Everything you need to know about owning a home.

Everything you need to know about owning a home.

Understanding confidence and humility from the set of Almost Famous.

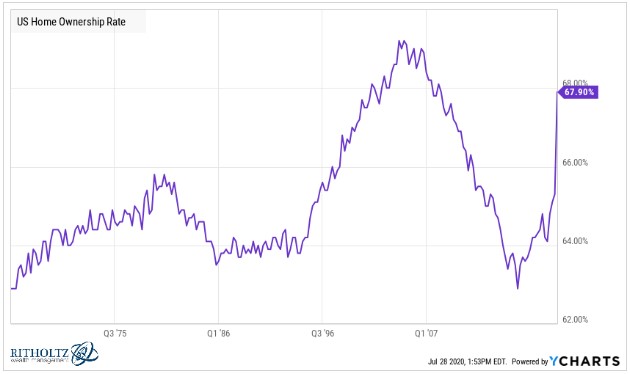

This week’s Animal Spirits with Michael & Ben is supported by YCharts: Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service. We discuss: The sheer dominance of Apple, Amazon, Microsoft, Google and Facebook What would need to happen for the market to roll over again? The performance of…

The outsized impact of Apple, Amazon, Microsoft, Google and Facebook.

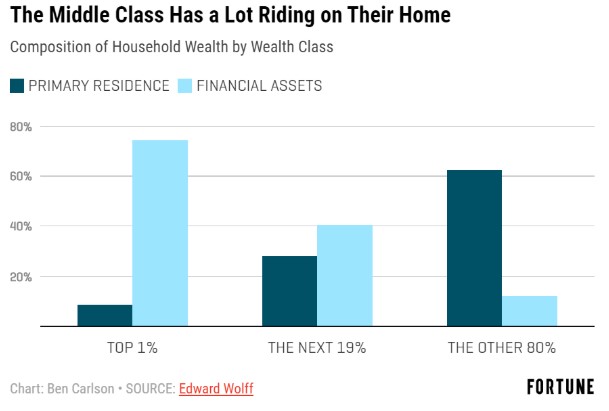

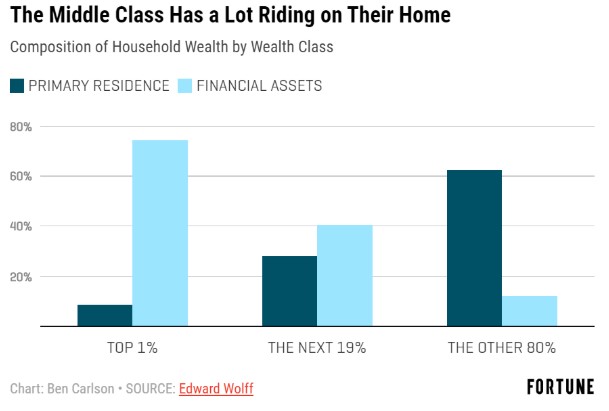

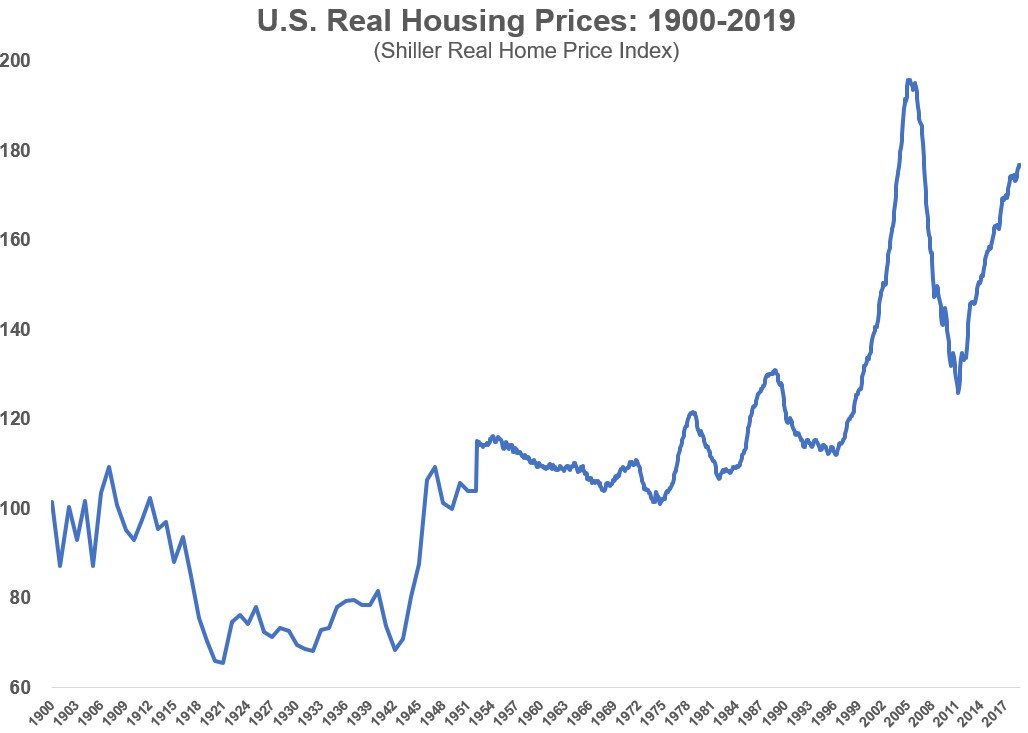

How housing could end up one of the best-performing assets of the 2020s.

