Anish Acharya and Matthieu Hafemeister from Andreessen Horowitz wrote an excellent piece this week about the rise of active investing among young people and why this trend is here to stay:

A new generation of Gen Z investors are willing to take risks to counter a deck that may be stacked against them. Active investing is a natural extension of hustle culture, in which risk is embraced and failure is accepted (and even celebrated); YOLO behavior on WallStreetBets is just one example. Furthermore, Gen Z retail traders have never experienced a market contraction—the oldest of them were 10 in 2007 when the S&P began its 50 percent decline. For many, passive investing is viewed as a strategy for the already rich to *stay* rich, not for those wanting to *get* rich.

They point to the fact that so many of us are overconfident in our ability to actively manage money on our own but that has always been the case. It’s human nature to assume we’re above average.

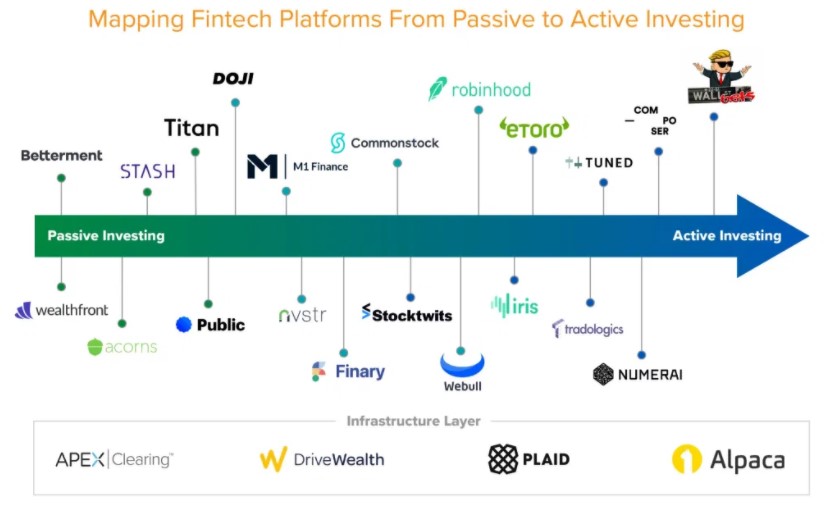

The biggest change in recent years is the sheer volume of fintech platforms and low-cost or free products that have hit the market:

The playing field has been leveled.

Individuals now have access to tools and products retail investors could have only dreamed of in the past. Add in improvements to technology, lower costs and the rise of a new class of promoters and it does feel like this isn’t simply a pandemic phenomenon.

But it’s important to remember not every Robinhood trader is the same.1

This new hoard of active investors isn’t all YOLO-ing their entire paychecks or stimulus payments.

With that in mind, I wanted to run through what I see as the 4 different types of Robinhood traders before giving my thoughts on whether this new crop of active investors is here to stay.

1. The YOLO trader. Ok so there are some people who are YOLO-ing with no idea what they are doing:

“I don’t know wtf I’m doing, I just know I’m making money.” pic.twitter.com/cWLl7teG95

— TTI (@TikTokInvestors) January 12, 2021

Jason Zweig shared a mind-blowing stat in a recent Wall Street Journal piece that helps explain why knowing what you’re doing hasn’t really mattered over the past year:

As of March 23, 95.9% of the slightly more than 3,000 stocks in the Wilshire 5000 Total Market Index had a positive total return over the prior 12 months, according to Wilshire. No other one-year period has come close to that since the end of February 2004, when 93% of stocks had positive 12-month returns.

Basically, everything you bought over the past year has gone up. Taking huge risks has paid off. In fact, not knowing what you’re doing has been an advantage in the past year.

Hopefully this group learns something from their trading escapades but I’m dubious all of the new speculators will stick it out when it’s not quite so easy.

2. The student trader. There is also a new breed of investors/traders who are using all of these new investment platforms as a learning tool.

They’re trying out different strategies. Learning about companies by investing in them. Finding their footing and paying their tuition to the market gods.

One of the most important parts of the investment process is understanding yourself and the type of strategy that suits your personality.

Indexing made sense to me at an early age. Not everyone figures out who they are as an investor right away. Sometimes you have to experiment.

3. The Reddit trader. This group generally knows what they’re doing. They have rules. They cut their losers and let their winners run. Or they build positions with a deep understanding of the potential risks involved.

If you actually read some of the r/wallstreetbets stuff before the whole GameStop phenomenon took off, you can tell they knew what they were doing. They understood the intricacies of options, hedge funds, and a short squeeze. They weren’t just closing their eyes and hoping for the best.

These were people who carried out a coordinated plan.

Are all of these traders going to earn obscene sums of money? No.

But they are so much more informed than traders of the past because there is so much more information available today if you know where to look and put in the time.

Plus the social media aspect of markets these days is something that didn’t exist in the past.

4. The dabbler. Many Robinhood customers are using the free trading platform to scratch an itch. They have a 401(k) or IRA and maybe some other investments elsewhere.

They carve out an allocation to have some fun, invest in some companies or strategies they wouldn’t elsewhere in their portfolio or use this account to speculate.

Technically I fall into this last category. The difference is I basically buy and rarely ever sell anything. I have a decent chunk of money at Robinhood but I’m still in accumulation mode and I am a buy and hold investor so I’m not trading.

Having this account makes it easier for me to leave the rest of my portfolio on autopilot.

I do believe many young people will be more active in how they invest going forward. These various types of traders and investors will likely be more prevalent in the markets than they were in the past.

And the number of assets you can invest in will only continue to grow.

Yet despite the rise in active investing for many young people, I still believe passive investments will continue to rule the asset management industry when all is said and done.

The Financial Times put together a graph last week that shows passively managed funds are set to take over actively managed funds for U.S. equity funds in short order:

Vanguard has something like $7 trillion in assets. Blackrock manages more than $8 trillion. Some of these assets are actively managed but more are index funds or ETFs.

I actually think the rise in younger active investors will hurt the active fund industry more than the passive side of the equation.

Why pay high fees to an active manager when you get more joy and status from doing it yourself?

And the one thing that happens to all young people is they eventually grow into older people.

You grow out of YOLO trading or you realize how hard it is to beat the market or you just don’t have enough time to actively manage your investments.

So most of the people in groups 1-3 will end up in group 4 and have the majority of their assets in low-cost, boring investments that are automated. And they’ll keep a small piece of their portfolio to have some fun and speculate and pick stocks.

The rise of a new class of active investors will actually be bad for the actively managed fund community.

Eventually, passive investing will win over the long-term just like it always does.

Further Reading:

10 Signs You Are Not a YOLO Trader

Some Friendly Reminders About Day Trading

1I’m using Robinhood as a catch-all term for all of the new, younger crowd of active investors. Obviously, Robinhood is not the only platform being used.