A reader asks:

Wow, unusual year with both stocks and bonds down at the same time. I’m in my early 60’s and still 5-7 years from retirement. The current market environment has me wondering what is the better position to be in when interest rates inevitably peak and begin to fall and the inevitable rebound in stocks: Down 18% and sitting in bonds or down 25% and sitting in stocks? What is your opinion?

I like this line of thinking. Lots of investors in today’s market environment are viewing the losses in stocks and bonds strictly through the lens of risk.

Losing money stings but I prefer to look at bear markets as an opportunity. And with both stocks and bonds down big this year, there is no shortage of opportunities right now.

Let’s start with bonds.

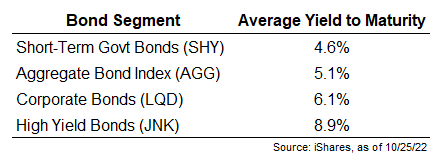

Fixed income yields are higher than they’ve been in years:

Depending on your tolerance for risk and volatility in bonds, yields right now range from 4-9%.

If we’re doing a relative value comparison between stocks and bonds at current levels, today’s higher yields in fixed income might be even more important than inflation or the Fed (if that’s possible) because investors finally have an alternative to stocks for the first time in well over a decade.

Yes, real yields after inflation are still negative but for the first time in a long time, nominal yields provide competition for the stock market in a way they haven’t in a very long time. And locking in yields at these levels will look even better when inflation falls.

Over the long-term, higher yields on bonds lead to higher returns. In the short-to-intermediate-term, the thing that matters most in terms of volatility for fixed income is the direction of interest rates.

To keep things simple, there are basically three scenarios for bonds to consider:

1. Interest rates fall

2. Interest rates stay where they are

3. Interest rates rise

Inflation is the wild card here for real returns but let’s look at each of these scenarios to game how bonds would react.

If rates fall, bond prices will rise. And the more duration or the longer your maturity, the better your bonds will perform. When you combine higher starting yields with falling interest rates, that’s a good short-term outcome for bonds.

This could be caused by inflation falling, the Fed lowering interest rates or a possible recession where investors rush into the safety of bonds.1

I actually think this is the worst case scenario for fixed income investors because it would mean better returns over the short-term but lower yields for future returns over the long-term.

What if rates continue to rise?

Prices would certainly fall in the short run but today you have much higher starting yields than when this rate hike cycle began. There is a much bigger margin of safety starting from rates at 4-6% than rates at 0-2%.

If you own short-term bonds, they would not lose as much money in this scenario as long-term bonds. Remember, longer duration bonds perform relatively better if rates fall but shorter duration does better, relatively speaking, when rates rise.

If inflation stays high and interest rates continue to go up there will be more short-term pain for bond prices but that also means higher yields for future returns after you eat those losses.

Finally, what if rates just kind of stay put for a while and stay in a range of say 4-5%?

This is the scenario where investors could expect the least amount of volatility and simply clip those coupons and earn some yield.2

Bonds typically aren’t as volatile as they have been these past 3 years or so. Bonds are supposed to be boring so most investors would welcome an environment where yields just chill out for a while.

With yields at much higher levels, the probability of good outcomes in the bond market is as high as it’s been in years.

Now let’s look at stocks.

If interest rates do begin to rollover, you would assume the stock market would do well but there is no guarantee that will happen. The stock market is something of a rebel that likes to break rules.

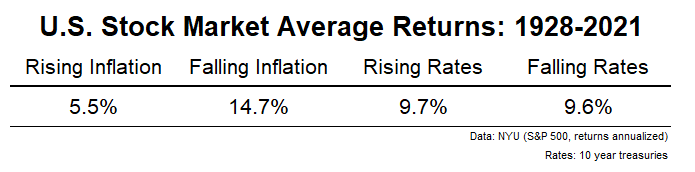

If you look at the historical data, rising or falling interest rates don’t have nearly as much of an impact on stock market performance as you would think:

Rising or falling inflation has had a far greater impact on stock market performance than rising or falling interest rates.

However, if rates fall one would assume inflation is falling as well in the current environment. Again, no promises here, but the combination of a decline in rates and inflation would seem to be a good thing for stocks.

BUT…what if inflation and interest rates are falling because we go into a recession?

Is that a good thing or a bad thing for the stock market?

Is a recession already priced in or would things get even worse in that scenario?

I honestly have no idea how long bad news in the economy would be considered good news for stocks because it might mean the Fed can back off. Recessions are usually not great for the stock market but an economic contraction in 2023 would be the most telegraphed slowdown in history.

As always, the short-term in the stock market remains unclear.

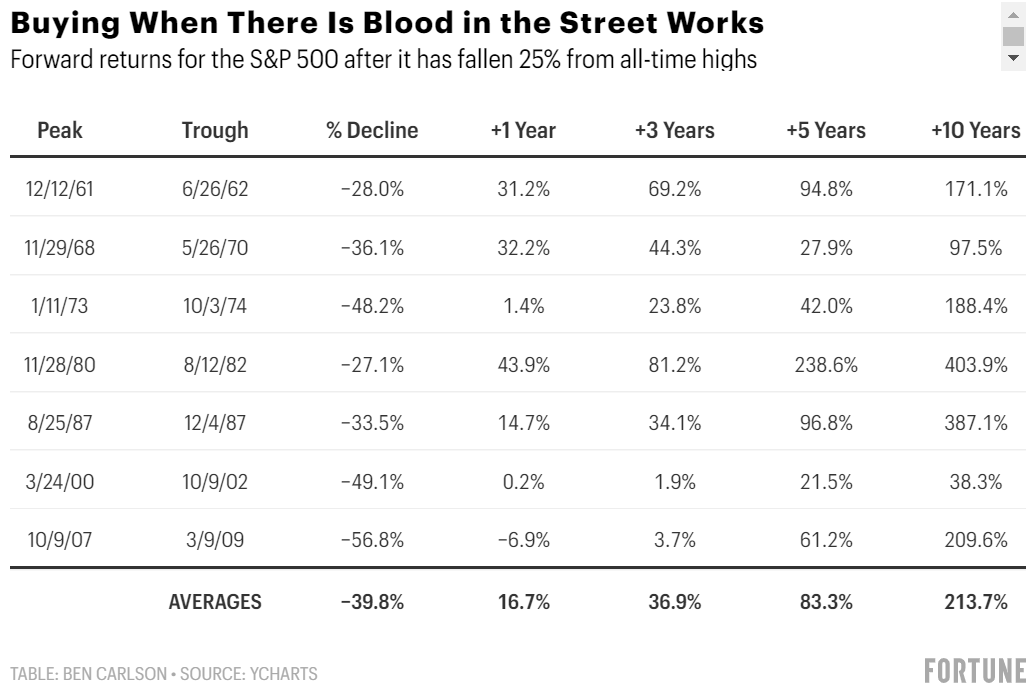

However, buying stocks when they are down this much has tended to work out well for investors over the long run.

Readers might be getting sick of this data but it bears repeating in a bear market that buying when stocks have gotten hammered has been a profitable long-term strategy historically:

The past is no guarantee of future performance and all of the usual disclaimers but it makes sense to me that buying stocks when they are down 20-30% would be a winning strategy as long as you have a long enough time horizon.

If I had to bet my life on it, bonds are probably a higher probability bet in the short-to-intermediate-term while stocks will provide more bang for your buck in the long-term.

That’s not exactly going out on a limb but the good news is you don’t have to bet your life on these things.

The beauty of diversification is that it relieves you from the stress of picking winners all of the time.

Diversification doesn’t always work in the short run but it all but guarantees you’ll own winners over the long run.

This has been a painful period for investors with stock and bond heavy portfolios. I’m not trying to sugarcoat it.

But the current set-up of much higher bond yields and lower valuations for stocks leads me to believe that, eventually, both stocks and bonds will offer much better outcomes than investors have gotten this year.

I just don’t know when that will happen or which asset class will be the winner in the coming months or years.

We discussed this question on today’s Portfolio Rescue:

Tax expert extraordinaire Bill Sweet joined me once again to answer questions about changing tax rates, how much to save for retirement as a young person, tax loss harvesting and how to optimize tax-deferred retirement savings.

You can listen to the podcast version of the show here:

Further Reading:

Bear Market Opportunities For Every Generation of Investors

1Even in the 1970s, bond yields fell during recessions

2This is true for government bonds. For corporate bonds and high yield bonds you have to factor in the potential for credit downgrades and defaults.