I’m not a fan of blaming the Fed for everything you don’t like about the markets or the economy.

Markets have always been rigged or manipulated. Truly free markets are a pipe dream.

You have to invest in the markets as they are, not as you wish them to be.

Having said that, the Fed deserves some blame for what’s going on in the housing market. I think the past few years are going to screw things up in housing for a long time.

There are a number of different factors that played a role in the huge move up in housing prices — the pandemic, the switch to remote work, low mortgage rates, demographics, etc. So it’s not all on the Fed.

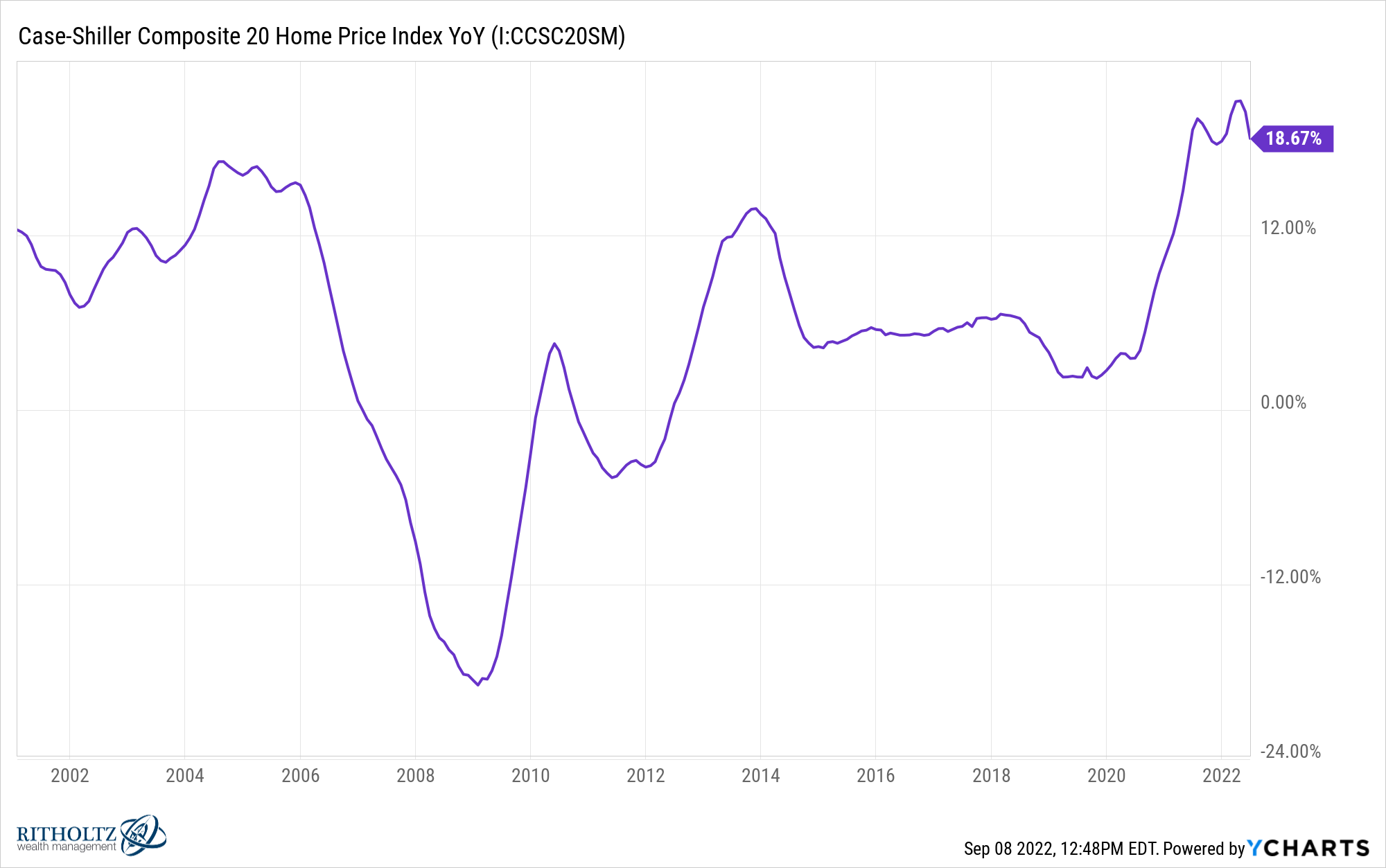

But look at how long they let that run-up in prices last:

The year-over-year gains have been in the double-digits since December 2020.

By raising interest rates, the Fed has certainly slowed the rapid price rise. So why did it take so long?

And why did they allow rates to rise so fast?

Mortgage rates have basically doubled since the beginning of the year:

This is after spending more than three years under 4%. Mortgage rates of 6% are not that high by historical standards, but the fact that rates rose this much this fast didn’t give consumers a chance to adjust.

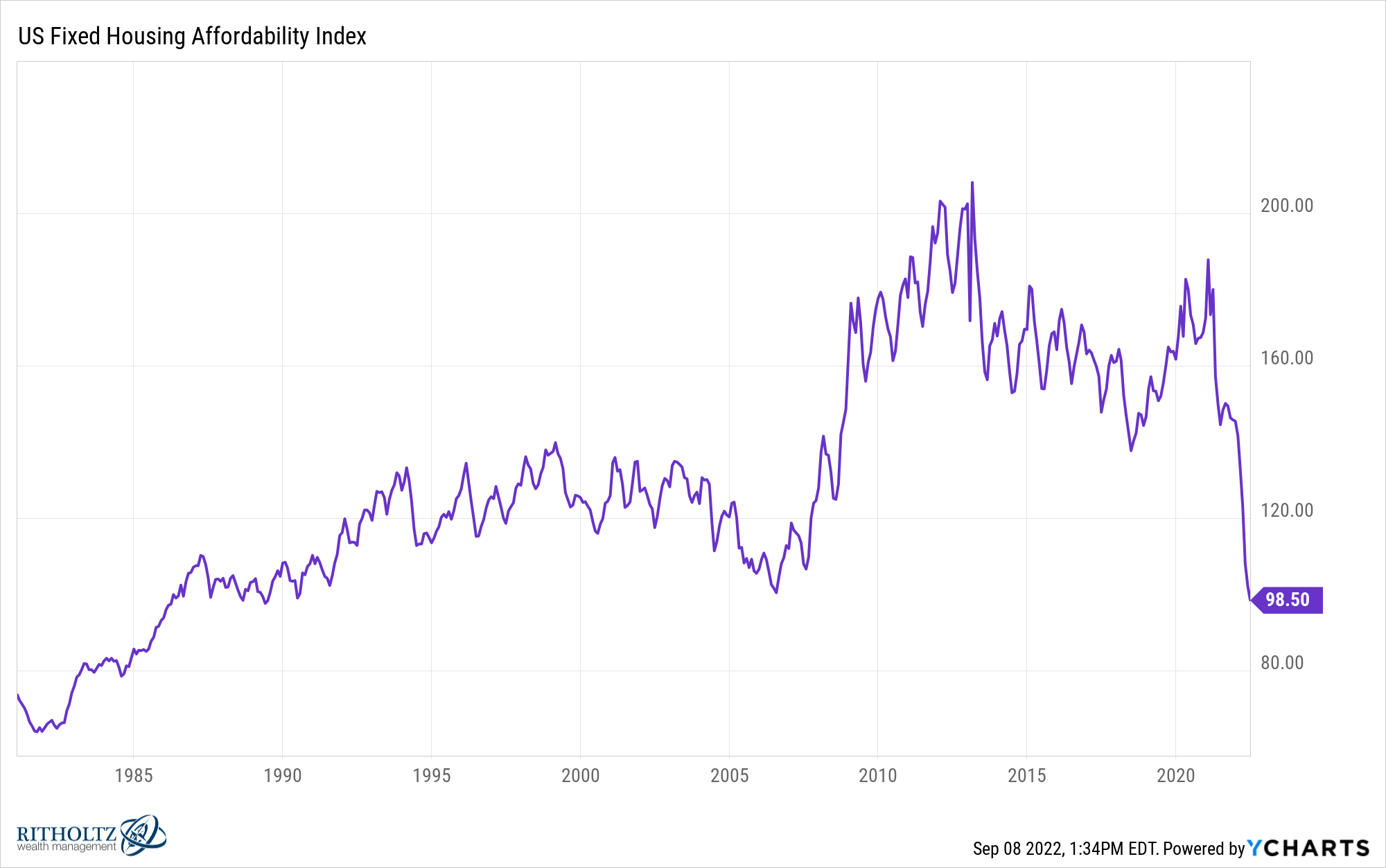

Just look at how fast affordability went lower:

Maybe if rates had slowly moved up to 4% for a number of months and then 5% for a while and eventually 6% after a number of years home buyers and sellers would have had a chance to adjust.

Our brains don’t like discomfort and changes that happen in a hurry are known to cause discomfort.

The amygdala is the part of our brain that releases hormones that signal fear and the fight or flight response. It helps us identify threats. And that part of the brain interprets change as a threat.

In general, our species has a difficult time dealing with change that happens in a short period of time.

I’m not saying the Fed should set mortgage rates but if you’re going to manipulate interest rate markets, wouldn’t it make sense to manipulate this one? I think it was a mistake to allow rates to get this high this fast.

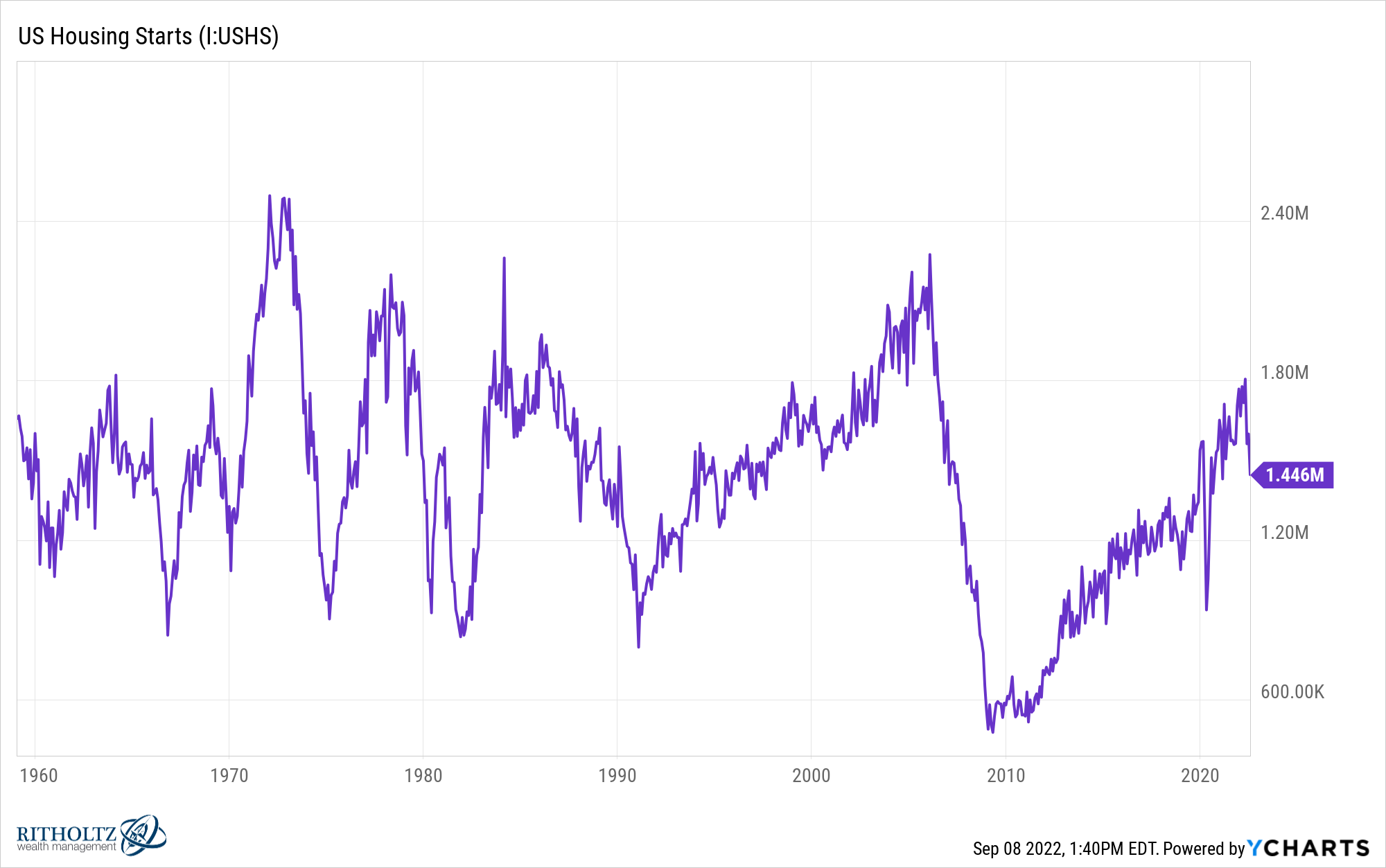

Housing starts (new builds) are already rolling over:

