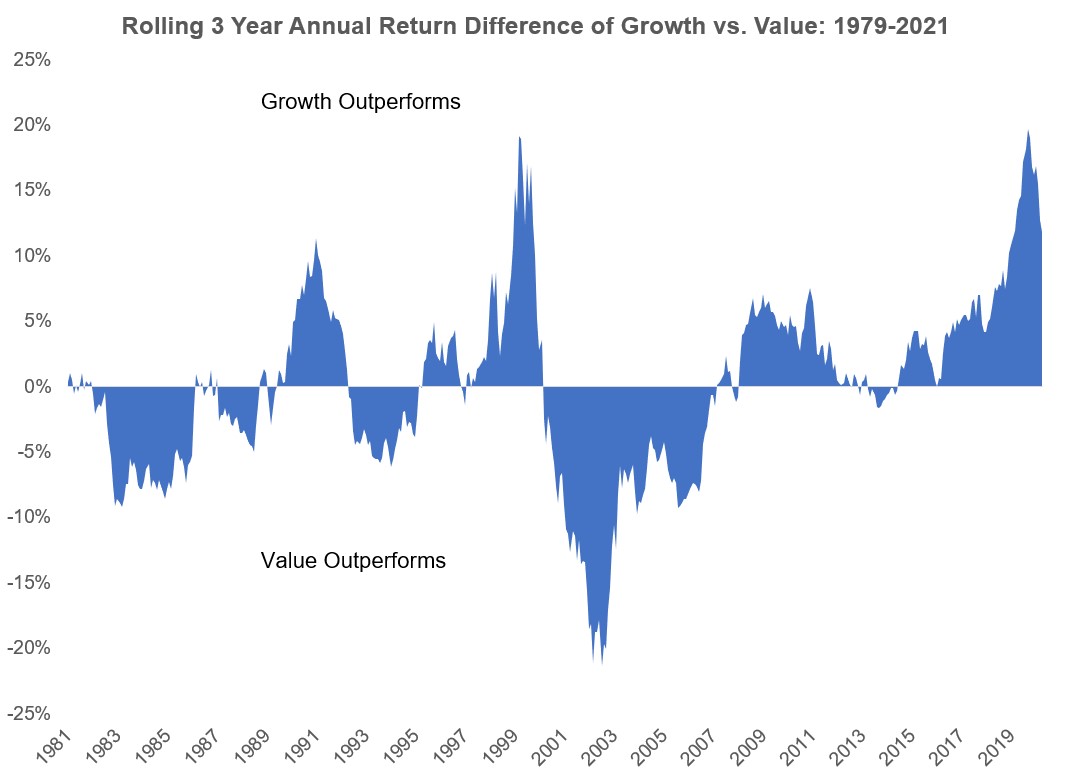

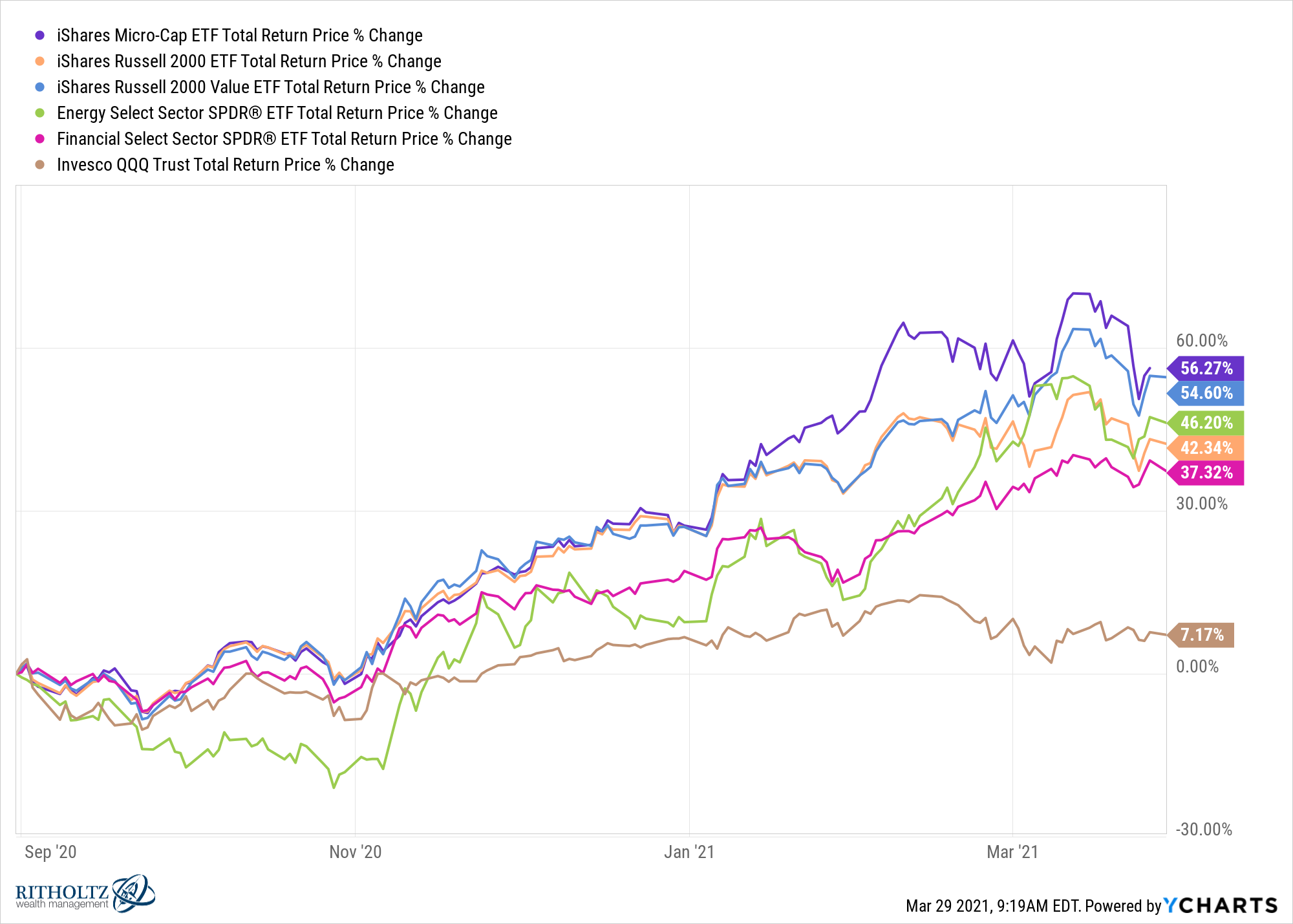

What it would take for value to outperform growth.

What it would take for value to outperform growth.

