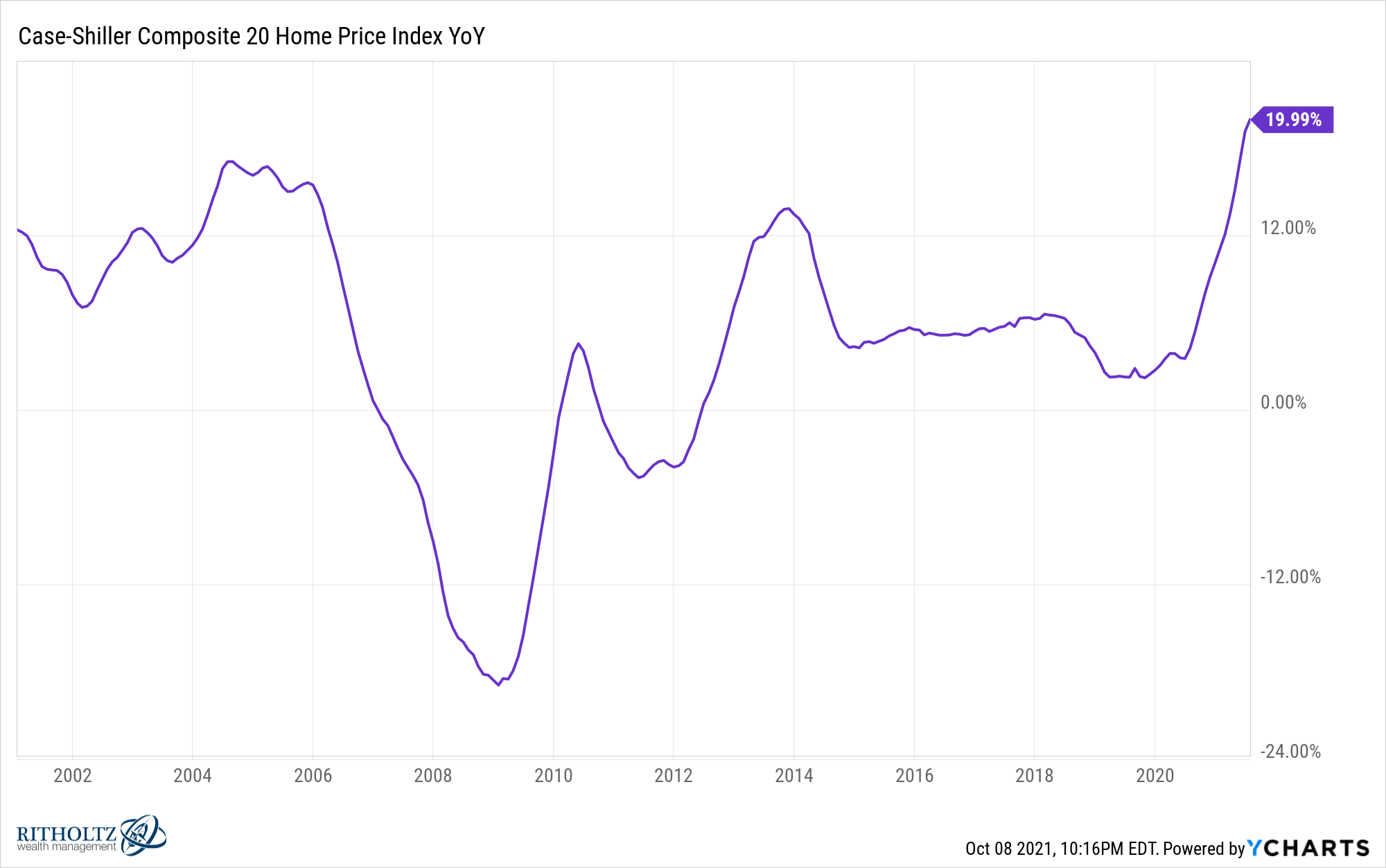

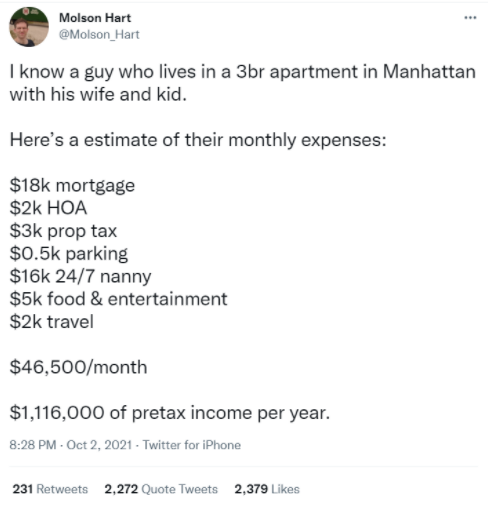

Looking at the rules of thumb for how much you should spend on a house.

