This week’s Animal Spirits with Michael & Ben is sponsored by YCharts: Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service. We discuss: Why dividends don’t matter as much as they used to for the stock market The guy who bet $85k to win $1.2 million on Tiger winning…

The Stephen A. Smiths of Personal Finance

It was reported earlier this month that Stephen A. Smith is in line to become the highest paid on-air talent in ESPN history when he signs his new contract. He could earn between $8 to $10 million a year. People on the Internet love to point out how wrong Smith’s takes can be at times….

Why We’ll Never All Be Happy Again

There are two things people need to understand about humanity: (1) Things are unquestionably getting better over time. (2) People assume things are unquestionably getting worse over time. I love this chart from Our World in Data: This data doesn’t quite jibe with how happy people report they feel today. You can see the trend…

Prudent Risk Management or Market Timing in Disguise?

A podcast listener asks: I work at a pension fund steadily losing performance chasing members (we were positioned too conservatively through the bull market) – and now the investment committee wants to be more “peer-aware”. I tend to think now is not the time to make a more aggressive allocation, but part of me also…

The Life Cycle of Wealth

In his book The Ages of the Investor, William Bernstein describes a mythical employer named Uncle Fred who offers investors a retirement savings scheme determined by the flip of the coin. One side of the coin results in a +30% annual gain while the other side gives you a -10% loss in a given year. Since the…

Animal Spirits Episode 76: Money Makes Money

This week’s Animal Spirits with Michael & Ben is sponsored by YCharts: Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service. We discuss: Is the retirement crisis overblown? Or is it worse than most people assume? What do we do today that will seem crazy in 50 years? Pay…

The Stories We Tell Ourselves to Sell Ourselves

Marc Andreessen recently told Brian Koppelman venture capitalists seem to have an unlimited amount of ideas to pick from these days. Ideas are the easy part. The hard part is executing on those ideas. Andreessen said his venture firm a16z is more interested in founders with great ideas who can also sell those ideas to…

RWM is Hiring!

My firm is in the market for a new trader. See the details here: Ritholtz Wealth Management is a registered investment advisor headquartered in New York City with advisors and clients across the country. The firm launched in 2013 and in just over five years amassed more than $1 billion in client assets under management,…

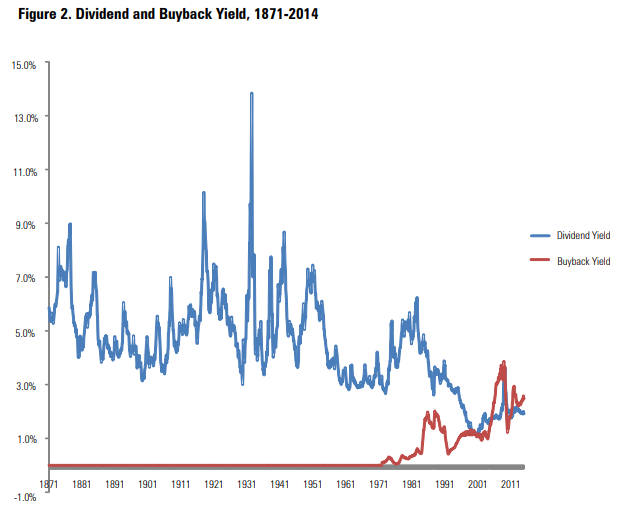

Dividends Don’t Matter As Much As They Used To

In his excellent market history book, It Was a Very Good Year, Martin Fridson tells the story of the year that was in the market in 1915. It remains one of the strongest years on record for the stock market, which was up more than 50%, even though World War I was well underway at the time….

The Stocks Manage Themselves

Professor, investor, and researcher Roger Ibbotson made an excellent point about investing in stocks in a recent sit-down with Barry for MIB: As a portfolio manager, you could do nothing and you might do fine. You don’t have to literally trade every day to make things work. You only want to trade when you really…