Balancing long-term bullishness with short-term bearishness.

Balancing long-term bullishness with short-term bearishness.

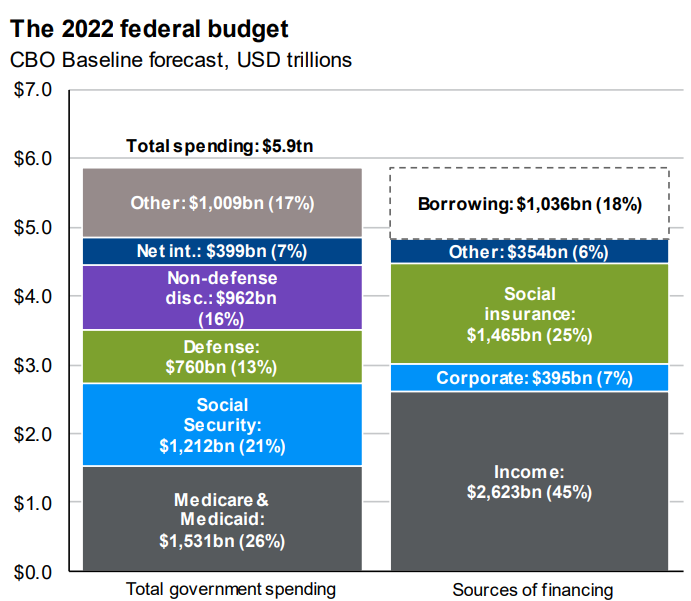

How is the government going to afford higher interest rates on its debt?

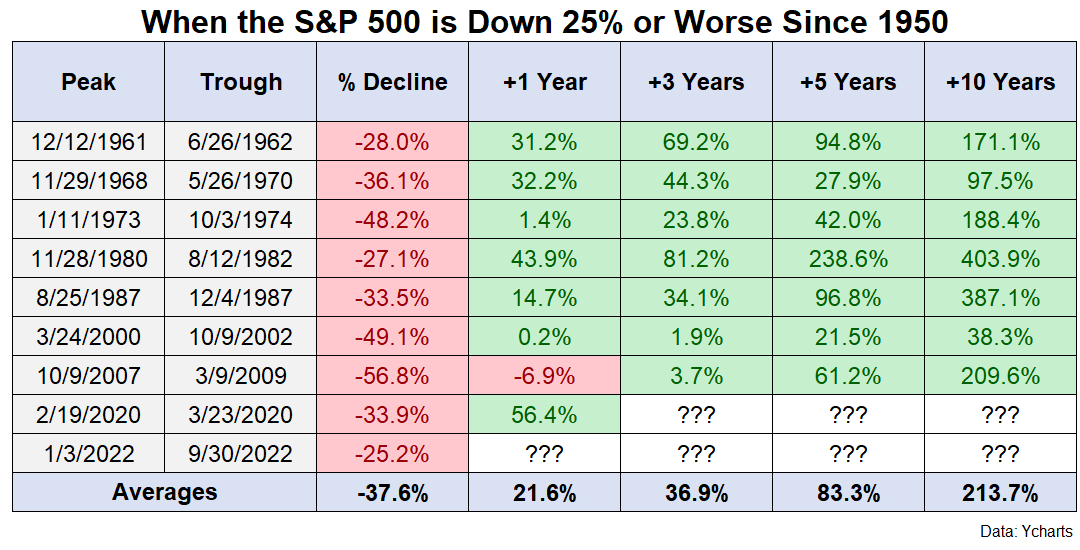

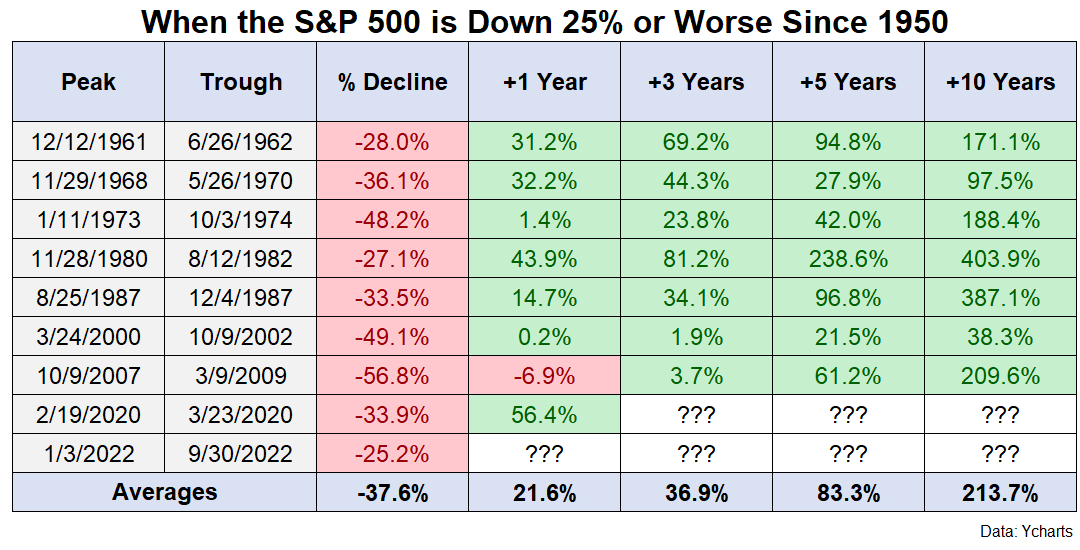

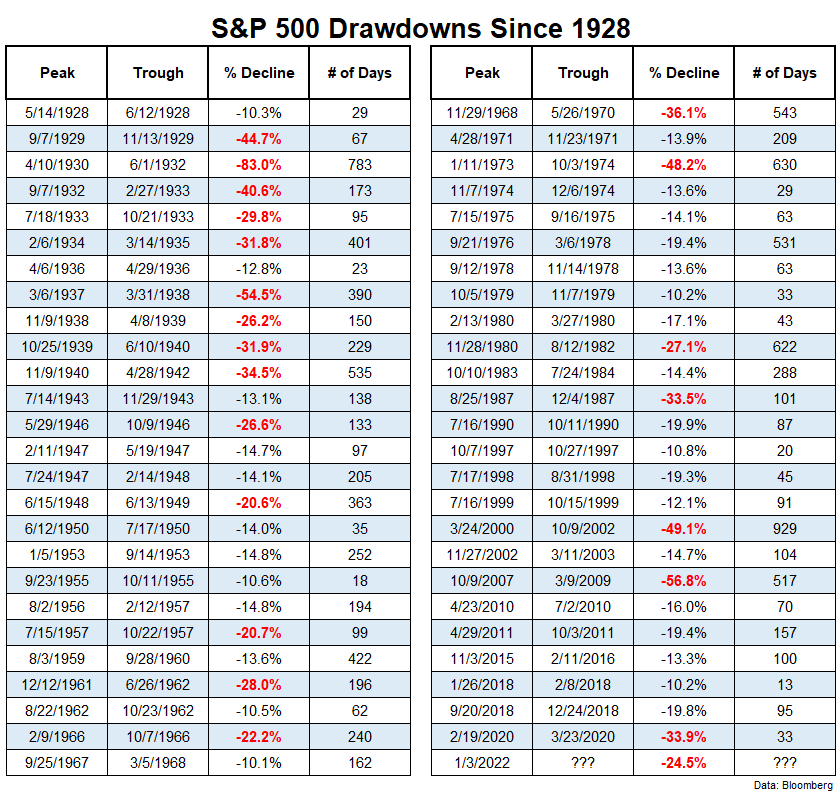

How retirees should think about navigating bear markets.

On today’s show, we discuss is the Fed making a huge mistake, why it’s so difficult to predict the economy, why it’s so easy to be bearish right now, breaking the housing market, why we’ve turned on Jerome Powell, the bullish case for a 60/40 portfolio and much more.

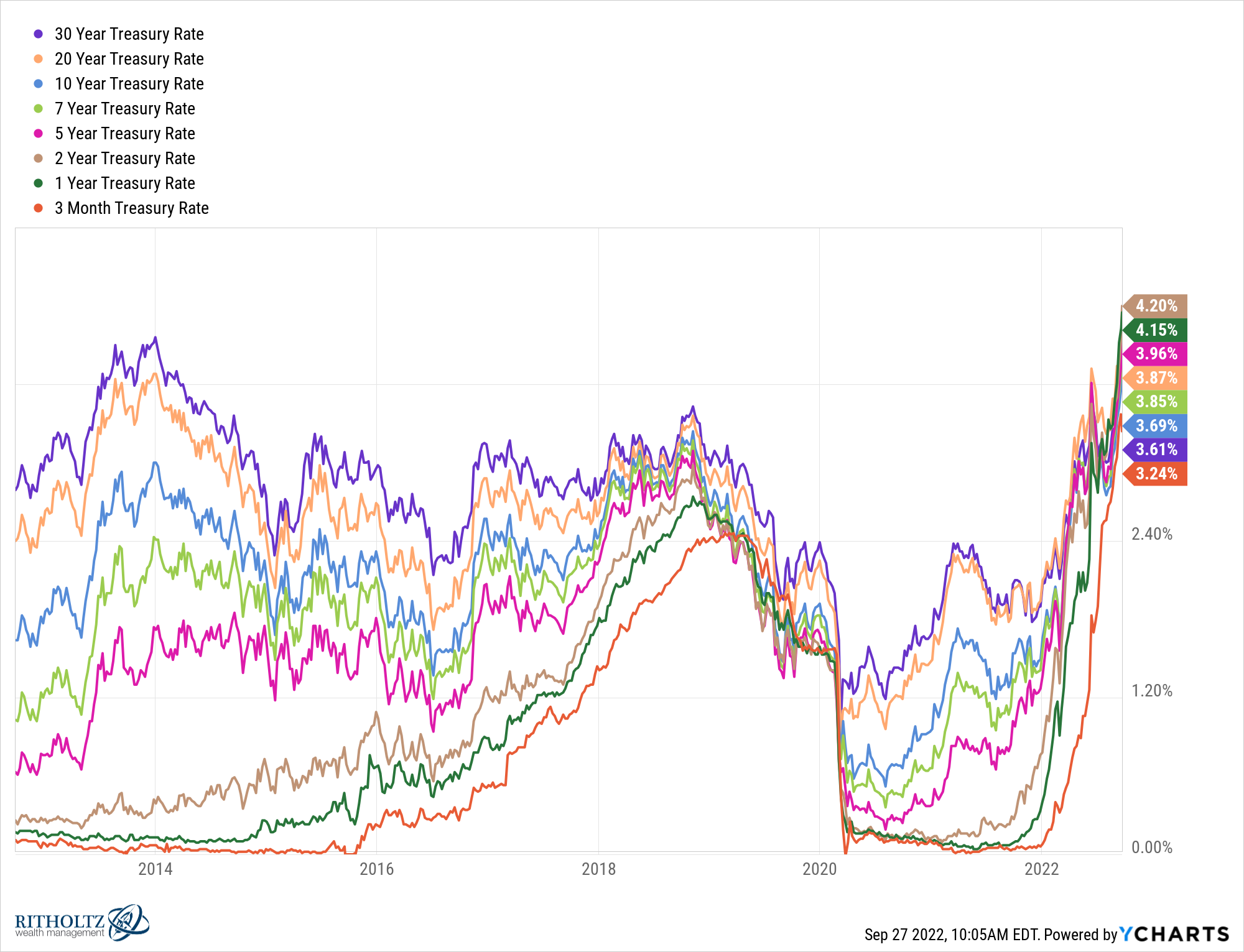

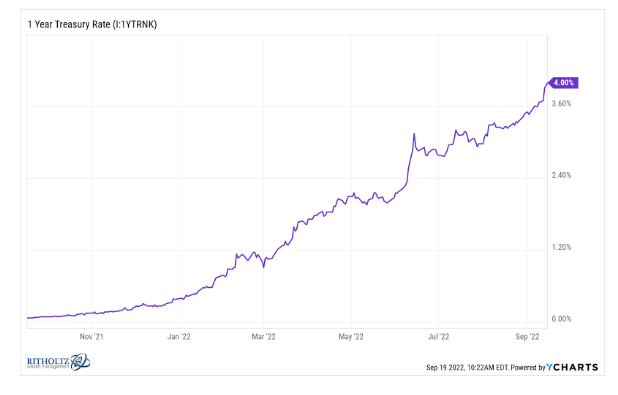

Bonds look a lot more attractive today then they did a year ago.

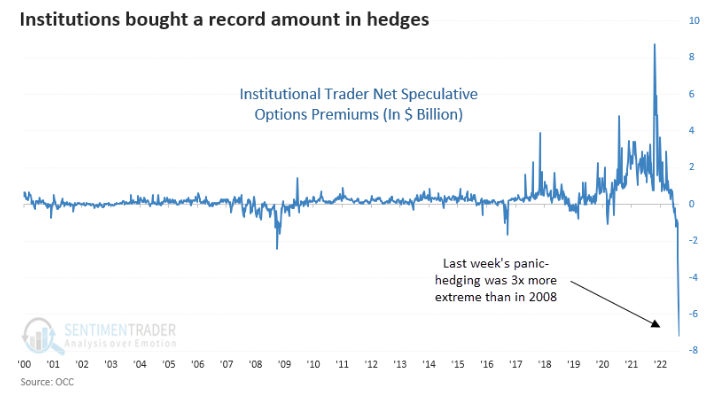

On today’s show, we spoke with Eric Metz, President and CIO of SpiderRock Advisors about tax-loss harvesting, replicating exchange funds, and de-concentrating portfolios using managed option strategies.

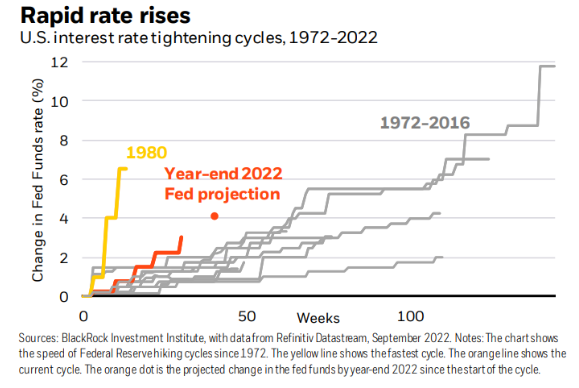

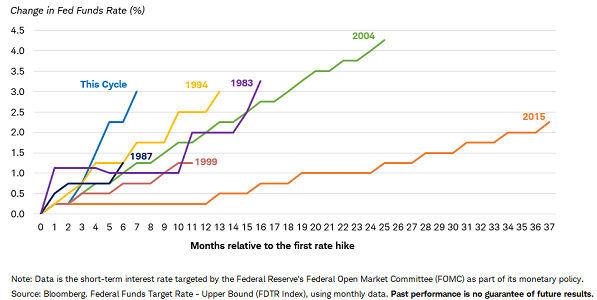

WTF is the Fed thinking?

Why luck plays such a large role in your financial success or failure.

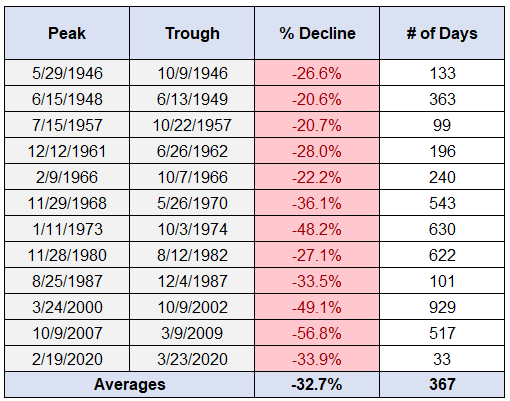

How to navigate your first painful bear market.

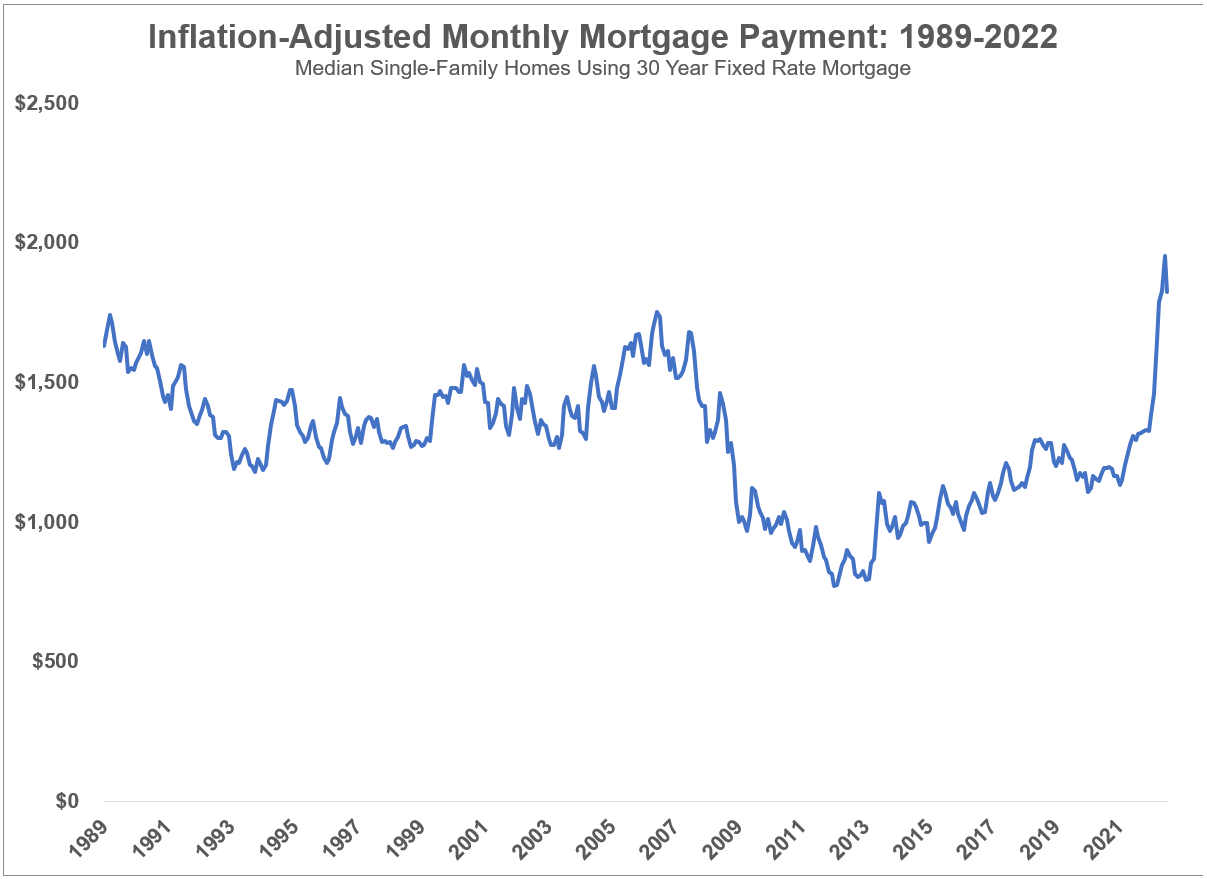

On today’s episode, we recap our experience at Future Proof, interest rates vs. inflation for the stock market, a blow-off top in short-term rates, what could cause international stocks to outperform, housing inflation, why the housing market is broken, George Clooney’s best movie and much more.