4 reasons to change your asset allocation.

4 reasons to change your asset allocation.

On today’s show we discuss why most people don’t care about the bear market, the relationship between wages and inflation, why we won’t see a repeat of the 1970s, why Apple is the best company in the world, the revenge of the Dow, tech stock valuations, the best decade ever for movies and much more.

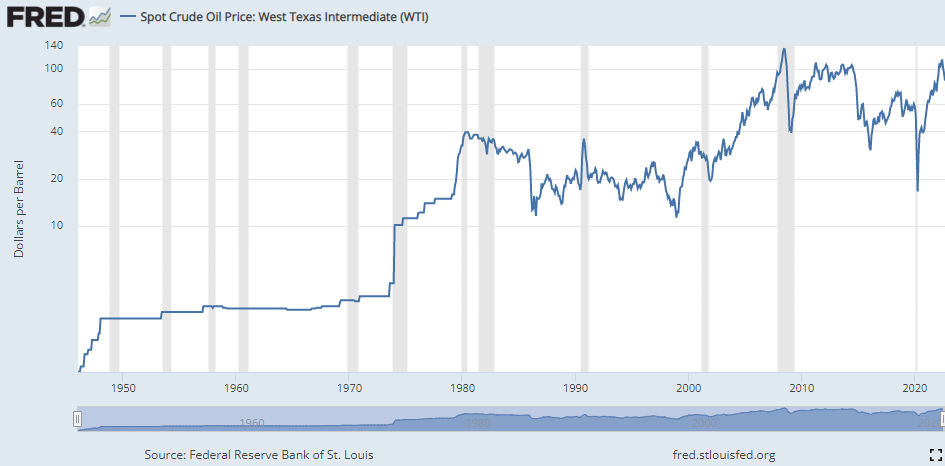

Some thoughts on the similarities and differences between now & the 1970s.

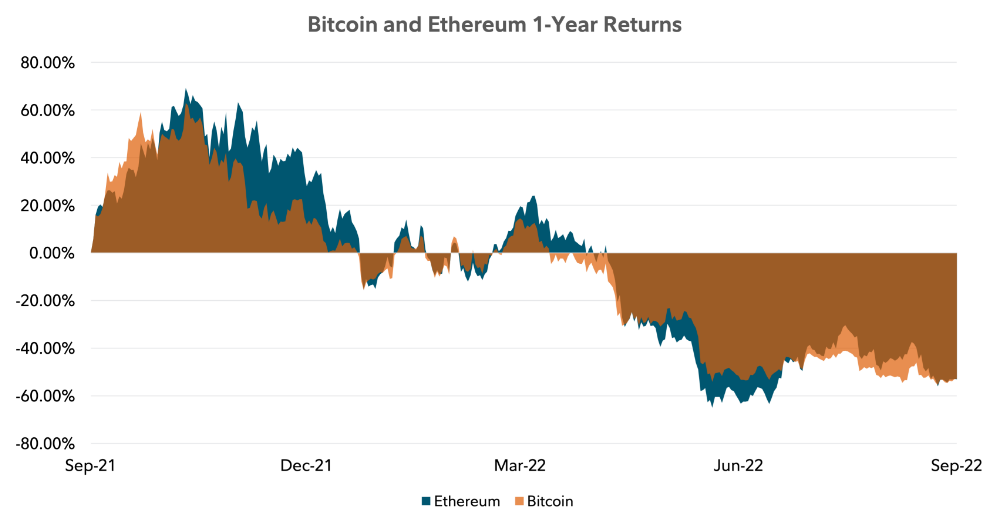

We are joined by Jack Neureuter, Fidelity Digital Assets Research Analyst, and Ramine Bigdeliazari, Director of Product for Fidelity Digital Assets to discuss Fidelity’s relationship and interest in crypto, proof of work vs proof of stake, crypto winter, and much more!

