Today’s listener mailbag is presented by Naviplan by Invest Cloud:

Michael and I dive back into the mailbag to go through a bunch of listener questions with a little help from our friend Tony Stich.

If you have a question for the show, email us at animalspiritspod@gmail.com.

We discuss:

- Why do we talk about bonds in terms of yield and stocks in terms of price?

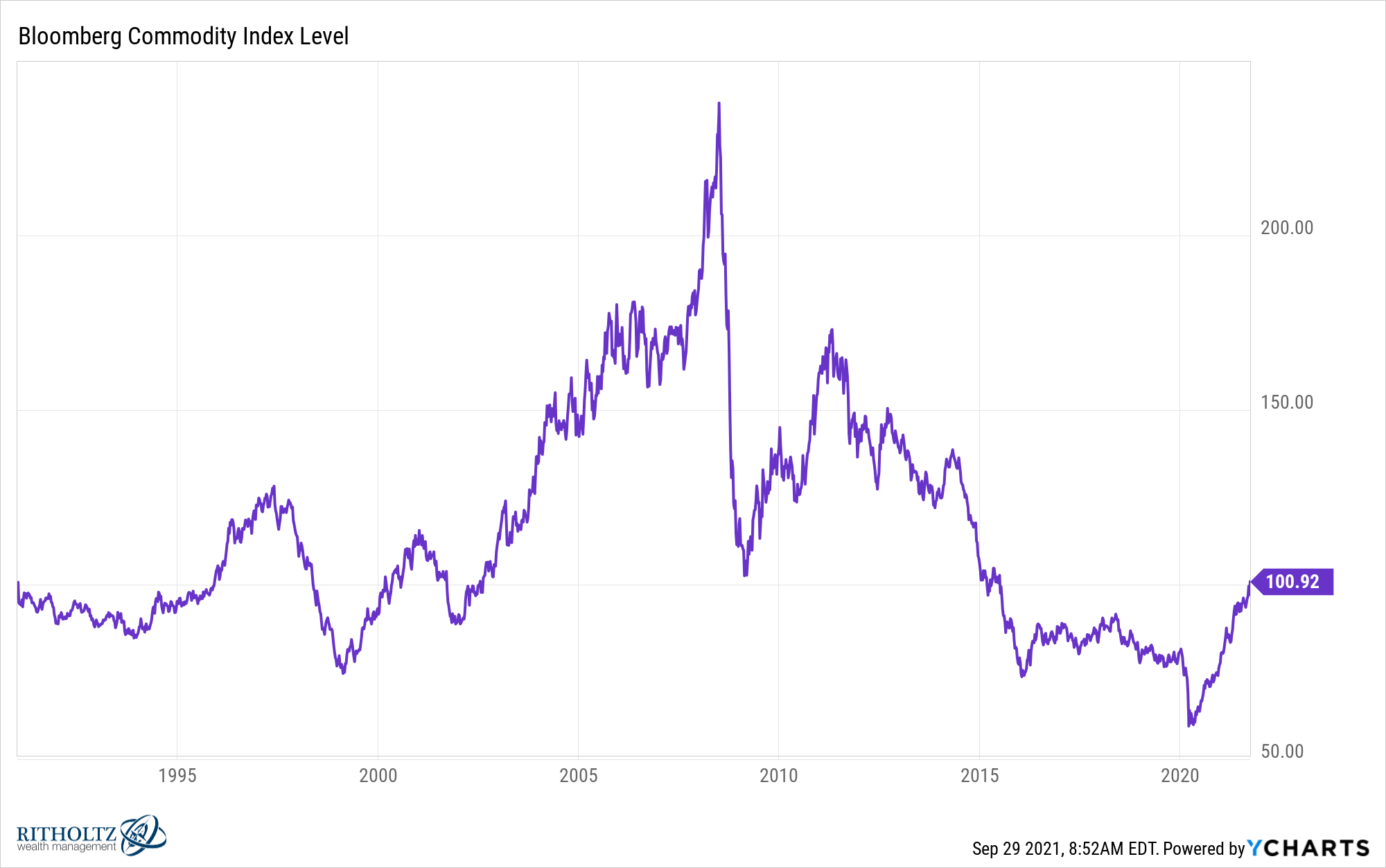

- Do commodities belong as a long-term holding in a portfolio?

- The psychology of sitting in cash and waiting for the fat pitch

- When should you refinance your mortgage?

- What is a mortgage recast?

- HELOC vs. cashout refi

- How to break into the wealth management industry

- What’s the best way to network for a new job?

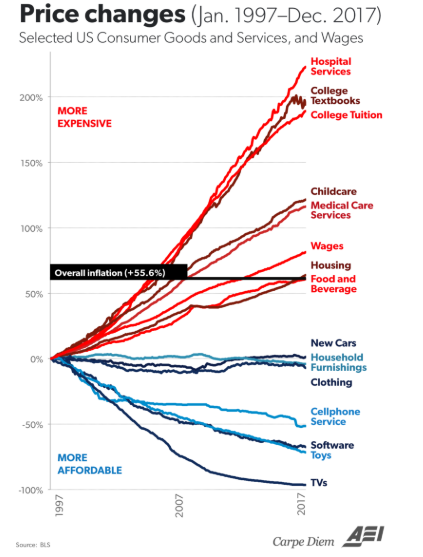

- Why do prices keep going up if technology makes life more efficient?

- Why inflation is preferable to deflation

- Why isn’t gold working in this environment?

- Can a 3-fund portfolio strategy work for you?

- The pros and cons of funding a 529 plan for your children

- Is confidence a prerequisite for being a successful financial advisor?

Listen Here:

Links:

- 200 years of asset class returns

- Why do we need inflation?

- An opportunity in precious metals and mining stocks?

- The psychology of sitting in cash

- Is now the time to cash out some home equity?

- What happened to gold?

- Where you live and the 50/30/20 rule

Charts:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here and here.

Subscribe here: