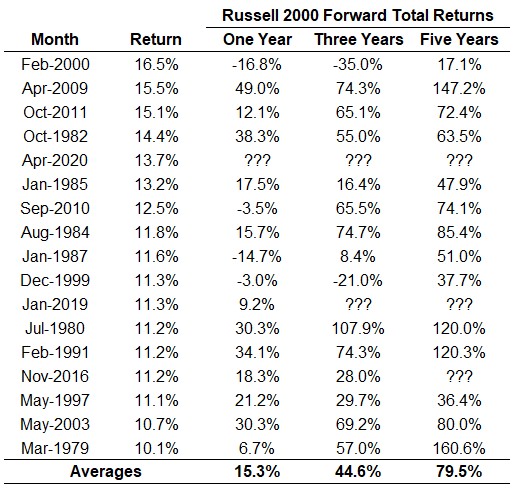

Small cap stocks are on track for one of their best months ever.

Small cap stocks are on track for one of their best months ever.

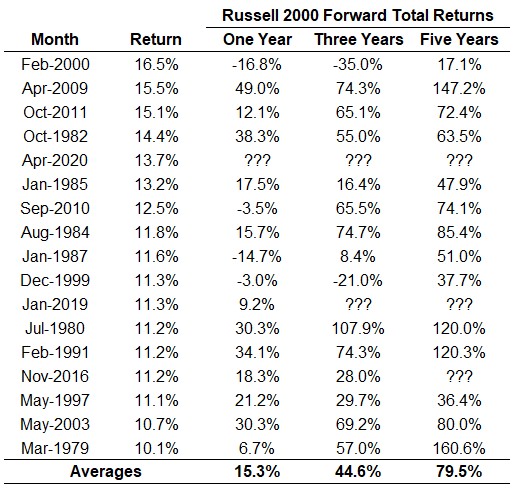

Why people in their 30s are going to be buying a lot of houses in the coming years.

Why honesty gives you an edge these days.

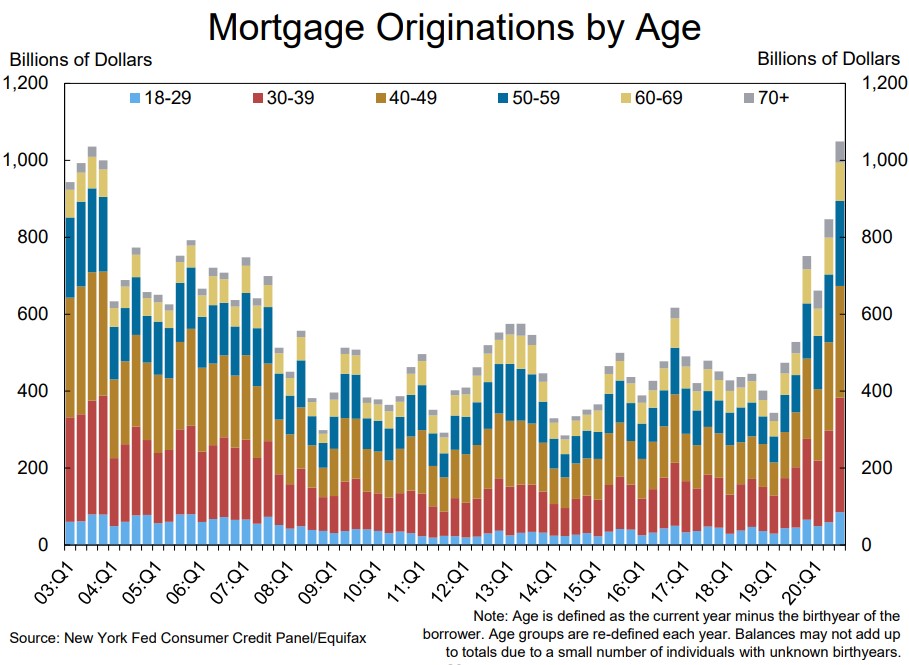

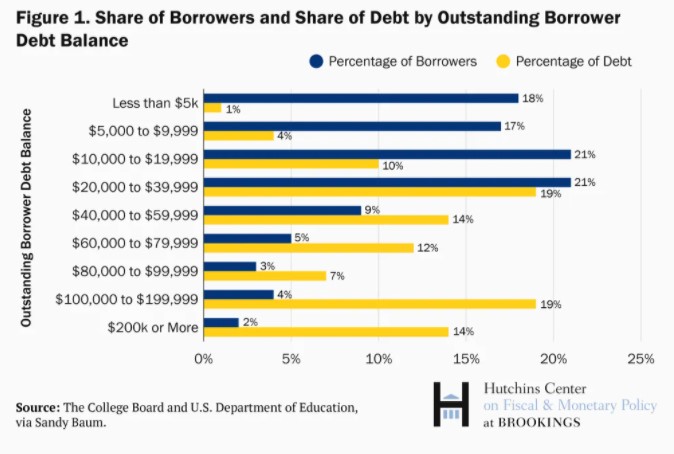

Tale of the tape: credit card debt vs. student loan debt

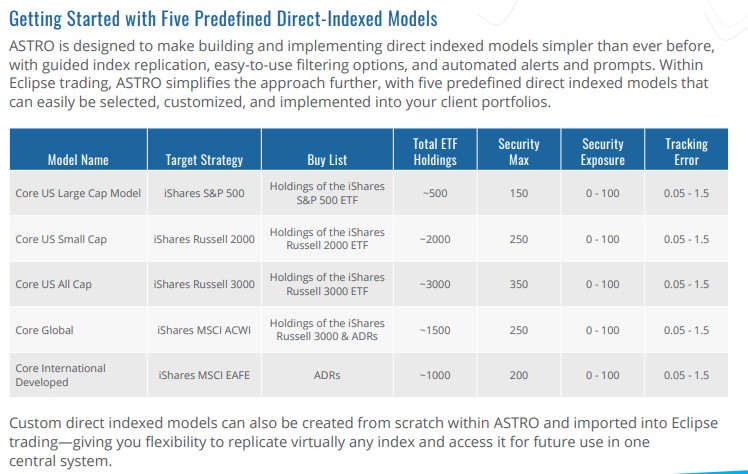

On today’s show Michael and I talked with Rusty Vanneman, CIO at Orion about direct indexing.

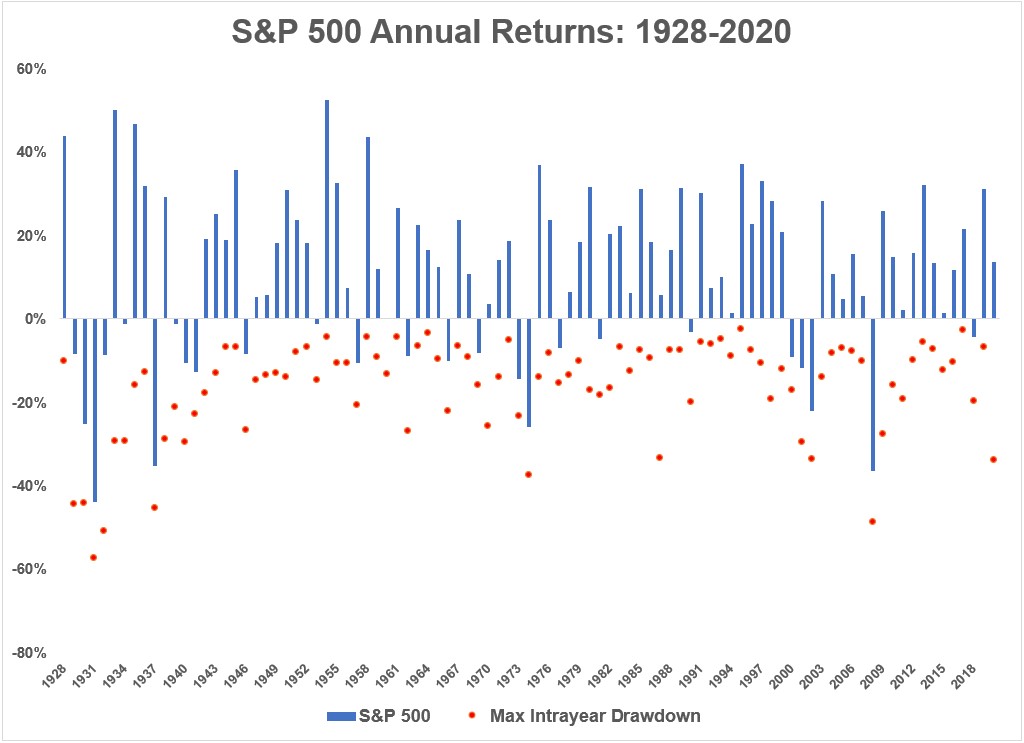

2020 is likely going have the largest drawdown in history that finished with a year-end gain.

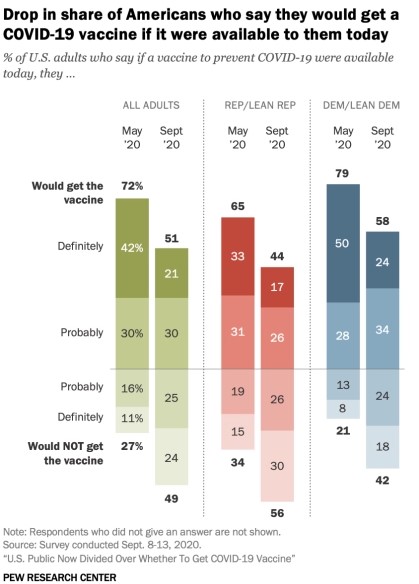

Michael and Ben discuss another vaccine, the ROI on college, canceling student loan debt and more.

A look at why Tesla does and does not matter for index fund investors.

What the Covid vaccine and Apollo 11 mission have in common.

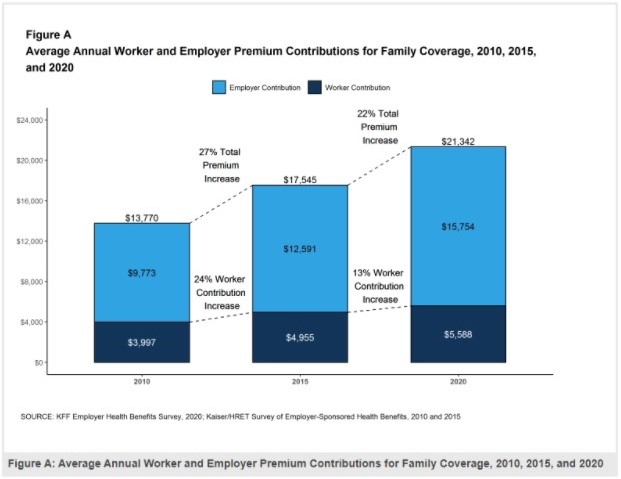

Healthcare is one of the biggest problems in our country.