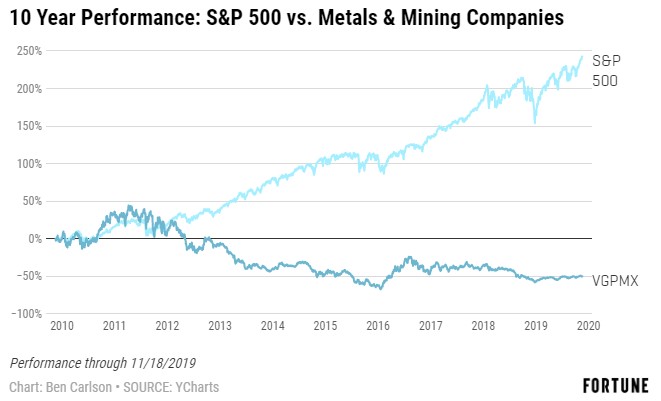

It seems like everything is up over the past 10 years or so but there have been a number of market segments that have been left behind by this bull market.

It seems like everything is up over the past 10 years or so but there have been a number of market segments that have been left behind by this bull market.

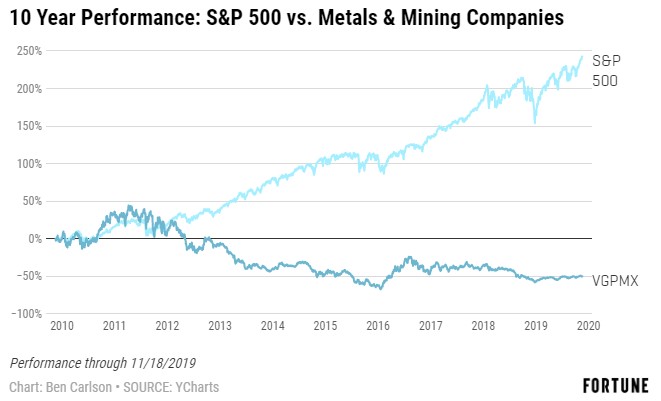

Michael and Ben talk with Will Rhind and David Barse about their new ETF that seeks to screen out the biggest losers in the S&P 500.

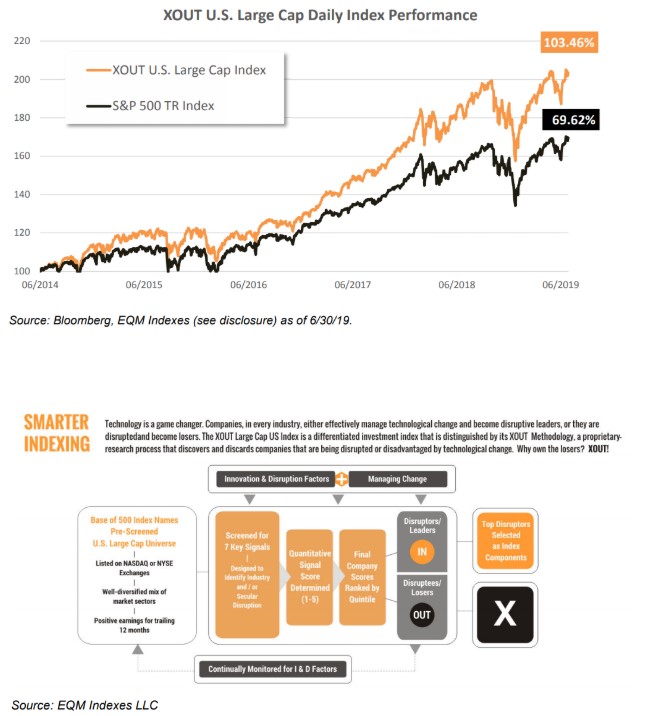

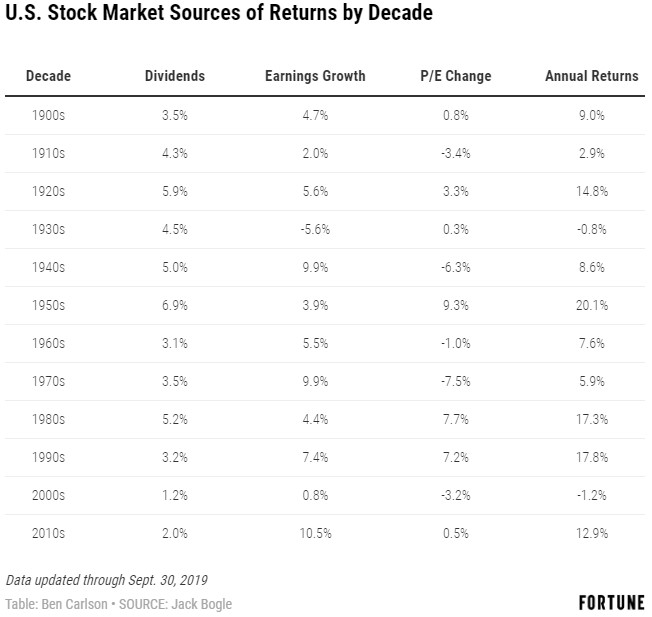

How much have fundamentals driven the bull market in stocks?

Before my oldest entered kindergarten this fall, we had 3 children going to daycare for a year-and-a-half or so. Our twins still have a few years to go. The monthly bill was higher than our mortgage payment (including property taxes). Luckily, my wife and I love our daycare. Our kids love going and playing with…

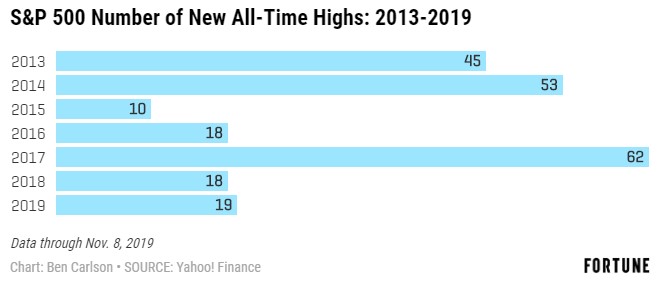

New all-time highs aren’t something to fear in the stock market.

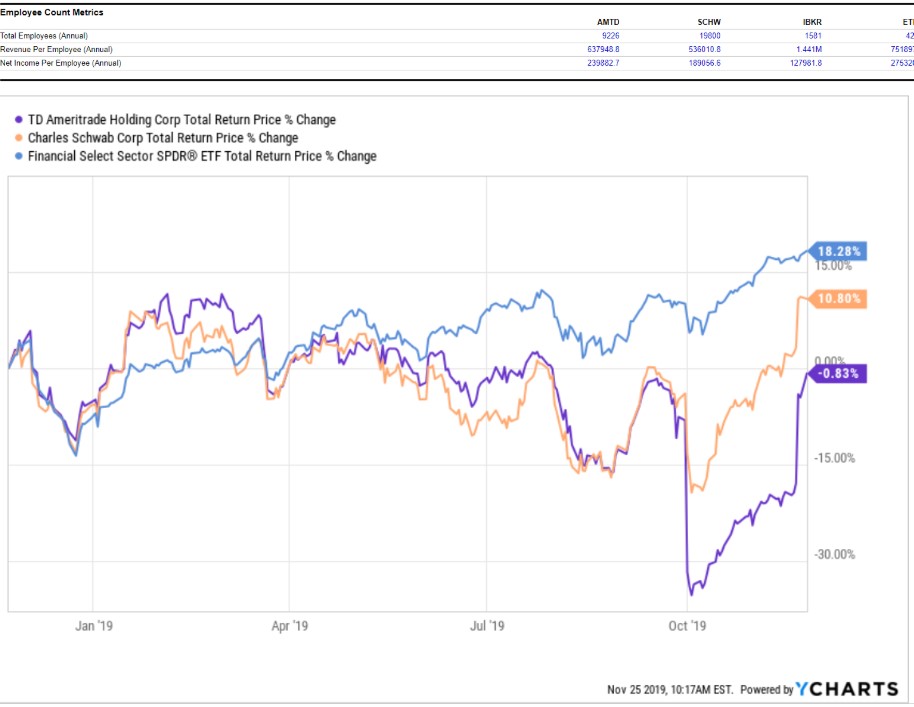

This week’s Animal Spirits with Michael & Ben is supported by YCharts: Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service. We discuss: The Charles Schwab-TD Ameritrade deal Did Robinhood completely change the landscape in asset management? The Robloncho and the Cybertruck How to crack the retirement income problem…

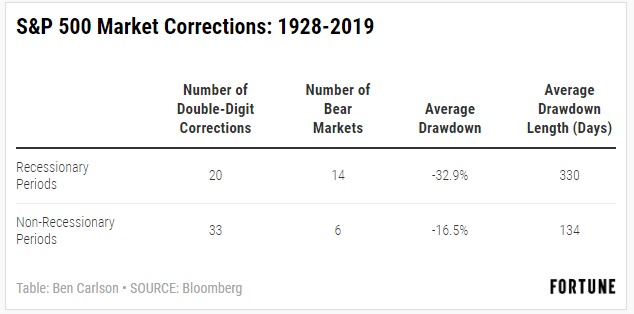

The stock market doesn’t need a recession for a large correction.

Ben & Michael chat with Wes Gray & Jack Vogel from Alpha Architect about their thoughts on value and momentum investing strategies.

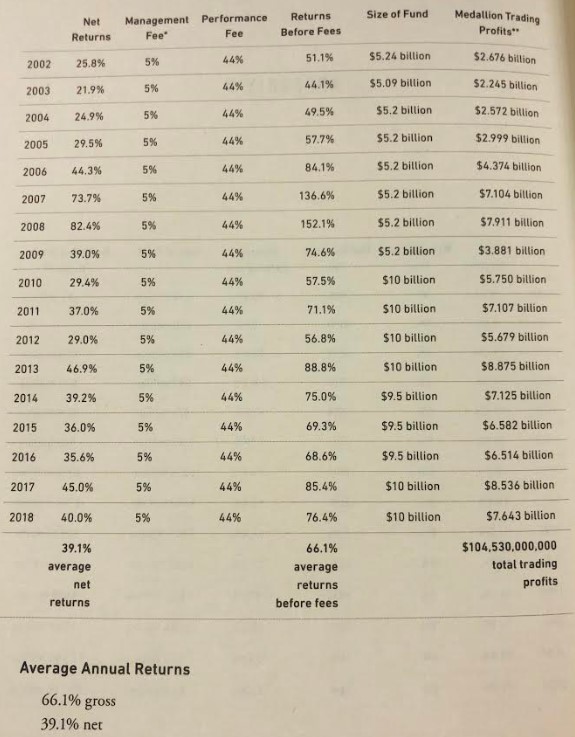

My picks for the greatest investors of all-time.

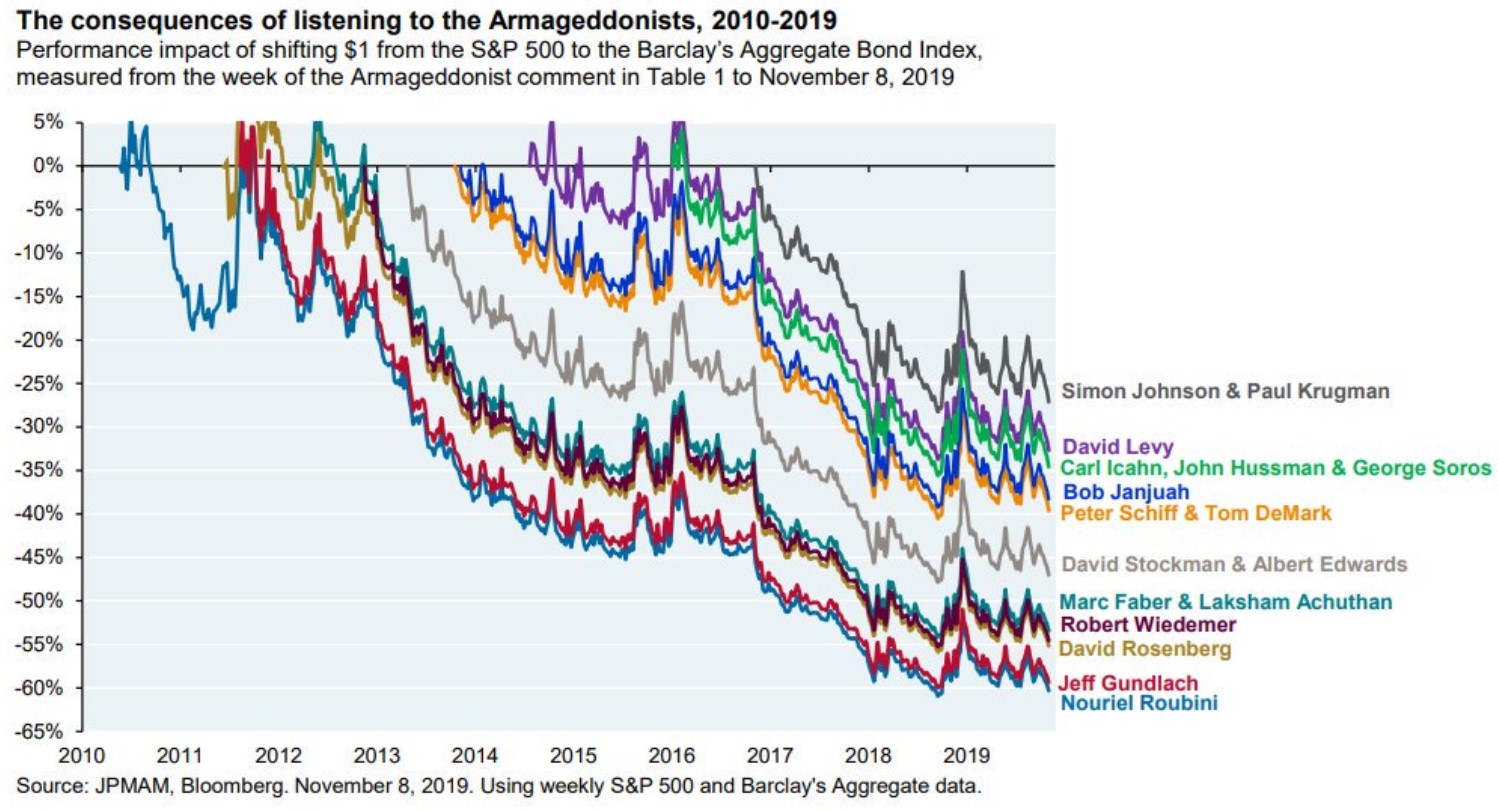

Understanding the motivations behind market crash predictions.