“I’m not going to argue with people that are broker than me about money.”

“I’m not going to argue with people that are broker than me about money.”

On today’s show, we spoke to Fabric Risk Co-Founder, Rick Bookstaber about identifying risks for advisors, lifestyle characteristics and risks, the MSCI factor model, scenario testing, and much more.

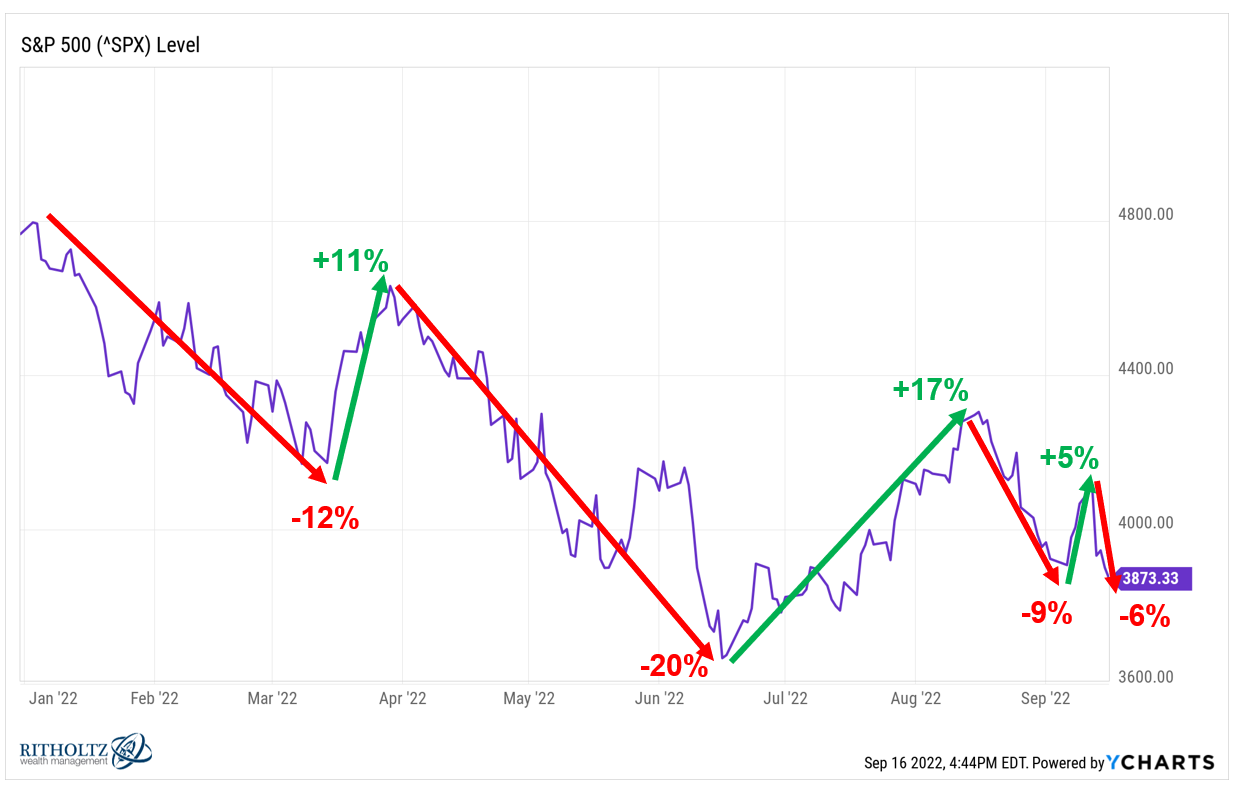

My all-time favorite stock market analogy.

