After 12 months in a row of falling annualized inflation numbers, the latest reading ticked slightly higher this month.

Here are those numbers from the peak in June 2022:

- 9.06%

- 8.52%

- 8.26%

- 8.20%

- 7.75%

- 7.11%

- 6.45%

- 6.41%

- 6.04%

- 4.99%

- 4.93%

- 4.05%

- 2.97%

- 3.18%

For a while there stagflation was all the rage. That risk subsided relatively quickly as the economy remained strong and the stag part of that equation fell by the wayside.

Plenty of people are still worried about a potential recession (and probably always will be) but the new risk is the potential for an overheating economy from the continued strength of both the consumer and the labor market.

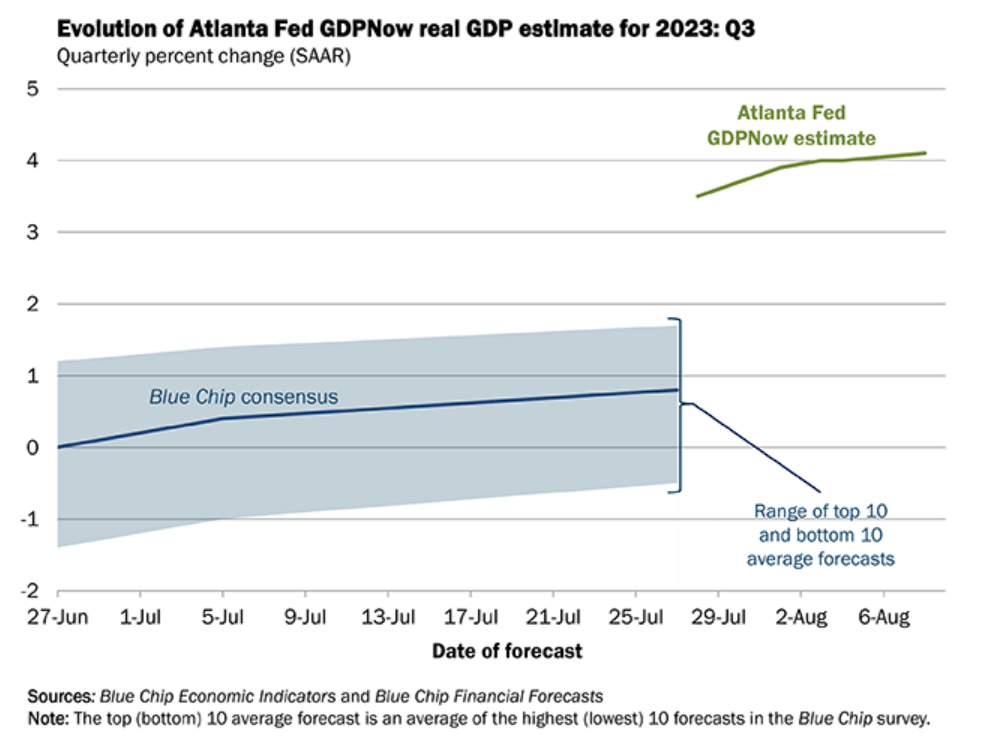

Just look at the Atlanta Fed’s GDPNow forecasting model for the upcoming quarter:

They’re looking at real GDP growth of more than 4%.

In this economy?!

It should be noted that the Atlanta Fed can’t see the future better than anyone else. Economists aren’t any better than you or me at forecasting what comes next with the economy.

But it is true that the economy has remained hotter than almost anyone thought possible at this point in the cycle.

Everyone thought we would be in a recession already but here we are.

It seems strange to worry about higher inflation while it’s been falling so precipitously but a re-acceleration in inflation is a big risk factor right now for the markets.

The big worry is if inflation stays elevated above the Fed’s 2% target they will have to continue raising rates until the economy goes into a recession.

My contention is this: why are we anchored to this arbitrary 2% figure if unemployment remains low and wages are rising?

Isn’t 3-4% inflation in this scenario a better outcome than a recession that brings inflation back down to 2%?

