Last week I wrote about navigating the pain of your first bear market after receiving a question from a young person about how to survive down markets.

The natural follow-up question, which I received from a number of readers, is this:

Sure, it makes sense for young people to stay the course and keep investing during down markets. But I’m retired. I’m done saving. What does this mean for me?

A fair question.

This is one of the main reasons risk means different things to different people. No one likes losing money but young people should be thrilled with bear markets while retirees should be annoyed with them.

When you’re young, time and human capital are your biggest assets. You have time to allow compounding to be the wind at your back. You have the time to wait out a prolonged bear market. And your future earnings power equates to future savings which can be put to work periodically, whether markets are high or low.

The advice for young people during a bear market is fairly simple – keep saving, keep investing and don’t get scared out of the markets. Patience and a long enough time horizon can smooth out a lot of awful market scenarios.

A retiree sits in an entirely different position when it comes to assets. When you retire your financial assets should dwarf your human capital.

You don’t have nearly as much time to wait out nasty bear markets. You don’t have income from your job anymore. And you have to shift from an accumulation mindset to one of decumulation since you need to begin taking withdrawals from your portfolio.

All else equal, financial planning is far more complex for someone spending down their portfolio than someone building it up.

Plus, you have the psychological factor of not wanting to screw things up.

What if we have a lost decade in the stock market? What if I run out of money? What if my healthcare costs are too high? What if I live longer than expected? What if I’m not spending enough money?

It can be a scary proposition to fund your own lifestyle with no job to fall back on.

Monte Carlo simulations are great and all because they show you a wide range of potential outcomes, but we all have but one shot to get things right when it comes to retirement. There are no practice sessions for the last few decades of your life.

There is plenty of advice on saving for retirement. There is very little advice on how to live out your years after you’re done working.

Even though your time as a saver is up when you retire, you still likely have a number of years ahead of you to invest.

And even though you don’t have as much time as you once did, you could have another 2-4 decades to invest during retirement depending on when you hang up your cleats and your longevity. If you’re investing for 20-30 years, you’re going to have live with a handful of bad market environments.

There have been 4 different bear markets (drawdowns of 20% or worse) in the last 30 years.1 In the 30 years prior to that there were 5 bears. In the 30 years before that, there were 10 bear markets.

So you have to build these things into your financial plan even when you’re retired.

Those plans just have to be different than they would be for someone who is still accumulating assets that should jump at the opportunity to buy more at lower prices.

First of all, you need to be invested in the bull markets to smooth out the bear markets.

A simple Vanguard 3-fund portfolio invested in 60% stocks and 40% bonds would have been up 8.4% per year in the 10 years through the end of 2021. That is a phenomenal return when you consider interest rates were so low during that time (meaning bonds didn’t help much at all).

Yes, that same portfolio is down almost 20% this year but those financial assets you built up over the course of your career just experienced an amazing bull market leading up to this year.

Even if we include the 24% drawdown from this year, the S&P 500 is up 12.5% per year since the start of 2012. The Russell 2000 Index of smaller-company stocks is down more than 30% from the highs but it’s still up almost 10% per year since 2012.

If you own your house, you should have a substantial amount of equity built up right now. Even with the housing crash in 2008, nationwide home prices are up more than 200% since the turn of the century.

Sometimes the biggest reason for a bear market is because there was a bull market that went so well leading up to a downturn.

Most retirees require a more balanced portfolio than a young person but this year has been unique in that both stocks and bonds have taken a hit at the same time. In the majority of bear markets, bonds are the portfolio stabilizer. That hasn’t been the case this year with rising rates.

But retirees now have the opportunity to add yield to their portfolio in a way that simply hasn’t been available in well over a decade.

One year ago these were the prevailing interest rate in various parts of the U.S. bond market:

- Short term govt bonds: 0.3%

- Corporate bonds: 2.3%

- High yield bonds: 4.4%

Here are those yields today:

- Short term govt bonds: 4.4%

- Corporate bonds: 5.6%

- High yield bonds: 9.0%

Short-term government bonds today yield what junk bonds yielded a year ago. This is the reason bonds have sold off so much this year. It’s also the reason expected returns are much higher for bonds than they’ve been in a long time.

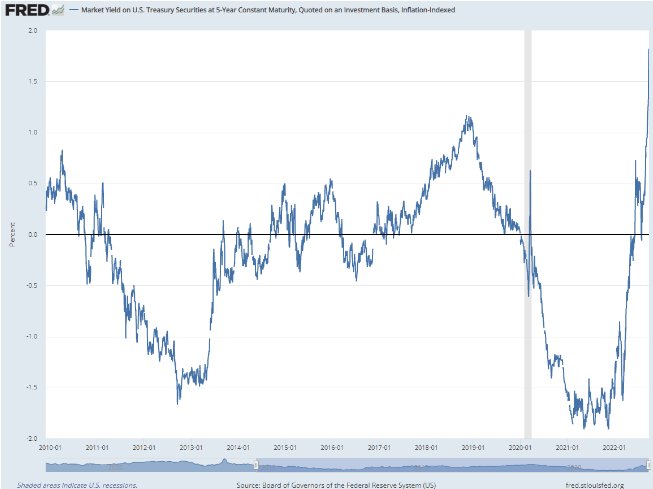

Take a look at the yield on 5 year TIPS:

These inflation-protected securities were trading at a negative yield just a year ago. They’ve now gone from -2% to +2% like that. Your expected return has improved by 4% annually plus you get that inflation kicker.

Let’s say the Fed is able to bring inflation down to a more reasonable level of 3-4% and interest rates stabilize for a while. You’re looking at an expected return of 5-6% on TIPS (2% + inflation).

That’s not bad.

Retirees have options for the first time in a long time to lock in some higher yields on the relatively safe part of their portfolio.

You still have to balance the need for growth over the long run with stability over the short run when it comes to building a durable retirement portfolio.

While growth has been the key driver of returns over the past decade-plus, stability can finally pick up some of the slack going forward.

It’s never fun to see the value of your portfolio decline.

Yes, bear markets are painful but they also present opportunities.

We spoke about this question on the latest edition of Portfolio Rescue:

The tax man Bill Sweet joined me yet again to discuss questions about…

Remember if you have a question for us, email AskTheCompoundShow@gmail.com.

Further Reading

Navigating the Pain of Your First Bear Market

1There have also been 4 different downturns of 19% and change. So pretty darn close to 8 bears.

Here’s the podcast version of this week’s show: