One of the most frequently used analogies in the personal finance space is the similarities between staying physically fit and staying financially fit.

Success in both your finances and your health requires some fairly simple rules.

To stay healthy you have to eat right and exercise regularly.

To build wealth you have to spend less than you earn and invest the difference.

Both of these endeavors are simple but not easy.

You’ve probably heard this analogy before. Heck, I’ve used this analogy many times in the past. It’s a good one.

Yet the more I think about it, the more I realize it’s probably not a fair comparison.

It’s certainly not easy to build wealth but there are things you can do to ease the burden. Technology now allows us to automate many of the actions people had to do manually in the past.

You can automate your bill payments, savings, retirement contributions, asset allocation, portfolio rebalancing, tax loss harvesting, dividend reinvestment, etc.

The ability to automate good decisions with your finances has been a huge leap forward for individual investors. This doesn’t mean you can’t or won’t make mistakes, but going on autopilot with the vast majority of your financial decisions puts you in a pretty good position to succeed.

It’s much harder to automate your health.

Diet researchers estimate that on average we’re forced to make more than 200 food-related decisions each day.

Just think about how easy it is to snack or eat food that’s bad for you — fast food, snacks in the cupboards, gas station food, food delivery apps, restaurants, etc. The temptation feels like it’s never-ending.

And you can’t exactly automate exercise. It’s something you have to do day in and day out. You can’t put it on autopilot. You have to motivate yourself to produce a good sweat a few days a week.

This is why something like 95% of all people who lose weight on a diet end up gaining back the weight they lost.

It’s hard!

Some people find it easier to stay physically fit while others find it far easier to keep their finances in check, but on the whole, health is much harder to sustain than wealth in my experience.

You have to try each day to be healthy. Wealth mostly happens from making some good decisions up front and staying out of your own way.

This is why it’s so important to remain dedicated to a long-term mindset during a bear market. Bear markets tempt you into thinking the days are more important than the years.

Bear markets want you to act like a fad diet and force you into an unforced error. Bear markets want you to pay attention to the day-to-day movements in the market.

How do they do this?

By exhibiting more volatility — to both the upside and the downside — on a daily basis.

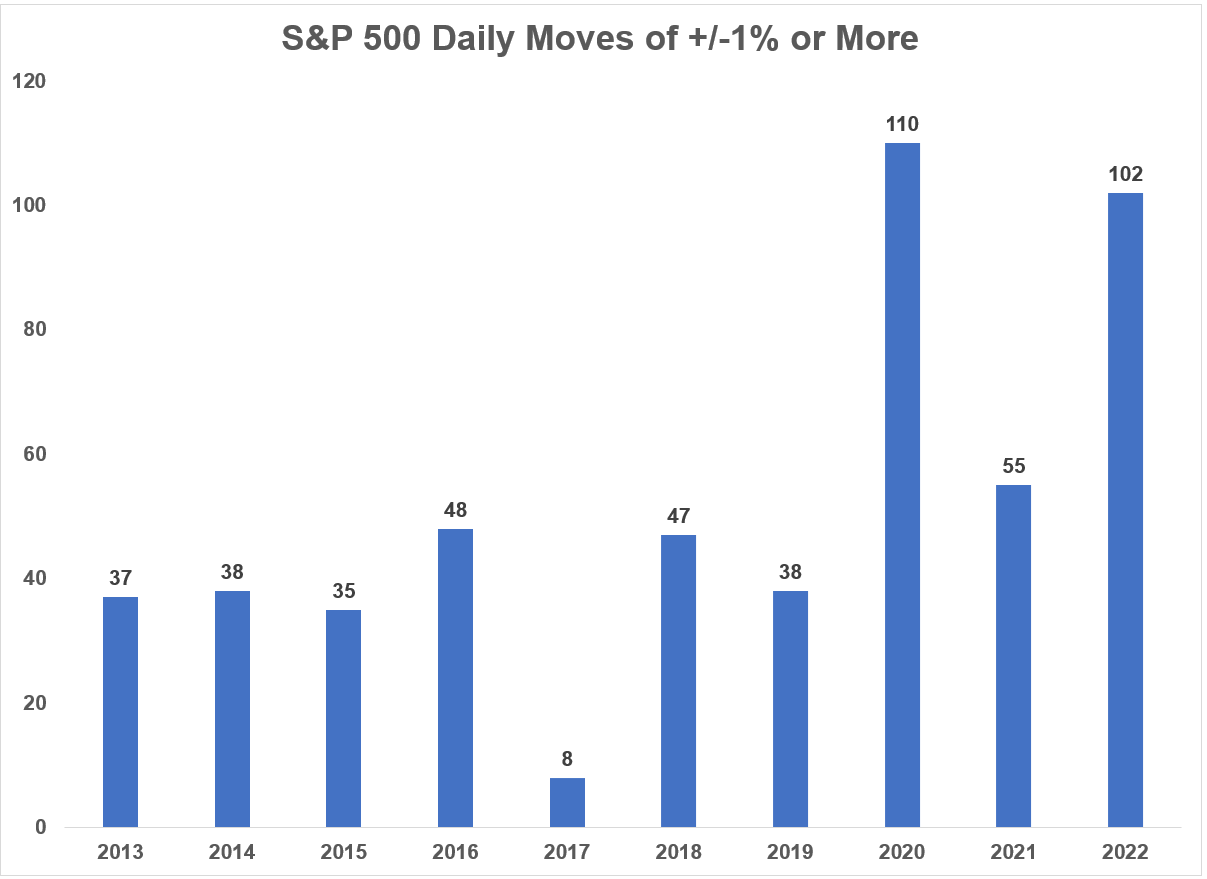

This month alone, the S&P 500 has seen 60% of all trading days with daily gains or losses in excess of 1%.

This is what happens during downturns — volatility clusters because investors panic sell and panic buy when they start losing money.

I looked at the past 10 years of daily moves in the S&P 500 and broke down the gains and losses to show how often there have been big moves in both directions.

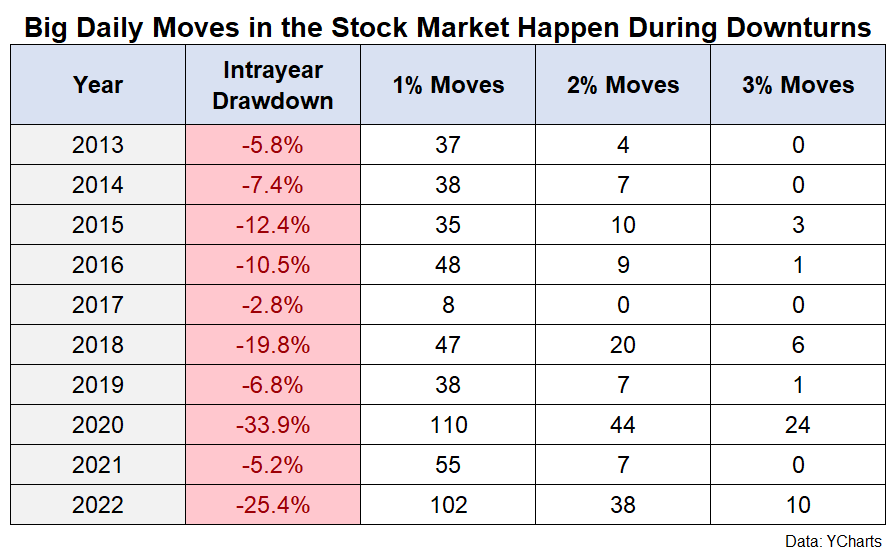

This table shows the number of times the S&P 500 was plus or minus 1% or more, 2% or more and 3% or more on a daily basis in a given year along with the max intra-year drawdown:

The years with bigger drawdowns — 2015, 2016, 2018, 2020 and 2022 — have shown bigger moves on a daily basis than those years that didn’t have a deep drawdown.

When markets are volatile, investors have a hard time making up their mind. That typically doesn’t happen when stocks are moving higher.

When stocks are moving higher, people kind of forget about the market.

When stocks are moving lower, everyone starts paying more attention.

For example, in 2017 there was basically no drawdown to speak of and very few big moves from day-to-day. The S&P 500 finished that year with a gain of more than 21% but it’s a fairly forgettable year in the grand scheme of things.

However, this year we’ve seen massive swings on a daily basis. There have already been more than 100 daily gains or losses of 1% or more. And even though the market is down quite a bit this year, those gains and losses are actually fairly even in terms of the number of times they have occurred.

The stock market has fallen by 1% or worse on 52 occasions so far in 2022 while it’s risen 1% or more 49 times.

Moves of this magnitude are begging you to make a mistake with your long-term investment plan.

I am a huge proponent of long-term thinking. The bedrock of my investment philosophy is based on the idea that it’s best to think and act for the long-term.

But you have to survive the short-term to get to the long-term.

In his Nobel Prize-winning speech, behavioral psychologist Daniel Kahneman said an exclusive focus on the long-term might not help, “because the long term is not where life is lived.”

Some investors have the ability to ignore the daily gyrations in the market but not everyone was born with a Spock-like ability to keep their emotions steady regardless of the circumstances.

People are people and people have emotions. That’s why we panic in the first place.

So most investors need some sort of emotional release valve.

For some people, that could mean holding more cash than is necessary as an emotional hedge against falling stock prices.

For others that could be implementing a tactical strategy or allocating a small percentage of their portfolio to speculation or investing in securities that don’t have daily liquidity or simply not looking at their retirement balances when stocks are falling.

These moves may seem irrational when taken at face value but humans have to be irrational at times for the purposes of coping.

You have to survive many short-terms to get to the long-term.

Further Reading:

My Evolution on Asset Allocation