Business Insider had a story this week proclaiming the death of the starter home.

Here’s the gist of the argument:

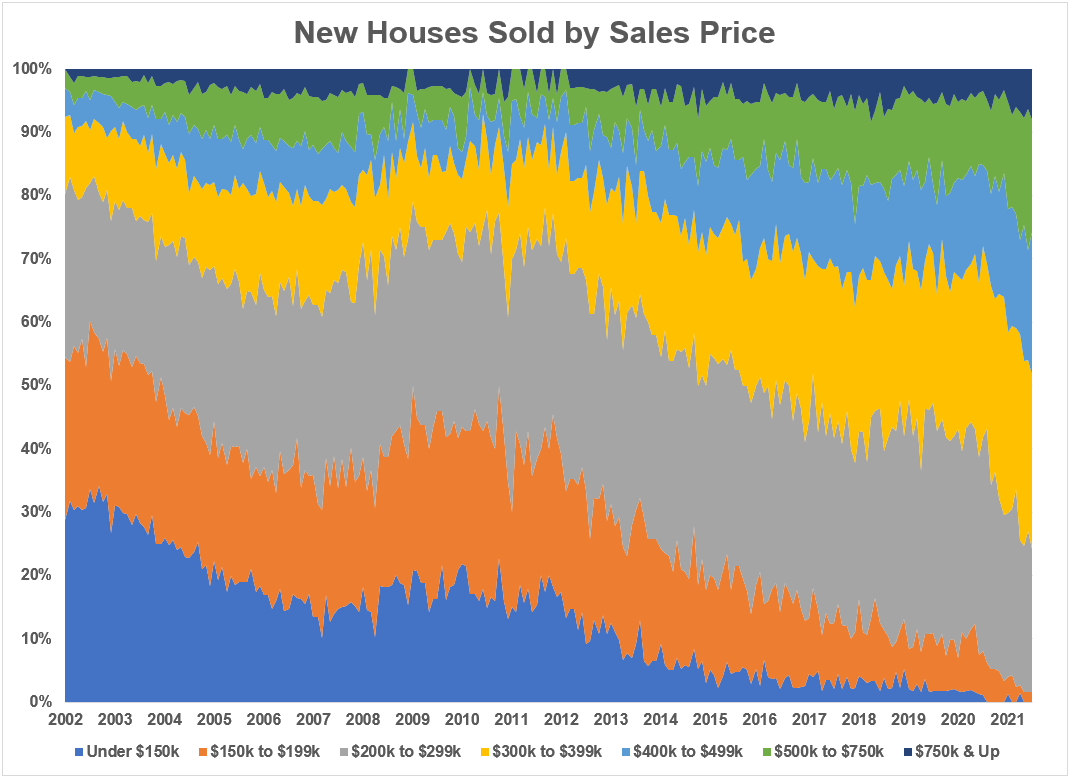

Oxford Economics’ chief US economist, Gregory Daco, highlighted a chart created by economics blogger Bill McBride showing the distribution of new homes by price range going back to 2002.

That chart, using data from the Census bureau’s monthly report on new home sales and prices in the US released on Tuesday, shows that while over half of new homes sold in 2002 were priced at under $200,000, only about 2% fell in that range in July 2021. Meanwhile, the share of new homes selling for over $400,000 has steadily risen, with nearly half falling in that bracket last month.

Homebuilders aren’t making new houses that sell for $200k or under anymore. Thus, the starter home is dead.

At first glance, it would be hard to argue with this conclusion. After looking under the hood, my conclusion is somewhat more mixed.

I decided to dig through the numbers myself with some help from Federal Reserve data.

This is the proportion of new houses sold in the United States going back to 2002 broken out by various price points:

New home sales at $200k and under were as high as 60% of total new houses sold in 2002 at one point. In July of this year, that cohort accounted for just 2% of new home sales. New homes of half a million dollars and up were just 3% of sales in 2002 but nearly 30% in June of this year.

There is an obvious trend of new homes being built at higher price points.

There are a few explanations for this trend.

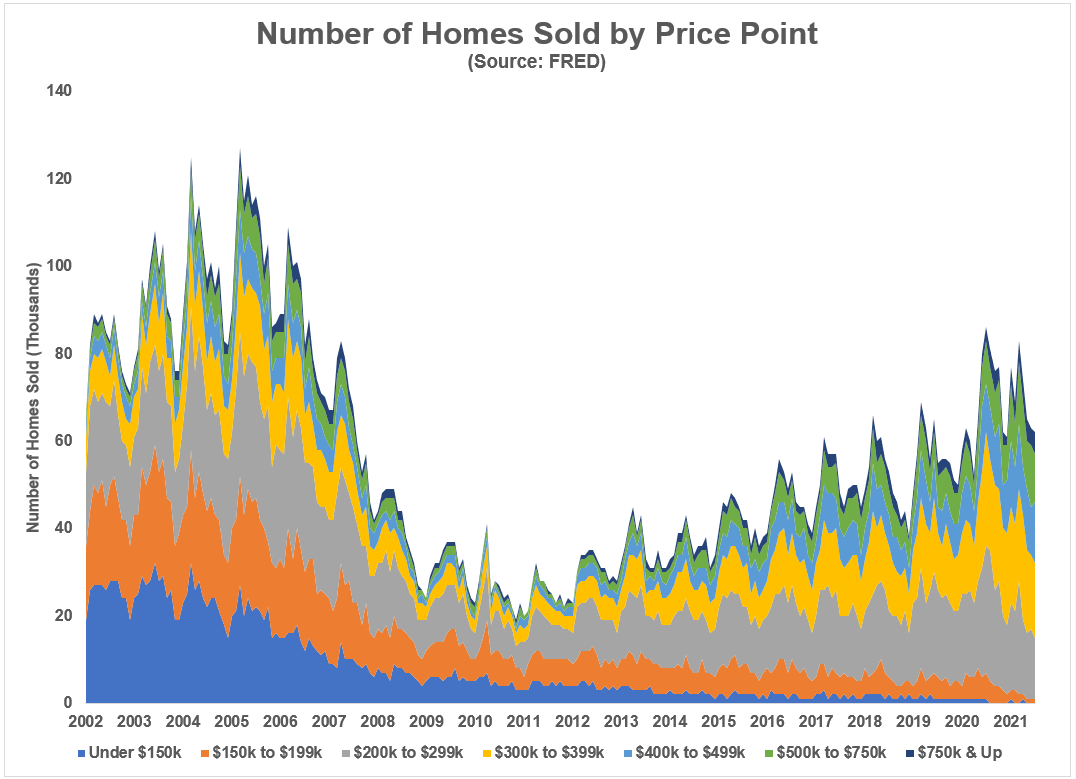

For one, there were simply more houses being built back then. Here is the same breakdown by price point but instead of the proportion of total houses sold, this one shows the absolute number of new homes built:

This number is finally creeping higher but it is still well below the early 2000s boom.

What if the number of starter homes being built back then had more to do with the housing bubble than anything? What if that period was the outlier?

The higher price point for new homes is also being driven by the experience homebuilders had following the housing market crash. Builders went overboard in the housing bubble and were left holding the bag. There are still lingering scars.

It makes sense homebuilders have moved up to higher-priced homes that have better margins and buyers with higher credit scores.

The $200k to $400k range of new home sales averaged 35% of the total in 2002. So far in 2021, it’s more like 54%. Unfortunately, for new home buyers that might be the updated threshold for a new build.

If you want an affordable new home it may have to come in the form of a rental built by an institutional investor (listen to our podcast with Fundrise CEO Ben Miller for more on this trend).

There’s also a huge factor at play that we simply can’t ignore in this equation — mortgage rates.

I hate to play this card every single time1 but let’s adjust the monthly payments by interest rates to see how much that changes things.

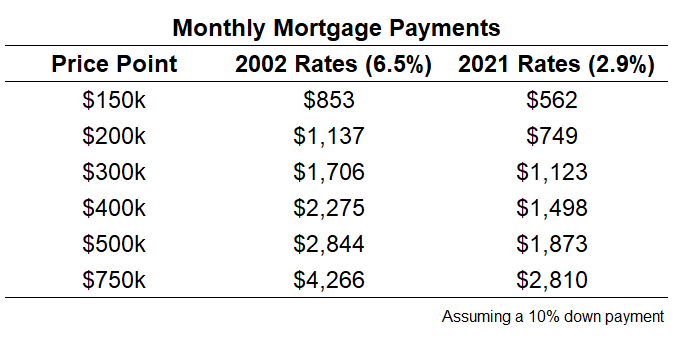

The average 30 year fixed mortgage rate in 2002 was 6.5%. This year the average is 2.9%. This makes an enormous difference in monthly payments:

Monthly payments are almost 35% lower at today’s interest rate levels versus the rates in 2002.

Of course prices are going to be higher!

Rates have allowed buyers to move up their price points. Yes, taxes and down payments are higher too but lower mortgage rates have allowed homebuyers to build pricier homes with little-to-no inflation in their monthly payments.

People can afford more home at today’s rates. The monthly payment for a $400k house is now lower than the monthly payment for a $300k home in 2002.

If we take this to the extreme — the monthly payment for a $1,000,000 home is now $520 lower than the monthly payment for a $750,000 home in 2002.

Add in fewer homes being built, a touch of inflation, scarred homebuilders, HGTV messing with our expectations and it’s no wonder new home sales prices have risen over the past 20 years.

This doesn’t necessarily mean the starter home is dead. It just means those looking for a new starter home at lower prices are going to have to adjust their expectations.

And they’re likely going to be buying an existing home rather than a new build.

Further Reading:

What If Housing Prices Aren’t as High as They Appear?

1Actually I love playing this card every time.