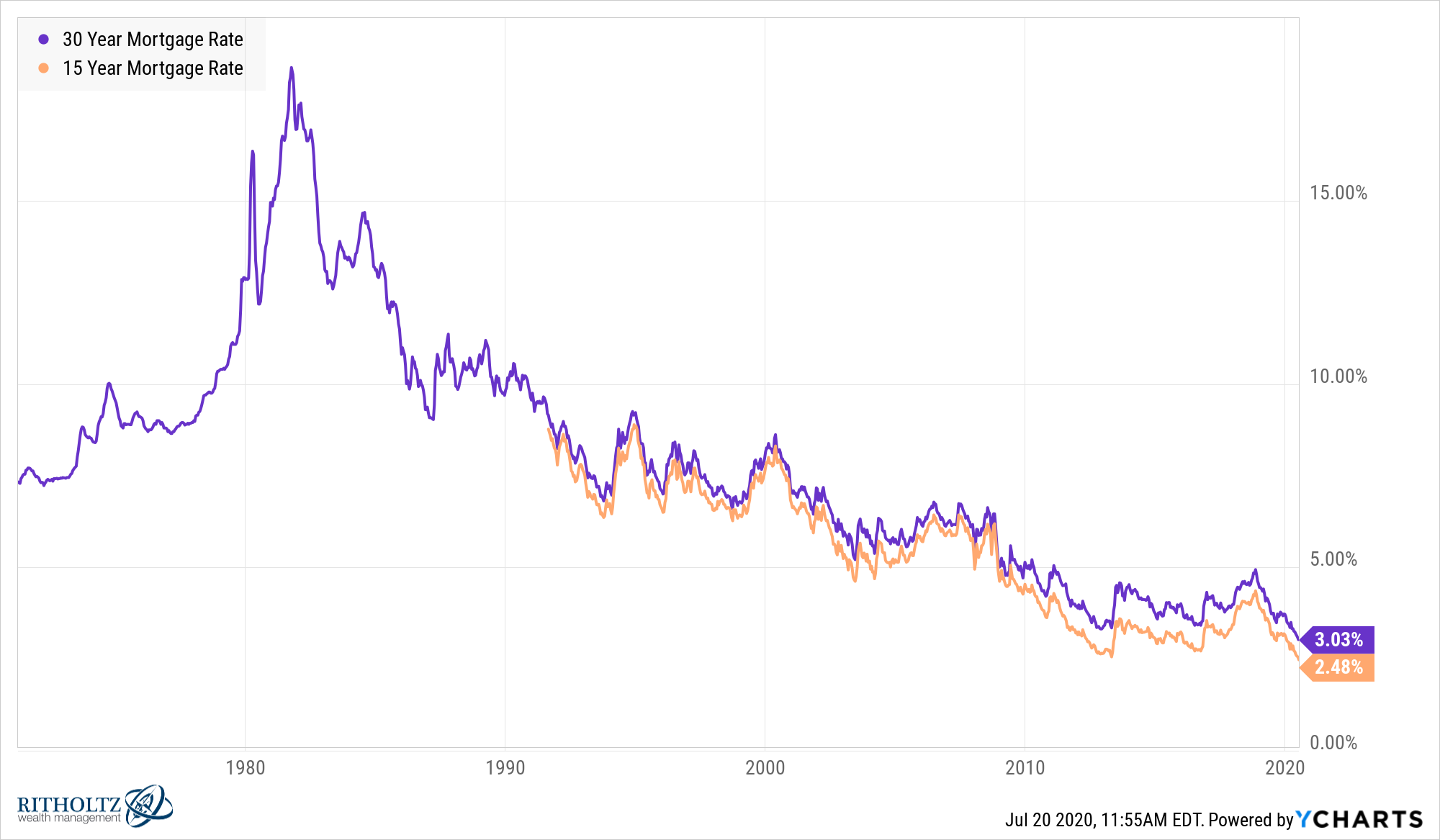

The Wall Street Journal reported 30 year mortgage rates fell to their lowest level ever this past week to just 2.98%.

The rate on a 15 year fixed is now under 2.5%:

Depending on where you live it may not feel like it, but these borrowing rates have made the finances of homeownership much more cost-effective than most people realize.

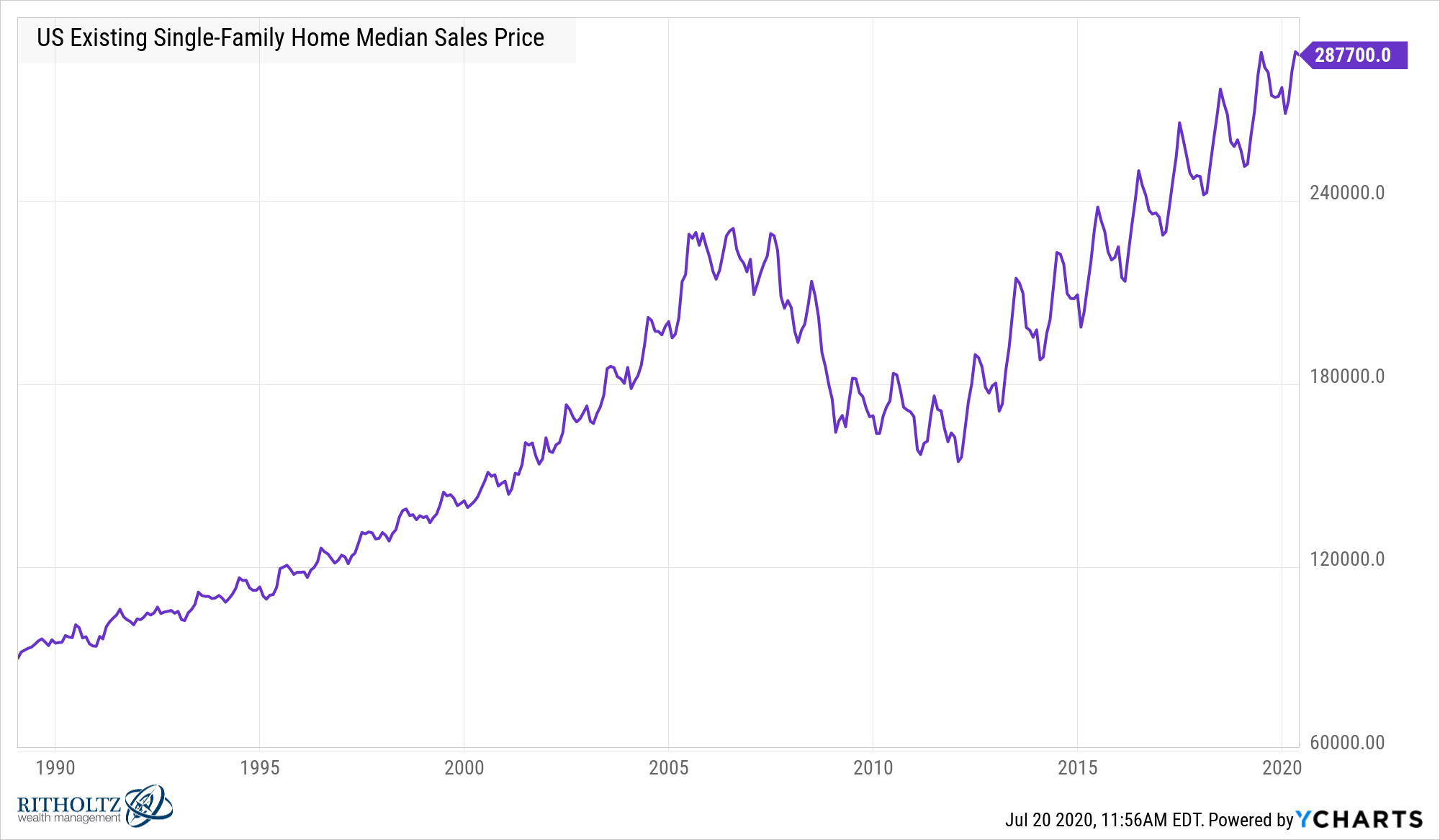

Here is a look at the median sale price of existing single-family homes since the late-1980s:

There was a big hiccup from the real estate boom and bust of the 2000s but the median price for an existing home has gone from under $100,000 to nearly $300,000 over the past 30+ years.

However, looking exclusively at the price of a home doesn’t tell the whole story when it comes to affordability.

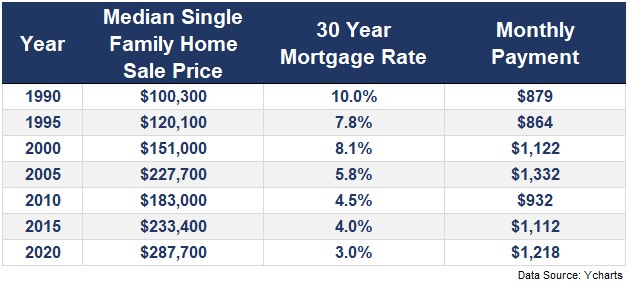

Going back to 1990, I matched up the prevailing 30 year fixed mortgage rate with the median home sales price at the mid-point of the year to figure out the monthly mortgage payment and the results are somewhat surprising:

Let’s unpack these numbers.

The growth in the median sales price since 1990 is close to 190% while the monthly payment is up just shy of 40%.

Since the turn of the century, the median sales price of an existing home is up more than 90% but the monthly mortgage payment is up only 8%. Over this same period, inflation is up more than 50%.

And since 2005 the median sales price of a home is up 26% while the monthly mortgage payment is actually down 9%.

So while housing prices look much higher over this time because we are dealing with big numbers, those higher prices are not translating into the same level of increased monthly carrying costs.

Obviously, real estate prices and taxes and such are different depending on where you live so this isn’t a universal cost-saving for every homebuyer.

But one of the biggest benefits of a fixed-rate mortgage is the fact that your monthly payment is set in stone while your wages (hopefully) rise over time, thus making it easier to handle the costs of homeownership as your career progresses.

When you combine those existing benefits with much lower borrowing costs, the finances of owning a home are not nearly as daunting as they may appear to some people.1

I have always looked at owning a home as more of a personal finance decision than an investment opportunity because there is so much more that goes into homeownership — the ancillary costs, the emotions, the property taxes, the memories you create, the community, the school district, the maintenance required, etc.

But from a purely financial perspective, the fact that borrowing costs have come down so much can provide a nice tailwind for those buying a home or refinancing their current loan.

And because those savings come in the form of a lower fixed monthly payment, that can make a real difference to your budget and ability to save or spend elsewhere.

Further Reading:

Real Estate vs. the Stock Market

1To reap these long-term benefits it is helpful to actually stay in your home for the long-term so you’re not giving away money through the frictional costs of buying and selling.

*I didn’t take into account a down payment here just to keep things simple because it’s the relative differences I was trying to point out but these are the monthly payments assuming a 20% down payment starting with 1990: $704, $692, $895, $1,069, $742, $891 and $970.