It’s always different in the markets.

It’s always different in the markets.

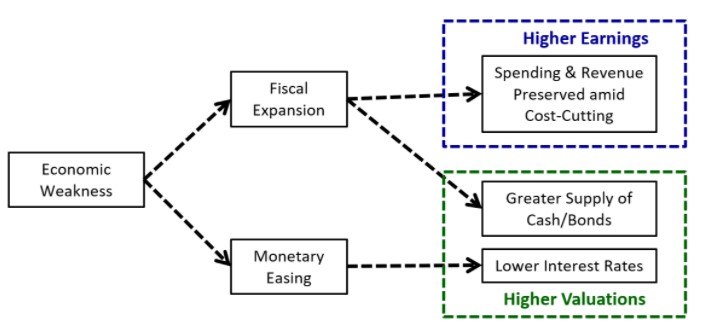

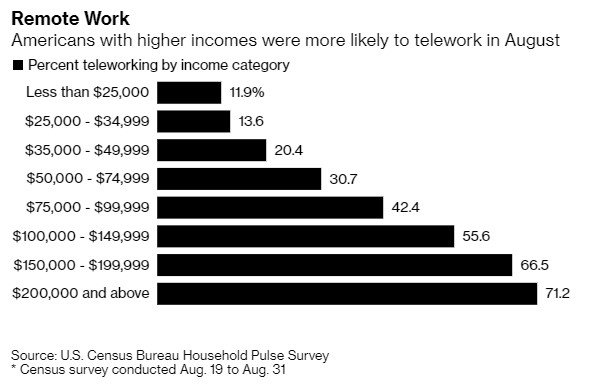

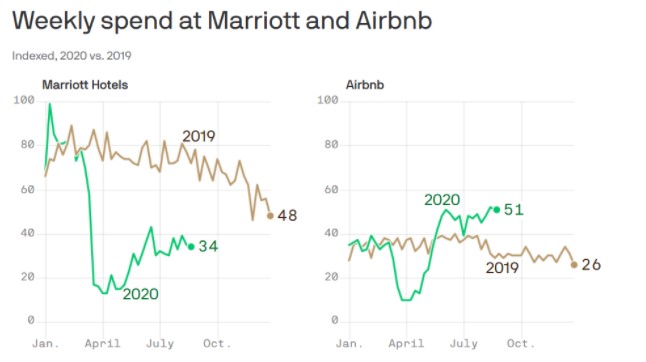

Why there was bound to be pushback to the work from home trend.

A look at my family’s journey through IVF.

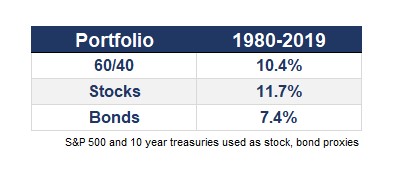

Why the past 40 years are an aberration but that doesn’t mean the 60/40 portfolio is dead.

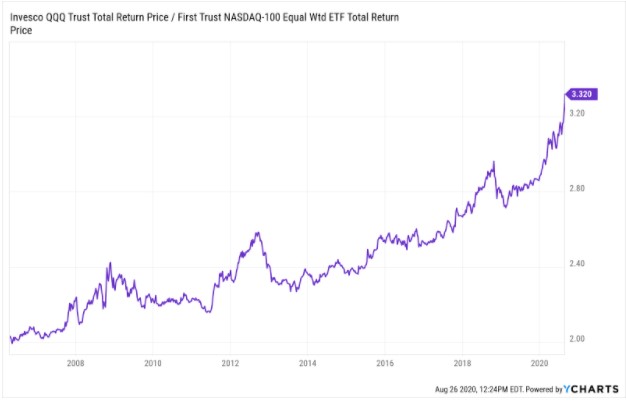

Michael and Ben discuss the quick correction in tech stocks, Softbank buying call options on tech stocks & more.

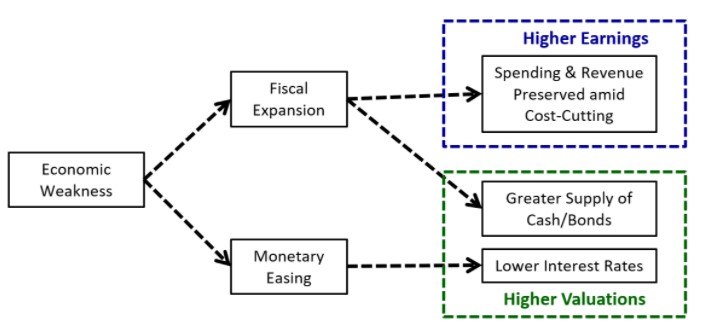

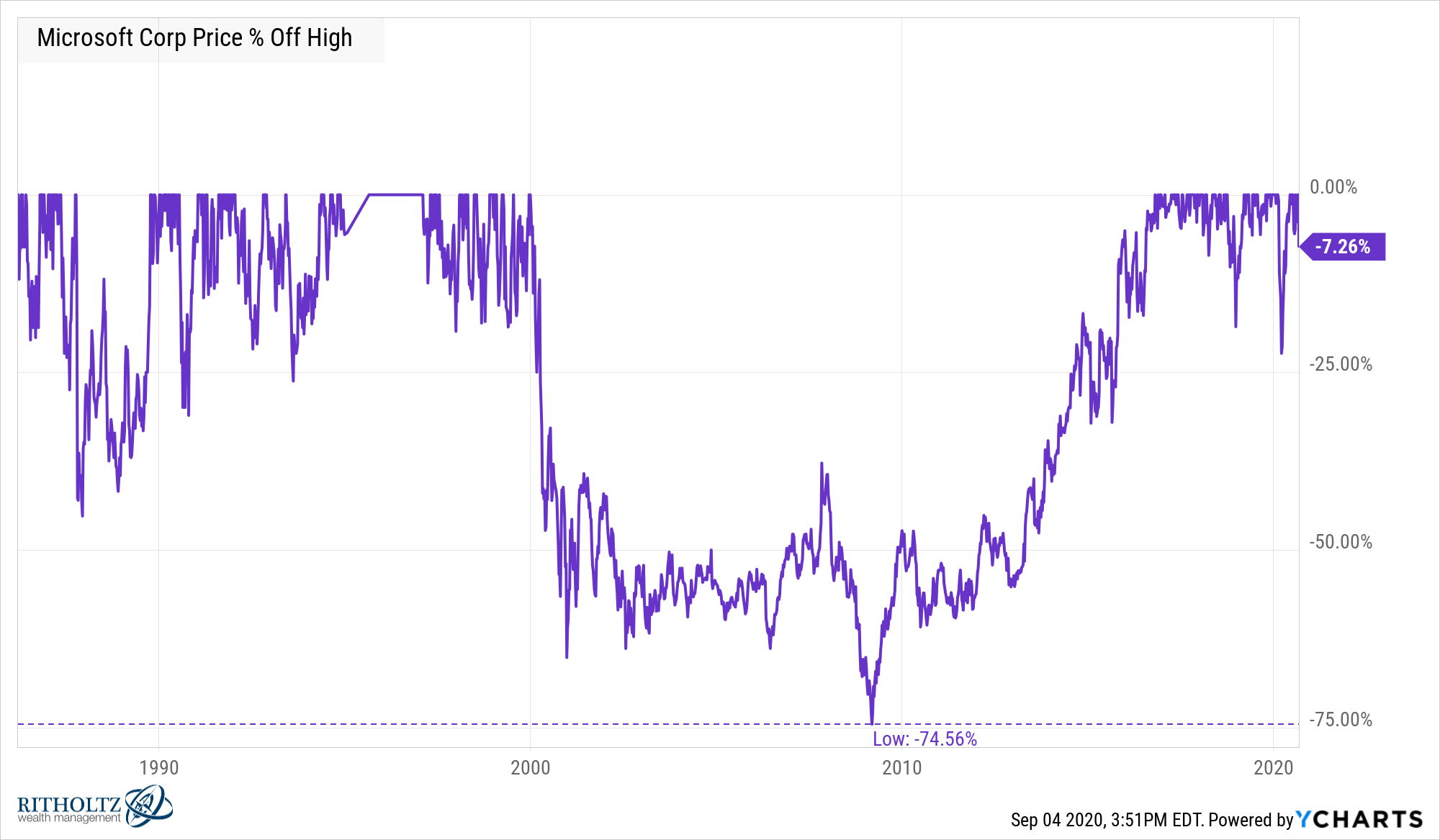

Sometimes the biggest reason the stock market or certain stocks experience a severe decline in price is because they first experienced a massive rise in price. Trees don’t grow to the sky and all that. The pandemic has changed the way we view the many previously held ways of doing things which has led to…

As recently as the 1990s, investors were forced to guess what the Federal Reserve was going to do next based on the width of Alan Greenspan’s briefcase.1 Communication from the Fed is still relatively new, maybe two decades old. The 2008 crisis brought the Fed into the information age as Bernanke and company upped their…

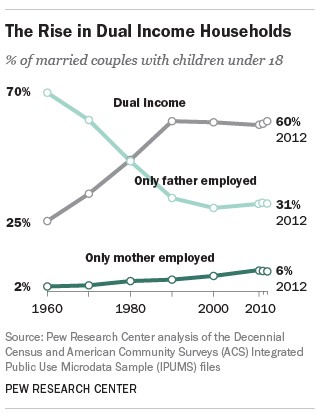

How much does it really cost to raise a child?

Some money lessons from the fast food industry.

Michael & Ben discuss the Fed’s new mandate, inflation, Robinhood traders, a new way to buy a car and more.