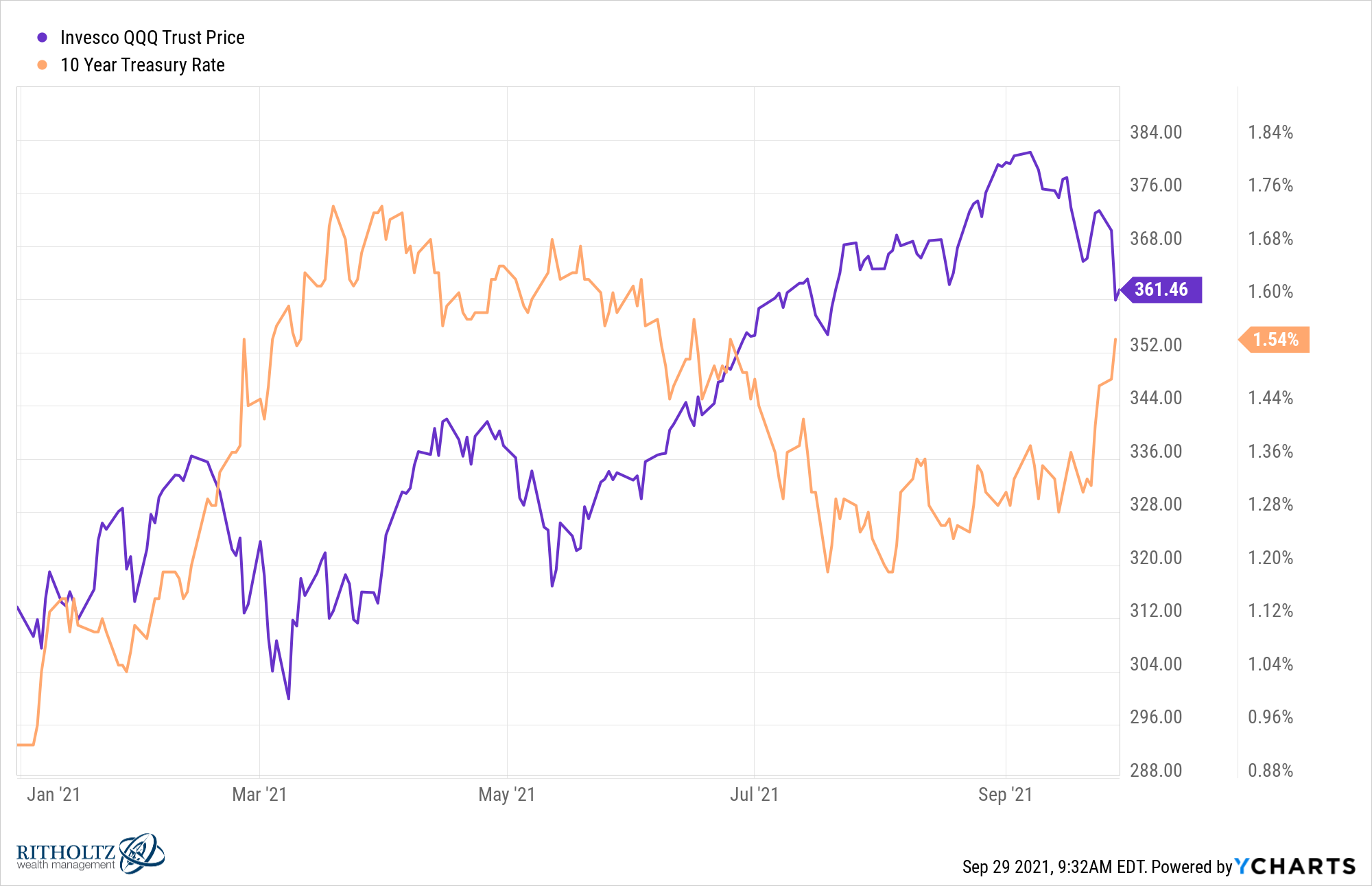

A noticeable relationship has emerged this year between tech stocks and interest rates:

When interest rates rise, tech stocks fall.

When interest rates fall, tech stocks rise.

Tuesday was a prime example. The 10 year yield rose and the Nasdaq 100 got crushed, falling nearly 3%.

This relationship makes sense in theory.

The value of any financial asset is its future cash flows discounted at the prevailing rate of interest.

Growth stocks have higher expected future earnings. When interest rates are falling, this makes those future earnings worth more to investors right now. When the hurdle rate is low, growth comes at a premium.

They’re almost like a zero coupon bond.

Value stocks, on the other hand, have more predictable cash flows now as opposed to promised cash flows in the future. And it’s possible those cash flows will even fall in the future.

