A reader asks:

I was wondering if you all would consider writing an article that covers the pros and cons of taking a home that is completely paid off, refinancing the house at these incredibly low interest rates and investing the money into the market.

Basically the complete opposite of today’s article.

Last week I wrote a piece about the pros and cons of liquidating your portfolio to buy a home with cash. This is the opposite situation. The cash is already in the house.

The idea here goes something like this: You can’t spend your house so there is essentially unlocked cash just sitting there waiting to be used. If you take out a mortgage where you’re paying around 3% but you’re earning something like 7-8% in the market that’s a good trade-off.

The potential downsides here are you now have to make monthly mortgage payments again, you’re paying interest on that debt and it’s always possible the markets could crash and go into a decade-long bear market.

Regardless of what you want to use the cash for, homeowners are going to start looking to use the equity in their homes for more productive uses.

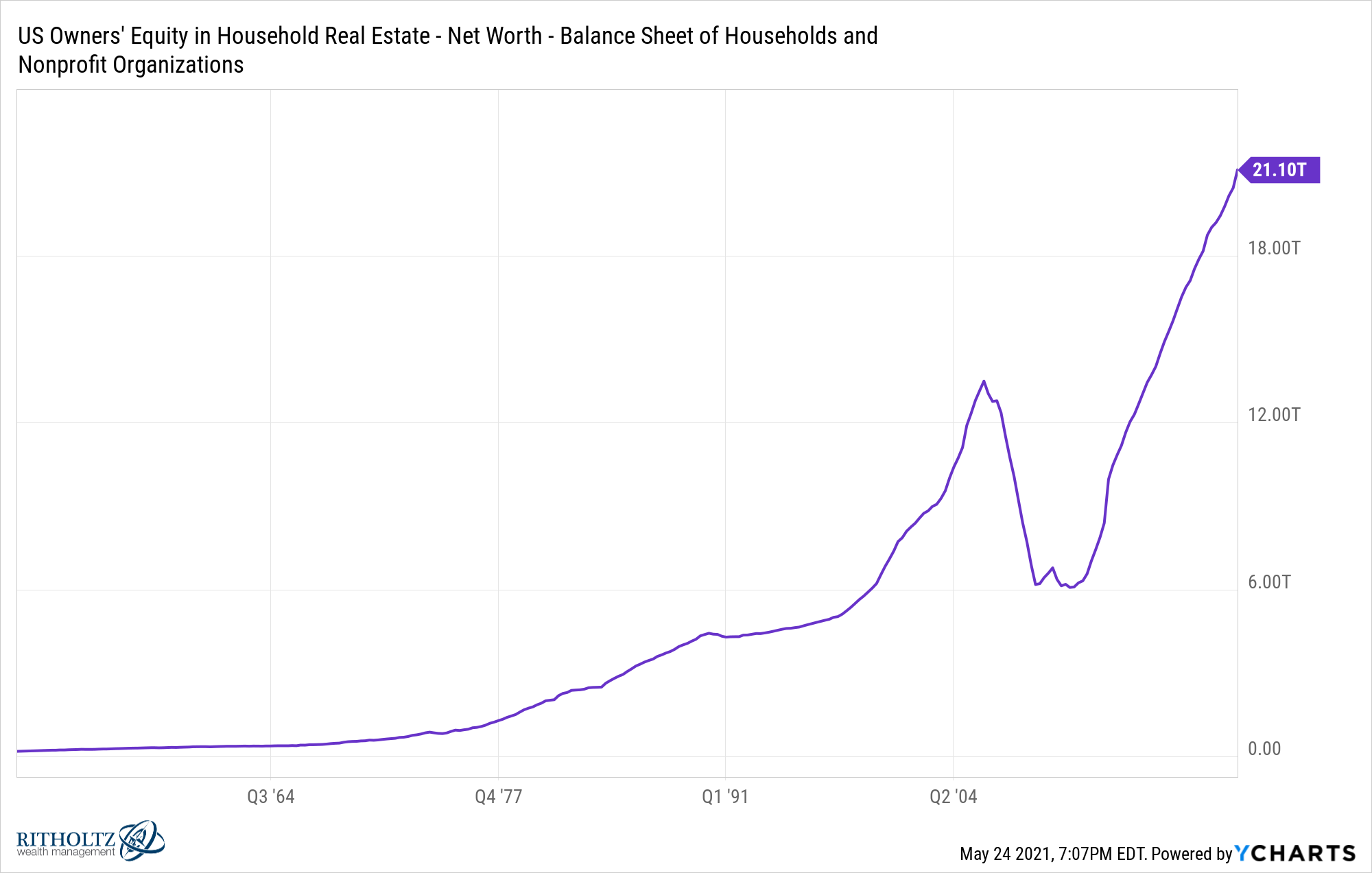

There is now more than $21 trillion in home equity:

Homeowners are in pretty good shape right now.

Some people are simply debt-averse and would never consider this but I’ve come around to the idea of using your home as an intelligent form of leverage.

If you purchased a home in the last 10 years or so, you’re likely sitting on some nice gains at the moment. Assuming you don’t use those gains to trade up to an even higher-priced home, you now have options in terms of using that good fortune.

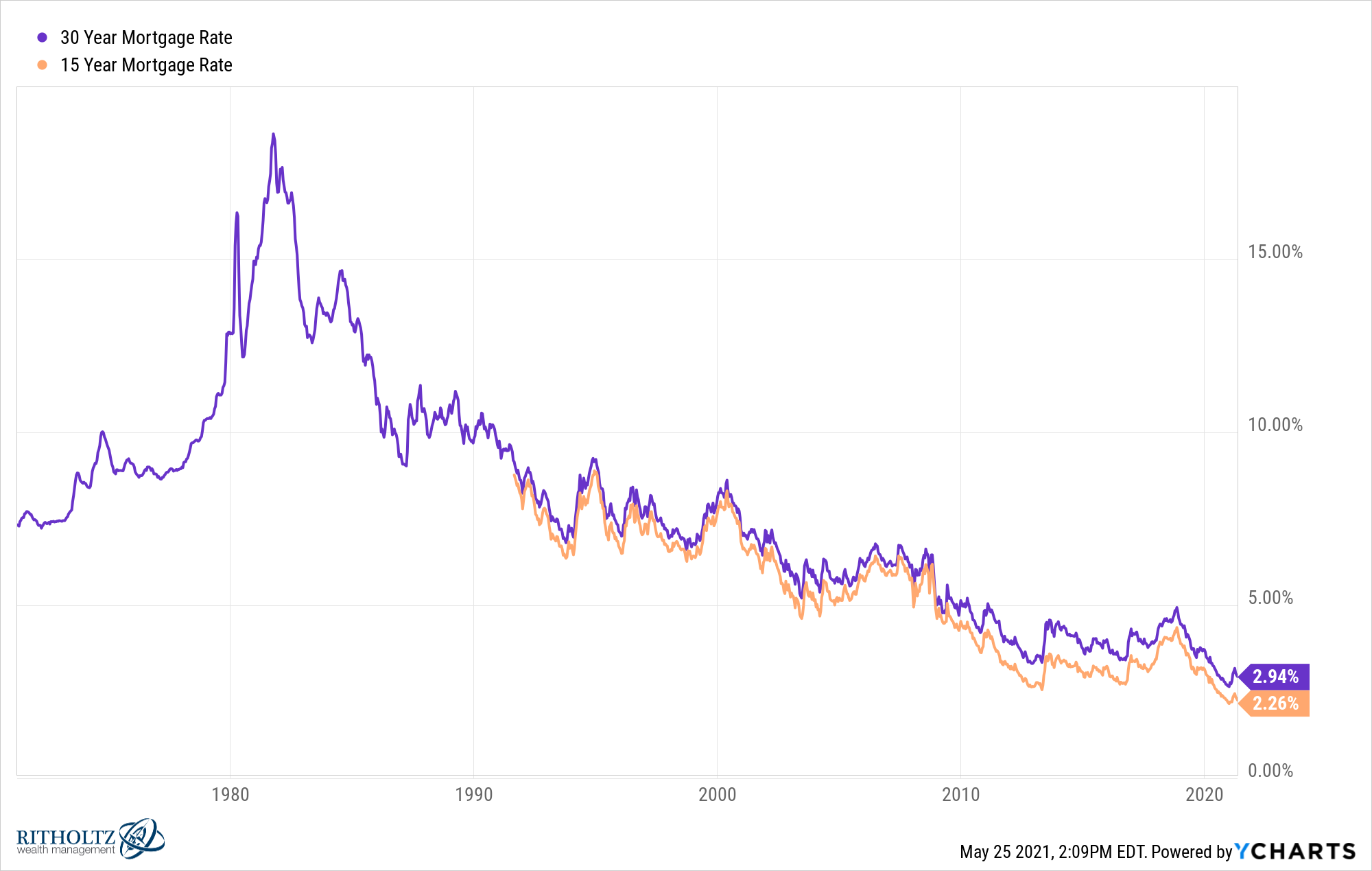

Most personal finance experts wouldn’t say this but when you consider how low mortgage rates are at the moment, the intelligent use of leverage has probably never made more sense for those who are financially literate enough to understand what they are getting themselves into.

Thirty and fifteen-year mortgage rates are still ridiculously low by historical standards even if they’ve bounced off generational lows from last year:

There are two options for pulling some cash out of your house:

Option 1. Cash out refi. You basically take out a new mortgage loan by refinancing and get a lump sum to do with as you please. Some people will use this to invest in the markets. Others will renovate their current home.1 I suppose you could pay for a vacation with these funds but that’s not a very productive use of capital.

Option 2. HELOC. A home equity line of credit would allow you to borrow money against your home. Essentially a HELOC gives you a checkbook attached to a loan that offers competitive borrowing rates because your home acts as collateral against the loan.

There are pros and cons for each.

A HELOC offers more flexibility because you can use the money as needed. The way my HELOC works is they gave be a borrowing limit. Let’s say it’s $50k. I have the ability to borrow up to $50k for 10 years and pay only the interest that accrues on that loan. I can also pay off the principal and potentially use those funds again at some point. After my 10 year borrowing window, I have an additional 15 years to pay off the loan.

The downside of a cashout refi versus a HELOC is you begin making monthly payments right away. The upside is, you can immediately put that entire sum to work if you have a good use for it. The cashout refi also allows you to lock in your interest rate while a HELOC rate could rise if interest rates rise in the future.2

One downside with a HELOC is it’s possible for the bank to pull the rug out from under you during a crisis. Many of the biggest banks in the country either cut back or completely stopped issuing HELOCs during the pandemic.

So it’s possible your line of credit won’t be there during a crisis when you may need it the most.

As with most things in finance, there are trade-offs here between either option.

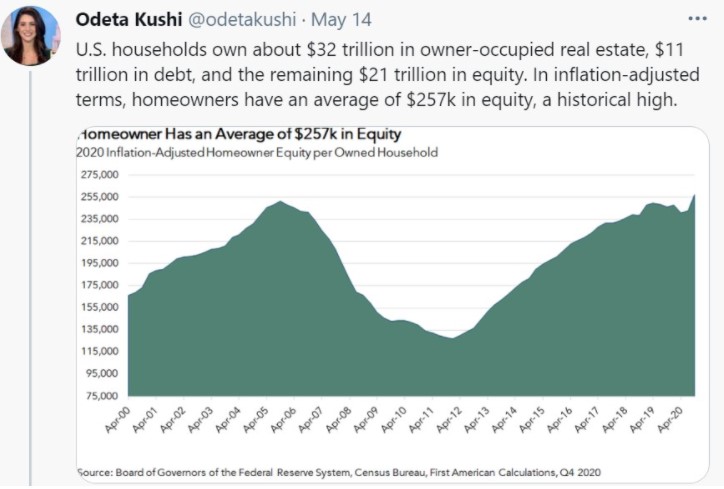

Most people now have more equity in their home than ever, an average of nearly $260k:

People can now borrow money against a solid piece of collateral at generationally low interest rates.

The big question is: should you?

That’s a personal question. I’ve gone back and forth on this topic many times over the years. My views were much different when I borrowed at 6.25% with my first mortgage than my more recent borrowing costs that were well below 3%.

Some people simply can’t handle taking on more debt or the potential risks it brings.

Others can use this kind of leverage intelligently assuming they understand those potential risks.

Regardless of each individual’s tolerance for debt and risk, I would be shocked if Americans don’t start tapping the equity in their home in a big way in the years ahead.

Further Reading:

Why This is Not Another Housing Bubble

1Good luck finding a contractor right now.

2I also didn’t get into the tax benefits here. Interest on HELOCs is deductible on up to loans of $750k (assuming the money is being spent to improve your home).