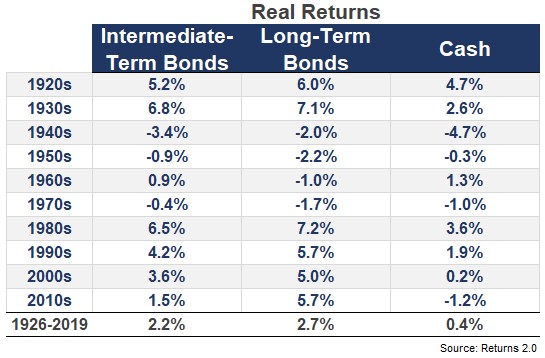

Government bond yields remain unbelievably low across the maturity spectrum: The correlation between starting yields and future long-term returns is very high, meaning you can use these rates as a decent approximation of forward bond returns. In other words, don’t expect much from the bond portion of your portfolio. When you compare today’s yields with…