A podcast listener asks:

My wife and I are 27, and we have accumulated about $300,000 in savings combined via passive investing over the last couple of years. What is your opinion on liquidating all of our assets and buying a home with cash? We live in New York, but are looking to leave the state due to how expensive and fast-paced it is. Some areas we have looked at have houses in the price range we can afford. Do you think buying a house with cash is a good idea or a bad idea?

First of all, nicely done. That’s a fair amount of savings for your late-20s.

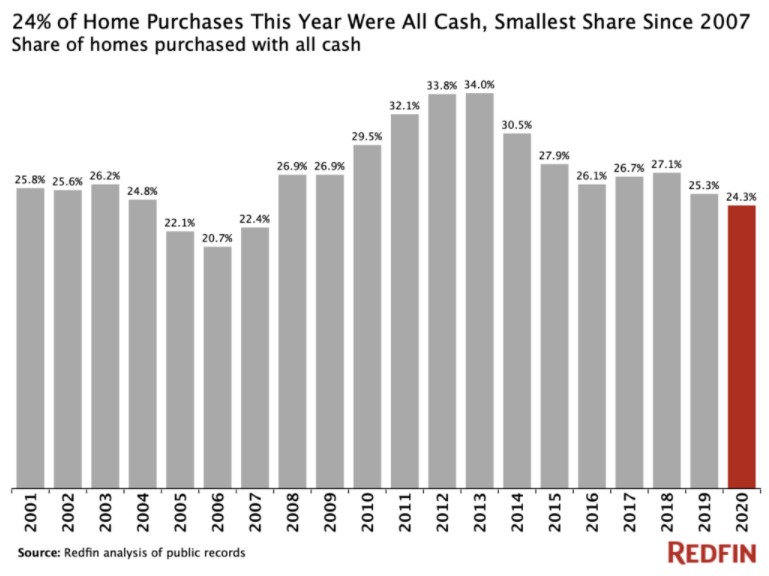

More people buy their home using all cash than I would have expected (via Redfin):

Now for the hard part — there really isn’t a right or wrong answer to this question. There are good and bad financial decisions on certain topics but a decision like this where you have such a high level of savings at your age means you’ve already won in many respects.

There is a lot to consider in this kind of decision though. Much of it comes down to your relationship with money, debt and financial assets.

Let’s look at the pros and cons of selling your investments to buy a house:

Pro: Peace of mind. You never have to worry about a monthly mortgage payment. It’s impossible to quantify this feeling on a spreadsheet, especially for people who detest taking on high levels of debt.

Con: A home is an illiquid asset. Your money is essentially trapped. You can’t spend your house. This isn’t a great feature in times of financial hardship or when you need to access your investment dollars.1

Pro: You give yourself a nice margin of safety in your personal finances with no mortgage payment.

Con: Owning shares in the stock market offers far more diversification than a single house. There is far more idiosyncratic risk in your local housing market.

Pro: You save a lot of money on interest payments over time. A $350k loan over 30 years at a 3% interest rate works out to more than $181k in interest payments over the life of a fixed rate loan. Paying with cash takes that off the table.

Con: Taking on a mortgage can reduce your tax bill. It rarely makes sense to put your money into something specifically for the tax benefits but avoiding a mortgage also means you don’t get to take the mortgage interest deduction on your taxes.

Pro: If you get into a bidding war, paying with cash will likely make it easier to buy if there is competition.

Con: Interest rates are near generational lows. After accounting for inflation and tax deductions you’re basically borrowing for free at today’s mortgage rates.

Pro: Paying in cash means you save some costs on the transaction and could probably close on the house faster.

Con: If housing prices continue to rise you could be missing out on the leverage component of further gains. For example, a 20% down payment on a $300k house would be $60k. If the home appreciated 10% it’s now worth $330k but you just made 50% on your $60k down payment.2

Pro: Stock market returns could be lower going forward. If you simply take what you would have paid in monthly mortgage payments and dollar cost average them back into your passive investments, you could find some better entry points along the way.

Con: There could be the potential for a massive opportunity cost if you sell out of the market and it continues to rise. The compounding benefits could look better from a combination of leverage in a house and dividends/earnings growth in the stock market.

Depending on how you feel about debt and the stock market, you could come up with sensible reasons for or against using your investment dollars to buy a house with cash.

The “right” answer will likely also be determined not just from financial returns but from your level of regret depending on each market.

Here are three scenarios from this decision that could potentially bring you some level of regret:

(1) You decide to sell out of your investments and stocks continue to rise.

(2) You decide to keep most of your money in the market and stocks crash.

(3) You decide to pay for the house in cash right as your local housing market is about to cool off.

Each scenario has a fairly high probability of occurring at some point depending on your time horizon and location.

It’s also important to remember this doesn’t have to be an all-or-nothing decision. You could always sell half of your investments to cover a down payment. That way you’re covering a large portion of the mortgage upfront but you don’t completely wipe out your early savings from a compounding perspective.

Splitting things up would also leave you the flexibility to potentially take the rest of your investments and pay off the mortgage down the line if you change your mind.

But the most important thing to remember here is how difficult it is to make a level-headed decision. A home is the most emotional asset you’ll ever buy. It’s the roof over your head and it carries a large amount of psychic income.

Being in a place to have your home fully paid off before you’re 30 does sound appealing; so does allowing your savings to compound from an early age.

The good news is you can’t really go wrong here no matter what you do as long as you make the decision that takes into account all of the trade-offs involved.

Further Reading:

What’s a First-Time Homebuyer To Do Right Now?

1You could obviously borrow against your home but that just puts you right back where you didn’t want to be — in debt.

2Obviously, leverage works in both directions so if your house goes down 10% that would mean you lost 50% on your down payment in this example.