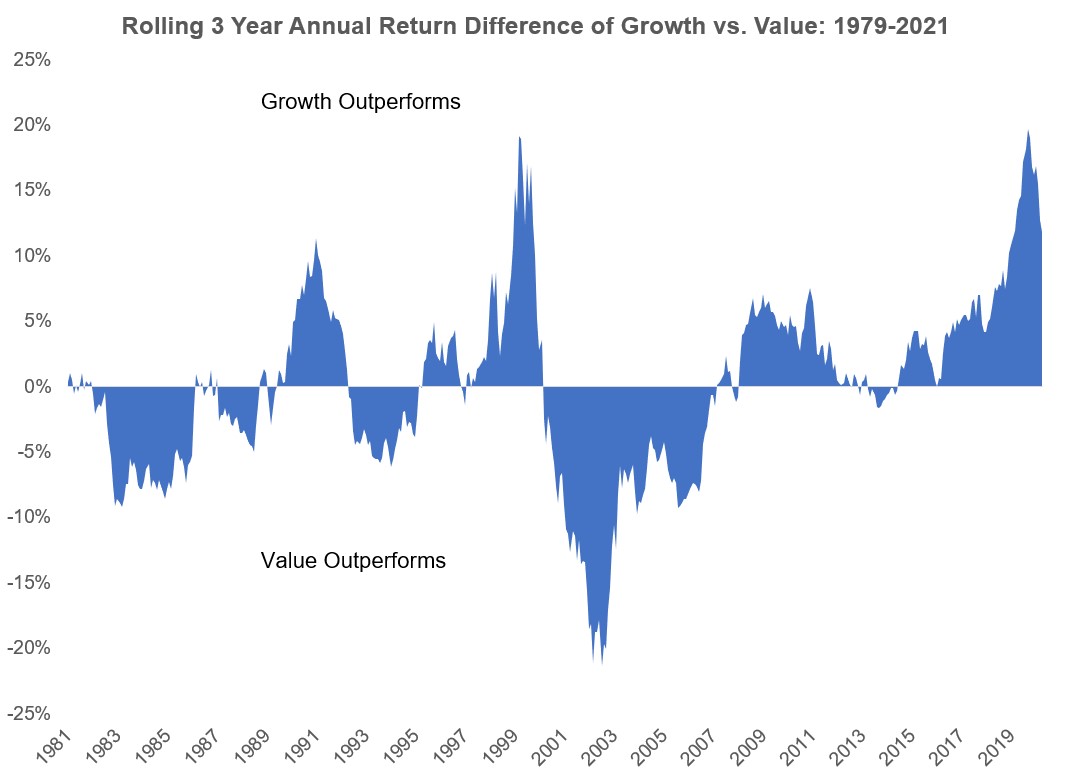

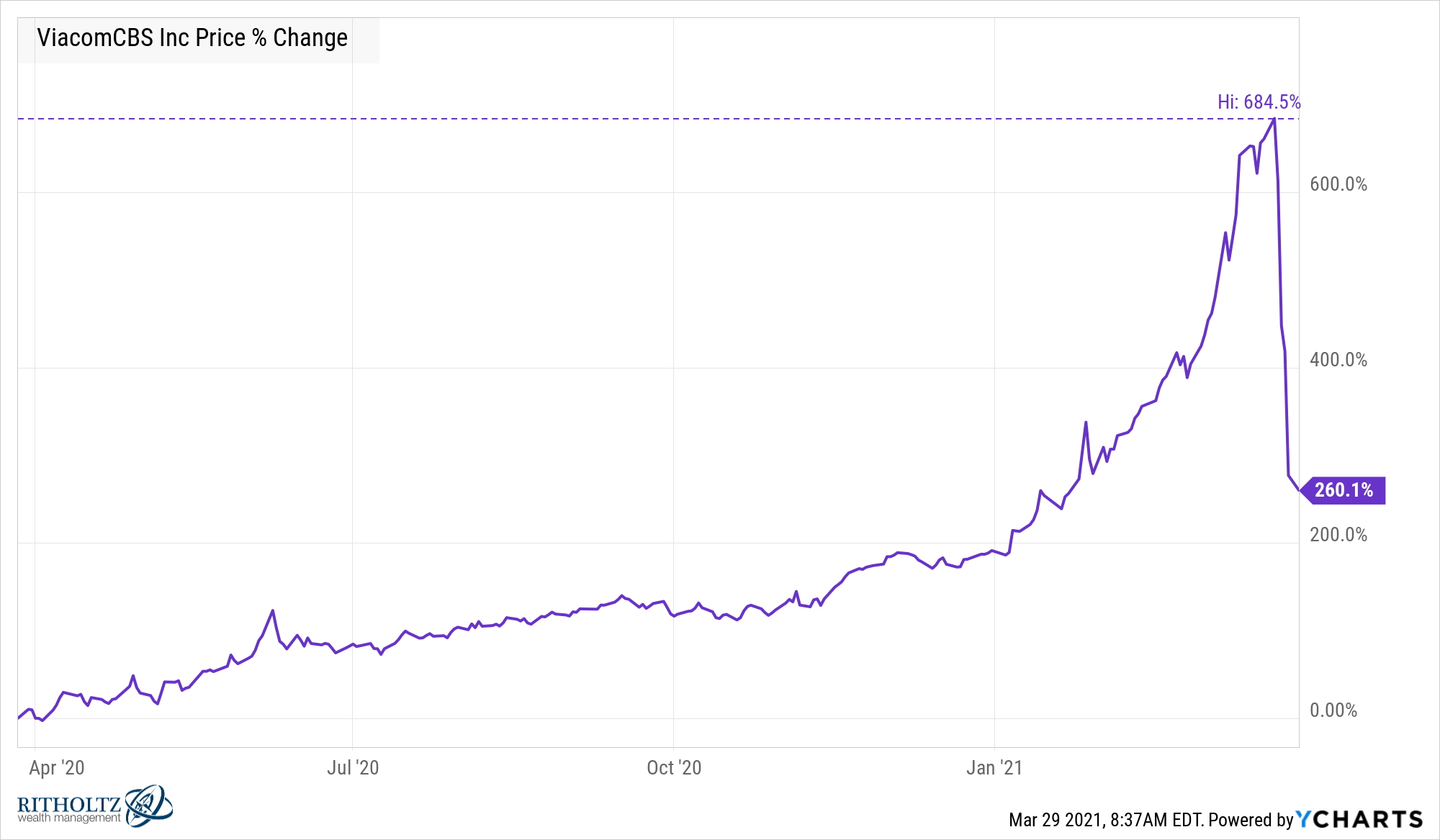

Anish Acharya and Matthieu Hafemeister from Andreessen Horowitz wrote an excellent piece this week about the rise of active investing among young people and why this trend is here to stay: A new generation of Gen Z investors are willing to take risks to counter a deck that may be stacked against them. Active investing is a…