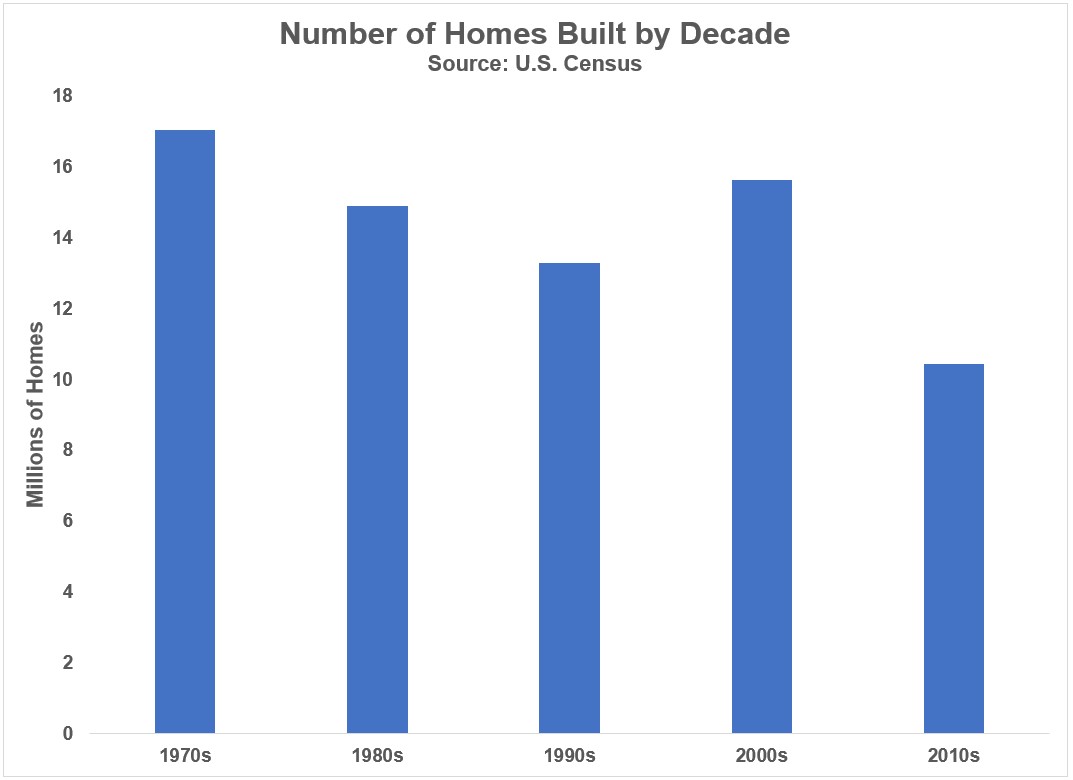

And that’s after a decade in which we didn’t build enough homes:

Homebuilders have now had to deal with the after-effects of the real estate crash and now demand falling off a cliff right as they were ready to ramp up the production of new houses again.

Existing home sales aren’t going to help much either for those in the market for a house.

