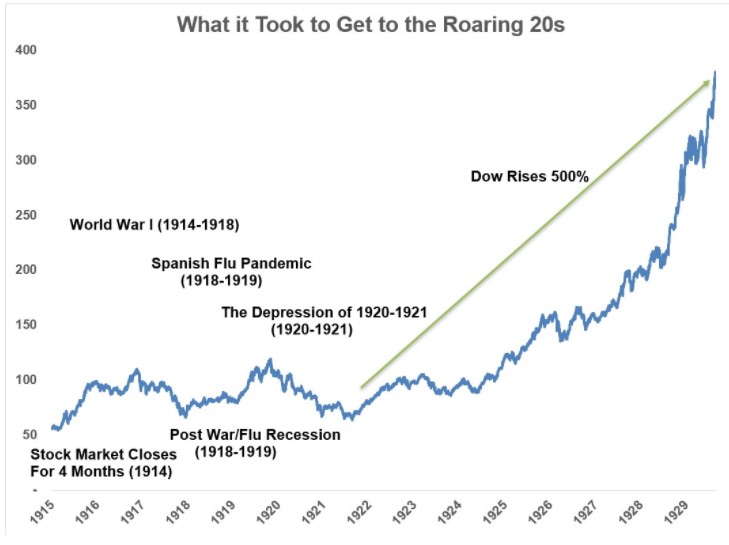

In March 2020, I wrote about what Americans had to go through to make it to the Roaring 1920s.

Here’s the summary in chart form:

The pandemic we’ve lived through has been less than fun but it was nothing in comparison to what people in the early-20th century had to live through.

Not only were they forced to endure the first world war, but also the Spanish Flu without the comforts of Zoom, Slack, DoorDash, Amazon, Netflix, Robinhood or an iPhone to see them through it.

Yet coming out of that awful period, America experienced an unprecedented boom time the likes of which this country had never seen before.

Here’s what I wrote in the original piece:

The 1920s ushered in the automobile, the airplane, the radio, the assembly line, the refrigerator, electric razor, washing machine, jukebox, television and more.

There was a massive stock market boom and explosion of spending by consumers the likes of which were unrivaled at the time. After the immense pressure of the Great War, many people simply wanted to have fun and spend money.

Now, things were far from perfect back then, but the Roaring 20s were one of the most innovative, prosperous periods in U.S. history.

Things are far from perfect now (and they always will be) but you could make the case that our version of the roaring 20s is already here.

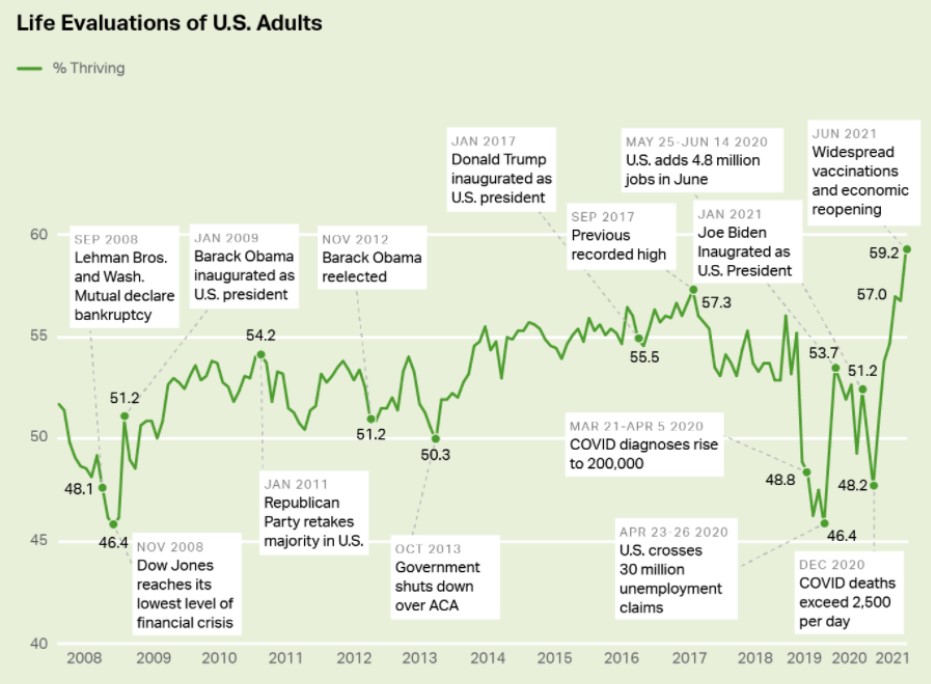

Gallup’s American Life Ratings are now at an all-time high:

It may not seem like it if all you do is watch cable news or traffic social media, but the mood of the country is pretty good right now. I’m sure this has something to do with the fact that the country has experienced a tumultuous couple of years with Covid-19, a contentious election and riots across the country.

The current level of satisfaction is a relative thing.

But that’s why people in the 1920s were so joyous — they went to hell and back before the boom times.

Frederick Lewis Allen once wrote, “Prosperity is more than an economic condition: it is a state of mind.” Yet the current boom isn’t just a happiness survey. The numbers back me up here.

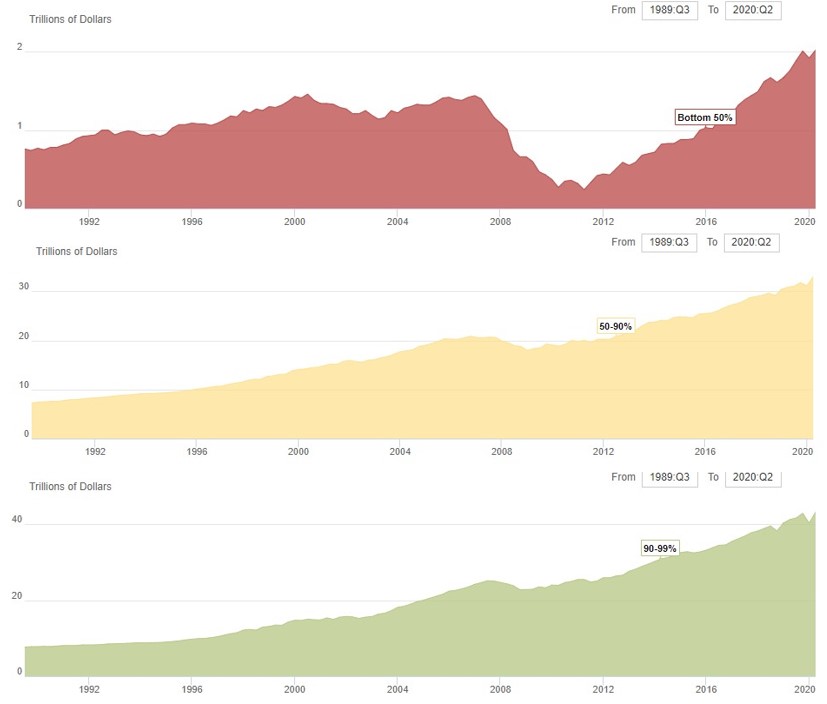

The S&P 500 has now hit 58 new all-times since the pandemic bear market ended in March 2020. Housing prices are at all-time highs. People have more equity in their homes than ever before. Wages are rising at the fastest pace in years. Economic growth is going to be at the highest level in decades in 2021.

Add it all up and the net worth of all American households is at all-time highs. But this time it’s not just the top 1% who is benefitting:

Wealth inequality is still an issue (and probably always will be) but at least people in the bottom 50% are finally starting to see some progress.1

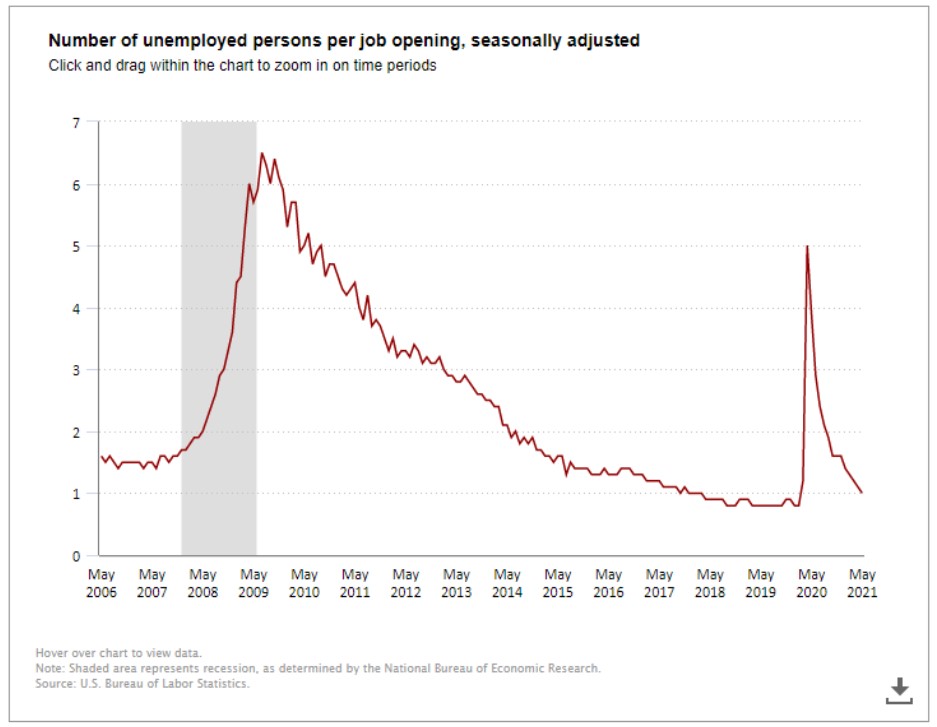

Workers also have more power now than they’ve had in decades. If you need a job right now, you’ve probably never had more leverage in your entire lifetime when you combine rising wages with a shortage of workers:

There is one job available for every person who is unemployed and a record 9.3 million job openings in the United States. And that’s with the unemployment rate at 5.9%.

Datatrek Research (via Sam Ro) has what they call a “take this job and shove it” indicator that monitors how many people are quitting their job. That number is the second highest it’s ever been and it’s at a record high for workers in the leisure and hospitality industry.

People quitting their jobs is a good sign because it tells us:

(1) They have better job prospects elsewhere.

(2) Their finances are good enough to quit until they find another job (through savings or UI benefits).

(3) Workers finally have the upper hand over employers because there is a shortage of workers.

(4) Remote work is allowing people to explore other job opportunities.

Much like the 1920s, there are still problems, of course. If you spend a lot of time on social media or watching the news you’re constantly beaten over the head on a daily basis with bad news and horrific stories.

But this might be about as good as it gets when it comes to boom times in the information age where it seems like no one is happy or satisfied.

On a relative basis from where we were 16 months ago to now, this might be our roaring 20s.

Enjoy it while it lasts.

Michael and I discussed the potential for our own roaring 20s on this week’s Animal Spirits video:

Subscribe to The Compound for more videos like this.

Further Reading:

How Did We Ever Make It to the Roaring 20s?

Now here’s what I’ve been reading lately:

- Blowing through a $400 million fortune (Indianapolis Monthly)

- 24 hours (Bull & Baird)

- The inner ring of the internet (Every)

- 3 ways investors can go astray (Humble Dollar)

- 3 boys and their Jeep (Gotham Canoe)

- Stop obsessing over every penny (The Long Game)

1Wealth inequality was an even bigger problem in the early-20th century than it is now.