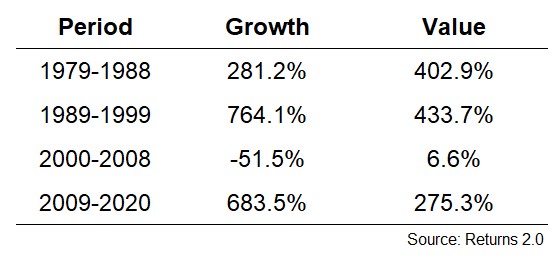

Since the advent of each index in 1979, the Russell 1000 Growth and Value Indexes have nearly identical annual returns through March 2021 — 12.1% for growth and 12.0% for value.1

But the path to get to those returns was completely different for each:

Both value and growth have taken turns outperforming and underperforming depending on the cycle.

In the first quarter of this year, the Russell 1000 value was up 11.3% while the Russell 1000 Growth was up 0.9%.

Value could be setting up for a baton hand-off but it’s way too early to tell. And to be fair, the cycles in the table above are long-term in nature. There can and will be a lot of give and take in the meantime even if we are setting up for a regime change.

And why couldn’t growth and value work going forward?

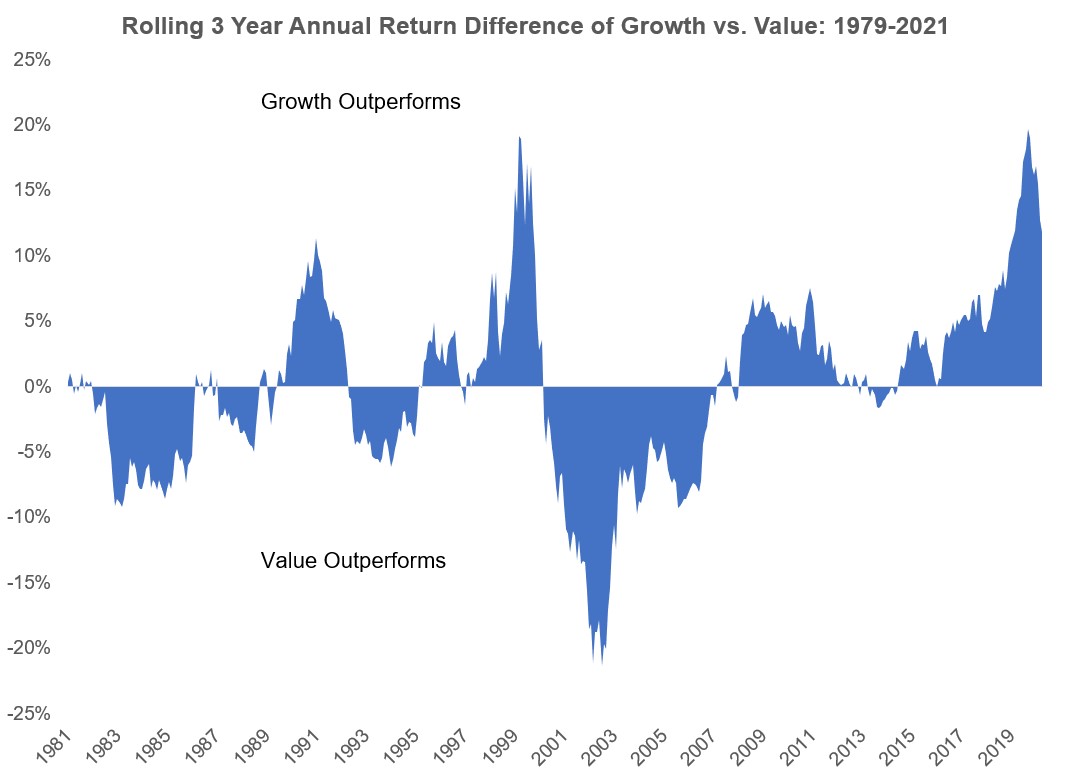

To see how often this has been the case over shorter cycles I looked at the rolling 3 year annual returns for the Russell 1000 Growth and Russell 1000 Value. I then calculated the outperformance of those annual returns which gives us this chart:

For example, as of August 2020 the outperformance of annual returns for growth over value was 19.7% (24.2% to 4.5%). Even after the comeback in value in recent months, the Russell 1000 Growth has outperformed the Russell 1000 Value by nearly 12% per year over the past 3 years. To make up for lost ground value would have to outperform by a total of 36% just to even things out from the last 3 years.

You can see most of the time either growth is outperforming by a wide margin or value is outperforming by a wide margin.

In fact, the 3 year outperformance of annual returns is 1% or less just 16% of the time. And 26% of the time the 3 year outperformance is 2% or less. So the majority of the time one of these strategies is winning and it’s doing so by a fairly wide margin.

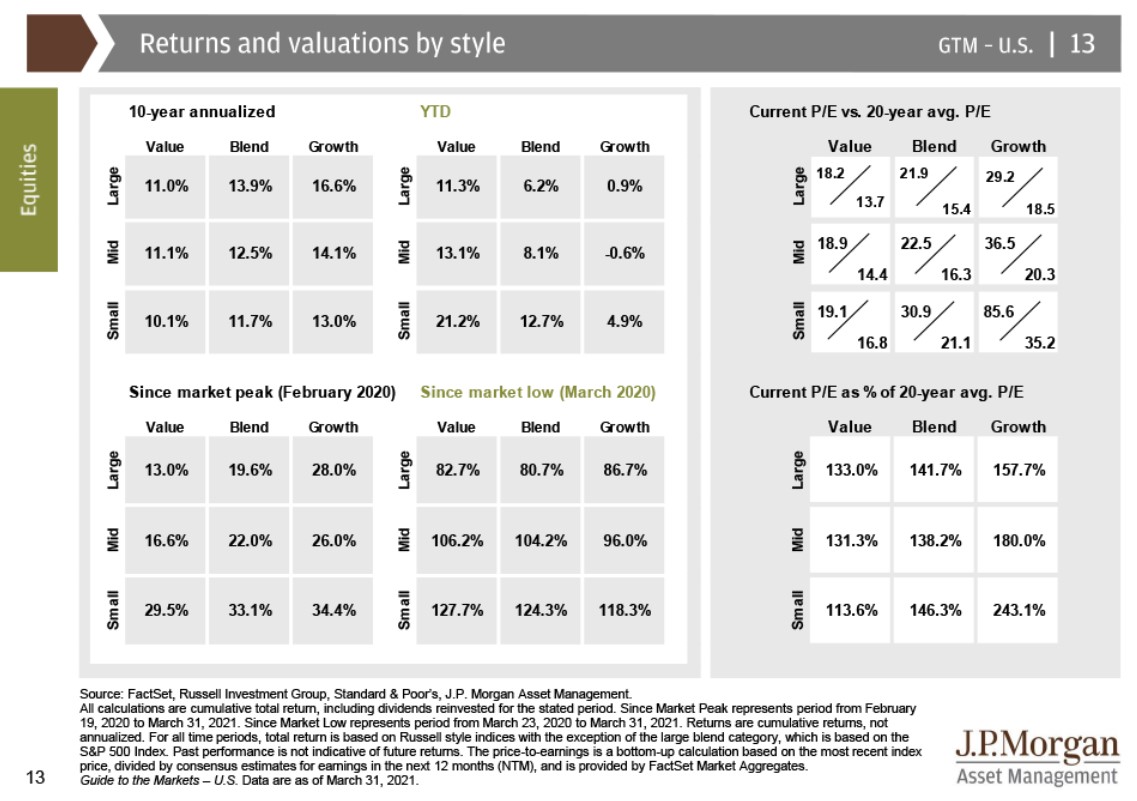

The latest JP Morgan Guide to the Markets has a nice longer-term breakdown of performance and valuations by style:

With various segments of the market up anywhere from 83% to 128% from the March 2020 lows, it’s not surprising valuations are elevated across the style-box versus 20 year averages.

So if you’re making a call on value over growth at the moment, that’s more of a relative value story as opposed to an absolute value play. Stocks aren’t cheap but it’s possible we now live in a world where stocks don’t get all that cheap for very long anymore.

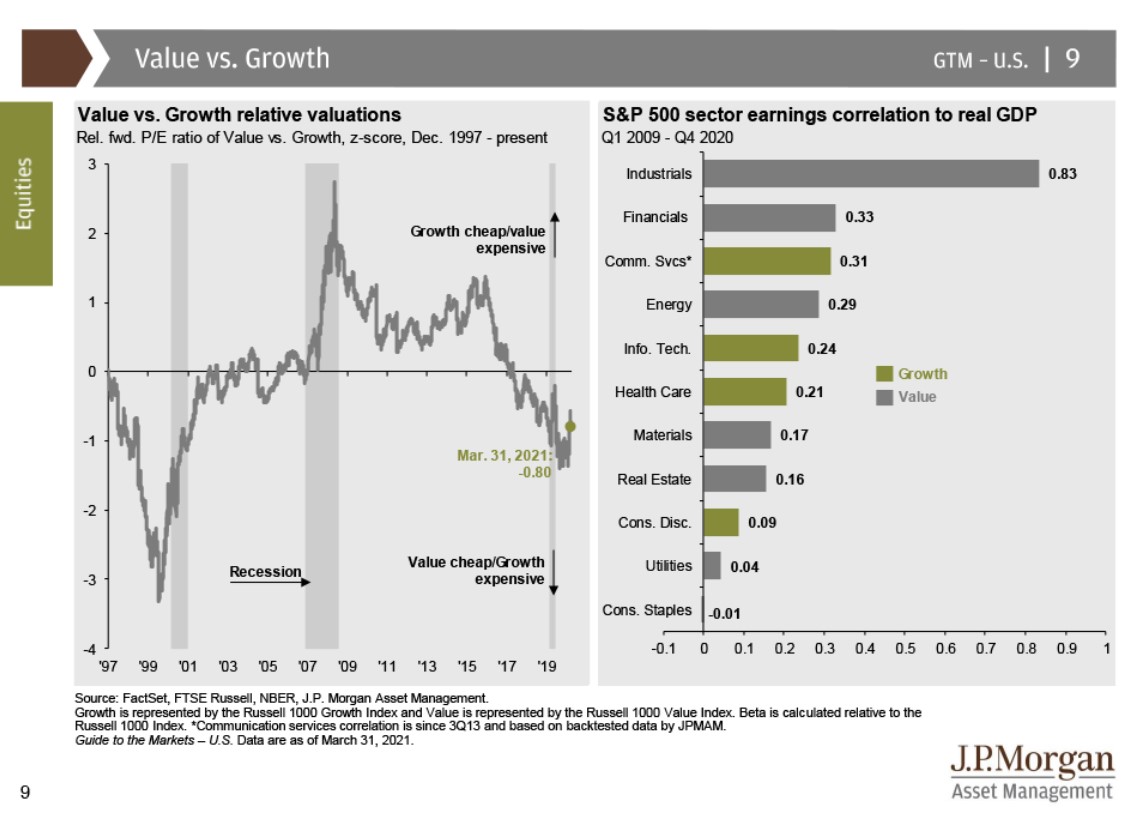

JP Morgan also shared a chart comparing the relative valuations between growth and value:

The chart on the left is a good reminder of why we get the long-term cycles I started this post with. Value was insanely cheap relative to growth in the late-1990s/early-2000s. Then growth got cheap in the lead-up to the Great Financial Crisis. Now value is cheap relative to growth yet again.

Howard Marks once wrote, “In the world of investing nothing is as dependable as cycles.”

The problem with cycles is most people assume they will remain in their current direction forever.

The other problem is they are very difficult to predict in terms of their length and magnitude.

Investors really have three choices when it comes to choosing between growth and value stocks:

(1) Pick one style and stick with it come hell or high water.

(2) Trying to pick which style will outperform at any given time.

(3) Own some growth stocks and some value stocks.

Luck plays a huge role in determining the success of option 1 depending on how long these cycles last. Option 2 sounds terrific until you realize how hard market timing is. And option 3 means always holding the outperforming groups of stocks but also holding the underperforming group.

Successful investing requires a little bit of luck, discipline and skill but survival is also key. The perfect strategy over the long run is worthless if you can’t stick with it over the short run.

Further Reading:

How Recessions Change the Winners in the Stock Market

1Just for fun I looked at a 50/50 portfolio of the two indexes, rebalanced annually. The return was 12.2% per year, better than the performance of either index individually. Not a great rebalancing bonus but not bad.