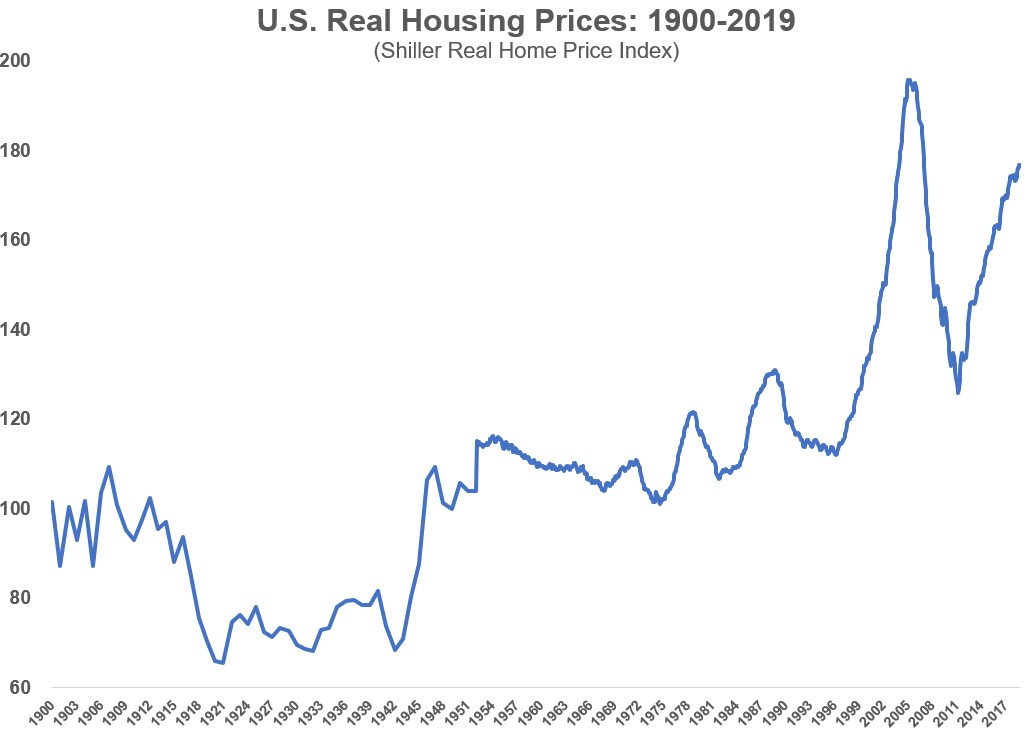

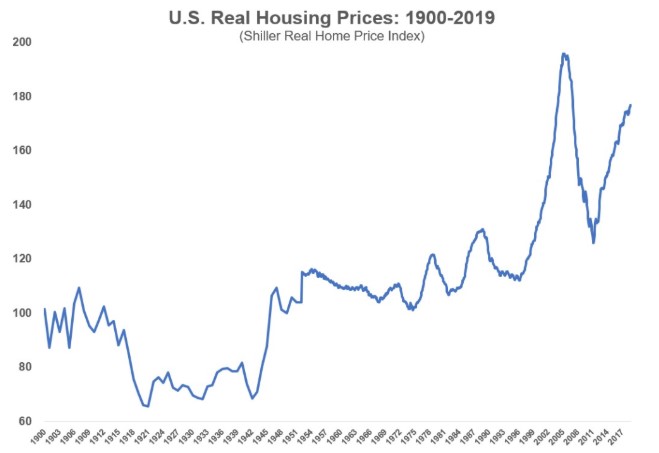

If you run the numbers, owning a home may not turn out to be the greatest investment option on the planet.

Sure, if you live in the right area at the right time and take advantage of the inherent leverage involved it could end up becoming your greatest investment ever.

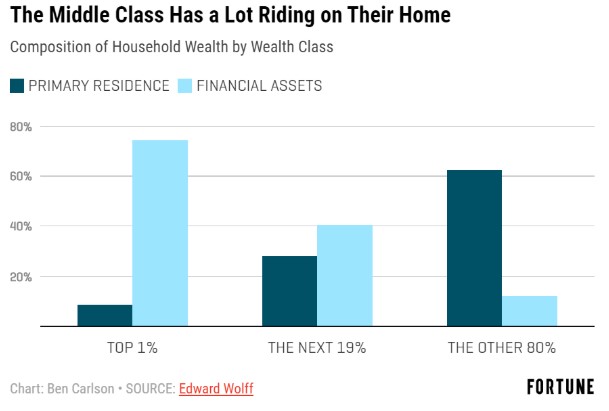

But even if a house turns out to be a subpar use of investment dollars, for the majority of Americans, a home is by far their biggest financial asset:

Those in the 1% have most of their money tied up in financial assets, which makes sense. But two-thirds of all money for the bottom 80% of Americans by wealth is in their primary residence while just 12% resides in other financial assets like stocks or bonds.

It’s estimated there is more than $6 trillion sitting in untapped home equity right now in the United States.

The stock market gets more attention from the financial media but housing is by far the most important financial asset for most normal people.

It’s also one of the most confusing assets because there is so much involved in the process. We don’t buy and sell homes very often in our lifetimes. In fact, the average length of time people live in their house is around 13 years.

There is a myriad of emotions involved in home ownership because it’s the roof over your head, part of your community and neighborhood, your school district and a place you make memories. The psychic income on a home cannot be calculated to the decimal point but it’s there.

These emotions can blind you to the fact that the finances of owning a home can be complicated if you don’t understand what you’re getting yourself into.

So Michael and I decided to dedicate an entire podcast to the economics of home ownership.

We discuss:

- Myths around owning a home

- Is real estate the best investment you can make?

- Why calculating the return on your home is so difficult

- Why every real estate investor is a stock-picker

- Buying vs. renting

- When should you buy your first home?

- Pros and cons of renting

- The ancillary costs involved in real estate

- The economics of buying a starter home

- The frictions involved in selling a home

- The benefits of a fixed-rate mortgage

- The difference between a buyer’s and seller’s market in real estate

- The tax breaks involved in real estate

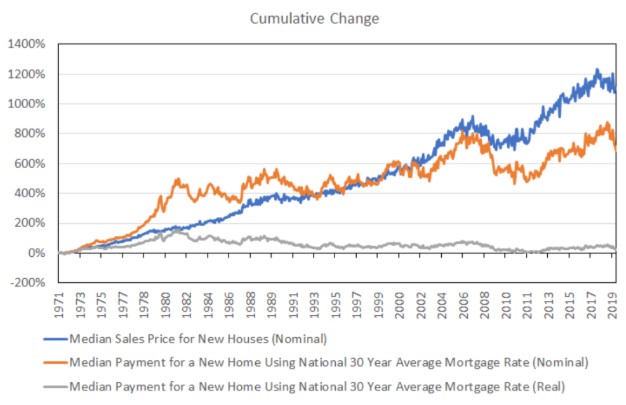

- How lower interest rates have kept housing more affordable

- Who should you go to for your mortgage loan?

- How refinancing works

- How should you sell your home when moving?

- Do low rates change the conversation about paying off your mortgage earlier?

- The growing importance of home equity

- How do reverse mortgages work?

- How HELOCs work

- Rental properties as an investment

- The benefits of forced savings and illiquidity of real estate

This episode is presented by Naviplan by Advicent:

Go to www.advicent.com/animalspirits to learn more about how their software can help with the financial planning surrounding the cash flows involved with home ownership.

Listen here:

Stories mentioned:

- The biggest problem in finance?

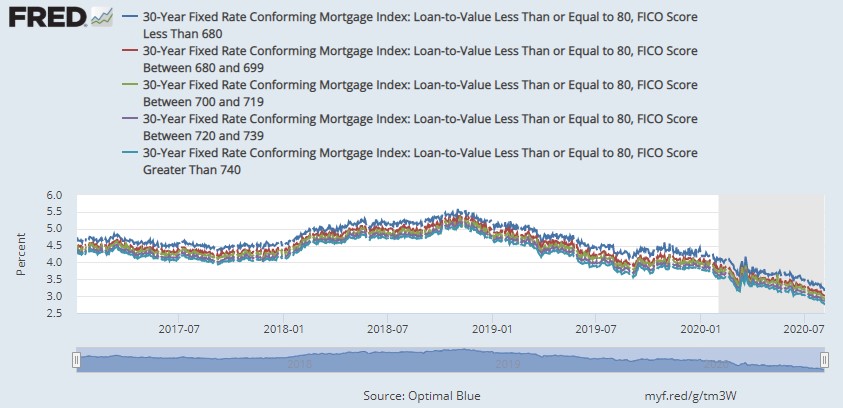

- The impact of FICO score on mortgage rates

- The economics of owning a home

- The David Bowie hedge when buying a home

- Should you pay off your mortgage early with rates so low?

- The cost of selling your home

- Owning a home is not for everyone

- Why housing could be one of the best performing asset classes of the 2020s

- Mortgage rates are insanely low

- Rebalancing your personal balance sheet

- Has there ever been a better time to be a homebuyer?

Book mentioned:

Video:

More charts:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on Shuffle.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: