There’s an old saying that goes something like this: if you want to know someone’s priorities in life just look at their checkbook online banking statement and calendar.

How people spend their time and money tells you a lot about where their priorities lie.

Unfortunately, budgeting is a four-letter word for most people, so very few bother tracking their spending in the first place.

My friend Dan Egan from Betterment recently wrote a great piece which looks at how he manages his monthly cash flow and budget. This was my favorite part:

My budget is inspired by the golfballs and beer method of prioritization.

I only budget for the “boulders”—the large and/or recurring items I know about.

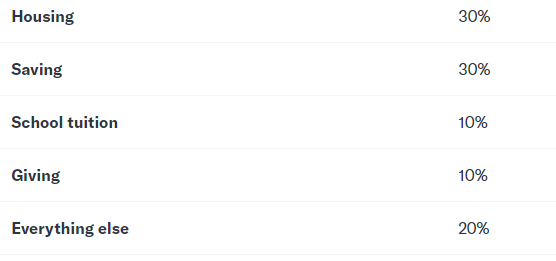

After that, I spend whatever I want, however I want. I do zero expense categorization/tracking; I have no idea how many coffees I buy. Not spending time on the small stuff can save stress, time and attention; it makes things more straightforward. Here’s how my budget looks:

I intentionally avoid some common expenses:

- I don’t have a car, which means no gas, insurance, parking, or maintenance.

- I don’t have cable TV, or a monthly transportation card, or a yard to maintain.

- I also have pretty inexpensive tastes, which makes it easier. Even though I’m not a hermit, a preference for inexpensive things is one of the best unfair advantages I have over people who struggle to keep their spending down.

A few of us bloggers had asked Dan to share his approach to cash flow management and some people asked for my thoughts on his piece so I only thought it was fair to share my approach.

My wife and I take a similar approach to Dan’s golfballs and beer methodology. We focus on the big stuff, automate as much of our saving and bill pay as possible, and spend whatever is left over. This works for us because it allows for guilt-free spending within reason so we don’t have to track every minor expense.

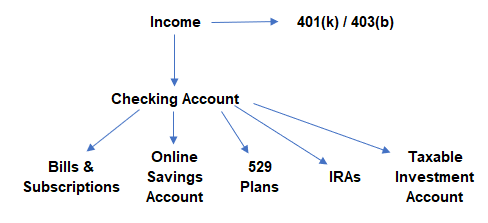

Our savings plan is basically on autopilot in that every month we have automatic transfers set up to sweep cash from our paychecks into our retirement, 529, brokerage, and online savings accounts. Here’s a basic rendering of how this works:

Our checking account acts as the central hub which dispurses funds to our various obligations and savings goals. Our mortgage, credit card payments1, utilities, daycare, etc. are all automatically deducted once a month much like a Netflix subscription. When 95% of your finances are operating without you having to even push a button it makes your life less stressful and easier to manage.

It’s difficult to give specific percentages for our overall budget but our savings rate has probably averaged around 30-35% of our gross income over the past decade or so. That’s not a FIRE-level savings rate but I enjoy spending money much more than the FIRE crowd. To each their own.

I’m not a huge fan of others trying to copy specific percentages in someone else’s budget because geography and circumstance often render these comparisons useless.

Dan lives in NYC but doesn’t have a car. Right now we have 3 children in daycare, which means we spend a decent percentage of our budget on childcare. Once they all go to school that expense will completely drop off so these things change and evolve over time. Percentages always require context.

Personal finance bloggers often like to compare and contrast the differences between being frugal and being cheap. There are obvious differences but I don’t really care what you call it. I prefer to view all spending through the lens of trade-offs.

Here are some of the ways my wife and I prioritize our family’s budget:

We prioritize saving money by treating it as a regular bill payment. Saving is non-negotiable.

We ferry cash out of our checking account automatically each month to our various investment and savings accounts but also keep a flex margin of safety amount which could be used for excess spending or saving as needed to account for unexpected expenses or a lack thereof. This cuts down on the need to constantly move money back and forth between accounts.

We like having a nice home but have filled it with relatively inexpensive furniture (much of which we had to painstakingly assemble ourselves).

We like eating out but prefer a burger and a beer at a brewery to steak or seafood and wine at a high-end dining establishment.

We like going out on occasion but are far happier staying in (yes, I’m getting old).

We don’t mind paying for a high-quality car but for us that means a Honda more than a Mercedes Benz.

We have specific savings goals which we go so far as giving them a specific name them as a reminder of why we’re delaying gratification.

Material possessions don’t consume our lives but there are certain little joys in life we don’t mind spending money on (I like nice clothes and shoes but couldn’t tell you the last time I bought something that wasn’t on sale).

Each year we increase the amount we save because all you have to do is change the amount once and never think about it again.

Saving money is great but there are limits to cutting back. Our biggest gains have come from diversifying our sources of income.

We understand the power of compounding through regular savings at a young age but we also value experiences and don’t want to miss out on a beachside vacation now just so we can have a beachside vacation in the future (having kids has completely changed my perspective on this).

My book tab with Amazon every year would make some hardcore personal finance bloggers blush but I see this as an investment, not an expense.

We prefer to pay for time (lawn care, snow plowing, dry cleaning, house cleaning, etc.) when it allows us to spend it with family or on work that’s more important to us.

Kids are expensive if you want to look at things that way but I’m always amazed at how often the most fun things we do with them are free (parks, walks, family gatherings, etc.).

We’re thoughtful about how much money we spend on ourselves, but rarely question the cost when it comes to paying for activities or experiences for our children.

I will never complain about spending money on cable or streaming services because my wife and I love watching TV shows and movies. I will be the last man in America to cut the cord.

I enjoy a glass of wine now and then but can’t imagine spending more than $20 a bottle (the law of diminishing returns is strong in this category in my experience).

I view budgeting as a process of prioritizing your behavior with your wants, needs, and desires.

For me, this means being selectively cheap in certain areas while spending money in other areas that are important to me and my family.

Everyone has different priorities in life. My goal is to spend money on the things that matter and then cut back everywhere else to strike the right balance between planning for tomorrow while also enjoying today.

Further Reading:

Are SUVs Ruining Retirement Savings?

1We put everything we can on our credit cards to earn rewards points and then pay off the full balance on autopay. It’s free money.