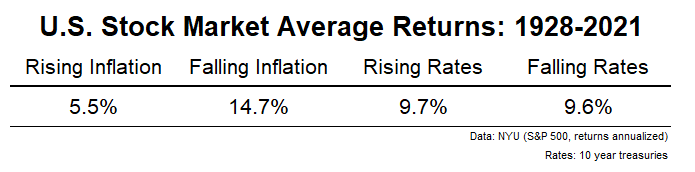

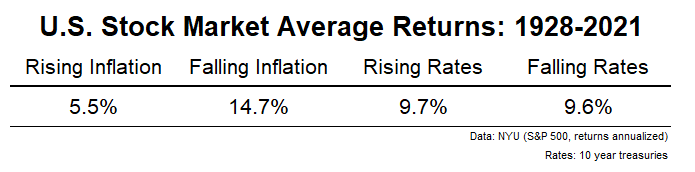

Some thoughts on the relative attractiveness of stocks vs. bonds.

Some thoughts on the relative attractiveness of stocks vs. bonds.

On today’s show, we discuss the slowing housing market, taking Animal Spirits on the road, why consumers keep spending money, how the stock market moves during a bear market, some optimism for a 60/40 portfolio, why the 4% rule is still alive and well, a bunch of movie recommendations and much more.

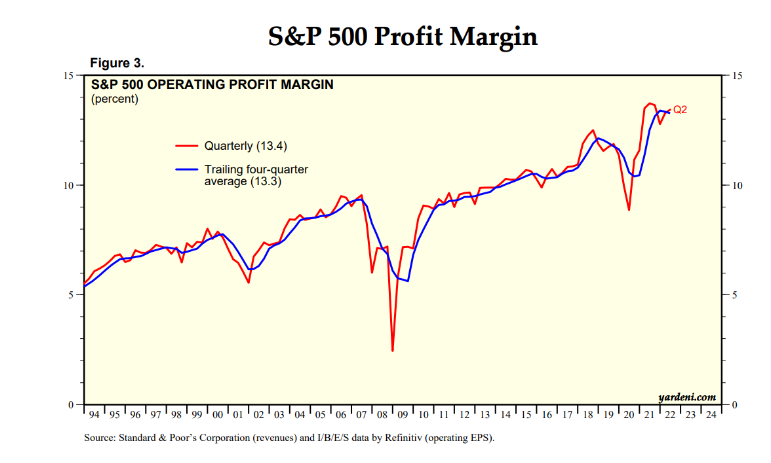

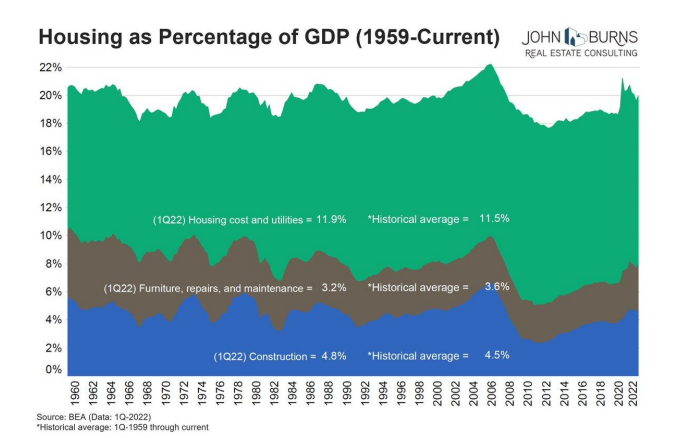

Why do consumers keep spending so much money?

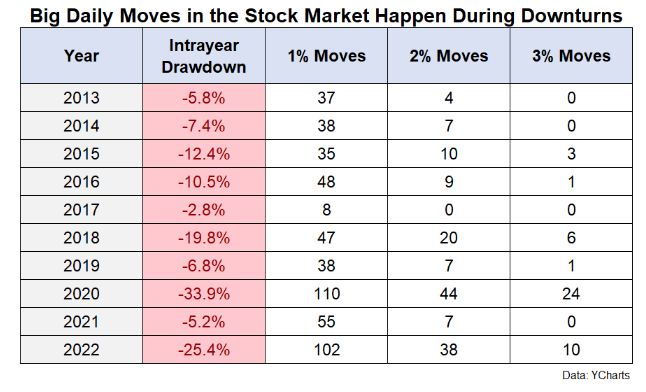

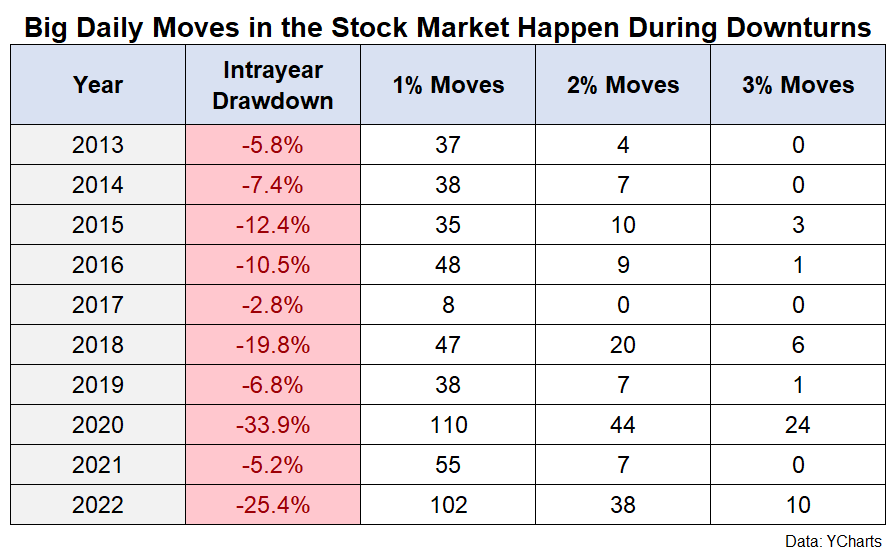

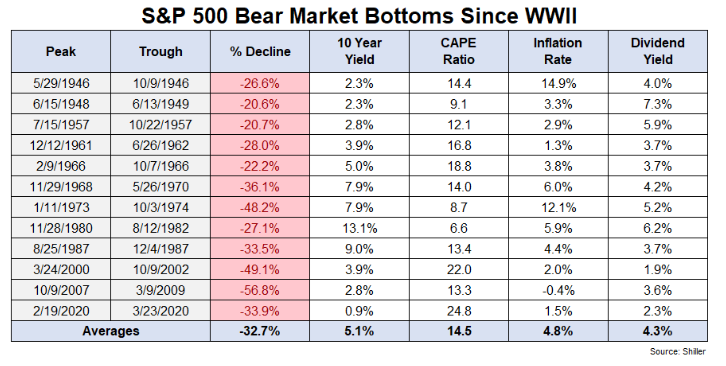

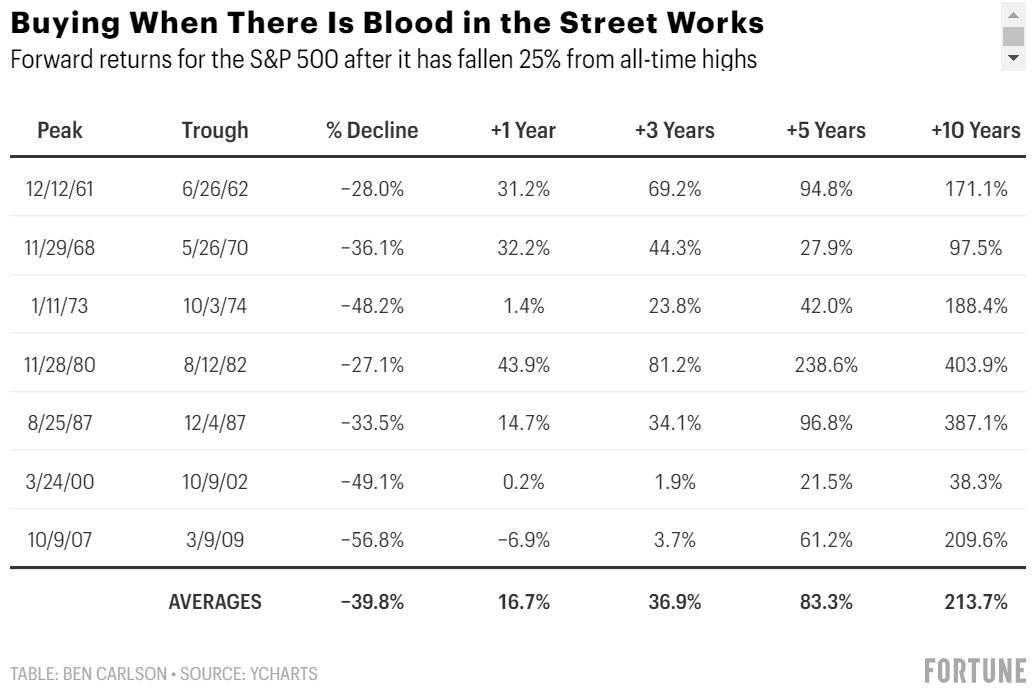

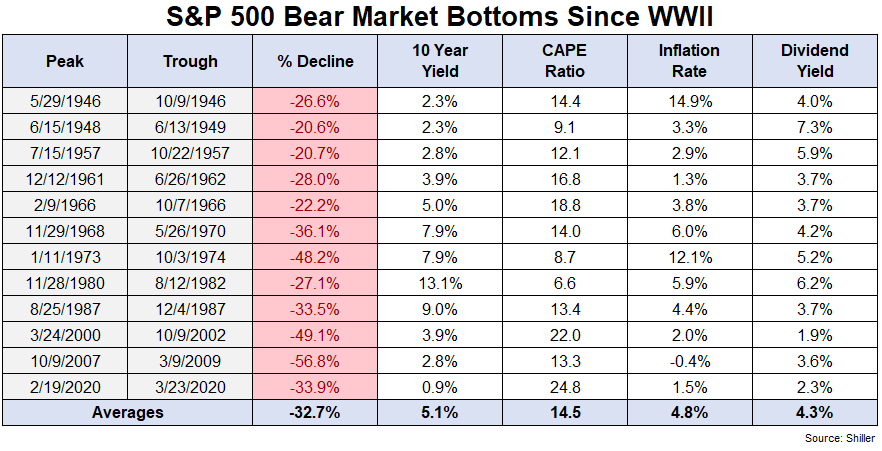

How bear markets tempt you into make mistakes.

Two reasons inflation has remained elevated.

Some questions I have about Fed policy.

On today’s show, we discuss the trouble with nailing the bottom in a bear market, why money continues flowing into ARK, why the VIX isn’t higher, sticky inflation, why the bottom 50% has seen their net worth double since the start of the pandemic, Netflix with ads and much more.

Some thoughts on how each generation should view the current bear market opportunity set.

There’s an old saying that they don’t ring a bell for you at the top. I know this to be true because investors spent more than 10 years during the bull market of the 2010s calling everything they saw a top. The regime changes are rarely obvious until after the fact. The same is true…

Personal finance advice you shouldn’t take.