This week’s Animal Spirits with Michael & Ben is sponsored by YCharts: Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service. We discuss: Tesla’s huge drawdown Why making your stock bets public makes it harder to have an open mind How our perceptions about retirement change over time Why…

Things That Were Said During the Bear Market

We recorded an episode of Animal Spirits called The Bear Market on December 21, 2018 (it aired on December 26). The first 10 minutes or so of the podcast provides a look back into the psychology in the midst of a decent-sized downturn in the stock market.1 We talked about the damage that was inflicted…

Why We Believe in Magic

In 1848, two young sisters in a small town in New York discovered they shared a room in their tiny farmhouse with a mysterious spirit. Margaret and Kate Fox learned of this spirit’s presence through a nightly knocking sound in the walls, floors, and furniture. To summon this mysterious spirit, Kate would knock on the…

What If You Retire at a Stock Market Peak?

Meet Sam. Sam’s entire family has terrible luck when it comes to the timing of their retirement. Sam’s great-grandparents retired at the end of 1928. Over the ensuing three years or so the stock market would drop close to 90% while the U.S. economy would contract nearly 30% in the Great Depression. In 1937, the…

How Hard is it to Become a 401(k) Millionaire?

The current retirement system leaves much to be desired. There are a decent number of people taking advantage of tax-deferred savings vehicles but it’s a fairly small number that ever reaches millionaire status in these accounts. In Fidelity’s defined contribution plan, there are roughly 157,000 people who have saved at least $1 million in their 401(k). There…

Animal Spirits Episode 78: The Re-Readables

This week’s Animal Spirits with Michael & Ben is sponsored by YCharts: Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service. We discuss: Is inflation dead? Does a more mature U.S. economy mean lower interest rates and inflation for the foreseeable future? What should we call our new podcast…

The 3 Levels of Wealth

Slack is a lot like Twitter from my vantage point. It’s a service I use all the time. It’s become an integral part of my life from both a work and social perspective. Every time I talk to someone else who uses the service they share my love for the platform. And it’s almost impossible to explain its usefulness…

A Bad Year in the Bond Market is a Bad Day in the Stock Market

A podcast listener asks: I was hoping you could try and explain the bond bubble risk. A third of my portfolio is in a Vanguard bond fund. If there is a bubble, what could I stand to lose in % terms? Here’s a short video Michael and I did on this one: The idea that…

What a Strange Round Trip It’s Been

Well that was pretty quick. Since peaking in late-September the S&P 500 ETF (SPY) now has a slightly positive total return, wiping out a nearly 20% loss: It’s hard to believe how quickly sentiment in the market can go from “the world is coming to an end and a recession has already started” to “everything’s…

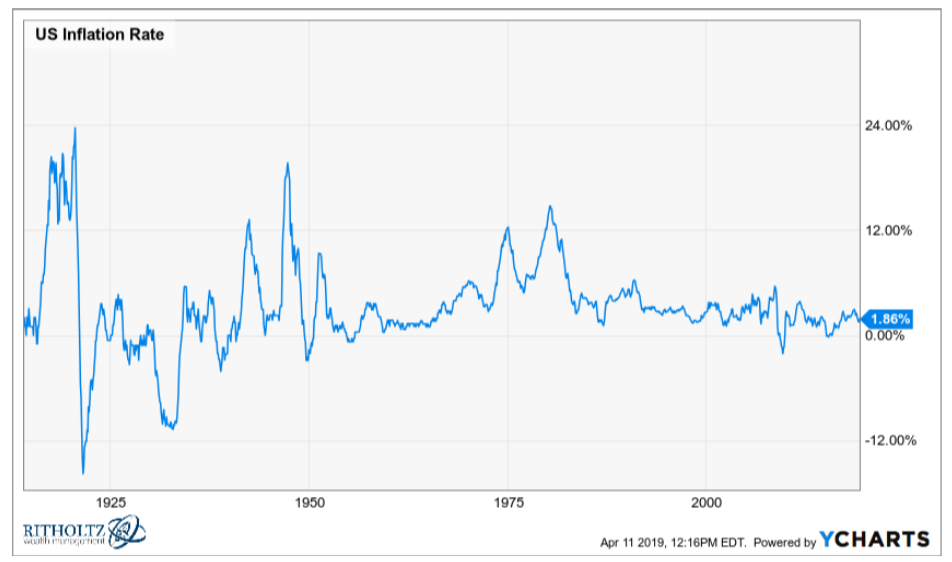

Recessions vs. Bear Markets

It may not feel like it after living through the Great Recession but the U.S. economy has become far more stable over time. Just look at the inflation rate over the past 100 plus years: And the contraction in GDP in each of the past 15 recessions: The Great Recession was an epic financial crisis…