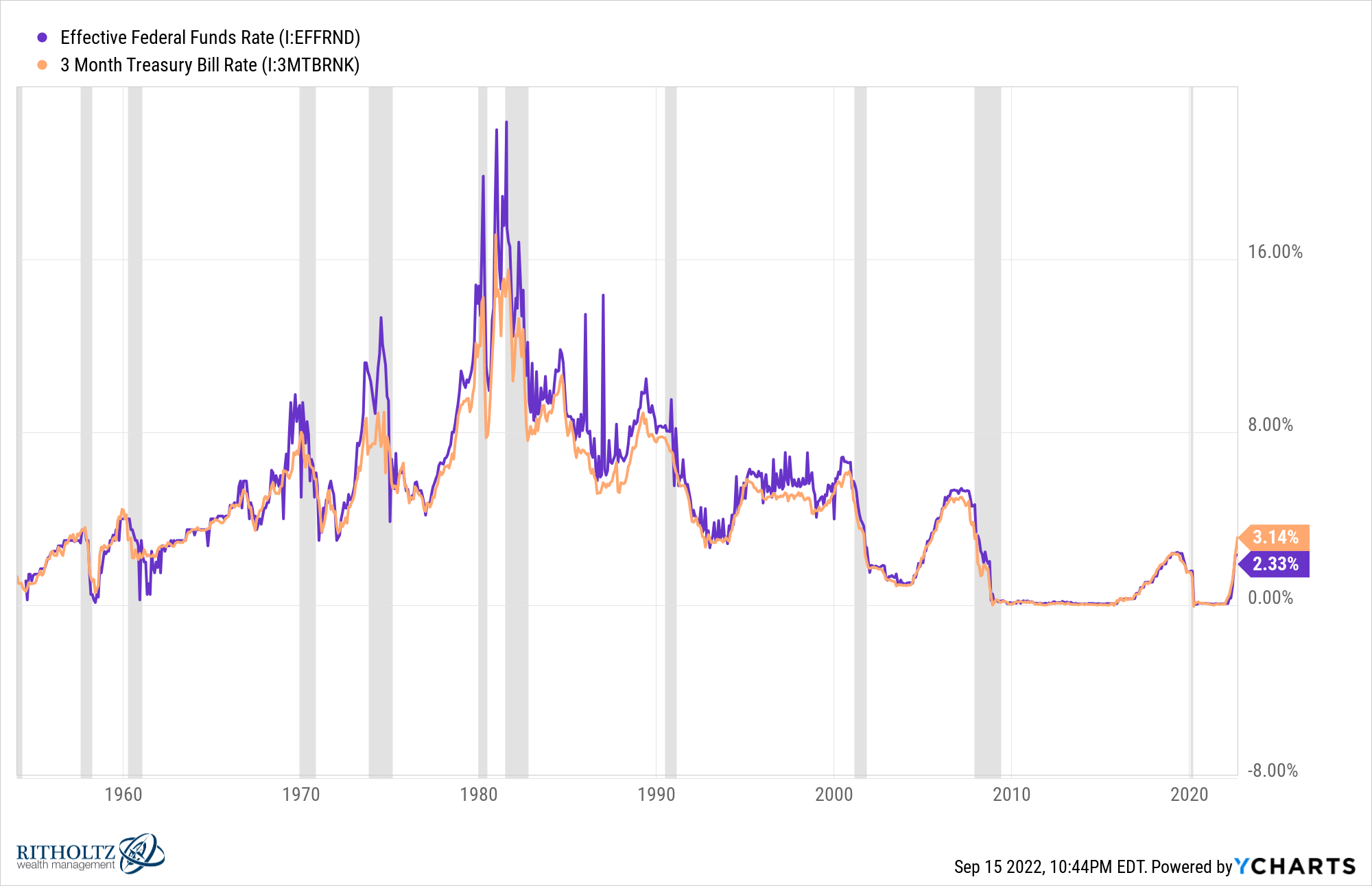

Why inflation matters more to the stock market than interest rates.

Life planning vs. financial planning.

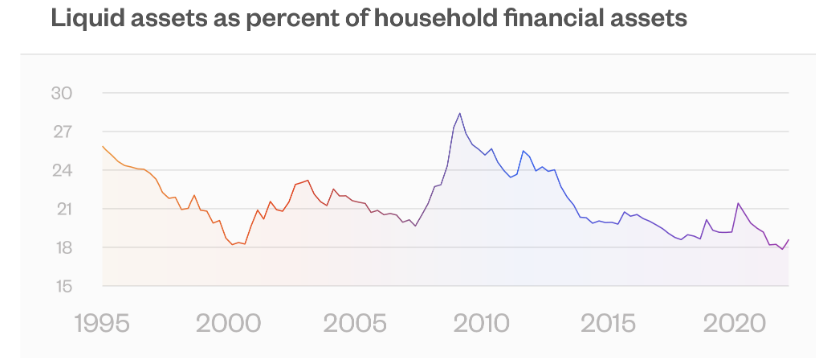

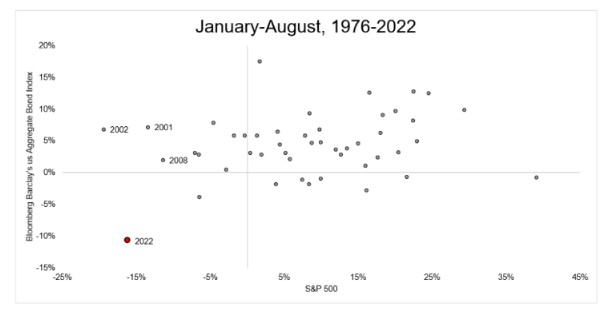

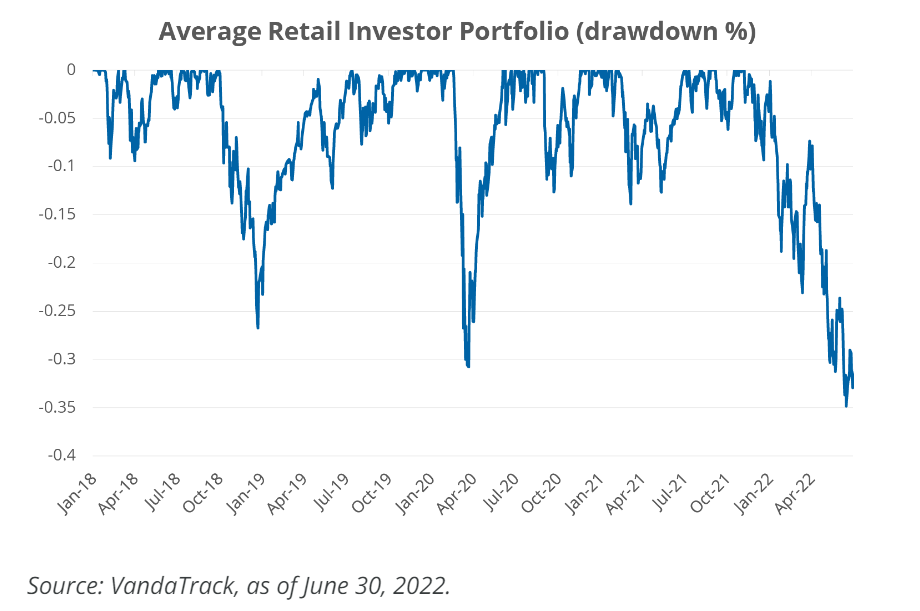

On today’s show, we discuss the worst first 8 months ever, the illiquidity premium, Q2 earnings, The Robinhood Investor Index, and much more!

Why our brains default to the negative side of things.

On today’s show, we had David Mazza, Head of Product at Direxion to talk about the use cases and risks of investing in single stock, leveraged, and inverse ETFs.

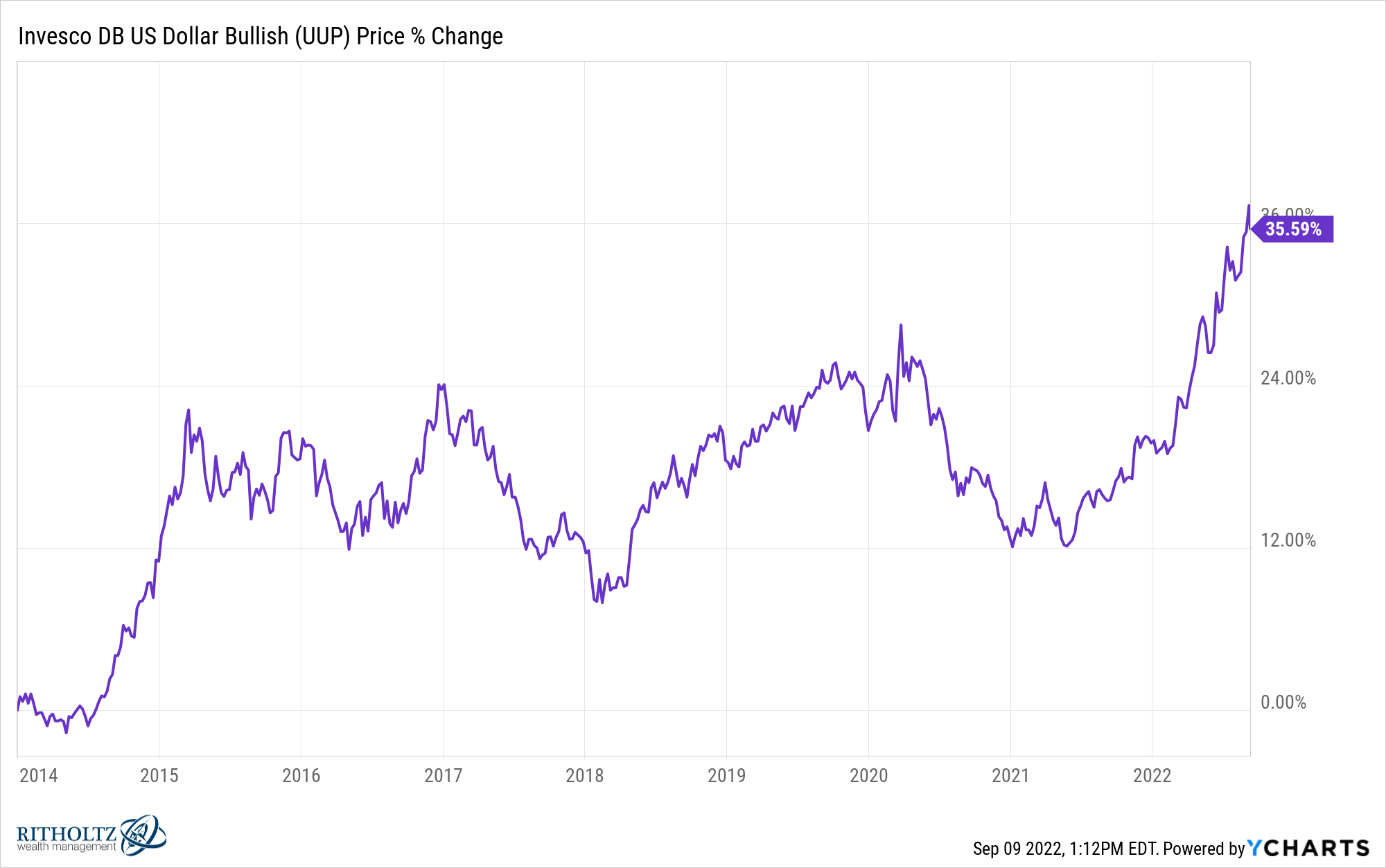

Following the Great Financial Crisis of 2008 a number of macro doom-and-gloomers began predicting a collapse of the U.S. dollar. The Fed was “printing” trillions of dollars. Interest rates had never been that low before. It was an appealing narrative if you were someone stuck in the negative feedback loop of the biggest economic crash…

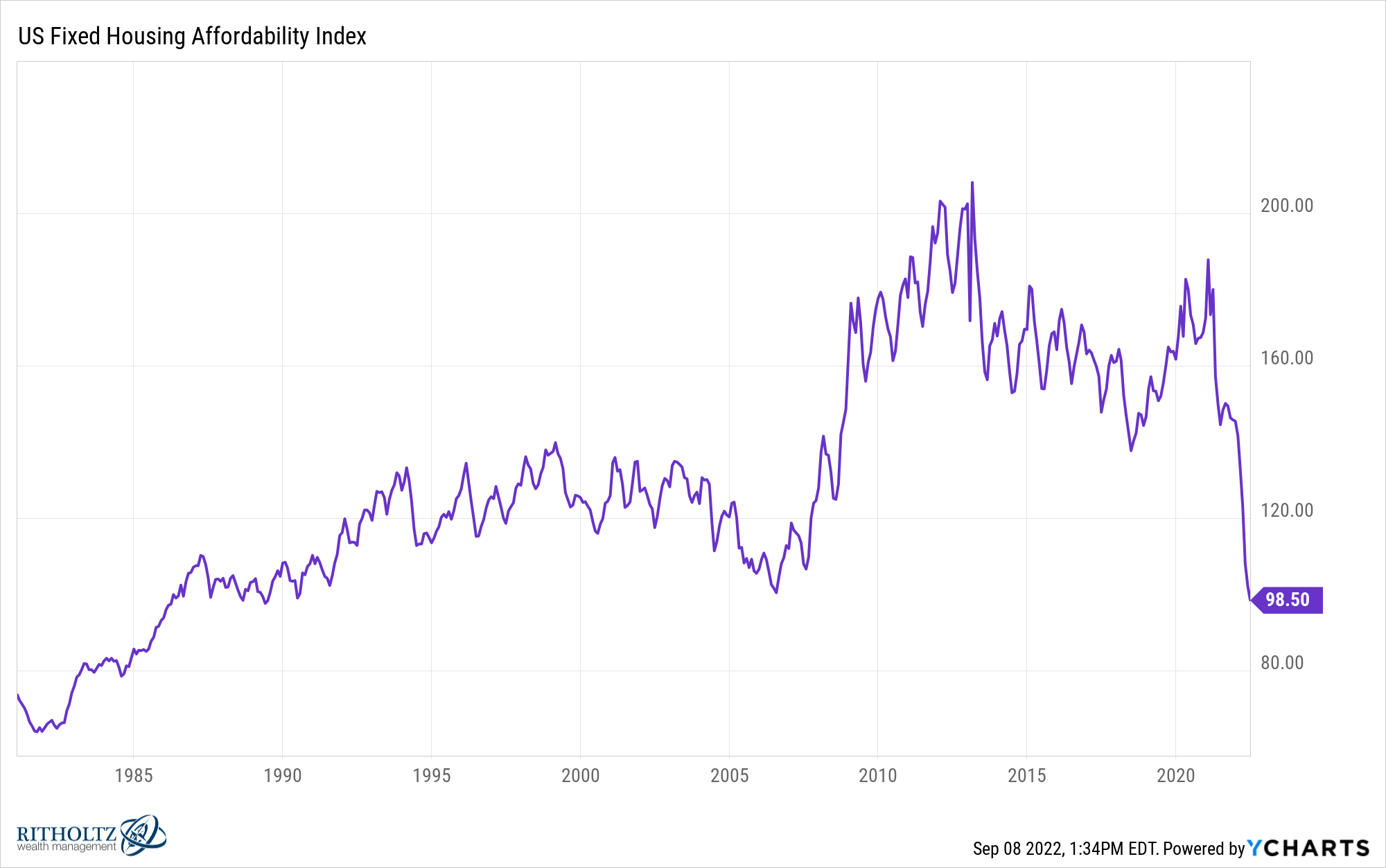

Why lots of people are out of luck with the hight cost of housing.