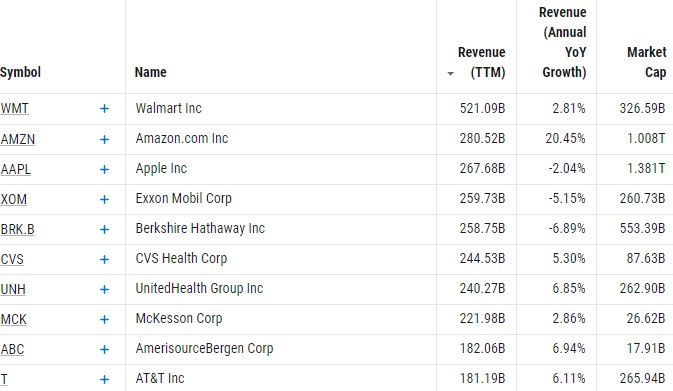

College students are day-trading Telsa shares and posting videos about it on TikTok.

College students are day-trading Telsa shares and posting videos about it on TikTok.

How the media can impact market sentiment.

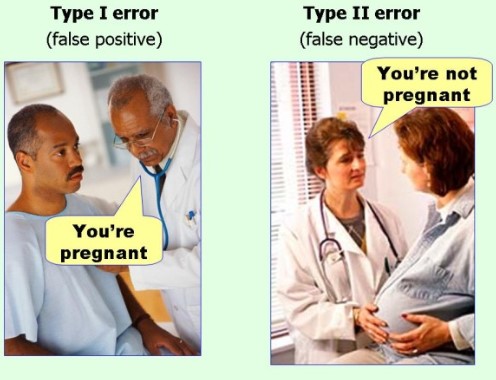

Charley Ellis is one of my favorite communicators in the investment world. His career has intersected with a number of different investment organizations which gives him a unique perspective on how things typically work. His book Winning the Loser’s Game is an all-timer investment book and his approach to minimizing mistakes resonated with me immediately upon…

This week’s Animal Spirits with Michael & Ben is supported by YCharts: Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service. We discuss: The insane run in Tesla’s stock price Understanding base rates when thinking about the future Bill Miller and Ray Dalio Why sports gambling is the new…