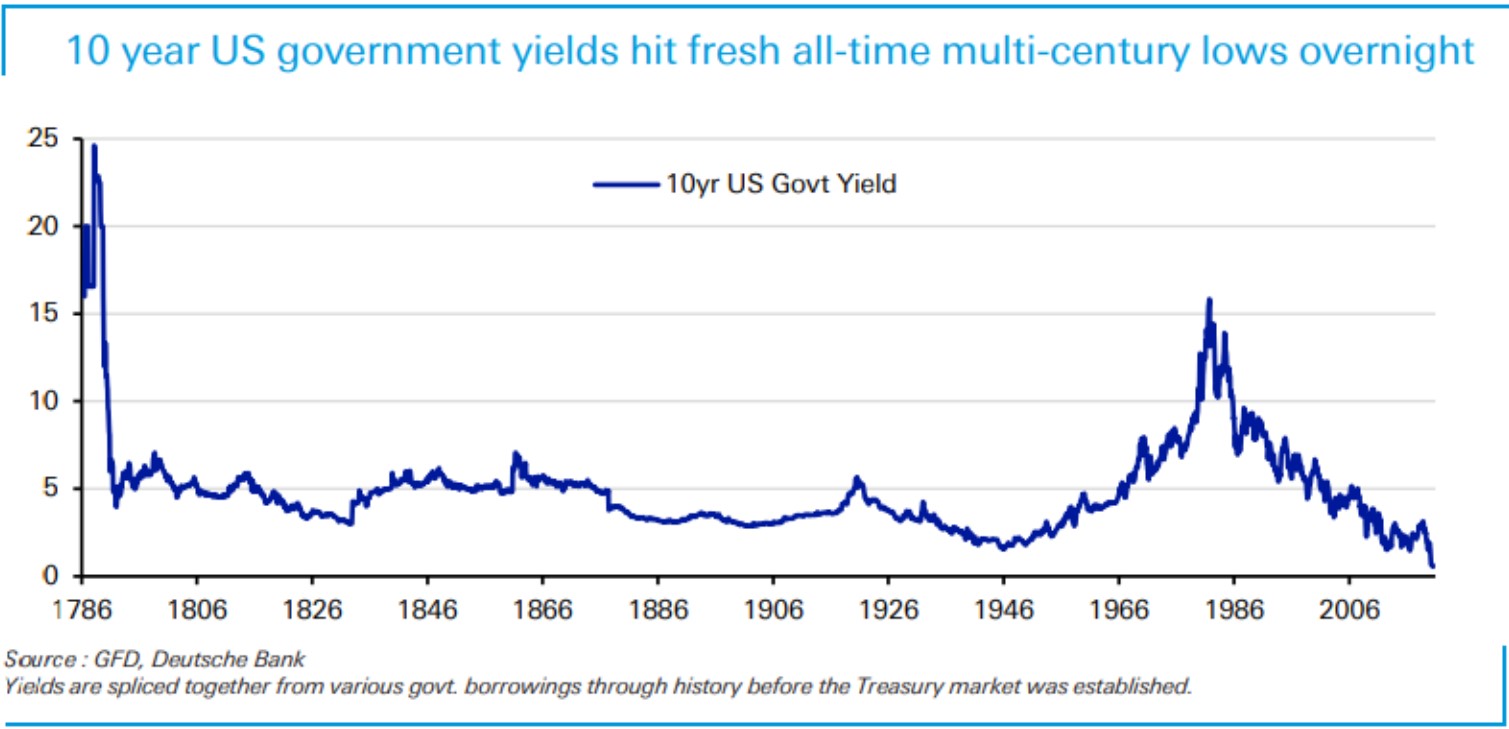

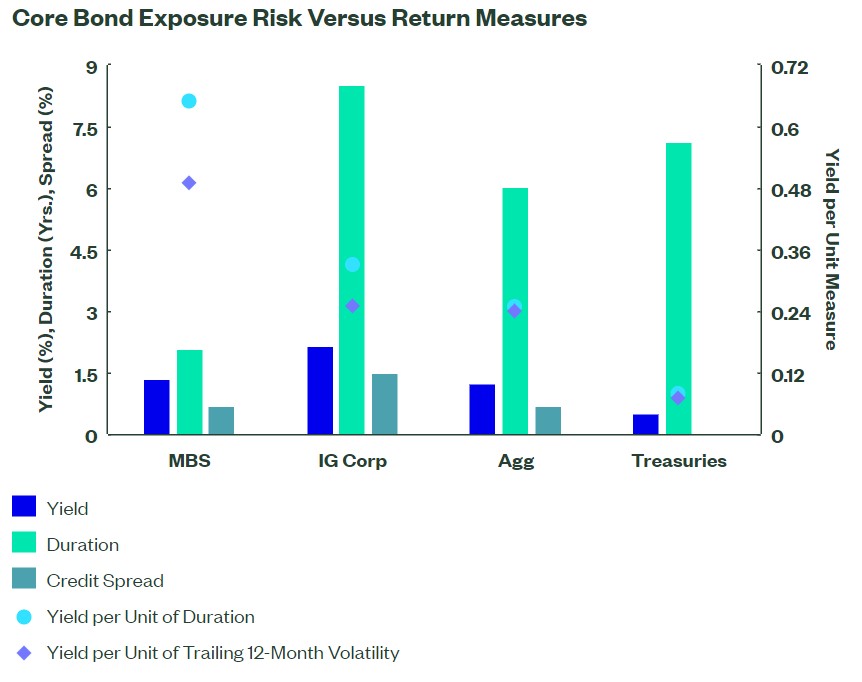

The pros and cons of owning bonds right now.

How the South Sea bubble created the original blank check companies.

Figuring out how to navigate a world with no yield in fixed income land.

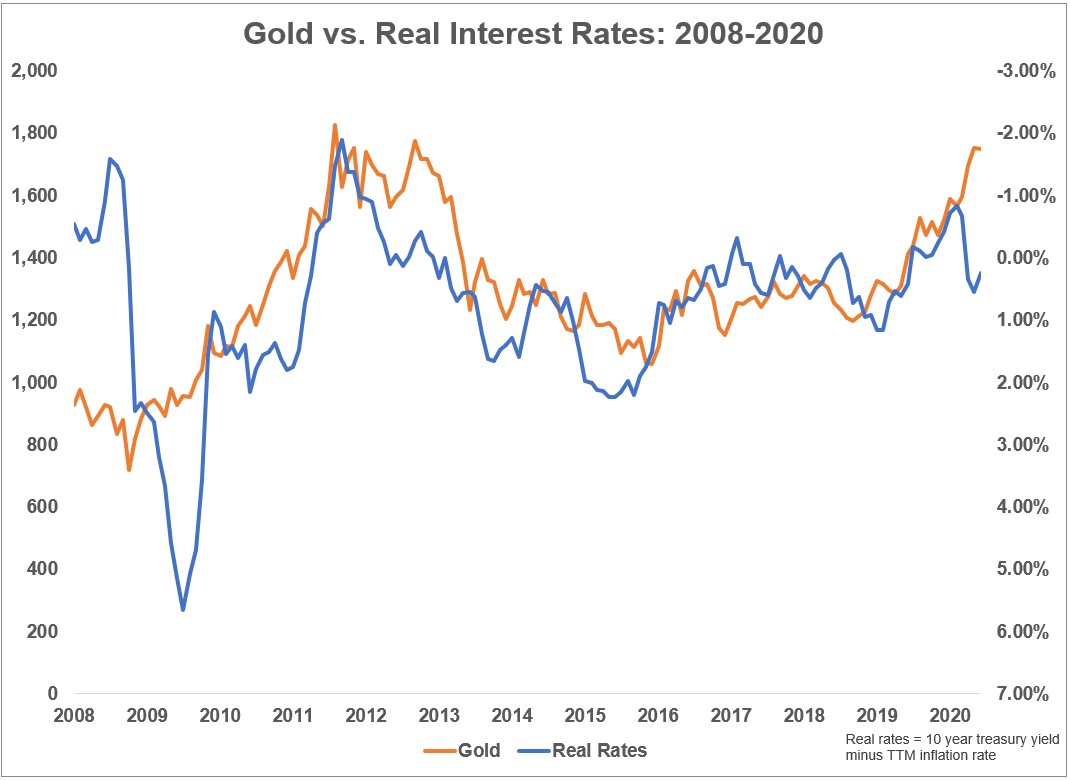

What causes the prices of gold to go up?

Michael and Ben discuss how crazy this market has been, going from 1929 to 1999 in a matter of months.