Investors tend to be more comfortable holding these stocks when the discount rate is higher because the hurdle rate for investment is higher.

The problem with financial theory is it doesn’t always work in practice.

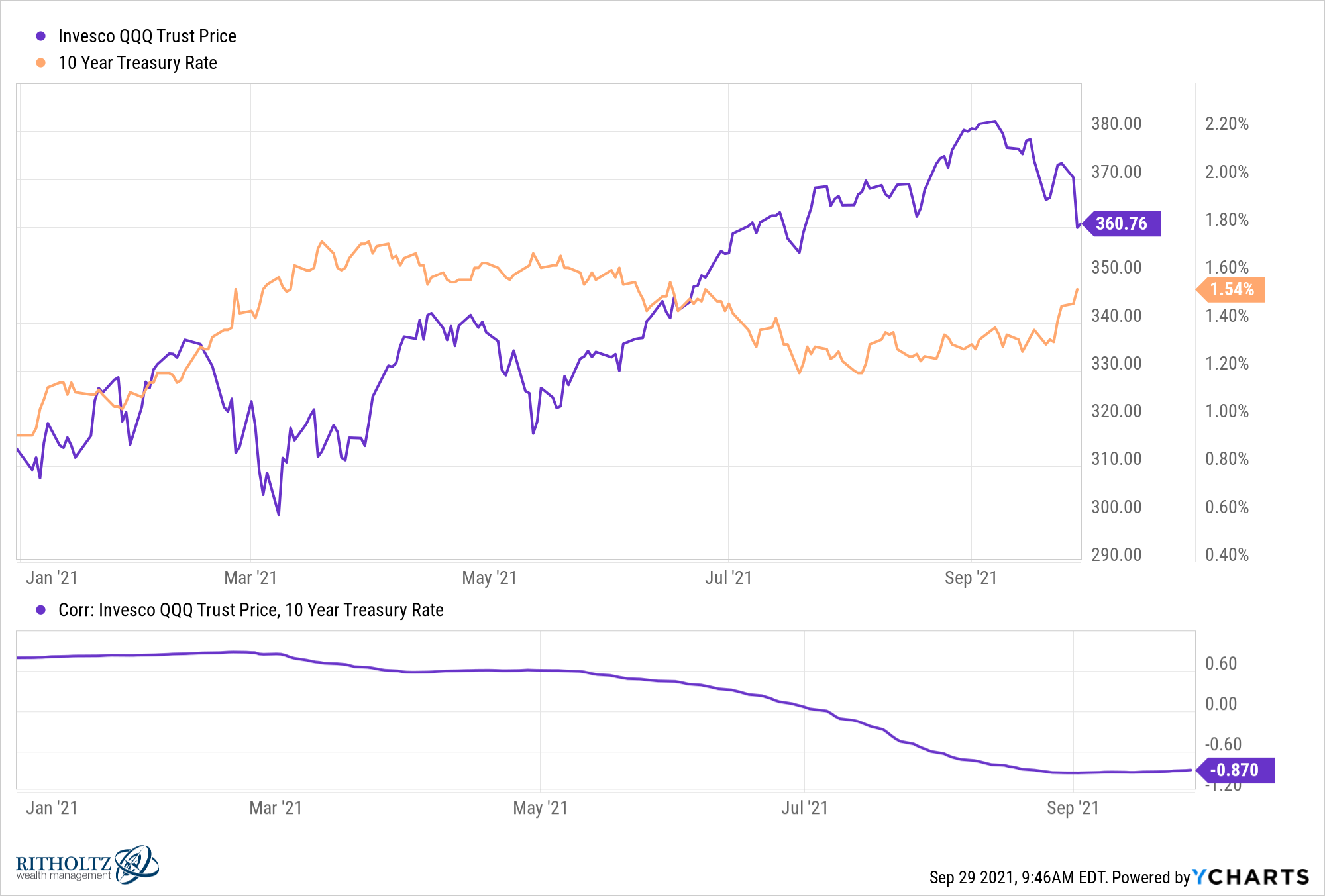

For example, the current correlation between the Nasdaq 100 and 10 year treasury yield is -0.9:

That’s a strong negative relationship, meaning when one value rises, the other tends to fall and vice versa.

So far so good.

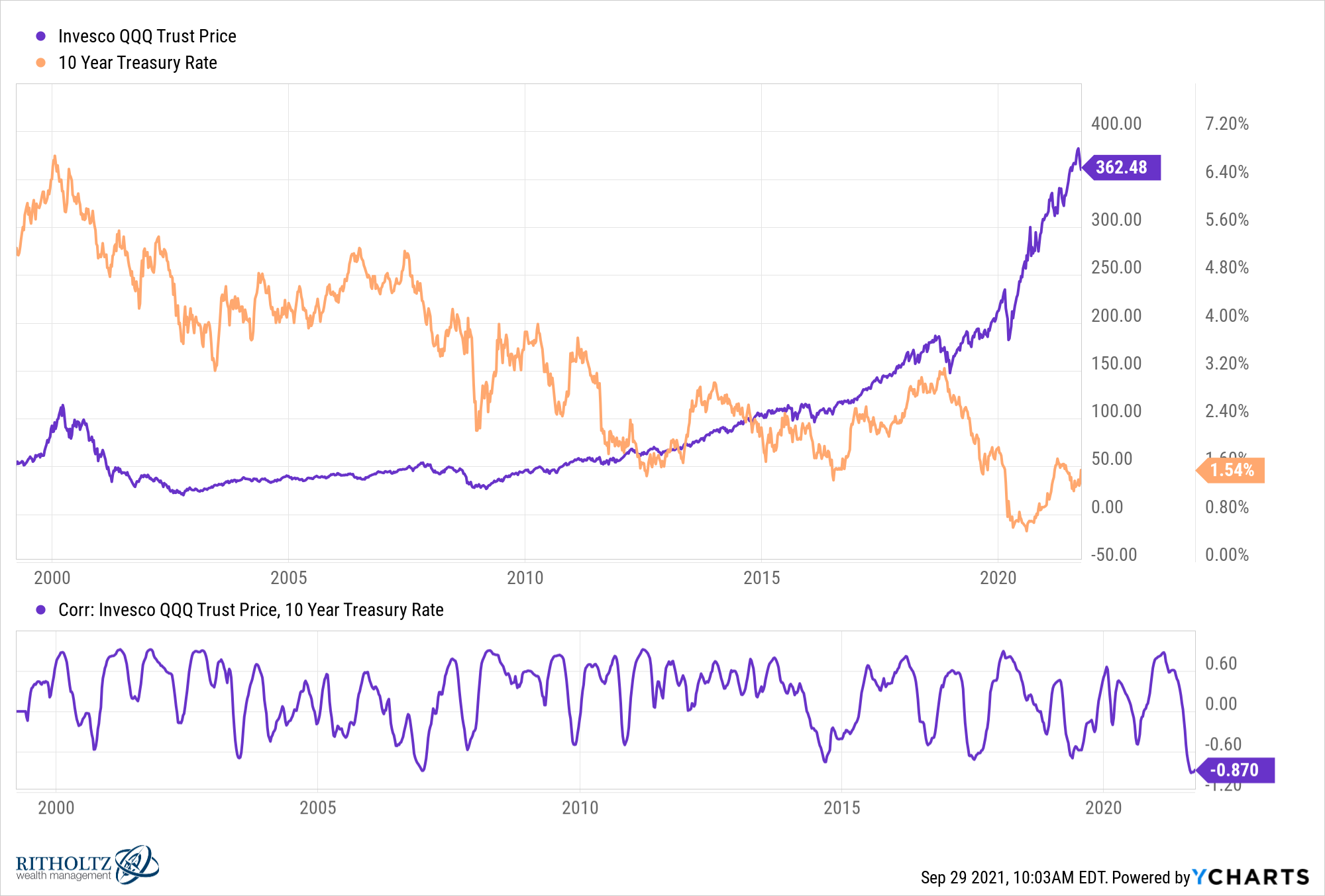

But let’s zoom out a bit to see how this relationship looks over the longer-term:

The correlation is all over the place, oscillating wildly from positive to negative territory. There is no noticeable relationship whatsoever.

Interest rates fell from 6.5% in the early-2000s to just over 3% a few short years later. In that time tech stocks got crushed, crashing 80%.

From the summer of 2016 through the winter of 2018, interest rates more than doubled from 1.4% to 3.2%. Tech stocks rose around 60% over this time frame.

Sometimes they move together. Sometimes they move in opposite directions. Sometimes they simply march to their own drummer.

This is how most relationships work in the financial markets.

Take stocks and bonds.

When the stock market sells off, government bonds are one of the surest hedges there is.

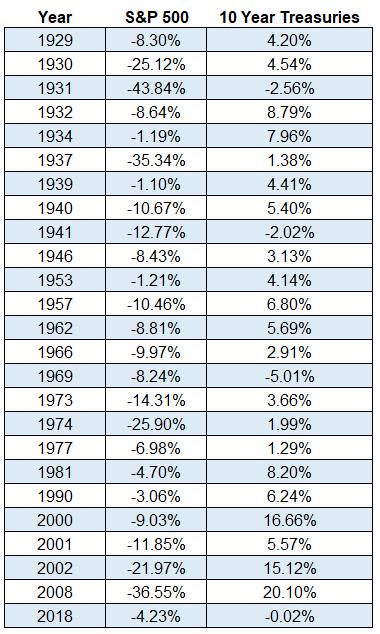

Here is every down year in the stock market going back to 1928 along with the corresponding returns on the 10 year treasury bond:

The average down year for the stock market is -13.3%. In those same down years, the average return for treasury bonds is +5.1%.

That’s an average outperformance of almost 19% for bonds when stocks are down in a given year.

This means stocks and bonds should have a negative correlation, right?

Not so fast.

Yes, when stocks fall bonds do tend to do well since treasuries benefit from a flight to safety (and the fact that crises typically see central banks lower interest rates).

But stocks generally go up over the long haul. So do bonds.

In fact, while the U.S. stock market has seen positive returns in 68 of the past 93 years, bonds actually have a better batting average, up in 76 out of 93 years. In 55 out of those 93 years, both stocks and bonds have risen concurrently during the calendar year.

That means 60% of the time stocks and bonds have both seen gains in the same year.

It’s also true that the relationship between stock and bond returns can and will change over time.

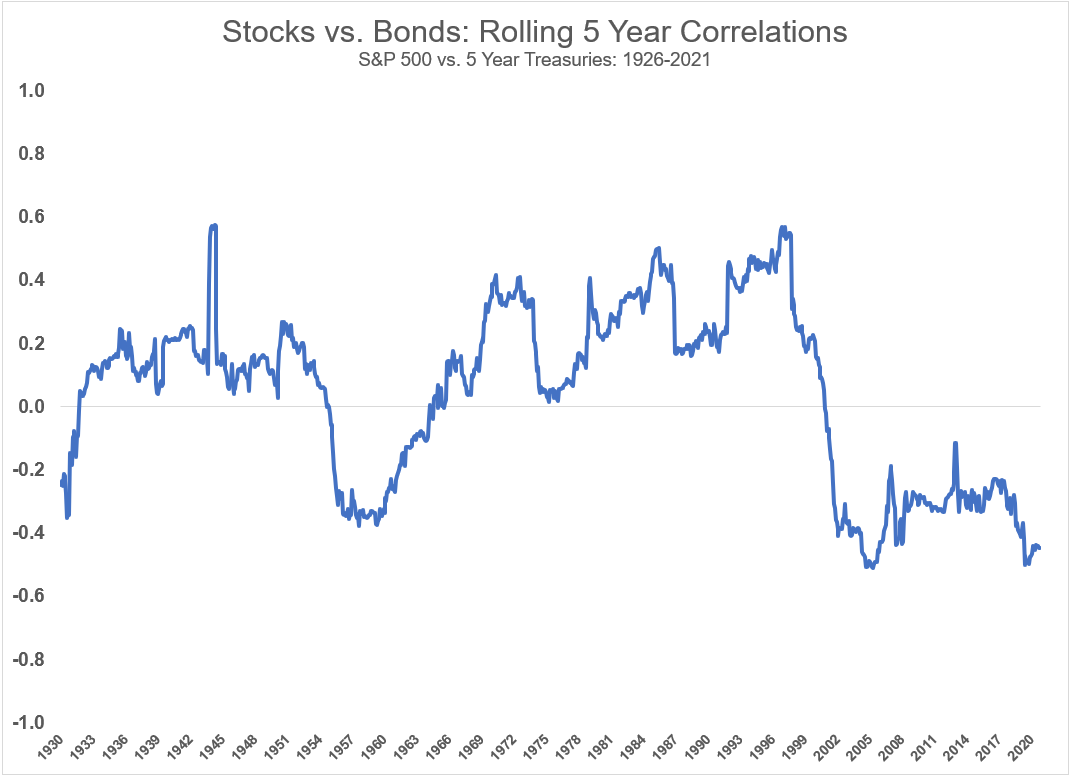

I looked at the monthly returns for the U.S. stock market and intermediate-term government bonds going back to 1926 to calculate the rolling 5 year correlation between the two return series.

Look at how the correlation changes over time:

Sometimes they’re positively correlated. Sometimes they’re negatively correlated. Sometimes there is little to no correlation at all.

Life would be a lot easier as investors if we simply knew the exact correlation over time and it never changed. Then we could create some seriously optimized portfolios.

Unfortunately, it’s not that easy.

Asset class relationships change and evolved over time. Different assets have different return profiles depending on where we are in the market cycle.

Can tech stocks continue to sell off if rates continue to rise?

Certainly.

Could it also be that investors who are sitting on massive gains in tech stocks are looking for a reason to sell those stocks?

Definitely.

Will there be a time where this correlation breaks down in the future?

I’m leaning towards a yes on that one as well.

Markets aren’t that easy when it comes to the relationship between different financial assets.

Further Reading:

Why Value Died