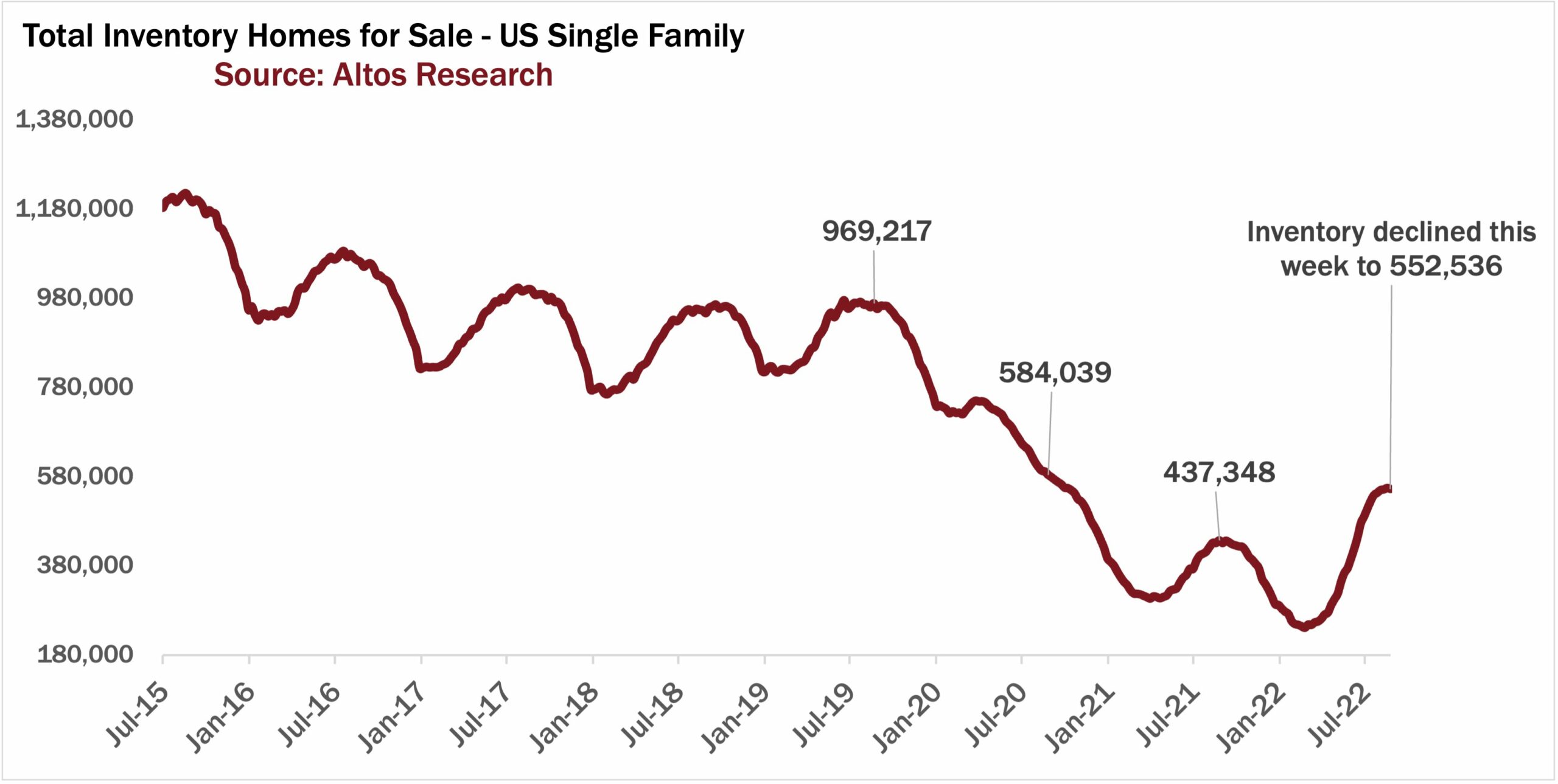

Mike Simonsen showed this week that inventory levels are already beginning to rollover:

The hope was higher rates would cause the inventory of houses for sale to rise. Instead, it looks like both buyers (demand) and sellers (supply) are sitting it out for a while as housing struggles to find a new equilibrium.

