Some lessons about Uber from Mike Isaac’s Super Pumped.

Some lessons about Uber from Mike Isaac’s Super Pumped.

Today’s Animal Spirits with Michael and Ben is brought to you by EquityZen. EquityZen is giving Animal Spirits listeners half off their first investment minimum by going to equityzen.com/animal – usually a $20K minimum investment – we’re giving you $10K minimum. We discuss: The coming Airbnb IPO Are there any likable tech CEOs? WeWork’s latest PR…

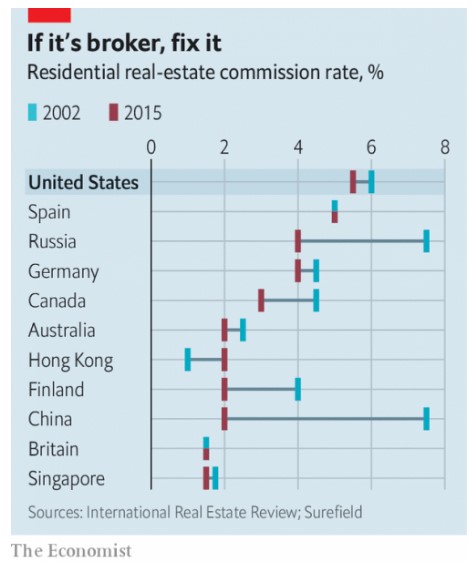

What are the frictions involved in the home selling process?

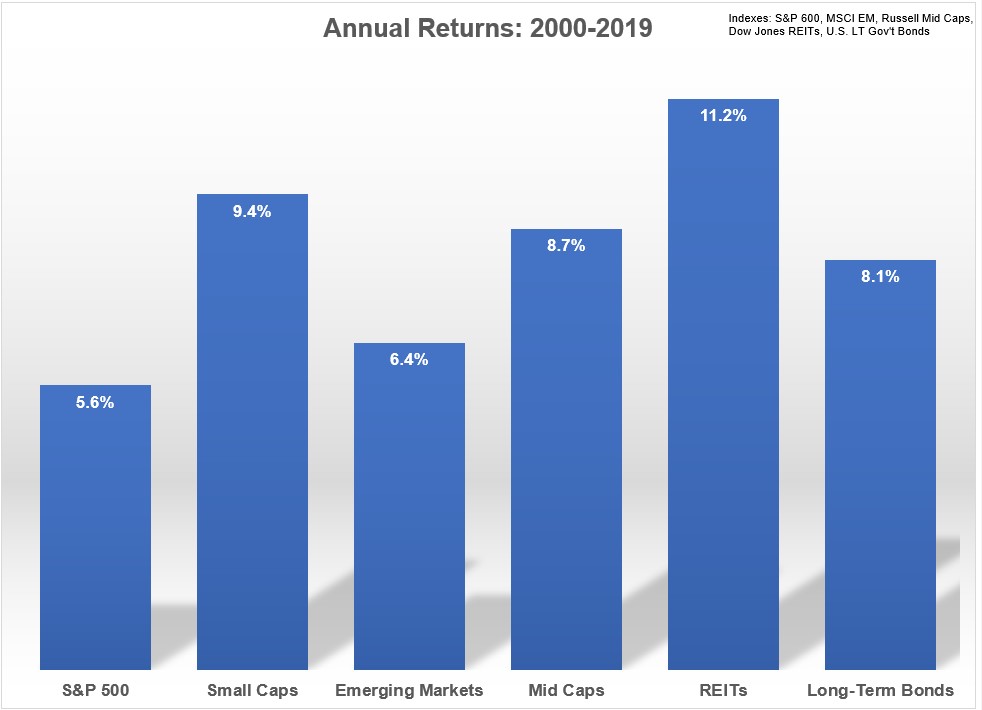

In doing some research for my stock market explainer piece from last week I came across a crazy but true stat about the stock market: The feedback on these types of stats is something of a Rorschach test for investors. I got the usual comments about Japan, buy & hold doesn’t work, maybe people should…

Narratives often drive the economy but figuring out the prevailing narrative has never been harder.

Dan Katz (Big Cat of Pardon My Take fame) and Alex Rodriguez (J Lo’s boyfriend) had Mad Money’s Jim Cramer on the latest episode of their podcast, The Corp, this week. Big Cat expressed a number of concerns about the stock market to Cramer, claiming he doesn’t play the stock market because it’s like a…

Michael and Ben discuss everything they’re reading, writing, watching, and thinking about on this week’s Animal Spirits.

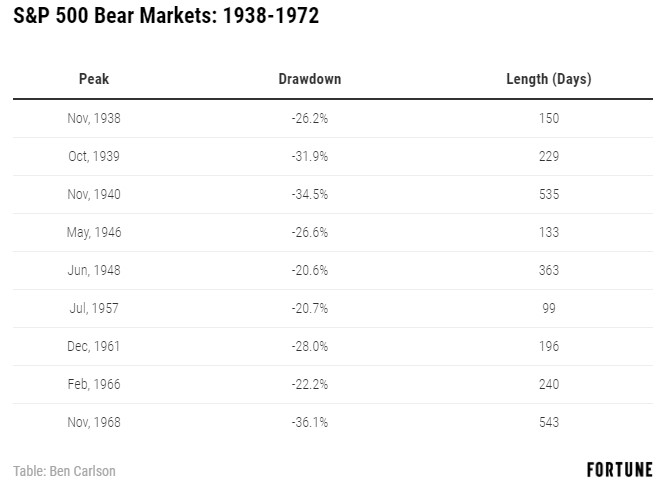

How to deal with the inevitability of stock market crashes.

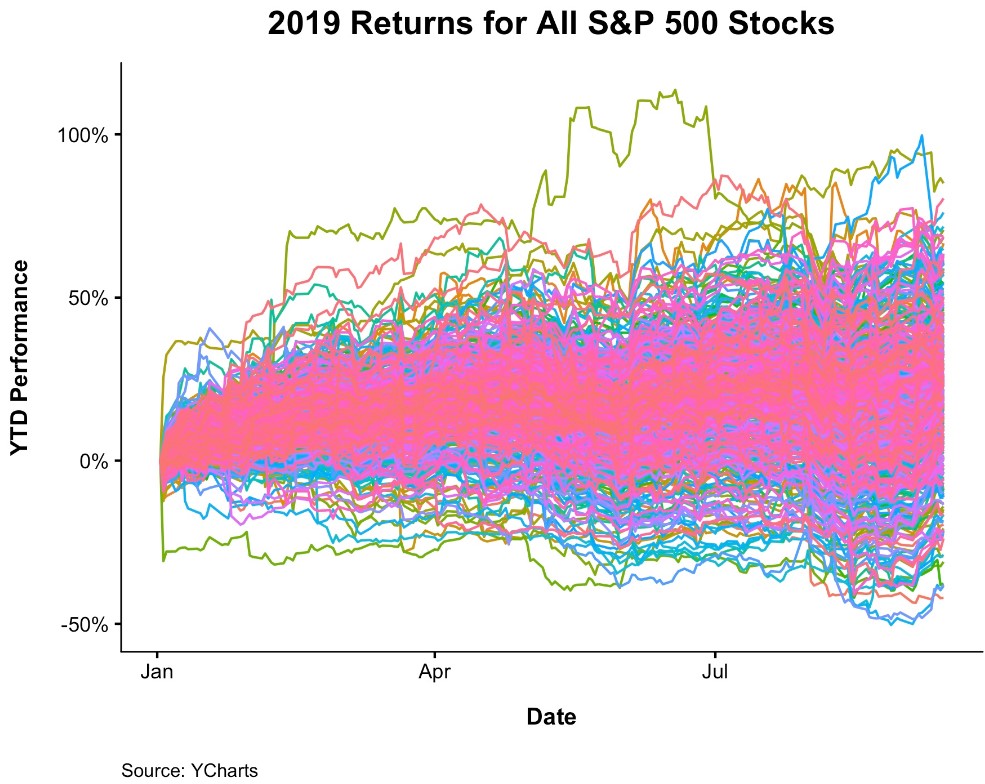

On a total return basis, the S&P 500 is up almost 22% on the year.1 To state the obvious, this means the underlying securities included in the S&P 500 are having a good year as well. But there’s still a wide range in outcomes for the performance of the individual stocks in the S&P. For…

Everyone lives in a relative world when it comes to money and buying stuff.