The way I see it there are 5 types of retirement savers (in honor of the final season of Schitt’s Creek I will be including one GIF from the show to describe each type):

(1) The Overwhelmed Saver. This group knows they need to save but always comes up with a good reason to put it off until later because there are too many choices and decisions involved. They always tell themselves they’ll start saving when they’re good and ready.

(2) The Noobwhale Saver. This is the people just starting out who have no idea what they’re doing but at least they’re trying. The good news is when you’re young the most important thing is to just get started and build those saving habits. You can always fill in the details as you learn.

(3) The Diligent Saver. This group saves a decent percentage of their income on a regular basis and generally has their finances figured out and on the right track.

(4) The Late Starter. It’s estimated Americans in the 50-54 age range have an average of $137,000 and change saved for retirement (the median amount it just $11,000) so this group is fairly large.

(5) The FIRE Saver. The financially independent retire early crowd has the highest ratio of blogs per capita these groups but this is a movement that has its fair share of advocates in the millennial crowd.

Unfortunately, there is also always going to be a segment of the population who can’t or don’t save. This group will likely rely heavily on social security to fund their retirement. Currently only about half the country owns shares in the stock market in one form or another. This number is actually up from roughly 30% in the late-1980s but is still a shame.

Michael and I discussed the different saver classes along with those who have a hard time saving on the podcast this week:

I used to be one of those people who assumed it should be easy for everyone to save.

Just live below your means. Pay yourself first. Track your spending. Understand the power of compound interest!

If only it were that easy.

Yes, these things can be important but much of your financial life can be circumstantial. This doesn’t mean disadvantaged people can’t get their finances in order or advantaged people always have pristine personal finances. It just means some people have it easier than others.

There are 5 variables that generally have the biggest impact on your retirement savings:

(1) How much you make

(2) When you start saving

(3) Your savings rate

(4) When you retire

(5) Your rate of return

Number 5 is the one people in the investment industry focus on but it’s also the one that’s mostly outside of your control.

Charley Ellis performed a study in his book, Falling Short: The Coming Retirement Crisis and What to Do About It, that looks at how you can use these variables to your advantage, especially if you’re behind on your retirement savings.

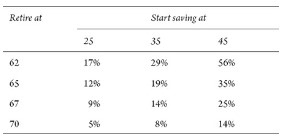

Ellis assumes you need to replace 75% of pre-retirement income (a figure that includes all other sources of income such as social security). He then looks at the differences in savings rates depending on when you start setting aside money and when you retire:

Here’s the takeaway from Ellis:

First, start dates and retirement dates are both very important, because time is so important. Starting to save at age 25, rather than age 45, cuts the required annual saving rate by about two-thirds. And delaying retirement from age 62 to age 70 reduces the required annual saving rate by more than two-thirds—from 17 percent to 5 percent (or 29 percent to 8 percent for those who start at 35, or 56 percent to 14 percent for those who start at 45.) Taken together, starting at 25 and working to 70—compared to starting at 45 and retiring at 62—reduces the required annual saving rate by a factor of 10!

It makes sense that the earlier you start saving the lower your target savings rate would be because you allow compounding to do the heavy lifting for you.

But that ship has sailed for those in middle age who are still trying to build a nest egg as well as those young people who simply can’t afford to save because of their financial situation.

Working longer will likely be the solution to people who got a late jump on retirement planning because it offers a nice bump for three reasons: (1) it allows you to continue to save, thus avoid drawing down your portfolio, (2) it allows you to delay taking social security until an older age, thus increasing your eventual payout and (3) it decreases your longevity risk.

Obviously, working longer also means a shorter retirement but for many it could be their only hope at attaining a level of financial comfort in their golden years.

Further Reading:

Some Thoughts on the Extreme Early Retirement Movement

Now here’s what I’ve been reading lately:

- What young investors are getting wrong (WSJ)

- Adulting shows what society has won and lost (CNBC)

- Some of the best quotes from Comedians in Cars Getting Coffee (Still Learning)

- Why market timing can be so appealing (Dollars and Data)

- How one decision can help you save for retirement (Abnormal Returns)

- My two-part Q&A with Tadas Viskanta about my new book (Part I) and (Part II)

- Distinguishing financial stress from anxiety (Kitces)

- Put on your own oxygen mask first (Financial Bodyguard)