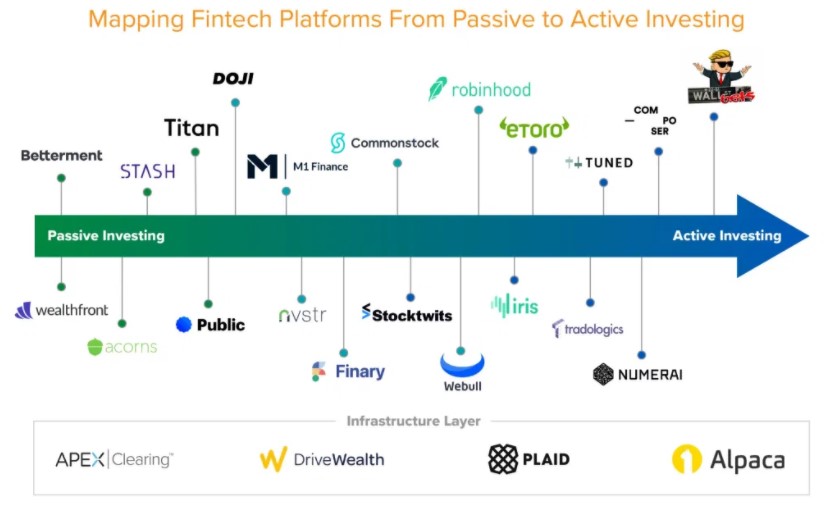

I first read The Millionaire Next Door a few years out of college. For some reason the following stats were the ones that jumped out at me the most: 63% of the millionaires surveyed for the book purchased or leased new cars but 37% bought used. 46% of these millionaires had either the current year…

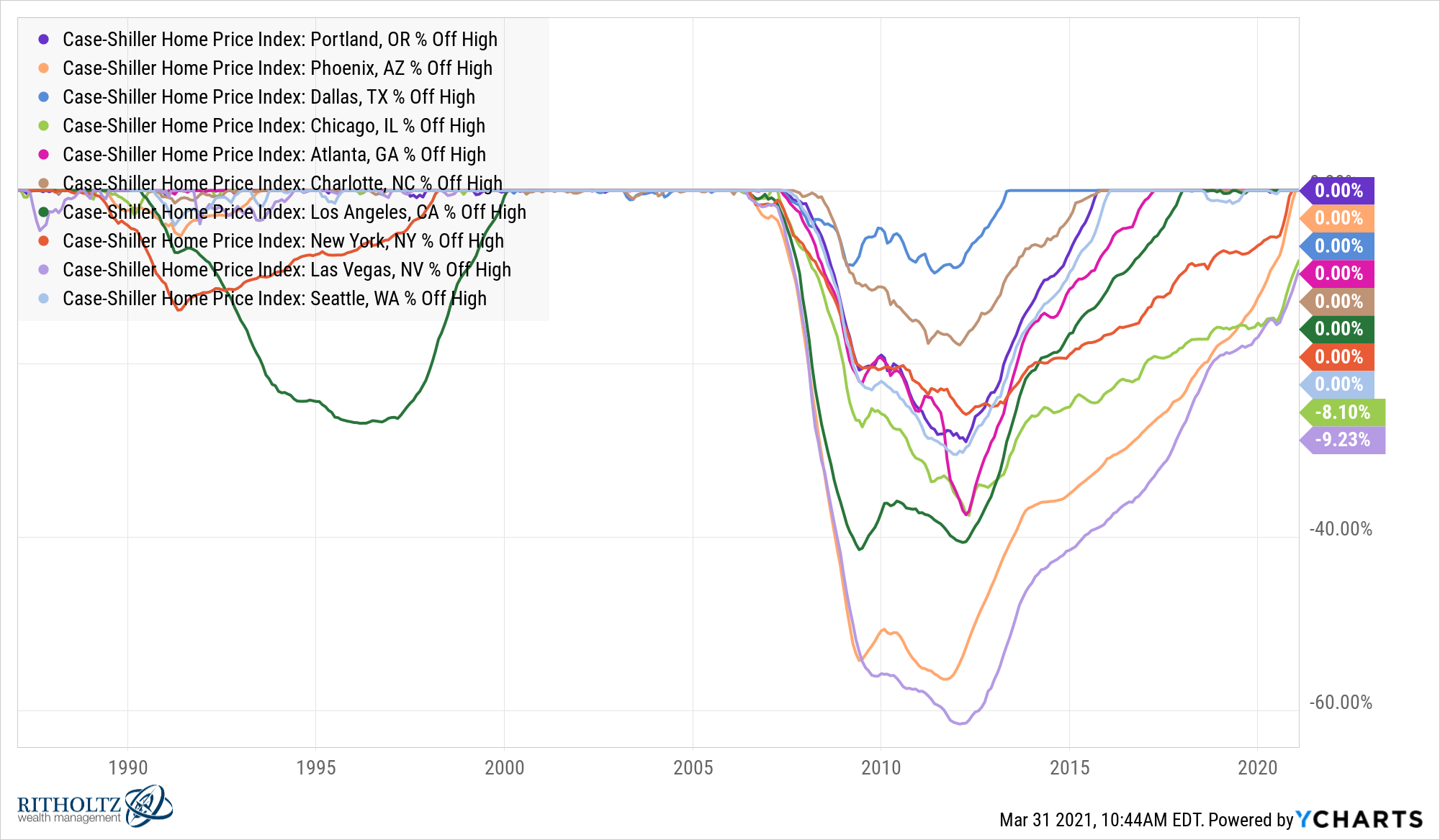

Timing the housing market is even harder than timing the stock market.

This week’s Animal Spirits with Michael & Ben is supported by YCharts: Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service. If you’re looking for a new job at a fast-growing investment research firm, YCharts is hiring. We discuss: The most bullish thing about the stock market right now The…

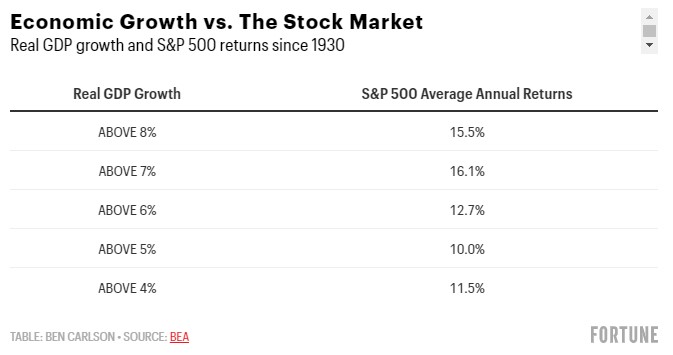

Is it riskier to be bullish or bearish in the face of an impending economic boom?

Why recessions change how investors position their portfolios.

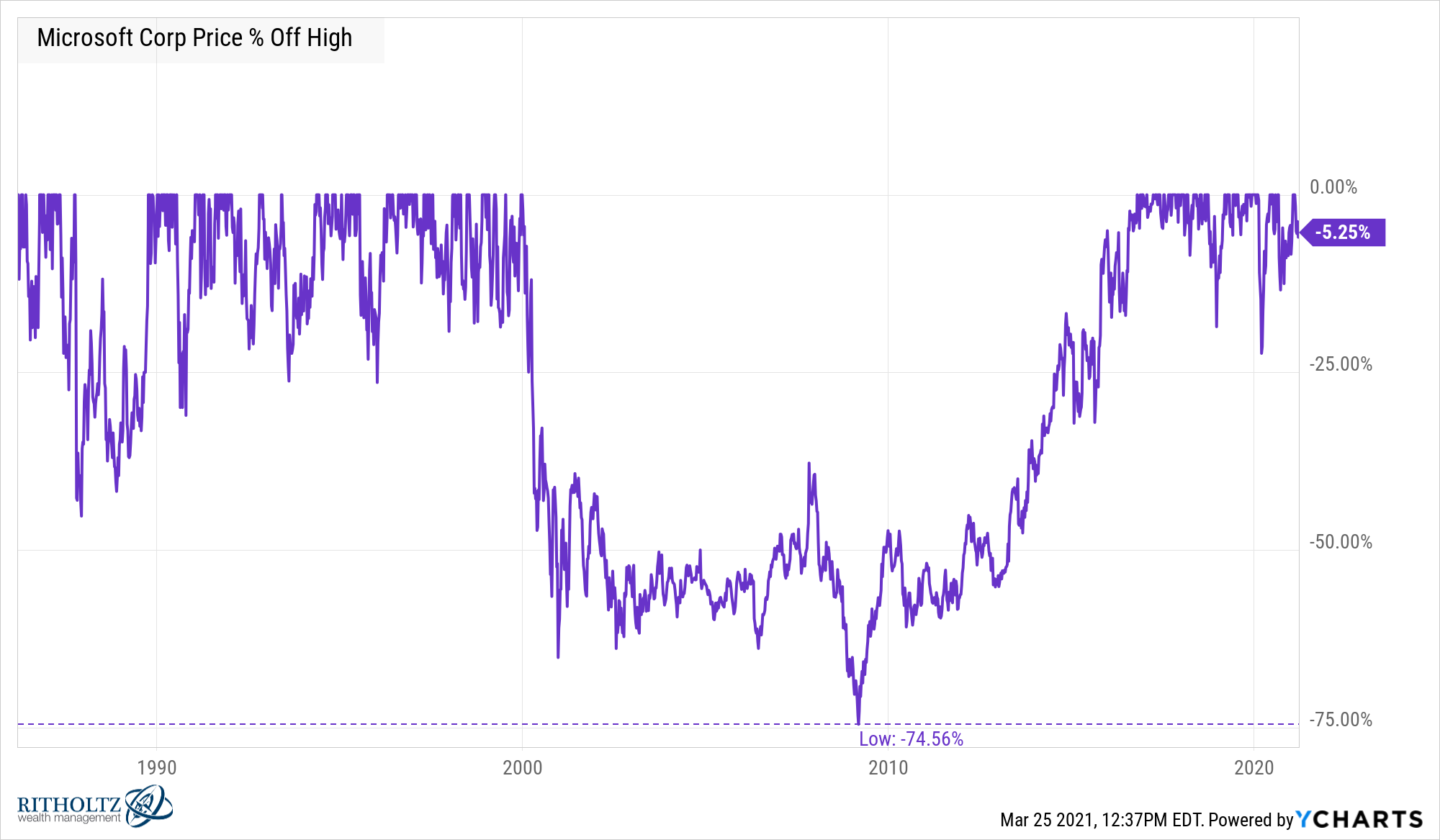

Trying to pick the next trillion-dollar companies is harder than it looks.

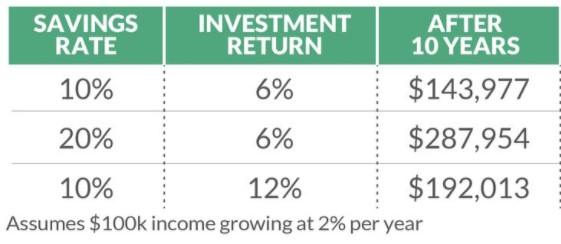

Making up for lost time with your retirement savings.

Today’s Talk Your Book is presented by SoFi: We spoke with David Dziekanski, Portfolio Manager for the SoFi Gig Economy ETF. We discuss: What is the gig economy? The 4 biggest themes in the gig economy What is the gig economy like outside of the United States? The Amazon of Africa The crazy growth of…