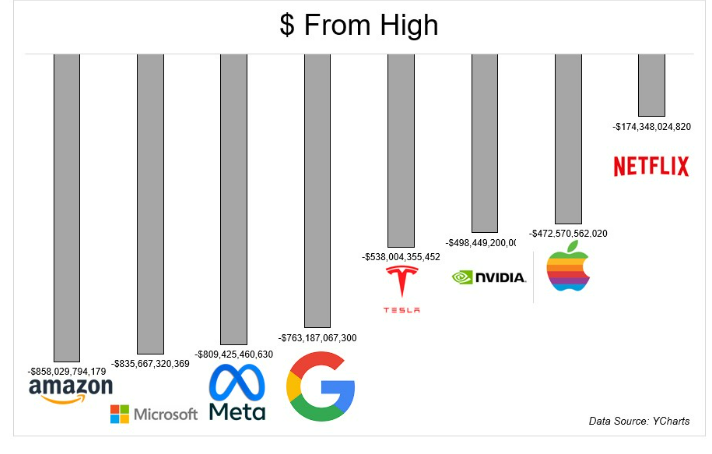

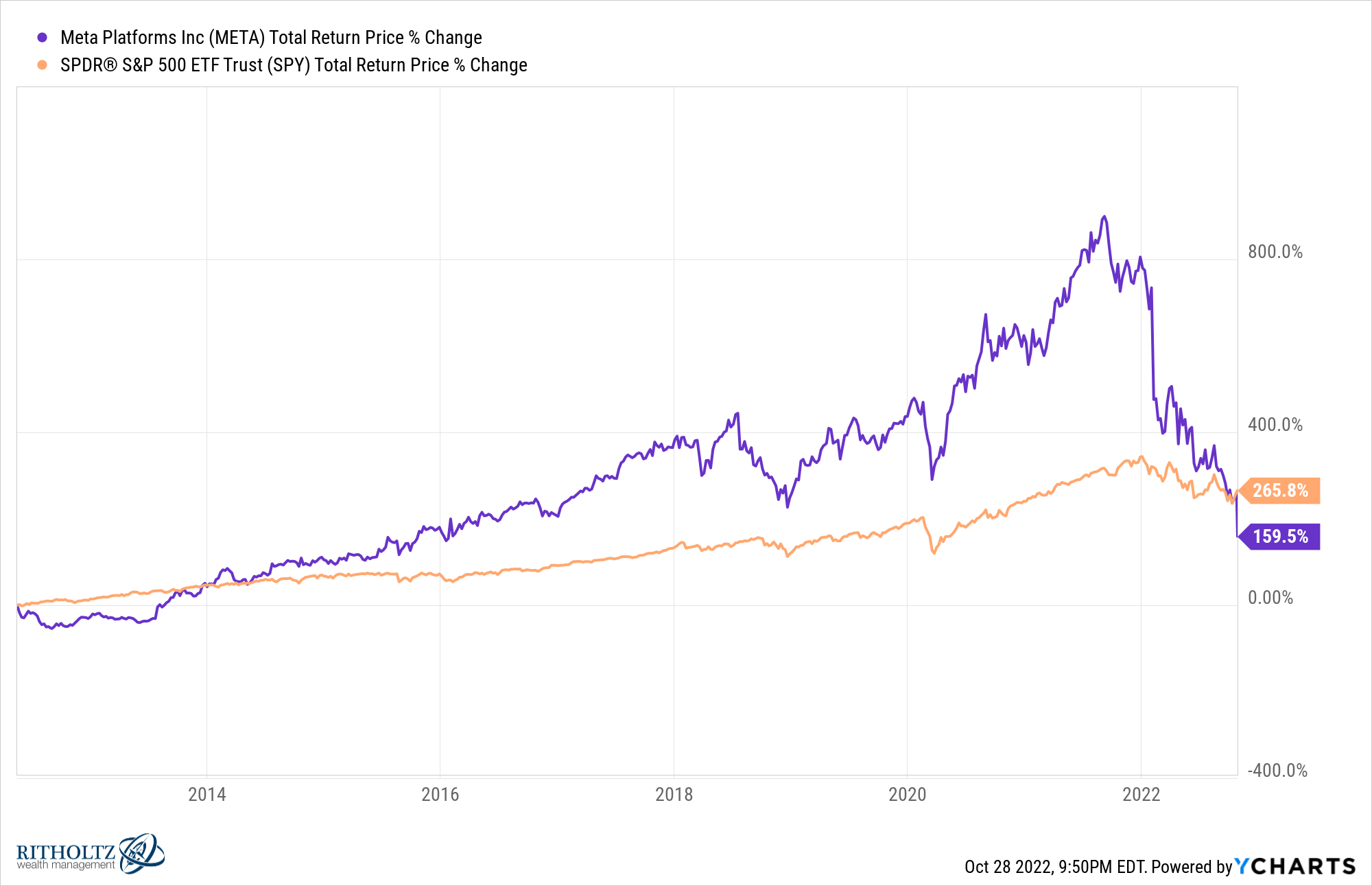

Tech stocks show how difficult it is to pick stocks.

Everything is cyclical in the markets.

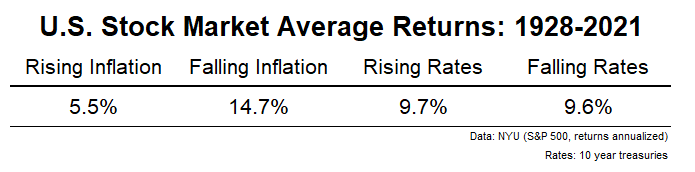

Some thoughts on the relative attractiveness of stocks vs. bonds.

On today’s show, we discuss the slowing housing market, taking Animal Spirits on the road, why consumers keep spending money, how the stock market moves during a bear market, some optimism for a 60/40 portfolio, why the 4% rule is still alive and well, a bunch of movie recommendations and much more.

Why do consumers keep spending so much money?

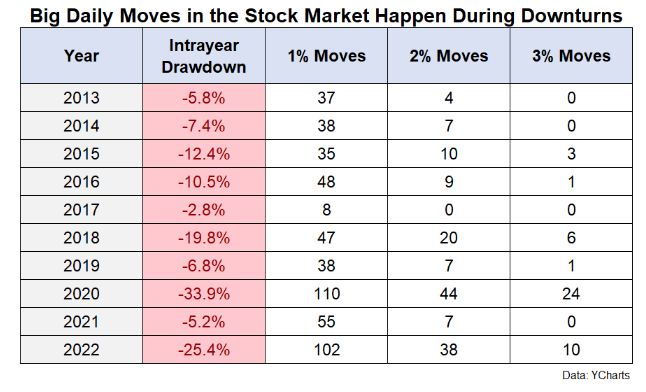

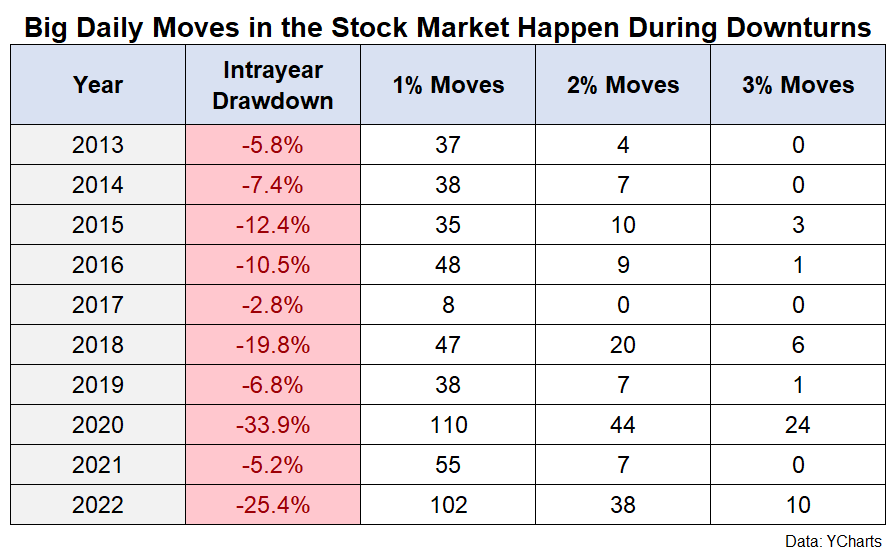

How bear markets tempt you into make mistakes.