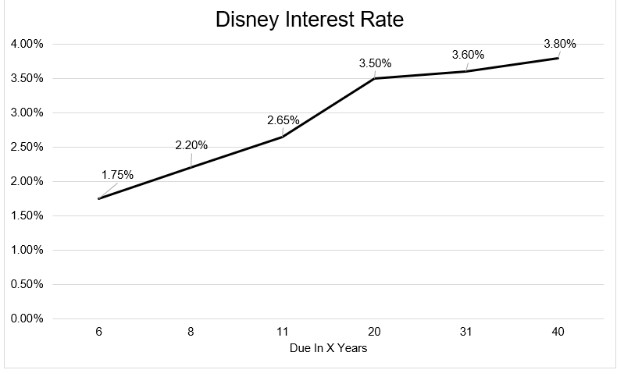

Graphs mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on Shuffle.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: