A reader asks:

Ben showed the numbers for U.S. stock positive returns over the long-term. How does the data look for global ex-U.S. performance?

Fair question.

Here is the data I showed in a recent blog post:

Since 1926, the U.S. stock market has experienced positive returns:

-

- 56% of the time on a daily basis

- 63% of the time on a monthly basis

- 75% of the time on a yearly basis

- 88% of the time on a 5 year basis

- 95% of the time on a 10 year basis

- 100% of the time on a 20 year basis

My least favorite description of the stock market is that it’s just a casino where the house always wins.

Maybe this is true if you are a day trader. But in a casino the longer you play, the higher your chances of walking away a loser since the house has the edge.

The stock market is the opposite of a casino. The longer you play, the higher your odds of success in terms of experiencing positive returns on your capital.

The ability to think and act for the long-term is your edge as an individual investor. Patience is the ultimate equalizer.

Now back to the original question — is this a U.S. phenomenon only?

We only have data on foreign stocks going back to 1970 but that’s more than 50 years of returns so that’s good enough for me.

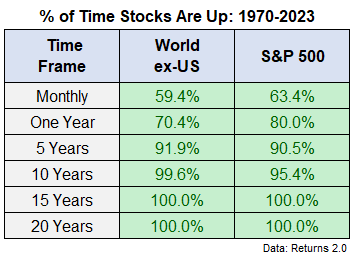

Here are the results over various time frames for positive returns going back to 1970 for the S&P 500 and MSCI World ex-U.S. Index:

Not bad.

Since 1970 the win percentages over rolling monthly and 12 month time frames have been better for the S&P 500.

But looking out 5, 10, 15 and 20 years it’s basically the same. And international stocks actually have a higher win percentage than US stocks over 5 and 10 year periods.

I think these numbers might surprise some people because the United States has outperformed international stocks by a hefty margin over the past 15 years or so.

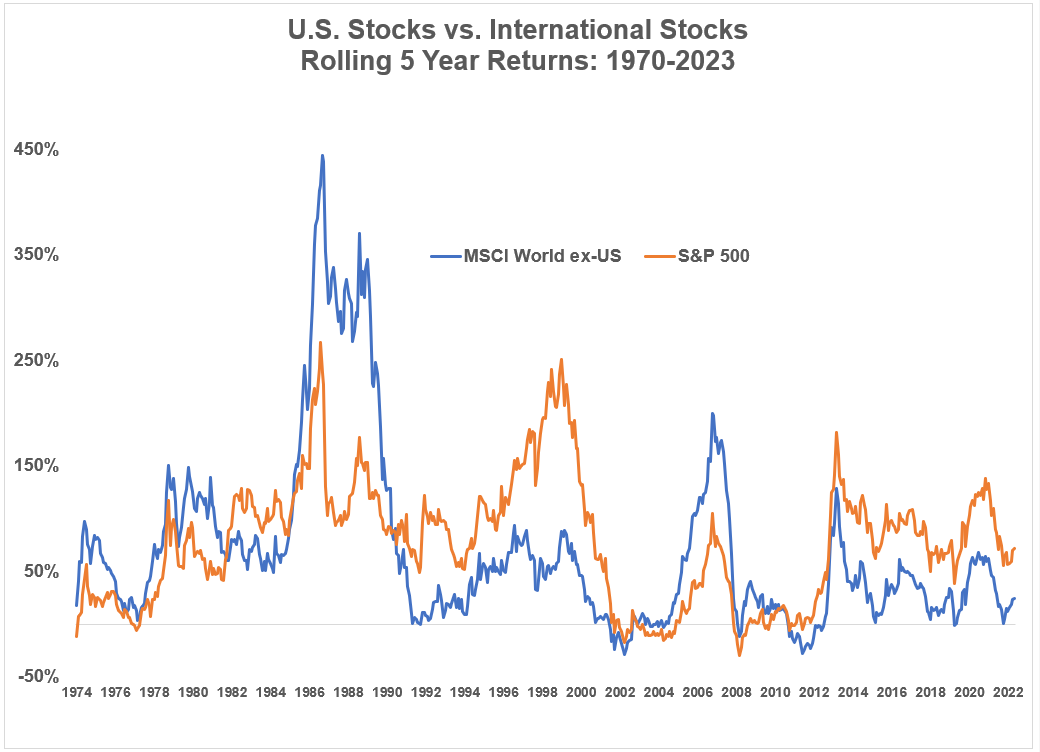

Here is a look at the rolling 5 year returns for both international and U.S. stocks:

These return streams are generally moving in the same direction over time but there are points in the cycles where one geography takes a clear lead and the other a back seat.

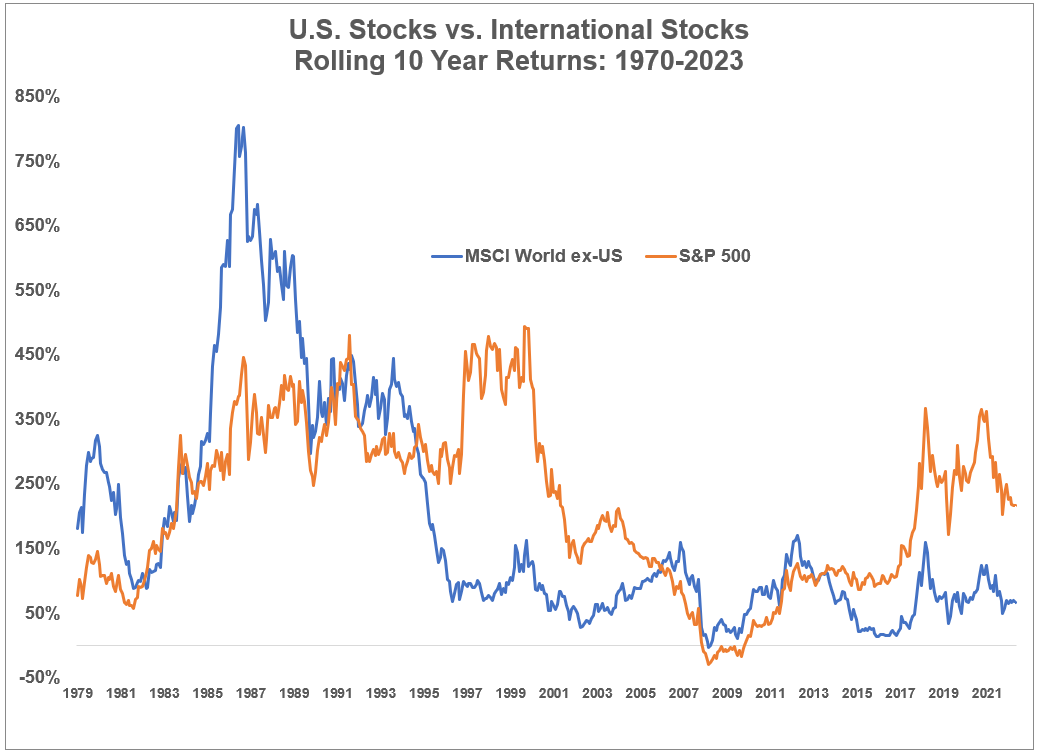

There are even larger divergences over 10 year rolling returns:

I was surprised by the fact that international stocks actually have a higher winning percentage than U.S. stocks over 10 year windows.

It is worth pointing out that the magnitude of the gains probably matters more than the winning percentage but this is surprising nonetheless.

The U.S. stock market has been the clear winner over the past 15 years and the past 100+ years. As they say, the winners write the history books so that’s why there is so much focus on the U.S. stock market.

But the risk profile for international stocks isn’t all that much different. Patience and diversification are rewarded around the globe. We don’t have a monopoly on that.

Long-term investing works just fine outside of the United States.

We discussed this question on this week’s Ask the Compound:

Ben Coulthard joined me this week to discuss the Boston real estate market, when you should get a financial advisor, where you should park your cash right now and student loans.

Further Reading:

The Case for International Diversification

Podcast version here: