Michael and I spoke with New Age Alpha CIO Julian Koski about investing in the human factor.

Michael and I spoke with New Age Alpha CIO Julian Koski about investing in the human factor.

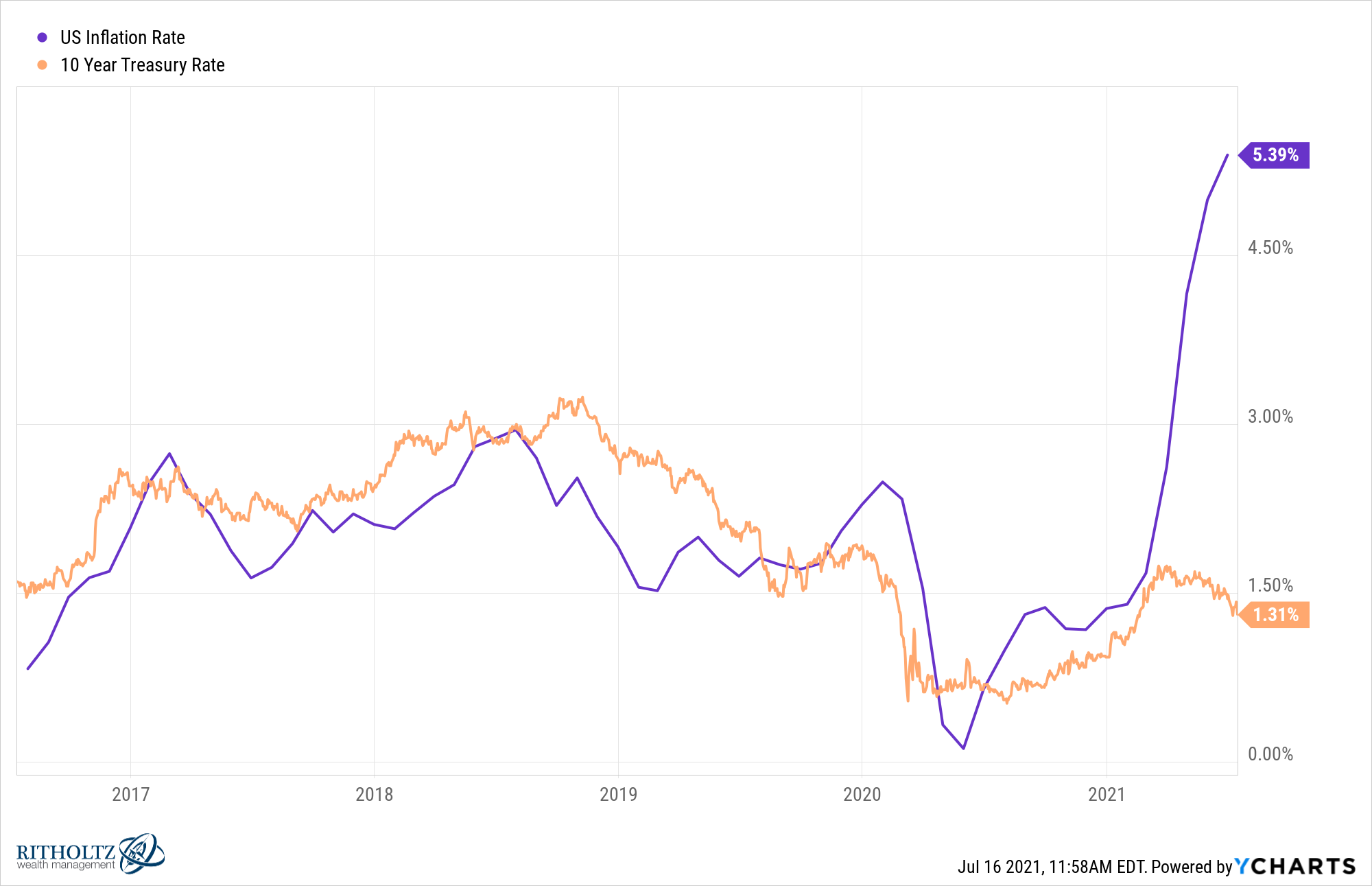

Traditional inflation hedges seem to be failing right as inflation reaches its highest level in years.

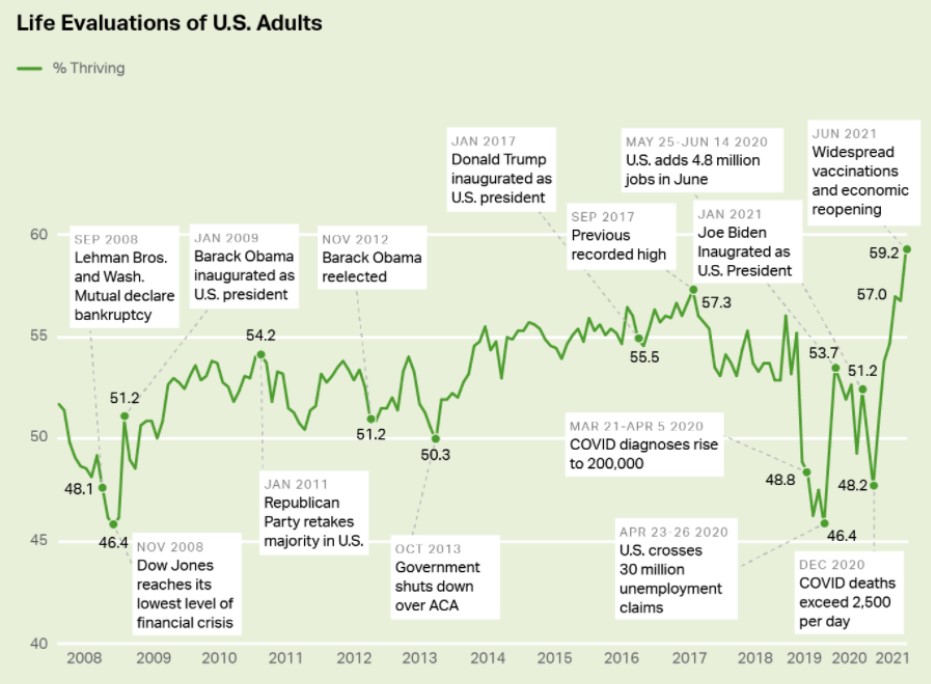

What if this is as good as it gets in terms of boom times?

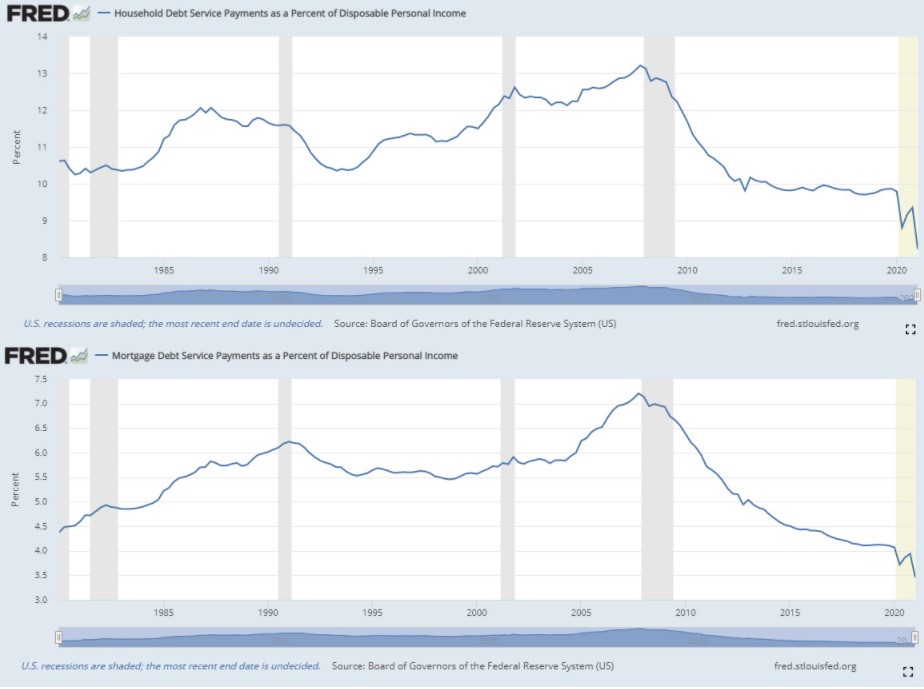

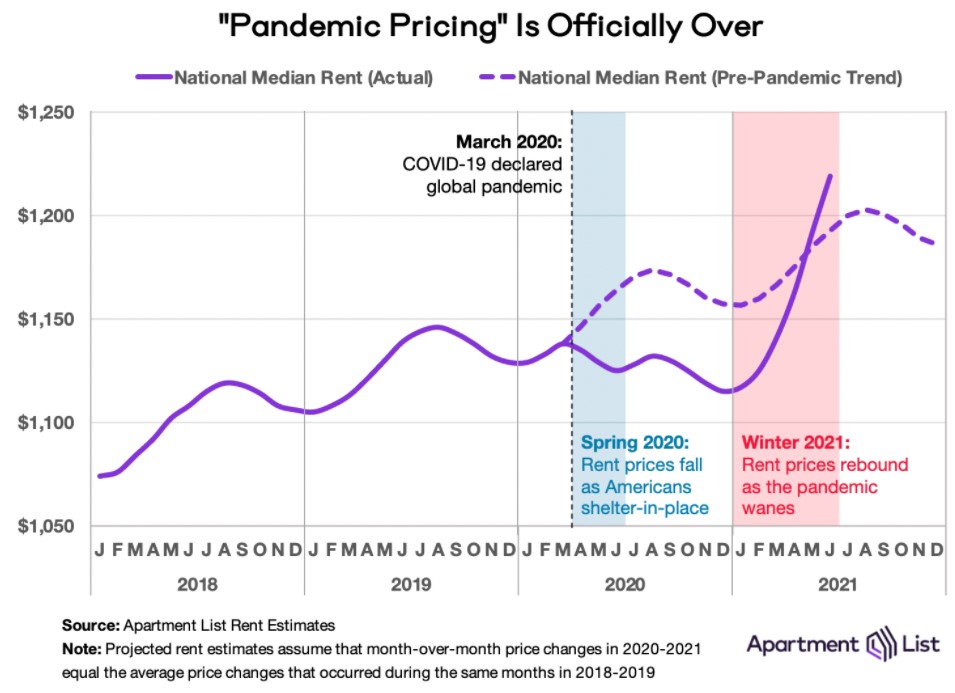

Why this is nothing like the housing bubble of the mid-2000s.

Michael and I discuss the roaring 20s, the end of cash, people quitting their jobs, growth taking out value again and more.

The bad always outweighs the good in our brains.

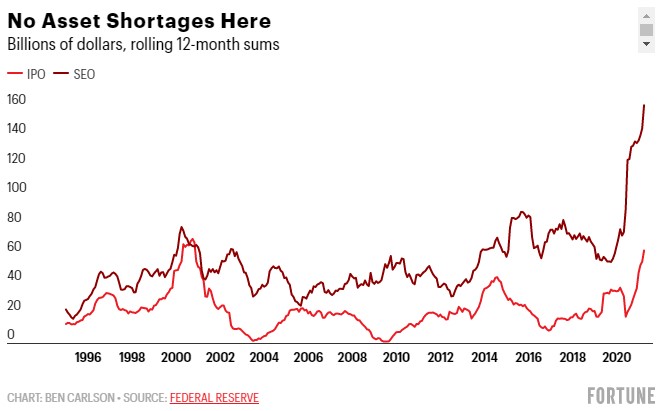

Everything in the markets is cyclical, including IPOs.

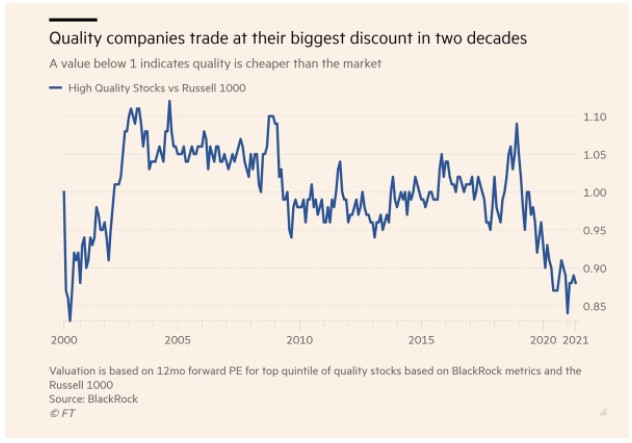

Michael and I spoke with Eric Schoenstein, CIO and portfolio manager of Jensen Investment Management about investing in high-quality growth stocks.

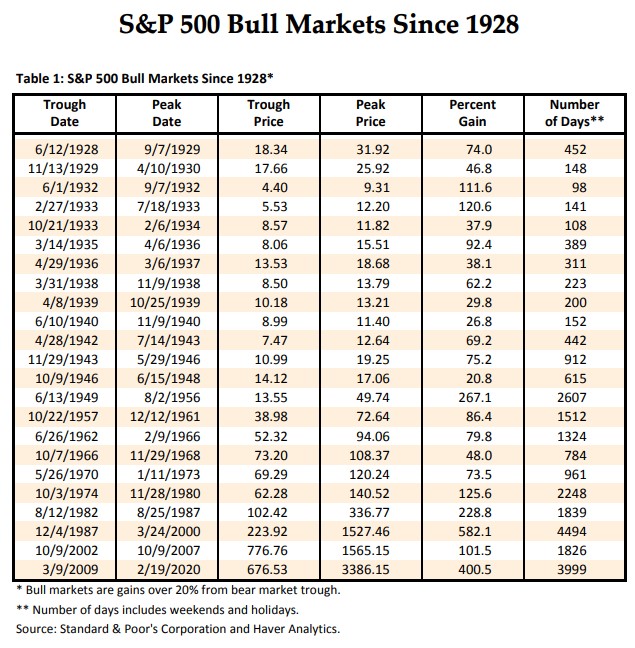

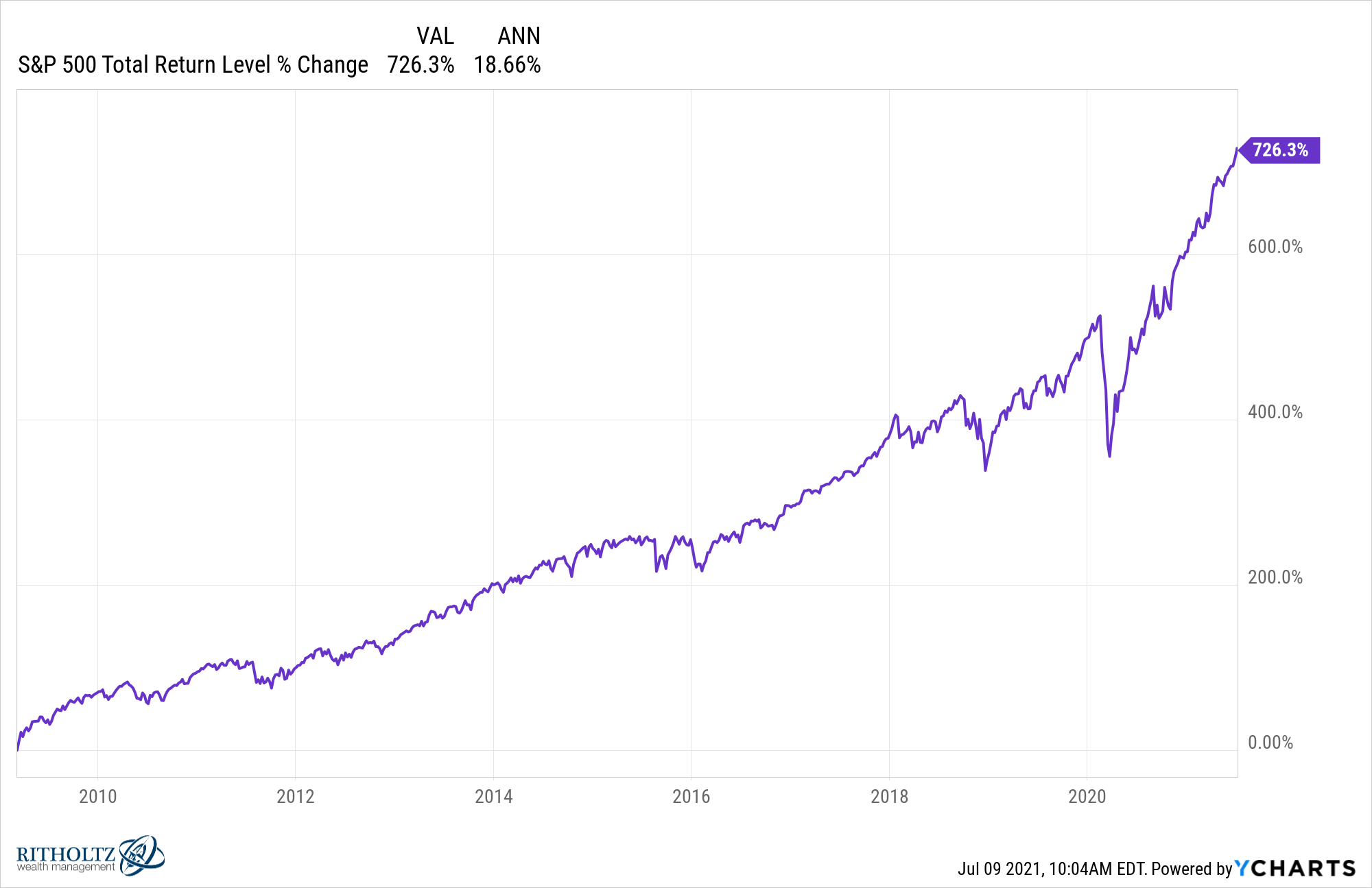

Bull markets last longer than you think but corrections are a feature of investing.

Investing in times of crisis.