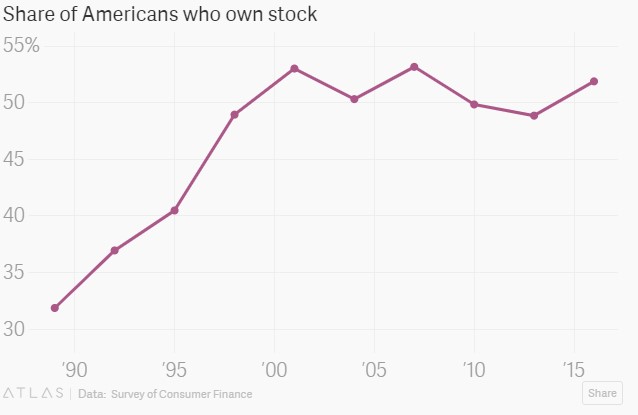

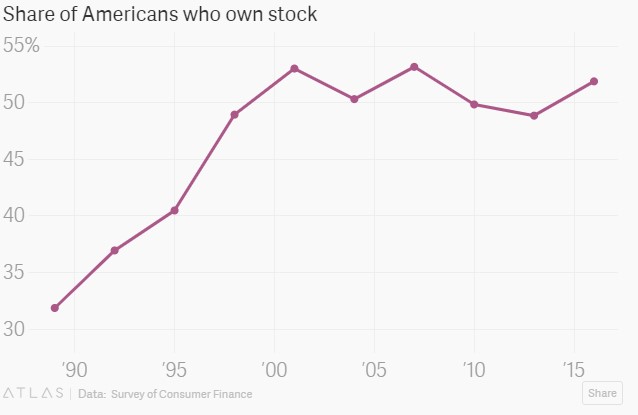

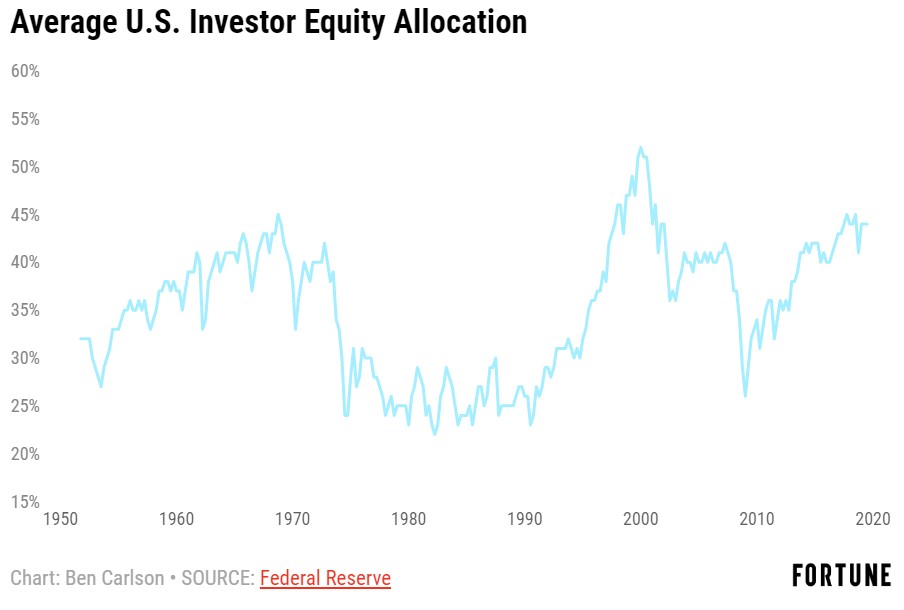

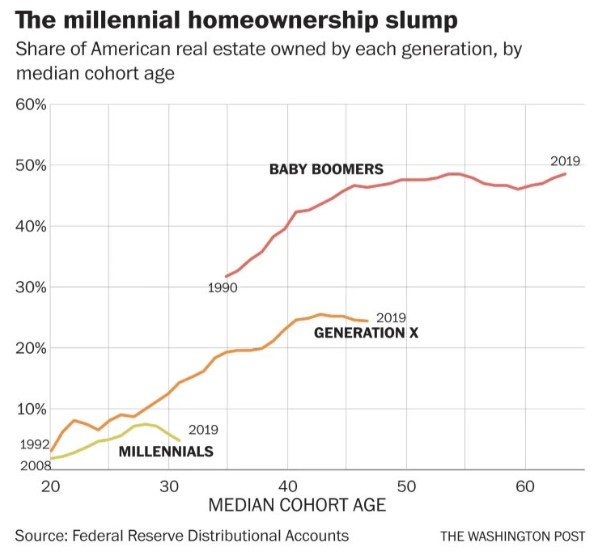

Why fears of a stock market crash from droves of retiring baby boomers are overblown.

Talking Don’t Fall For It with Barry Ritholtz and Michael Batnick.

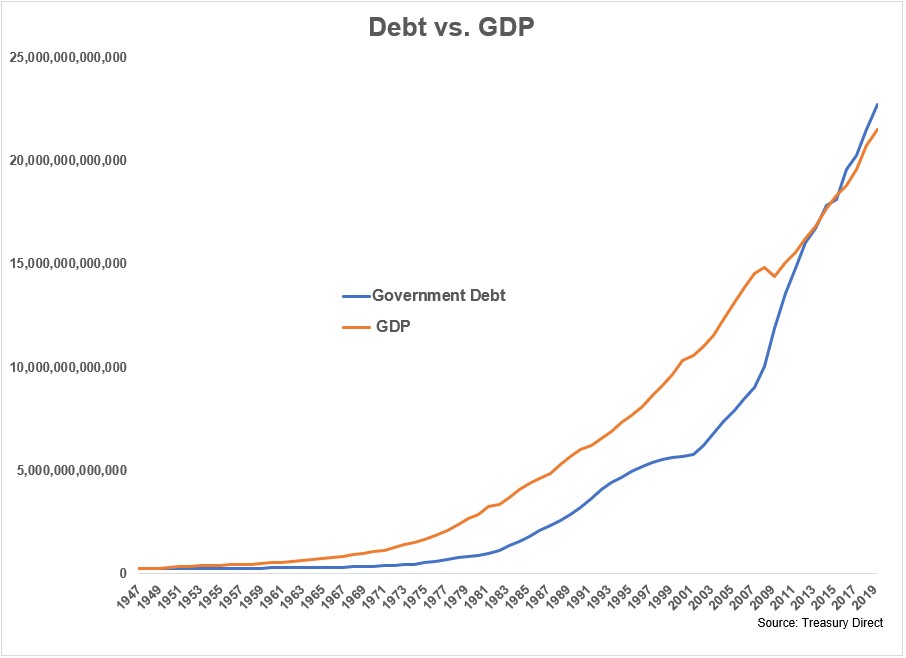

At what level does government debt become unsustainable?

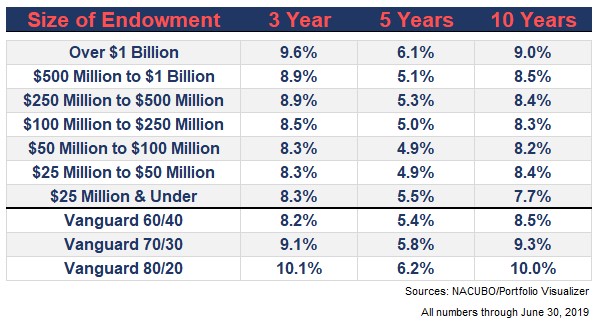

Thinking about saving for retirement from a number of different perspectives.

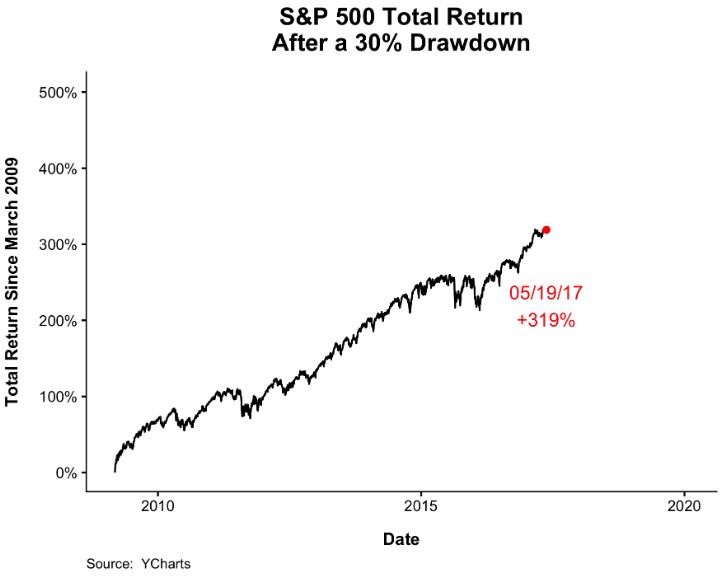

Back to the Future in the stock market when losses hit.

On this week’s Animal Spirits with Michael and Ben… We discuss: Kobe Bryant and learning to deal with death Why did boomers own so many more homes at a young age than millennials do now? Have zero trading commissions led to increased trading? Why has the turnover of stocks increased in recent decades? Reasons for…