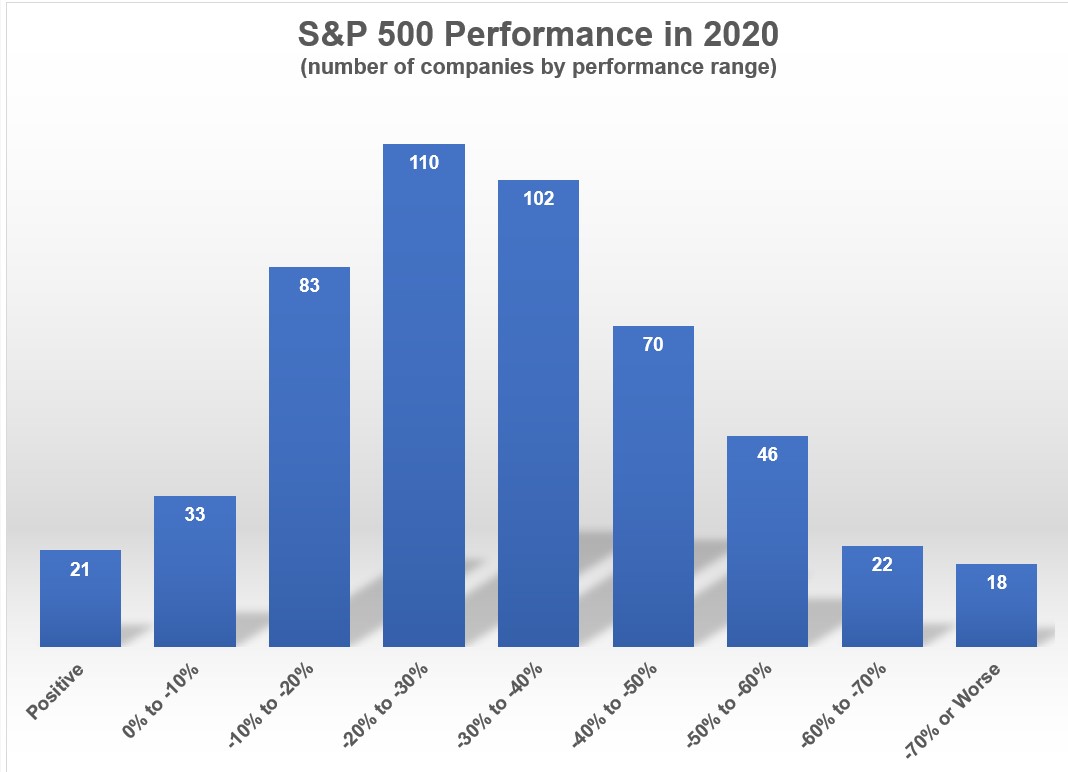

Some random thoughts as we get a couple of days off from paying attention to the markets: Will the winner-takes-all only get worse from here? One of the big worries before the current crisis hit, which seems rather trivial at the moment, is the growing concentration at the top of the stock market in just…