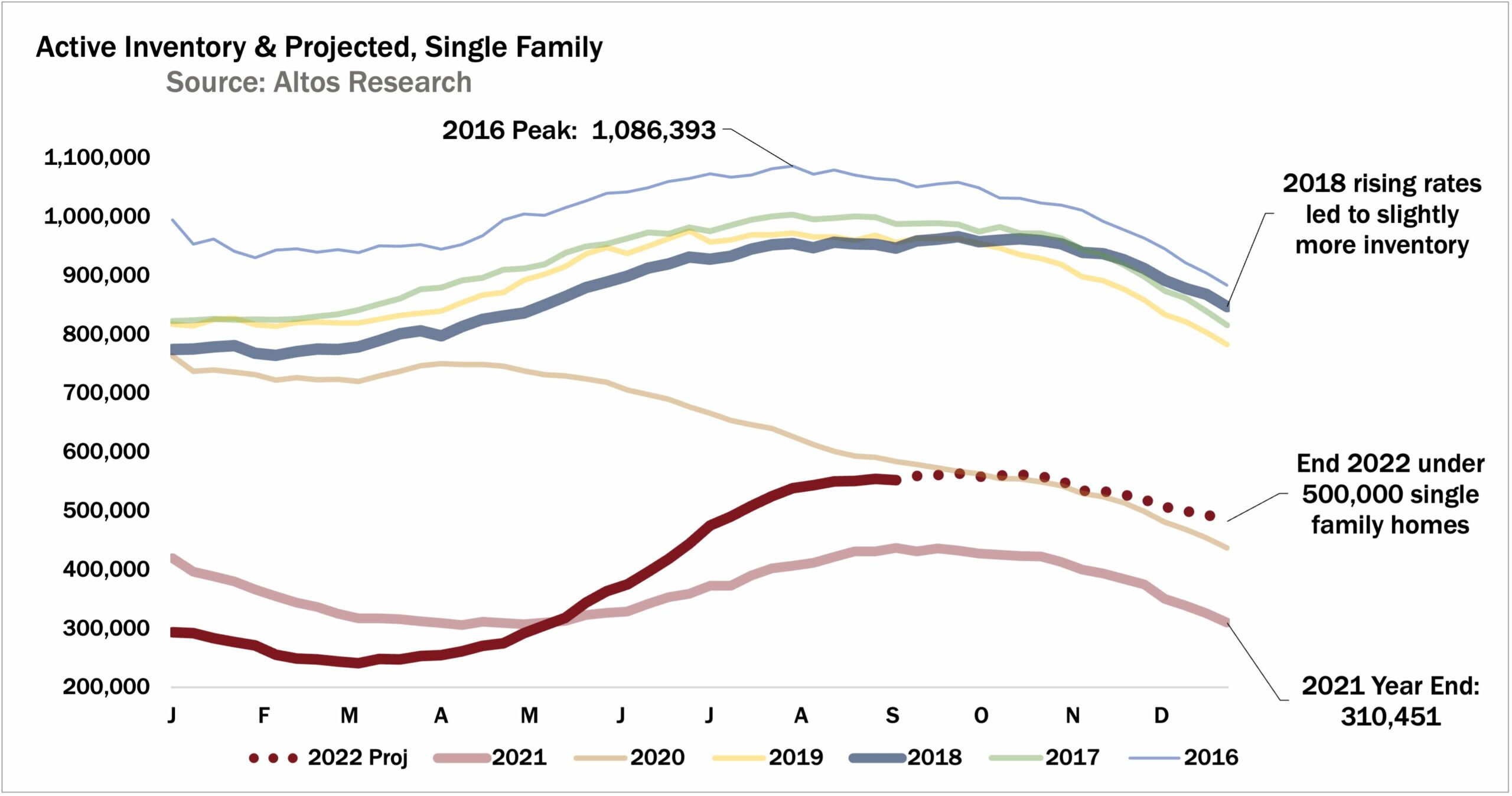

Just look at the inventory now compared to pre-pandemic levels by year:

There are half as many houses for sale. That’s not going to help all of those millennials looking to settle down and buy their first home.

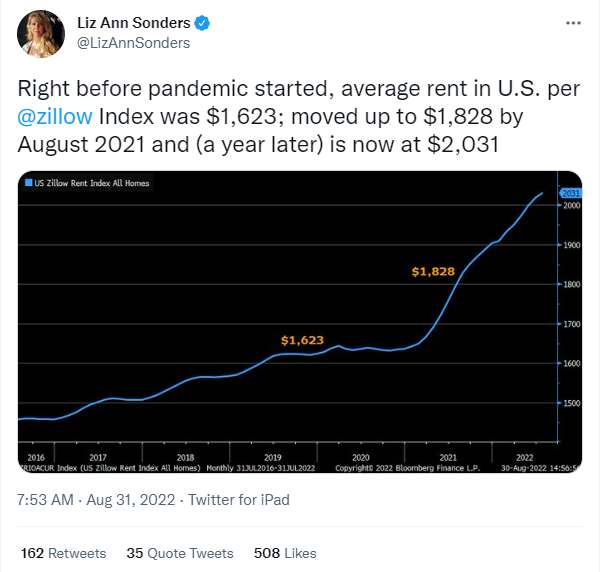

And if you are someone that’s considering buying your first place you’ve been screwed in two different ways. Not only is it now more costly than ever to buy a home because of higher housing prices and mortgage rates, but rents are screaming higher as well:

Either way, housing costs are more expensive now if you weren’t one of the lucky ones who bought a before this year or refinanced into a 3% mortgage in recent years.

The Fed made two big mistakes in the housing market:

(1) They waited too long to raise interest rates.

(2) They allowed mortgage rates to rise too quickly once rates began to tick up.

Yes this is Monday-morning quarterbacking and none of this is easy.

But I think they’ve screwed up the housing market for a long time and it’s going to make things very difficult for those who aren’t fortunate enough to have locked in lower housing costs.

Michael and I talked about the messed-up housing market and more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further reading:

Now here’s what I’ve been reading lately:

- The journey of finding satisfaction in life (Mr. Stingy)

- The 2 types of happiness (Humble Dollar)

- Is obesity a risk to your retirement? (Teachable Moment)

- The worst year ever (Irrelevant Investor)

- Your career is one-eighth of your life (The Atlantic)

- Don’t trust your gut if you want to be happy (Vox)