My general investment philosophy is the more bearish things feel in the short run the more bullish I should be over the long run.

If I’m taking my own advice right now I should be getting much more long run bullish.

It’s not easy.

Things are not great at the moment.

The Fed is trying to make stock prices go down, housing prices go down and the economy go into the toilet. There’s war, inflation, currency crises, energy shortages and a global economy on the brink of a recession.

It doesn’t take a genius to point out the bad stuff today. Being bearish is easy right now.

Things could always get worse before they get better but the stock market already knows how bad things are (I think).

But there needs to be some balance between being short-term bearish and long-term bullish.

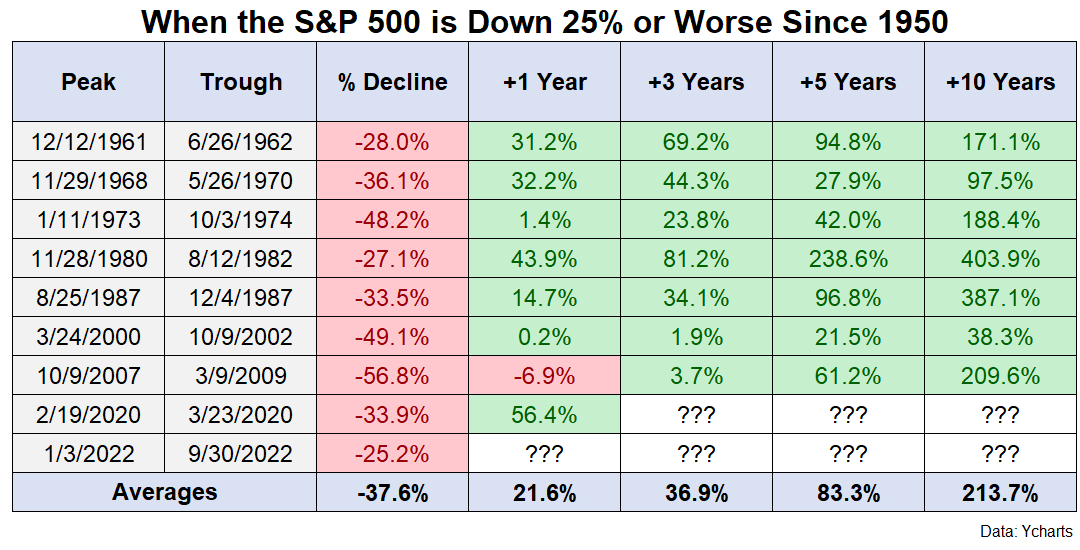

This is the 9th time the S&P 500 is down 25% or more since 1950.

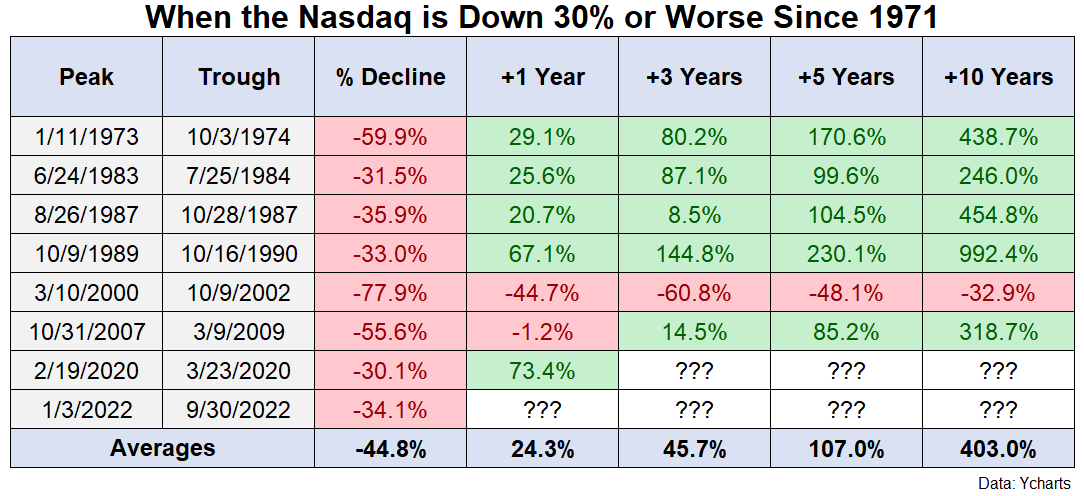

The Nasdaq Composite is down 30% or worse for the 8th time since 1971.

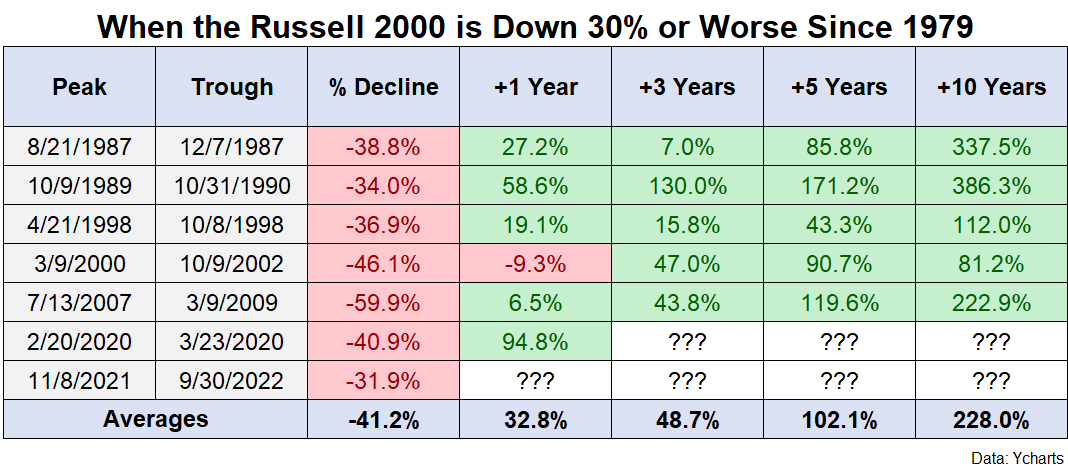

And the Russell 2000 Index is down 30% or more for only the 7th time since its inception in 1979.

This is not a 2008-level calamity but it’s certainly a full-fledged bear market.

History provides no guarantees for the future but I do find some level of comfort in knowing that buying stocks when they’re down big like this tends to offer positive outcomes.

These are the forward one, three, five and ten year returns1 from down 25% over the past 70+ years in the S&P 500:

Unfortunately, two of these declines have happened in the past 3 years.

But look at all that green. It’s a pretty good batting average. Every 3, 5 and 10 year period showed positive returns while just one 12 month period was negative.

And the average returns from down this much in past have been pretty darn good even if stocks fell even further in the mean time.

Now let’s look at what’s happened after down 30% in the Nasdaq Composite since 1971:

The one really poor outcome from the combination of the dot-com bubble bursting in the same decade as the Great Financial Crisis stands out but other than that it has paid to buy into the pain in the past.

The same is true for the Russell 2000:

Just one negative 12 month return while every other 1, 3, 5 and 10 year period was positive and most of them in a big way.

The stock market doesn’t fall 25-30% or very often and when it has in the past it’s provided solid returns when your time horizon is measured in years as opposed to days or months.

The unanswerable questions right now are as follows:

- How much worse will things get?

- How much is priced into the stock market?

- How bad could an economic slowdown impact stocks going forward?

I wish I knew the answers to these questions. I don’t.

Here’s what I do know:

- Buying stocks when there is blood in the streets is generally a wonderful idea historically speaking.

- Every single bear market in the history of U.S. stocks has resolved to new all-time highs eventually.

- There is no guarantee that buying stocks when they are down will lead to better outcomes but expected returns should be higher when prices are lower.

Maybe one of these days the financial system will completely implode. Maybe the stock market will too.

There are no certainties with this stuff. That’s why they’re called risk assets and not guaranteed returns.

But if you don’t believe in stocks for the long run what’s the point of investing in the first place?

Until proven otherwise, I will continue to view downturns as an opportunity, not a cataclysmic event.

The stock market might fall further from here. It wouldn’t surprise me.

I purchased stocks in the fall of 2008 and the market proceeded to fall another 30%. I don’t regret those purchases.

Past performance is no guarantee of future returns.

But I’m becoming more long-term bullish even if the short-term market observer in me still feels bearish.

Further Reading:

We’re Still in a Bear Market You Know

1Technically I used the first day of the month after down 25% to make things easier from a total return perspective. Close enough.