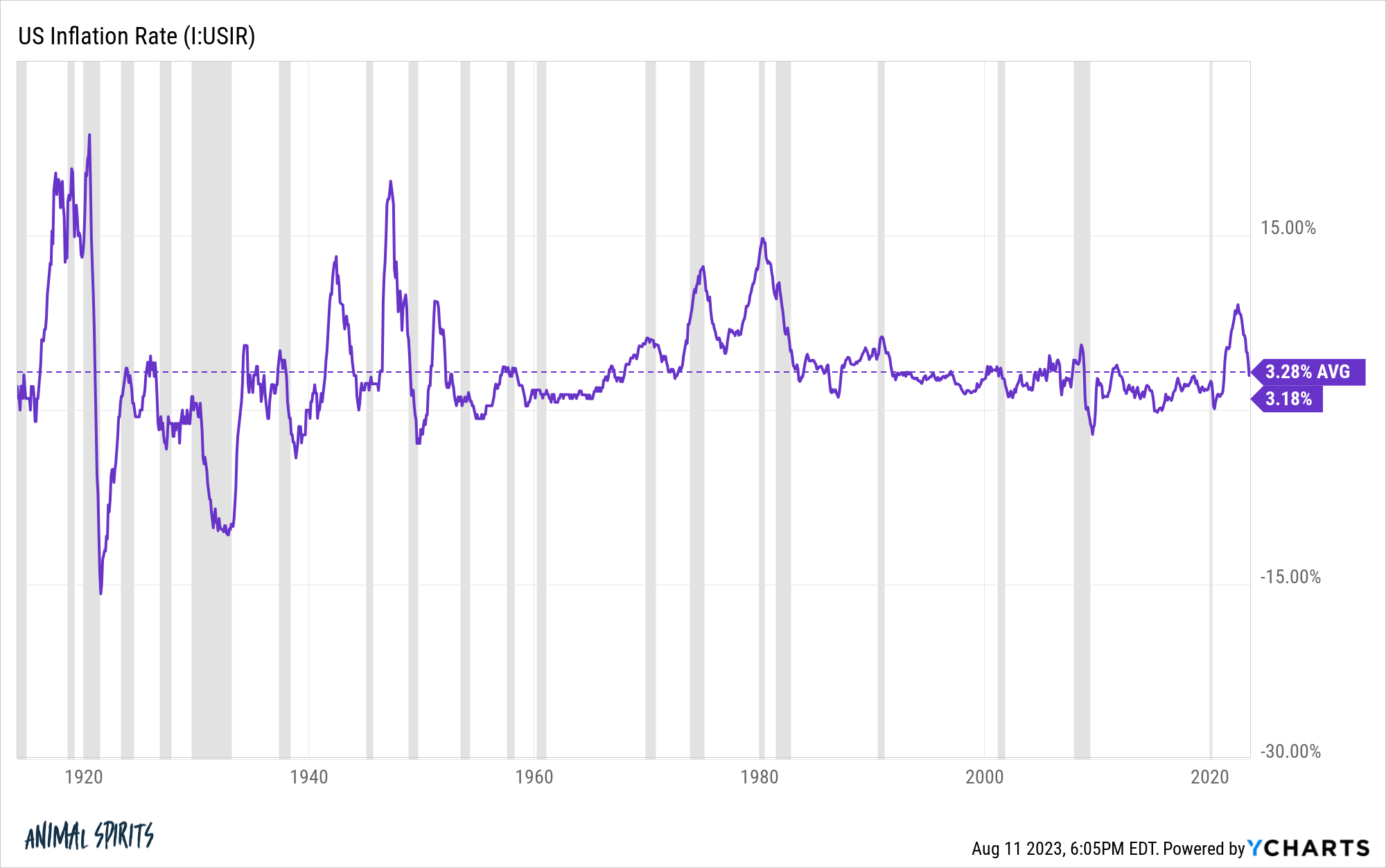

Here’s the long-term average over the past 110 years or so:

Obviously, price levels were far more volatile in the early-20th century but the long-run average is a little more than 3%.

Is that really so bad if that’s what we settle into?

This is what question I posed to Bob Elliott this week on The Compound and Friends (around the 40-minute mark):

Elliott essentially told us the worry with allowing inflation to run higher than normal is that it introduces the potential for more volatility in price levels, which has occurred historically.

Inflation itself isn’t great but frequent changes are what make it so difficult for households and businesses to make longer-term decisions for spending and investments.

If inflation was 5% but everyone knew it would be 5% for the foreseeable future, that’s something we could all live with for planning purposes.

If inflation cools off, then gets hot again and remains volatile that’s going to make things difficult.

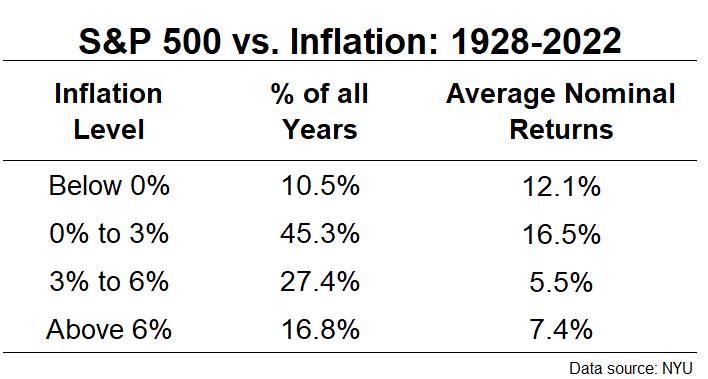

I don’t know if above-target inflation will cause a mass change in psychology for businesses and households but the history of stock market returns shows returns tend to be lower when inflation is above average.

