My family has lived in our new home for a little over two years now.

Our neighborhood has 20 houses or so in it. There are currently two homes for sale out of 20. By my count, in our two-plus years of living here, this would be the 7th and 8th homes up for sale in that short period of time.

That’s a pretty decent turnover rate.

This got me thinking about the costs involved in the moving process, which is something most people seem to gloss over when discussing the money they can make on the sale of their home.

I’ve been through the home selling process before so I’m basing my cost estimates partially on personal experience, partially on research, and partially on stories from other sellers.

Let’s say you’re selling your home for $400,000 and have matched the Case-Shiller Index over the past 5 years, a pretty decent period for the real estate market. That’s an annual return of 4.9%. Let’s round up to 5% annually over the past 5 years or just shy of 30% in total.

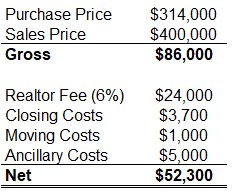

That would mean you bought the house for roughly $314,000, giving you a gain of $86,000 as the difference between the purchase and sale price. Not bad.1

Now let’s breakdown how much of that difference is eaten up by fees and costs.

A 6% realtor fee (when you sell you pick up the tab for both realtors): $24,000

The average closing costs according to Zillow: $3,700

Moving costs depends on how far you’re going, how much stuff you have, and how complicated the move is. I looked at a few different sources but couldn’t come up with a definitive answer. Based on research and personal experience, I’m going to estimate this one at $1,000.

The ancillary costs of moving into a new place are also tough to narrow down as an average but people always underestimate how much they’ll spend on new furniture, decorations, upgrades, and other little things. I would like to say ten grand is not out of the question for this but the range for this category is probably wider than most so I’ll cut that in half and say $5,000.

Adding it all up gets us the following breakdown:

Almost 40% of the gain gets eaten up by fees in this example. You could change these numbers up depending on your personal situation but most sellers will see a big chunk of their appreciation taken out by the frictions of the selling process.

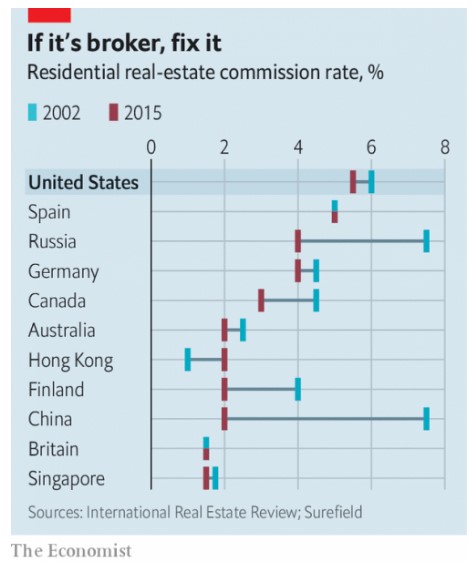

Realtor fees are obviously the biggest cost in this equation and there are ways to get around this. But per an article from The Economist, these fees have been relatively sticky in the U.S.3 for some time now:

I’m not taking into account the leverage involved in real estate nor am I calculating a return on investment here. And maybe people buying a home to live in it shouldn’t be thinking in terms of a return on investment anyways. Owning a home isn’t like owning shares in a corporation or buying a government bond.

I’ve talked to a handful of my old neighbors who sold. All of them had legitimate reasons for moving (new school district, new job, family reasons, etc.).

My family had to move to make more room for our twins. Sometimes life forces your hand when it comes to selling.

And maybe that’s my bigger point here. The old days of buy-and-hold with your home are probably over for the majority of people. My parent’s generation and their parents before them were perfectly happy to live in the same home for 30, 40 or even 50 years.

I don’t get the sense that same buy-and-hold approach to housing exists anymore for the majority of people my age.

There’s nothing inherently wrong with this idea but people have to be reasonable with their expectations when it comes to how much money they’ll make on any real estate transaction.

There are serious costs involved that often eat into any perceived profits.

Seller beware.

Further Reading:

Animal Spirits in the Real Estate Market

1I’m ignoring the inherent leverage involved in the equation here because calculating imputed rent is enough to make your head hurt and I’m strictly trying to make a point about the difference between the purchase and sale prices. I’m also ignoring all of the costs along the way including taxes, upkeep, repairs, closing costs when you bought, etc. Real estate is one of the trickier assets when it comes to understanding your true ROI.

2I could also throw in the cost of therapy in this one for the emotional rollercoaster you go through during the selling and buying process but I’ll leave that out. Don’t forget to tip your wait staff, I’ll be here all week.

3I know there are places like Redfin that offer lower commission rates but I’m surprised Silicon Valley hasn’t figured out a way to eat into these margins like other countries have experienced.