Michael and Ben discuss the death of the 60/40 (again), QE forever, Paul Rudd and much more.

Michael and Ben discuss the death of the 60/40 (again), QE forever, Paul Rudd and much more.

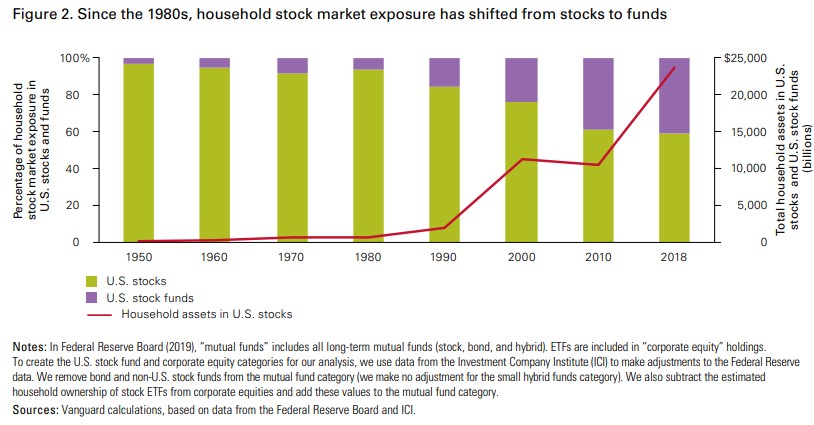

Why this cycle’s IPO class is nothing like the dot-com bubble.

Some random questions I’ve been thinking about lately.

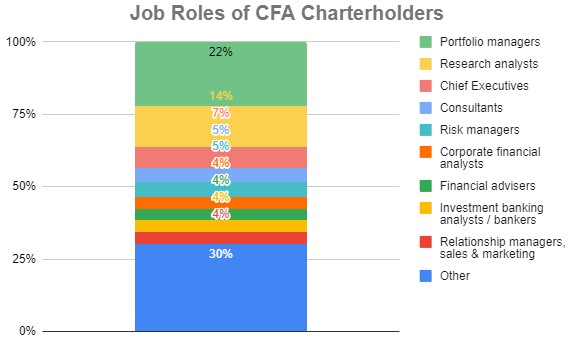

A podcast listener asks: What do you think the future looks like for people with the CFA designation/skillset? We’re hearing constantly that the investment management function is becoming commoditized. As a 30-year-old charterholder, it’s disheartening to not know where I fit in our industry. I’m effectively being let go from the small RIA I work…

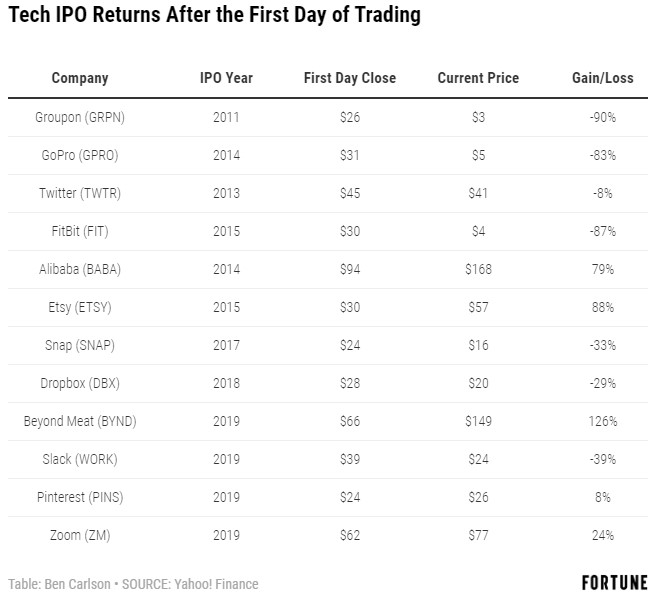

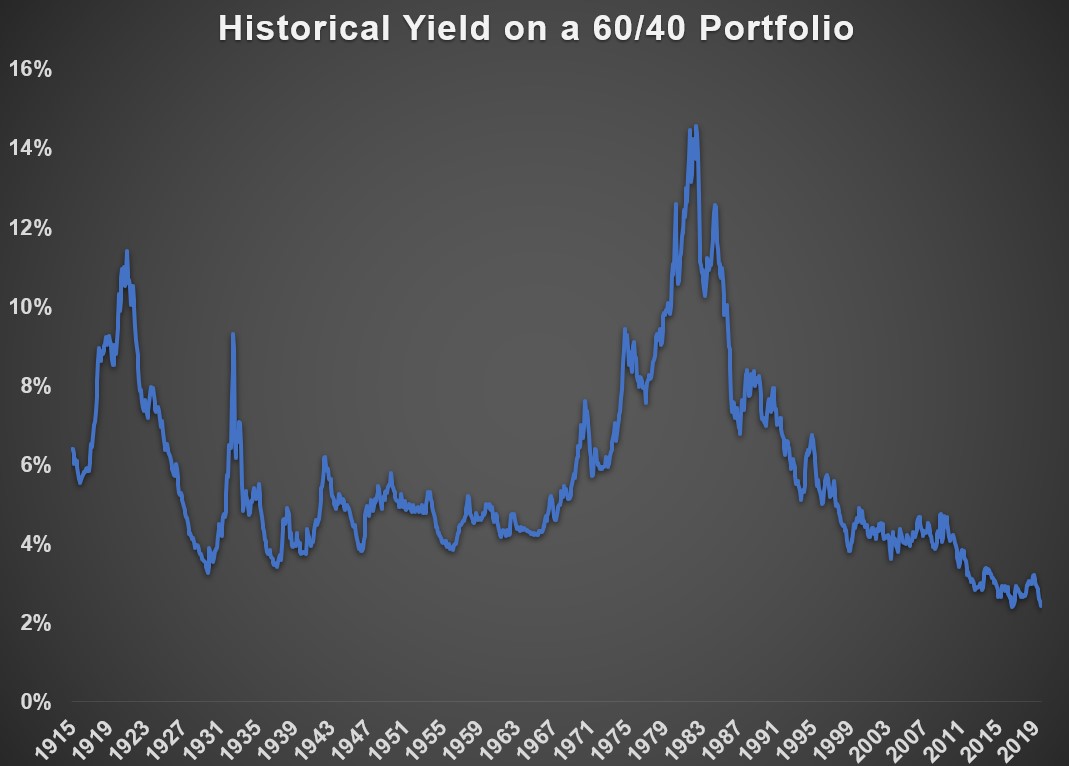

The 60/40 portfolio passed away on October 16, 2019, from complications of low interest rates and a bad case of Fed manipulation. This is the 27th time 60/40 has died in the past decade but enemies market timing, day traders, and alternative investments are hopeful it will stick this time around. 60/40 was 91 years…

Michael & Ben discuss the streaming wars, the NBA-China kerfuffle, what a CFA means today and much more.

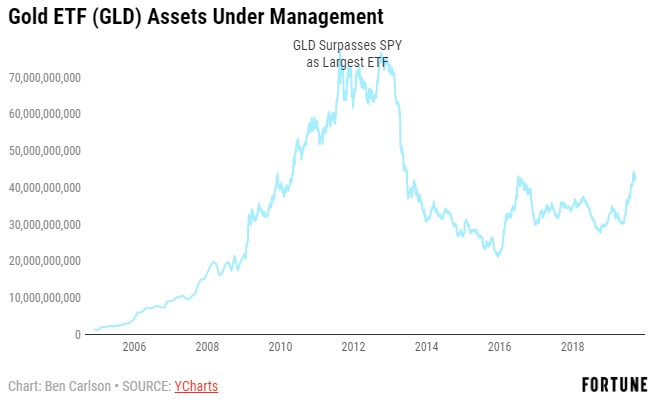

When performance causes outsized flows into and out of funds.

On this edition of Re-Kindled, we re-read Malcolm Gladwell’s first two books, Tipping Point and Blink. We discuss: Why is there so much backlash against Gladwell The rise of pop psychology Why has Sesame Street been so popular for so long? What causes ideas to spread like wildfire? The big investor who had money with Bernie Madoff…

Business plans that sound ridiculous until you realize how well they worked in real life.

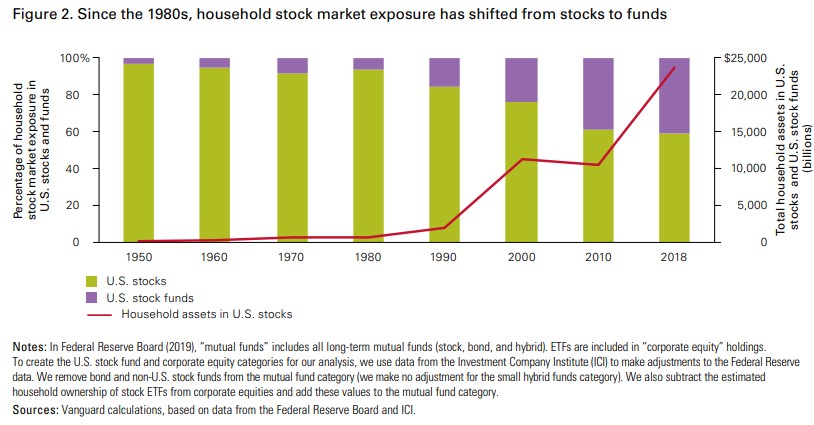

Why we’re unlikely to see many new stock market wizards in the coming decades.