Looking at the rules of thumb for how much you should spend on a house.

How outrage marketing works.

Shelby Davis, Warren Buffett, Hetty Green and the wrong personal finance mentors.

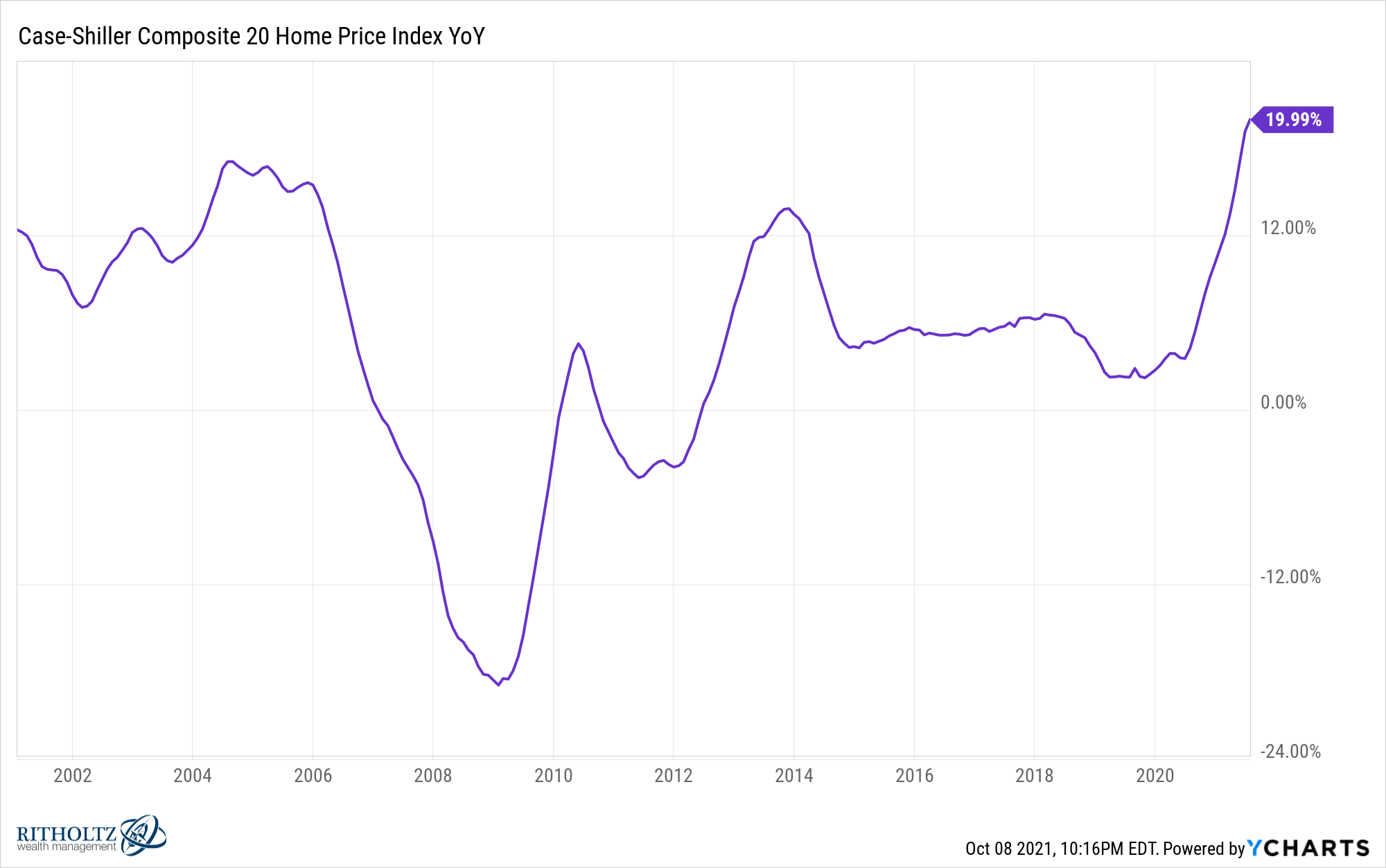

