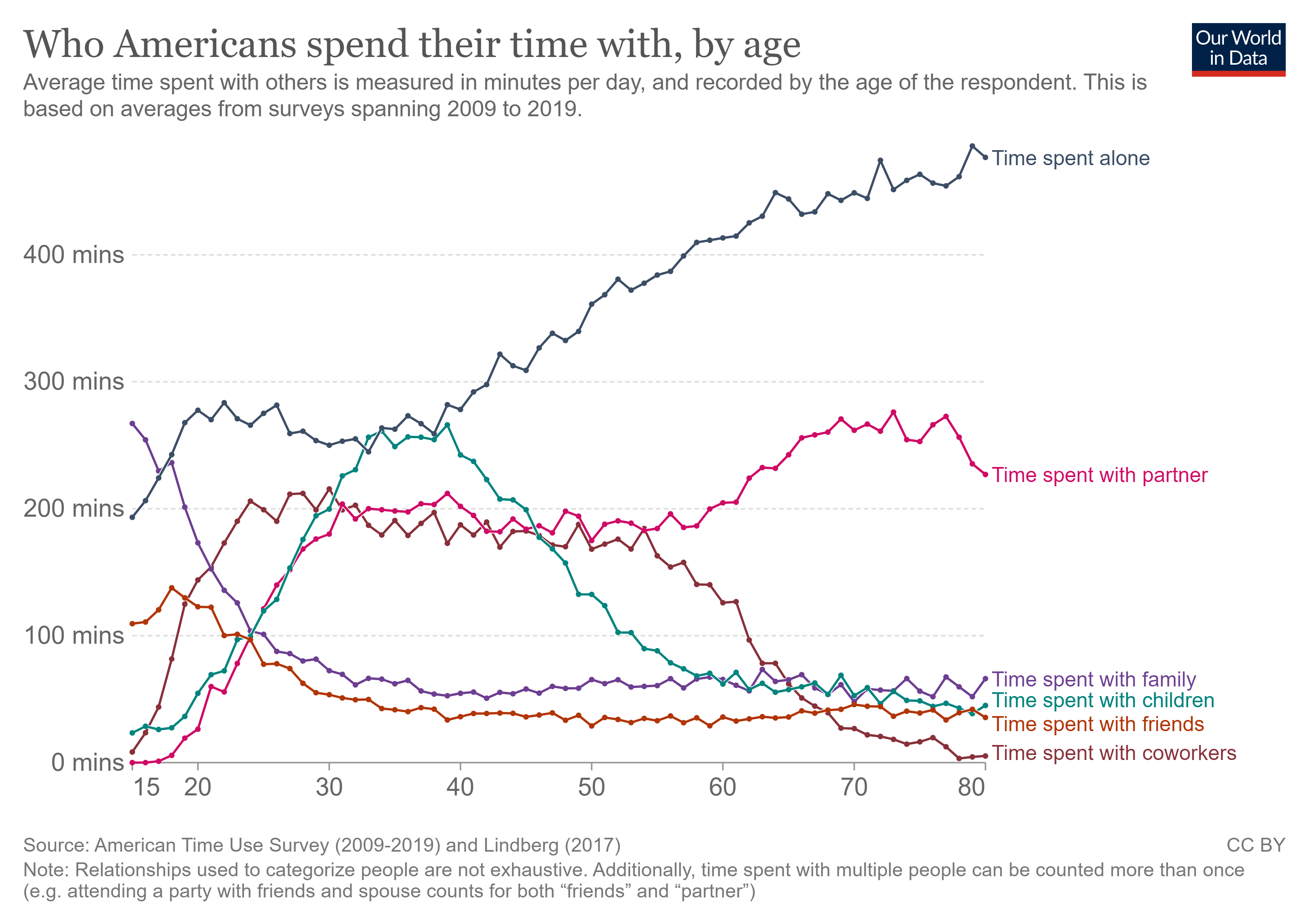

Derek Thompson posted this incredible chart from Our World in Data on who Americans spend their time with, by age:

These are average numbers but based on this chart the time spent with:

- Your family peaks at around 15 years old.

- Your friends peaks at around 18 years old.

- Your co-workers peaks at around 30 years old.

- Your kids peaks at around 40 years old.

- Your spouse peaks at around 70 years old.

- Yourself increases until you die.

Maybe I’m becoming sentimental with age but just looking at this chart brings about all sorts of feelings.

The kids one really got me.

I never really put much thought into time management when I was young.

Now I’m much more deliberate with how I spend my time, mostly out of necessity. Responsibilities tend to increase with age so juggling work, family, friends, health and hobbies is no easy feat.

No one has it all figured out when it comes to balancing out your time allocation but here are some thoughts from my experience:

I’ve learned to love routine when it comes to time management. I have an exercise routine. I have a diet routine. I have a writing routine. I try to go to sleep at the same time every night.

This may sound boring but I find the discipline and structure of routine to be refreshing.

There’s still room for chaos and spontaneity on occasion especially when you have kids but it’s nice to have a regimen to fall back on for some stability in an unstable world.

Downtime in middle age is harder to come by. When kids come along one of the biggest things that goes to the wayside is downtime.

There are no more lazy Saturdays. TV mostly waits until the kids are in bed. I don’t read as much as I used to. Watching an entire basketball or football game is basically off the table.1

I don’t mind this as much as I would have thought.

The weekend soccer games and family bike rides and practices keep you busy but I don’t mind having a full calendar.

When you have kids you can worry more about them, which is a relief in many ways. The beauty of being busy is it leaves little time to care so much about yourself.

Spending money on time is a good investment. One of the unsung reasons a lot of people choose to work with a financial advisor is because they value their time.

Managing a comprehensive financial plan that involves portfolio management, estate planning, insurance, taxes, budgeting and all of the decisions that come about when life intervenes can be time-consuming.

Some people don’t mind doing all of that on their own but others would rather spend their time doing stuff they actually care about.

Time is the most valuable asset.

Each year I find it more beneficial to outsource to experts whether that’s help with my own financial decisions or upkeep of my house or pretty much anything that would require handiwork since I am useless in that department.

Paying up for quality and the ability to save time is an investment that pays the best dividends.

Spending time with people is more important than spending money. I’ve always been big on buying experiences but the pandemic has cemented the benefits of investing in memories even more.

Sometimes you have to spend money to create memories like going on vacation but it doesn’t have to cost a lot to create quality time.

A lot of my favorite memories come during junk time. Playing cards. Going to the park or beach. Going on bike rides. Playing kickball in the front yard.

Money is not a prerequisite for a good time.

Trading too much time for money probably won’t pay off. It’s probably been 9 or 10 years since I read 30 Lessons For Living: Tried and True Advice from the Wisest Americans by Karl Pillemer.

For the book, he interviewed thousands of people 65 and up to glean some life lessons. This list of things not mentioned is the one I come back to on occasion:

No one – not a single person out of a thousand – said that to be happy you should try to work as hard as you can to make money to buy the things you want.

No one – not a single person – said it’s important to be at least as wealthy as the people around you, and if you have more than they do it’s real success.

No one – not a single person – said you should choose your work based on your desired future earning power.

It’s almost impossible to get these thoughts out of your mind when you’re young. I still have these inane worries at times.

The perfect amount of balance in life is probably unattainable but too much time spent chasing money typically isn’t a good investment.

Scarcity can add meaning and clarity. When I was young I went out all the time. I drank too much. I never watched what I ate. And when you’re young you can get away with that.

But too much of a good thing can dampen your enjoyment of it.

I’ve been practicing intermittent fasting during the week for a couple of years now. I try to limit carbs, sugar and alcohol to the weekends or on vacation.2

Scarcity is an ally of appreciation.

Maybe knowing the time you have to spend with loved ones is fleeting can help you appreciate it even more while you have it.

Further Reading:

Being in Control of Your Own Time

1DVR helps with this. I’m always amazed at how much dead time there is once you fast forward through commercials and halftime shows.

2I’m not always successful and it took me a number of years to get to the point where I can get close on a regular basis. I did it in baby steps. It took a while for my body to get used to it but once I got over the hump I’ve never felt better. I feel healthier at 40 than I did at 30 (not to brag).