Three random thoughts on personal finance, stock-picking and financial mistakes:

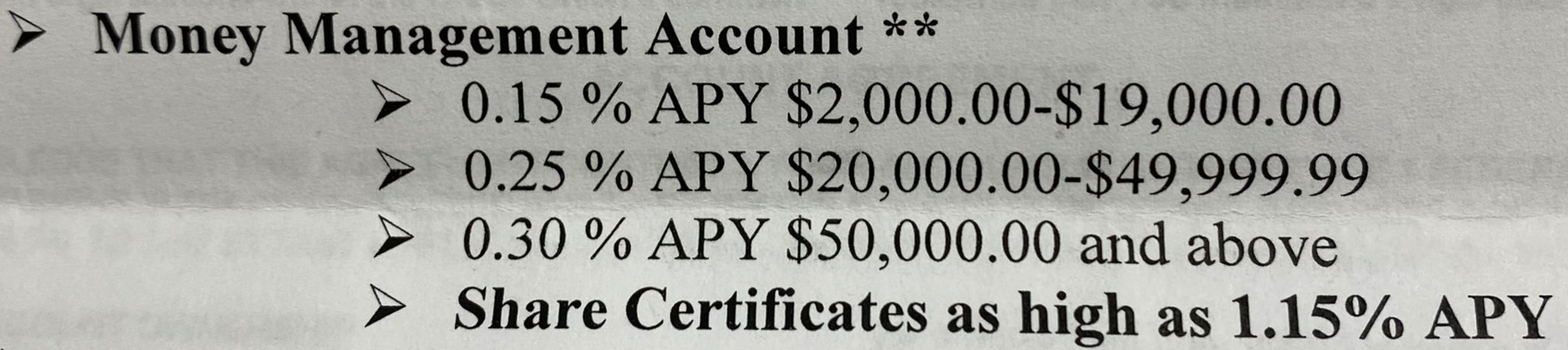

Banks are the worst. Got this in the mail this week:

In a word — ridiculous.

Inflation is over 9%. The Fed Funds Rate is now 2.5% and going higher. You can earn 3% on a 6 month T-bill these days.

Yet banks are still paying pennies on the dollar to hold your money.

Even my online savings account at Marcus is still only 1.5%.

What are they waiting for?!

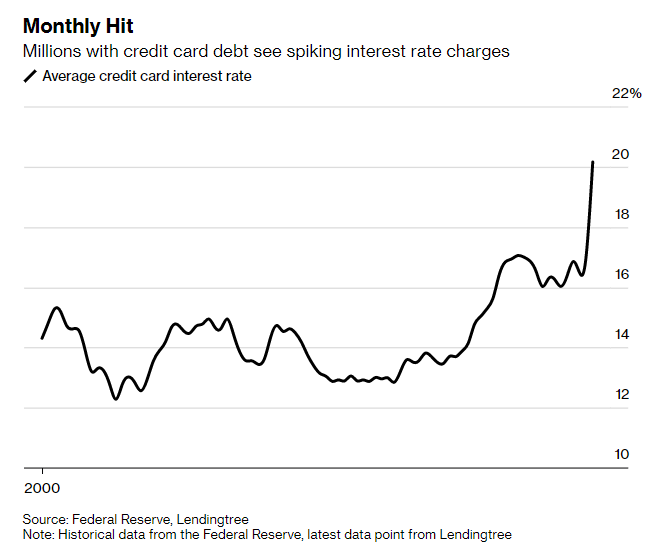

Credit card rates got jacked up real quick.

Savings account yields not so much.

It’s like they’re not even trying anymore.

Buy what you know. One Up on Wall Street is one of the first investment books I ever read. Lynch’s concept of ‘buy what you know’ still resonates to this day because it’s simple and intuitive.

The idea that Lynch could invest in Hanes simply because his wife tipped him off to the popularity of L’eggs pantyhose or some store in the mall made it seem easy.

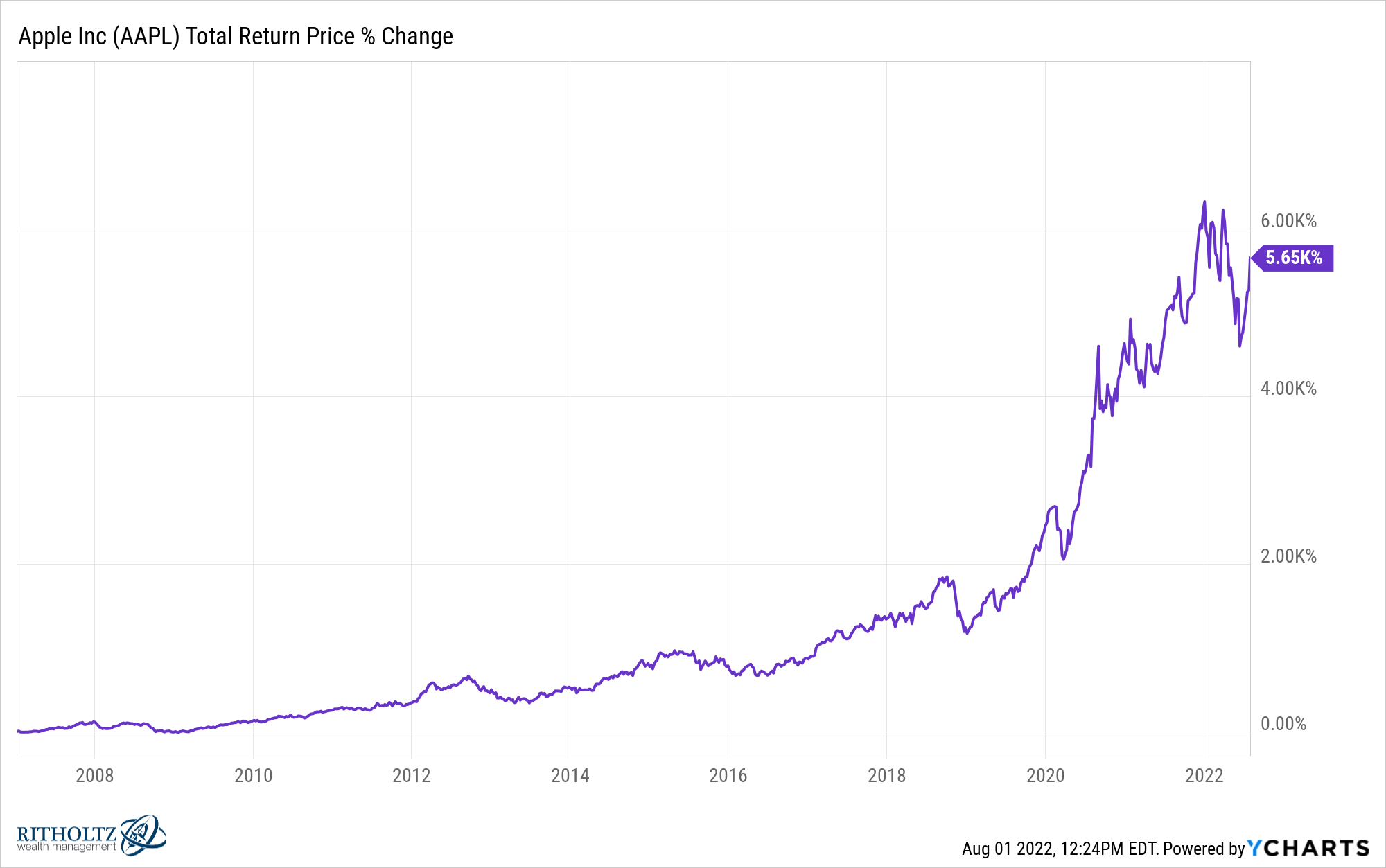

Just think if you would have purchased Apple on the day the original iPhone was released:

This strategy sounds easy when you look at the winners.

But what if we looked at some more recent examples?

I was looking through some charts of many of the newer brands I’ve been introduced to over the past couple of years and how terribly their stock performance has been.

I ride my Peloton a few times a week. It’s convenient and a nice change of pace from the rest of my workout routine. The stock is down 93% from its highs.

I watch a lot of TV and movies. We now have two TVs that came with built-in Roku systems (and one Roku soundbar). I love the user interface. We use it on a regular basis to search for new TV shows and old movies. It’s easily the simplest remote control I’ve ever used. The stock is down 83% from its highs.

RedFin provides fantastic research on the housing market. Michael and I have been mentioning their research on our podcast for years now. The stock is down 90% from its highs.

I enjoy buying clothes but hate going to the store. Just to shake things up a little I started using Stitch Fix a year and a half ago. Every other month they send me a box of clothes where I provide some feedback and a stylist picks out my attire. It’s like Christmas every time I open up a box. The stock is down 94% from its highs.1

Buying what I know recently would have been a painful strategy.

I’m not trying to pick on Lynch here. He also said, “Spend at least as much time researching a stock as you would choosing a refrigerator.”

Buy what you know was meant as a starting point, not an automatic trigger to make a purchase.

But this strategy is a lot harder than it sounds.

Everyone makes mistakes. Jonathan Clements has been one of my favorite personal finance writers since his early days at the Wall Street Journal.

His writing combines a healthy skepticism of Wall Street with a heavy dose of common sense by making complex topics easier to digest. My biggest problem with many financial gurus these days is they make it seem like they have it all figured out.

I appreciate people who are willing to talk about their mistakes just as much as their successes.

Clements published a retrospective this past weekend at the Humble Dollar on the ups and downs of his financial life over the decades.

He shares financial wins and losses on everything from saving to divorce to real estate transactions to investing to career choices and regrets about not enjoying his money more when he was younger.

The whole thing is worth reading but the biggest lesson that jumped out to me from Jonathan’s story is that we all make mistakes with our finances — even personal finance experts. And that’s OK!

No one has this stuff all figured out.

Sometimes you have to make decisions in real-time with imperfect information. Sometimes your emotions get the best of you. Sometimes it’s just bad luck that does in your finances.

Every financial plan should build in the potential for the occasional mistake.

The important thing is you learn from those mistakes and try to minimize them in the future.

It’s also nice to know that you can make a misstep when it comes to your career, your relationships or your spending habits and still be successful as long as you’re a lifelong saver.

Michael and I touched on these topics and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Anticipated Joy vs. Anticipated Regret

1I briefly owned this stock in 2020/2021 but sold it when the CEO and founder stepped down (she was the reason I bought it in the first place). I basically broke even which feels like a win considering the carnage in the stock.