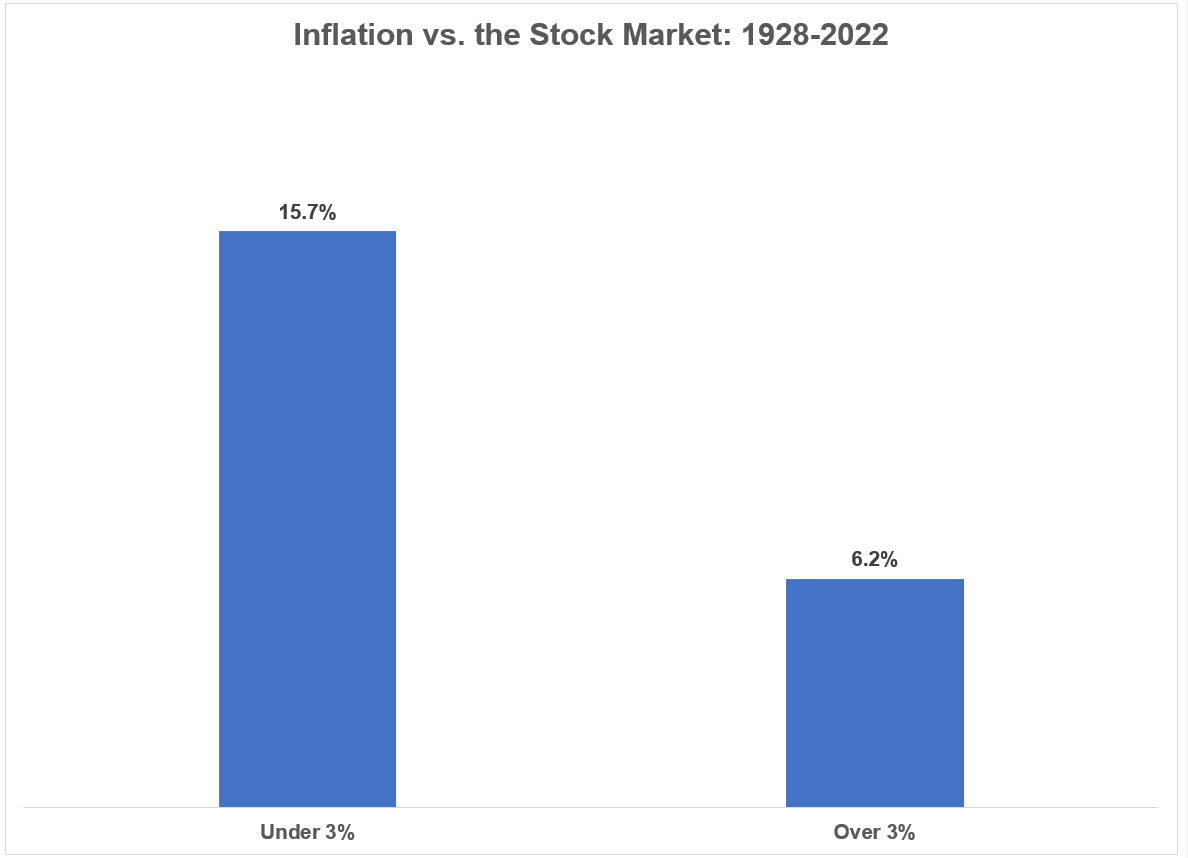

Here is a look at average annual returns for the S&P 500 when inflation is above and below 3%:

The stock market has experienced above-average returns when inflation was below-average and below-average returns when inflation was above-average.

Here’s a further breakdown by different ranges that tells the same story:

Higher inflation doesn’t guarantee lower stock market returns but it makes sense why equity investors aren’t thrilled with an increase in economic volatility.

While consumer sentiment is rarely pleased with economic volatility such as inflation, the past few years have had some unintended benefits.

Sometimes volatility can be helpful in that it shakes up the status quo.

Let’s look at some recent data that shows how the economic craziness has improved the fortunes of certain groups of people.

Here’s a story that led to a lot of memes this week about UPS drivers:

UPS drivers will earn an average of $170,000 in pay and benefits at the end of a five-year contract their union negotiated with the carrier last month to avert a strike, UPS CEO Carol Tomé said during an earnings call this week.

The deal, which was reached on July 25, will increase full-time workers’ compensation to $170,000 from roughly $145,000 over five years, according to UPS’ calculations. It will also boost part-time workers’ salaries to at least $25.75 per hour and end mandatory overtime, Tomé told investors on Tuesday.

Not bad.

A tight labor market gives workers even more leverage than me threatening to cancel my cable every year just to get a better deal (works every time).

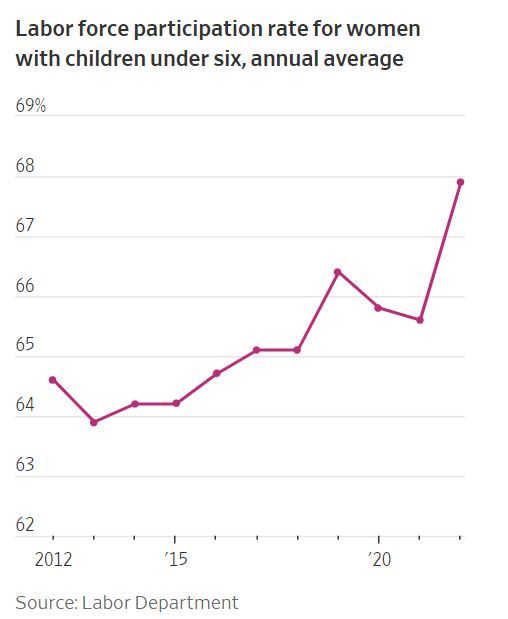

Or how about this chart from the Wall Street Journal:

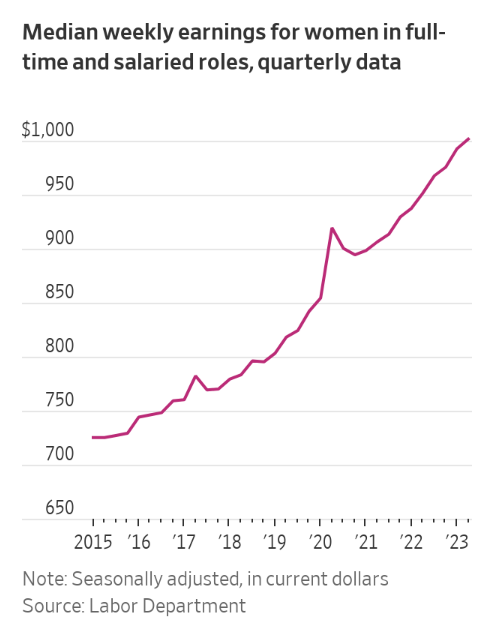

And another one:

I remember when a big worry during the pandemic was women in the workforce who were going to be forced to quit their jobs because of school closures and a lack of child care.

Here’s some more data on the labor force from The Washington Post:

The U.S. economy is in the midst of a wonderful — and unexpected — workforce boom. More than 3.1 million workers joined the labor force in the past year, meaning these people started looking for jobs and, largely, are getting hired. Almost no one expected this. It’s a nearly 2 percent expansion of the labor force — something that has not occurred since the tech craze of July 1999 to July 2000 and was more common in the 1970s and 1980s.

Women are driving this labor force boom. With rising pay and more flexibility to work from home or adjust their hours, they are surging into the workforce. Labor force participation for women ages 25 to 54 hit an all-time high this summer, far surpassing pre-pandemic levels. There are especially strong gains for mothers of young children. The sectors on hiring sprees lately — health care, social assistance and government — are also ones where women have historically found the most opportunities. The result is women now make up half of all U.S. employees. That milestone was reached only twice before in modern U.S. history: just before the pandemic, and in 2009 after the Great Recession destroyed so many “muscle jobs.”

I’m not here to argue that inflation has been a good thing.

Before you send me any hate mail, I know not everyone’s wages have kept up with inflation since it took off.1

Many people are struggling.

But people were also struggling in the 2010s when inflation was low, inequality was out of control and wage growth was slow.

There isn’t an economic environment in existence that helps everyone equally. As my mother used to always remind me when I was a kid, “Life isn’t fair.”

Every economic cycle will be good for some and bad for others.

I tend to think the current situation is much better than most people realize and will be looked upon as favorable in the future, even though it hasn’t been a walk in the park.

But I also agree that a re-acceleration in inflation is a huge potential risk for the markets and the economy.

In that scenario, some will benefit while others will struggle.

Unfortunately, there are always going to be trade-offs in these things.

There is no economy that makes everyone happy at the same time.

Further reading:

Inflation vs. Wages

1Although, if we go back to the start of this decade in 2020, wages actually are outpacing inflation. Average hourly earnings are up 21.5% this decade while CPI has risen roughly 19%. It’s really only since 2021 that inflation has beaten inflation.