Michael & Ben discuss everything they’ve been reading and watching lately including Michael’s theory on the next big short.

Michael & Ben discuss everything they’ve been reading and watching lately including Michael’s theory on the next big short.

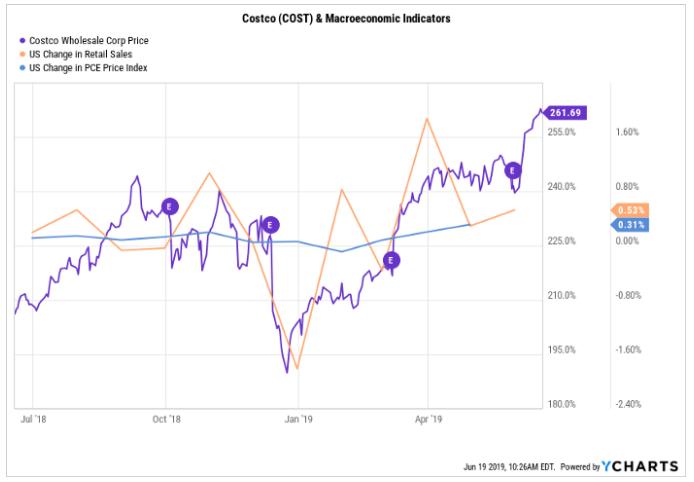

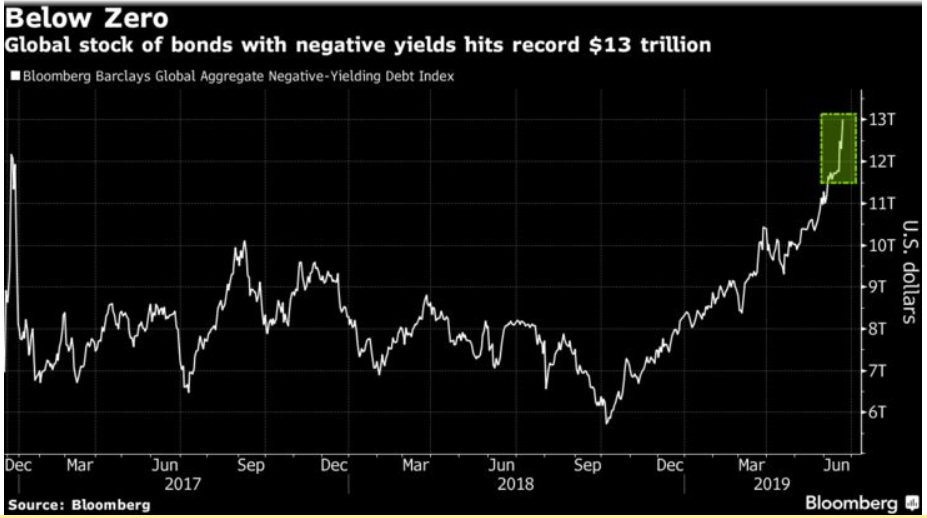

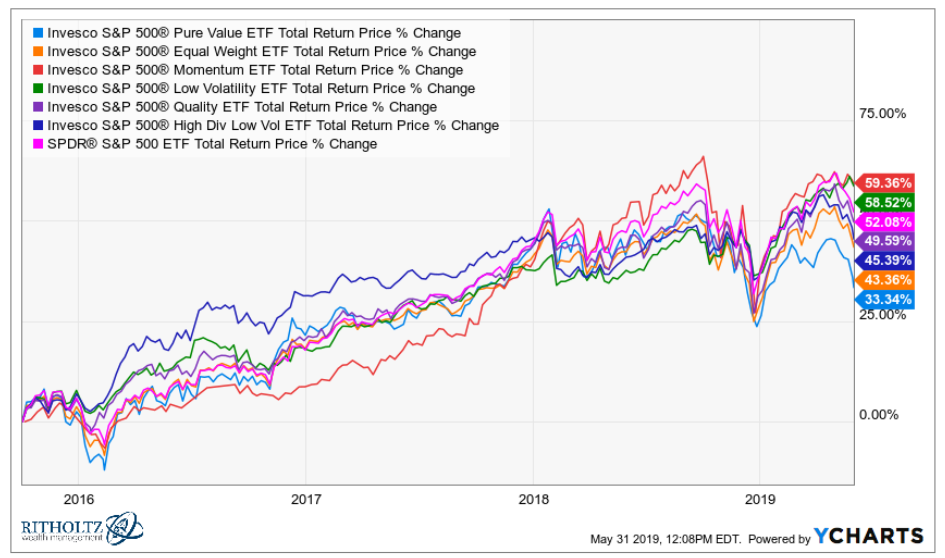

Simple ways to decrease the volatility in your portfolio without getting to complex.

Today’s Animal Spirits: Talk Your Book is presented by The Acquirer’s Fund: We discuss: Deep value investing with Tobias Carlisle Valuing businesses from the perspective of a private equity firm Where did the 130/30 fund structure originate? Have the new growth stocks changed the game for value investing? Why you shouldn’t short stocks based on…

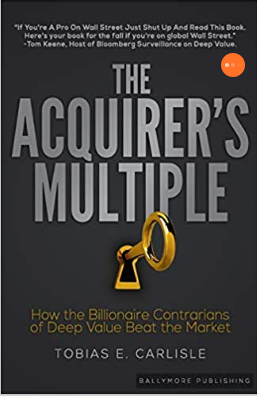

I have more questions than answers about all the negative-yielding government debt in the world.

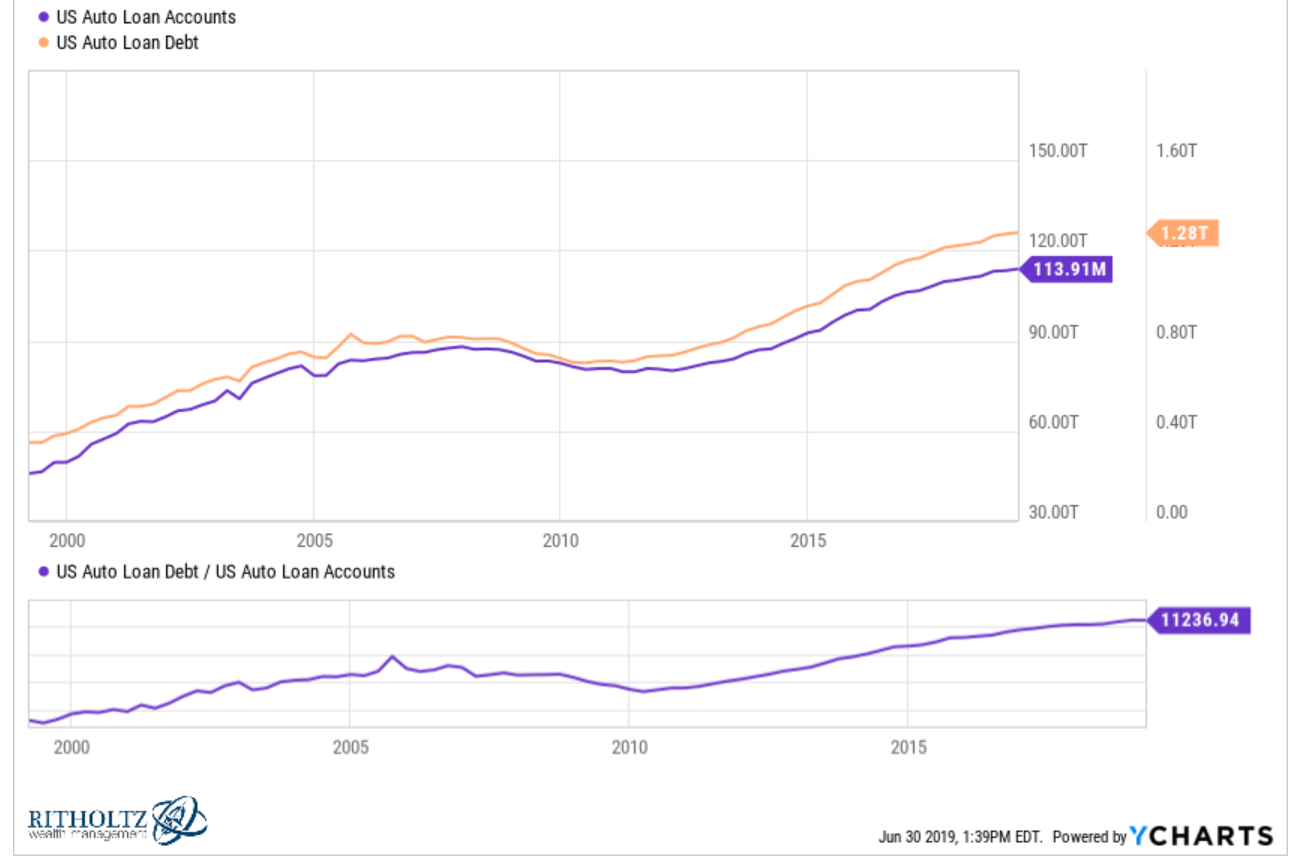

Why car loans are getting out of control.

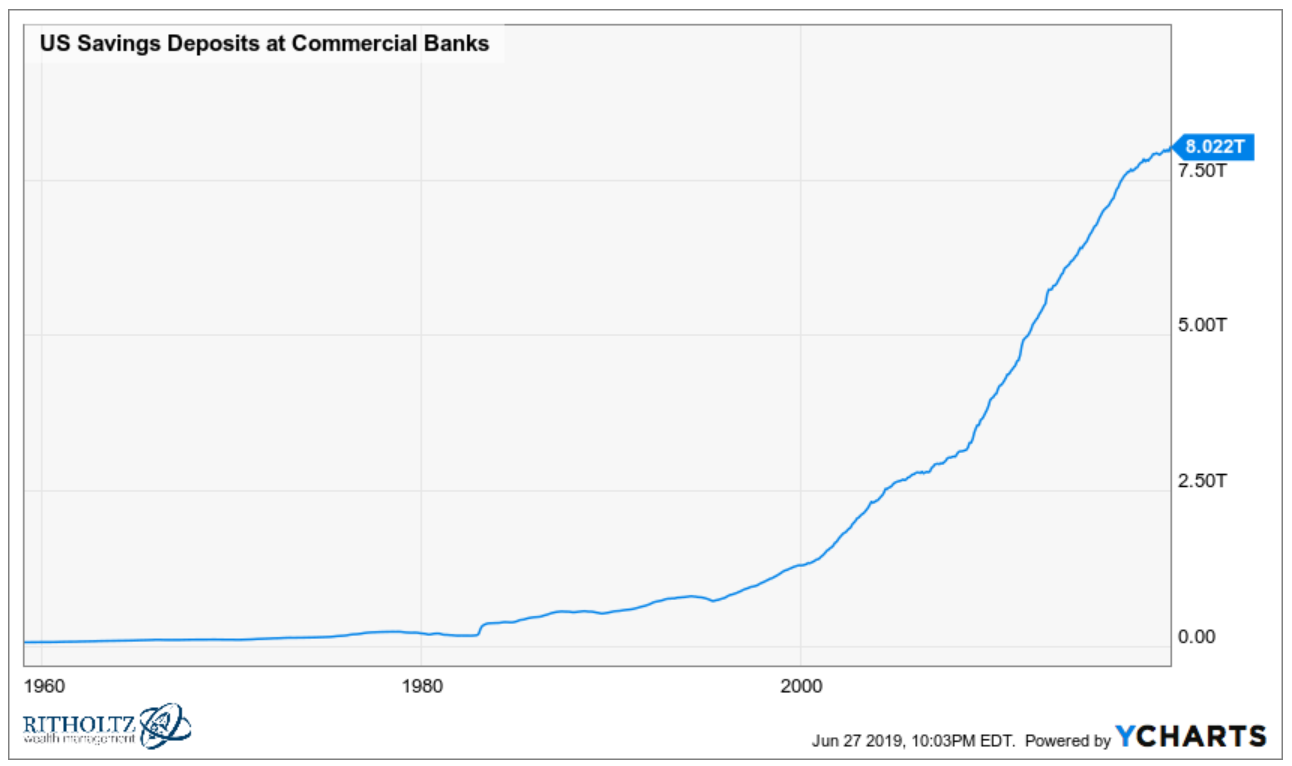

Michael and Ben discuss why movie comedies are dying, how Netflix is changing entertainment, online savings accounts and much more.

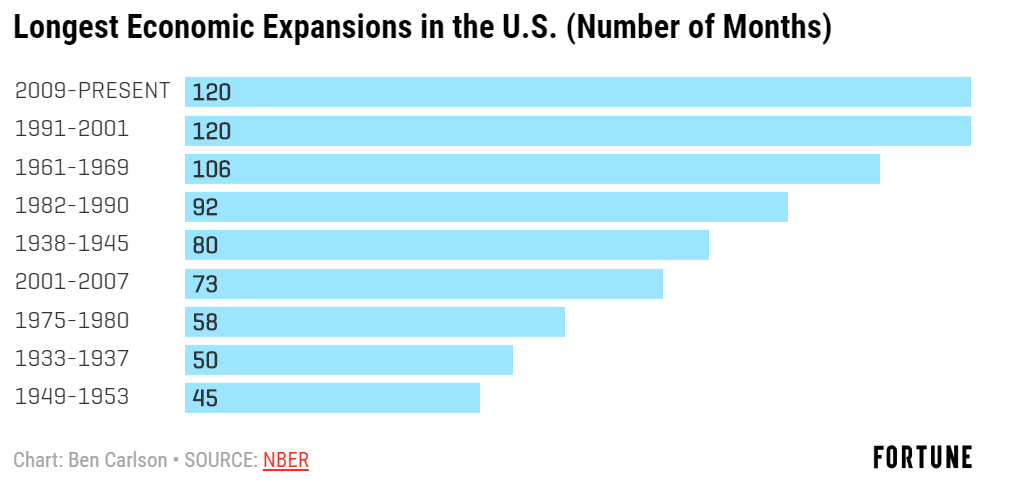

Looking at the glass as half full for the next recession.

Michael & Ben talk with Vincent De Martel about the Invesco Global Factor Investing Study.

What index funds, Seth Rogen, and golfing have to do with the benefits of being average.

Yesterday I got an email from Marcus, my online savings account. They lowered the interest rate on my savings (and everyone else’s) from 2.25% to 2.15%. I heard stories from people who use other savings accounts that also saw a drop. These online savings accounts are obviously getting ahead of the possible Fed rate cut…