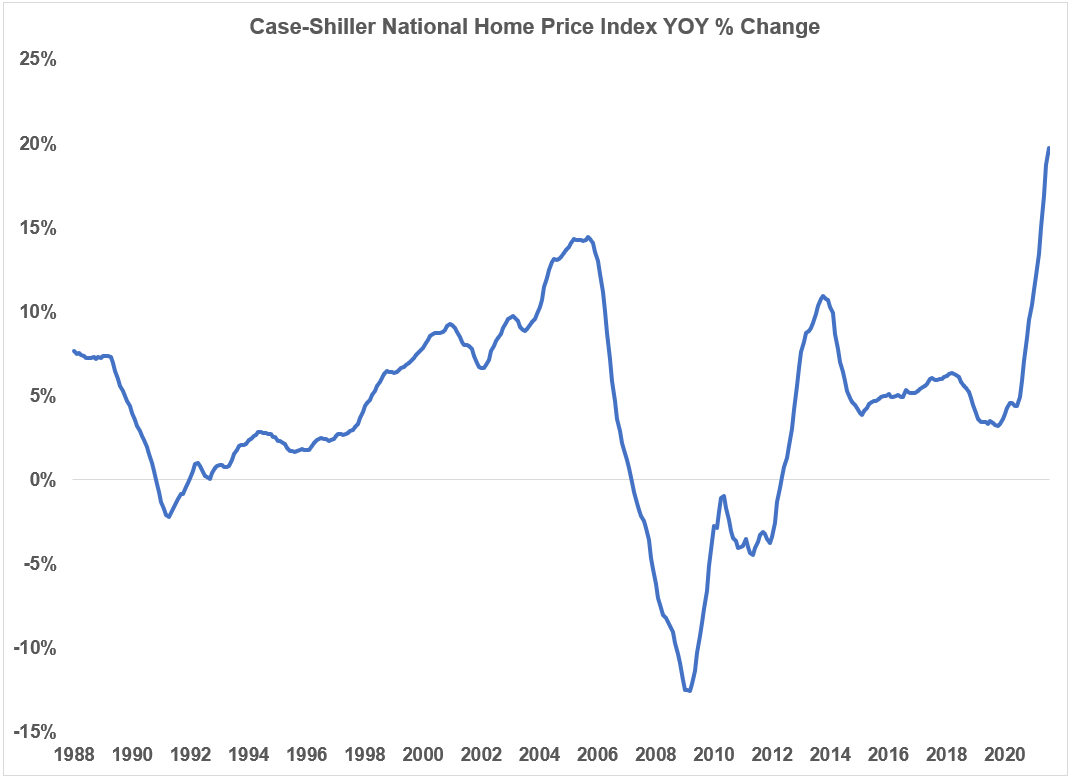

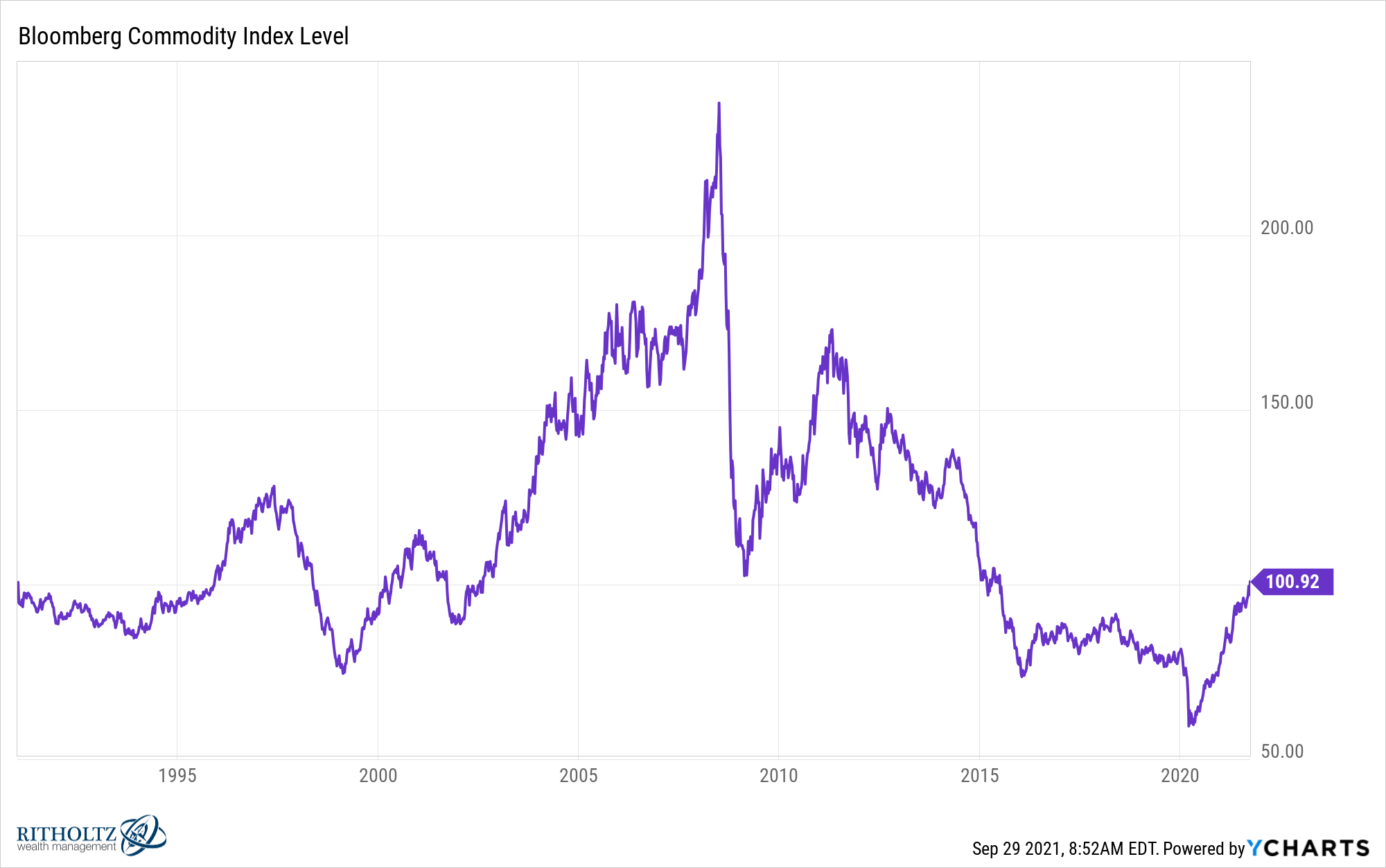

Michael and I discuss soaring housing prices, higher equity allocations, supply chain issues, Squid Game and more.

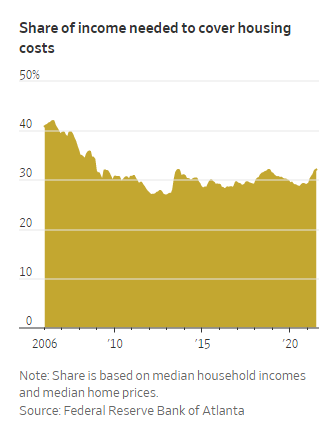

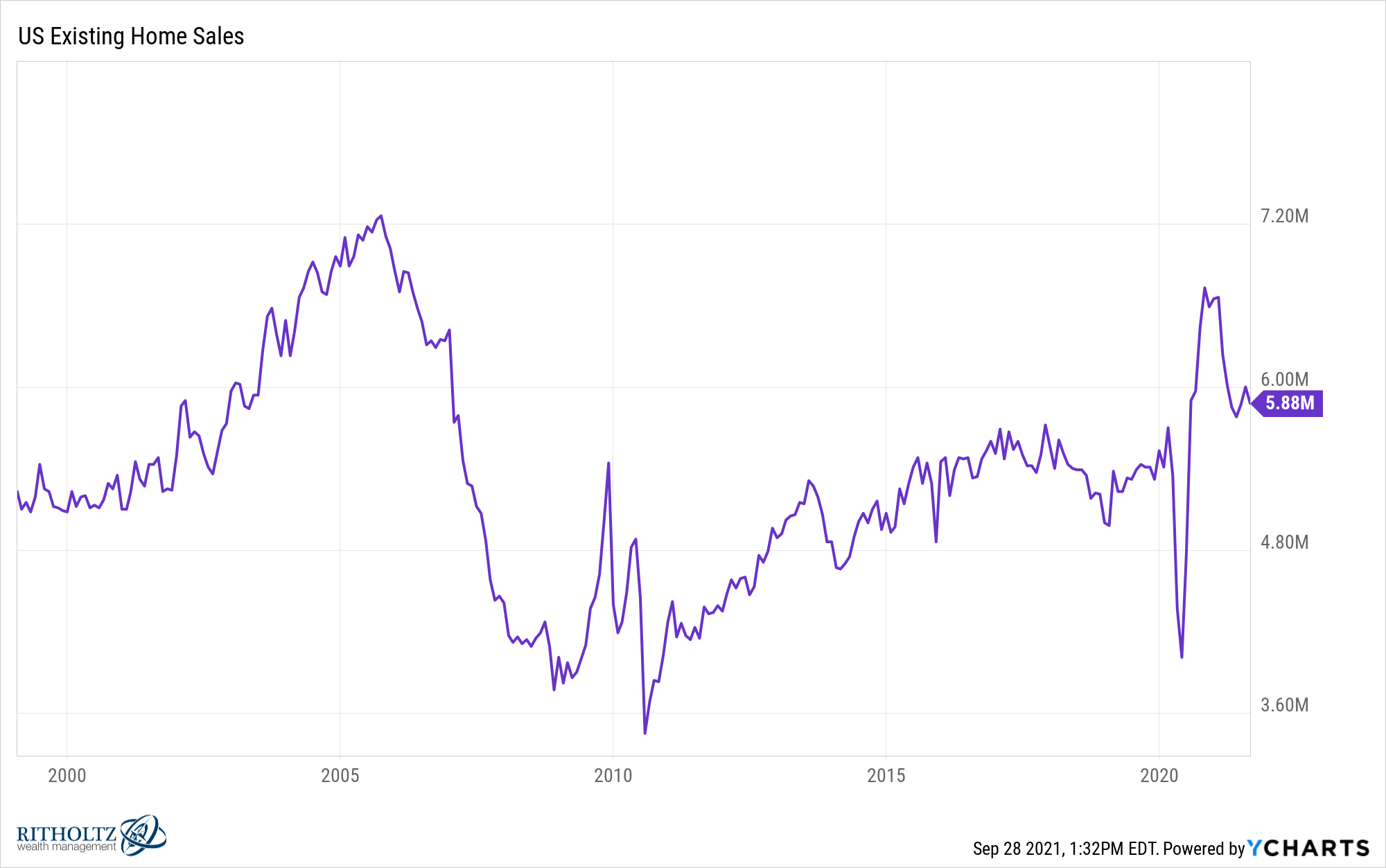

A look at how the housing boom is impacting affordability.

Michael and I answer questions from listeners of the podcast.

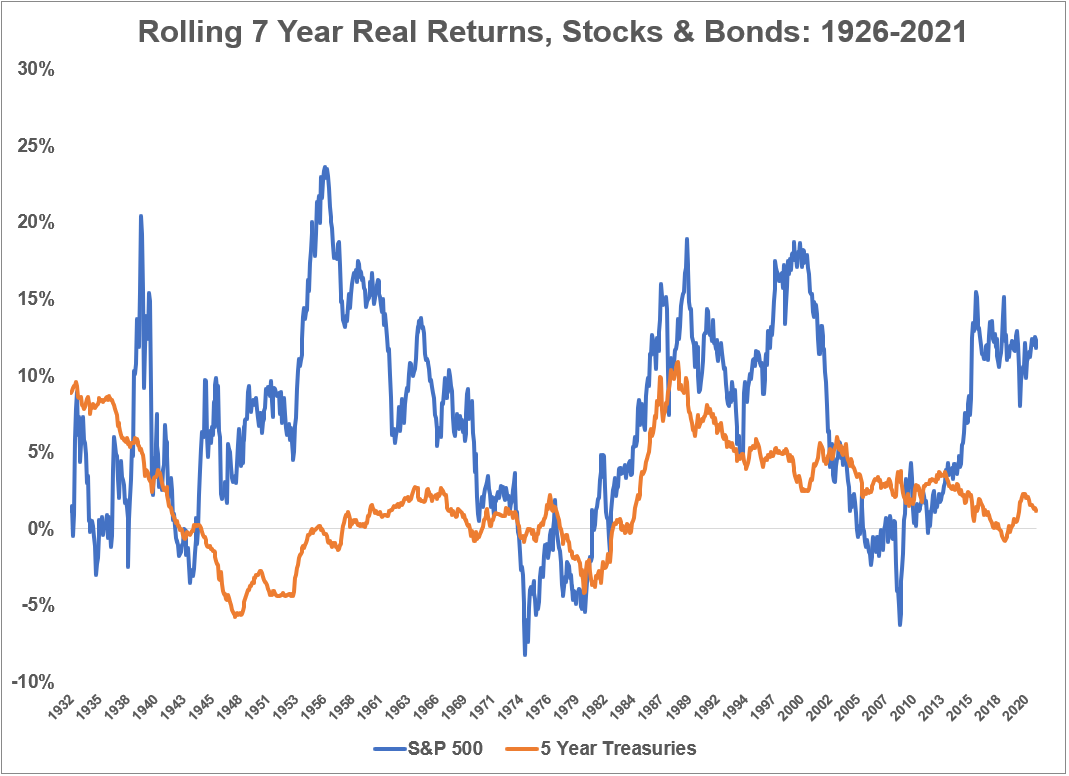

What would have to happen for both stocks and bonds to have terrible returns?

Why the current market environment is so confusing.

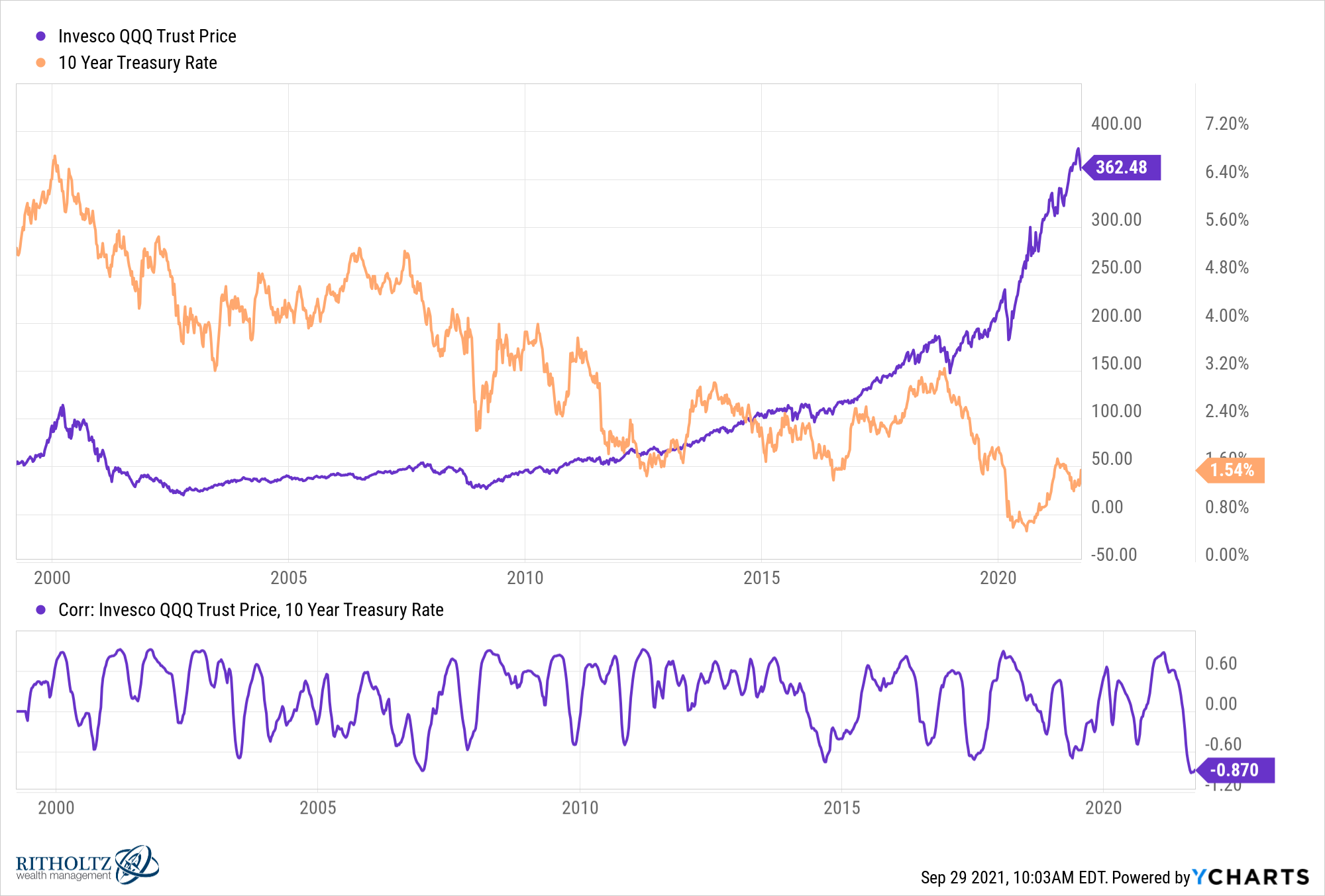

Will rising rates continue to punish tech stocks?

Michael and I discuss charlatans making predictions, why bailouts are here to stay, sports gambling and more.