Michael and Ben discuss craziness in the oil market and more.

Michael and Ben discuss craziness in the oil market and more.

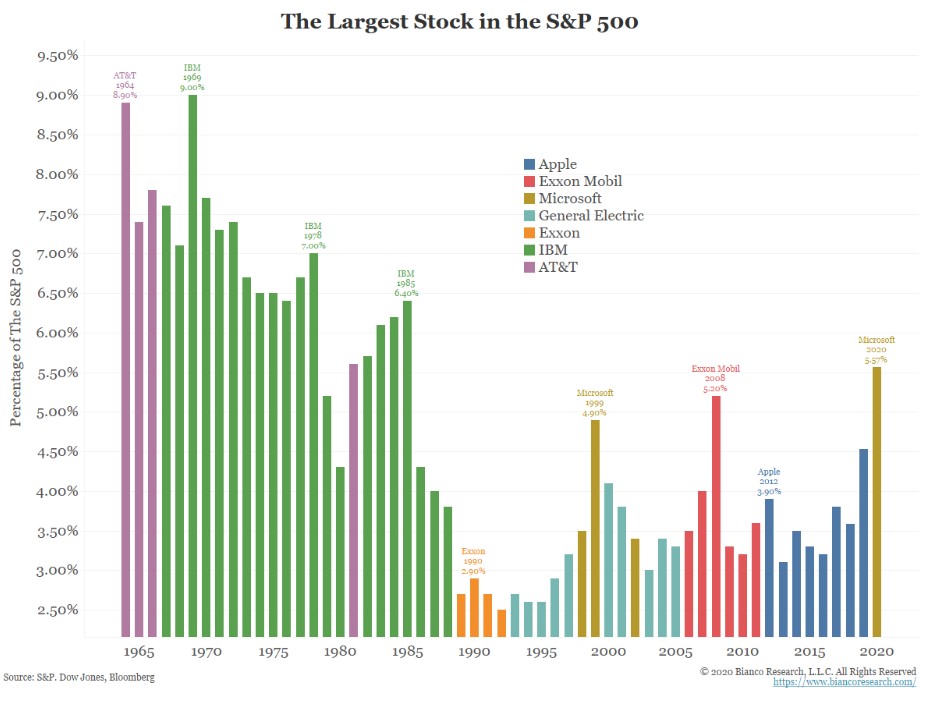

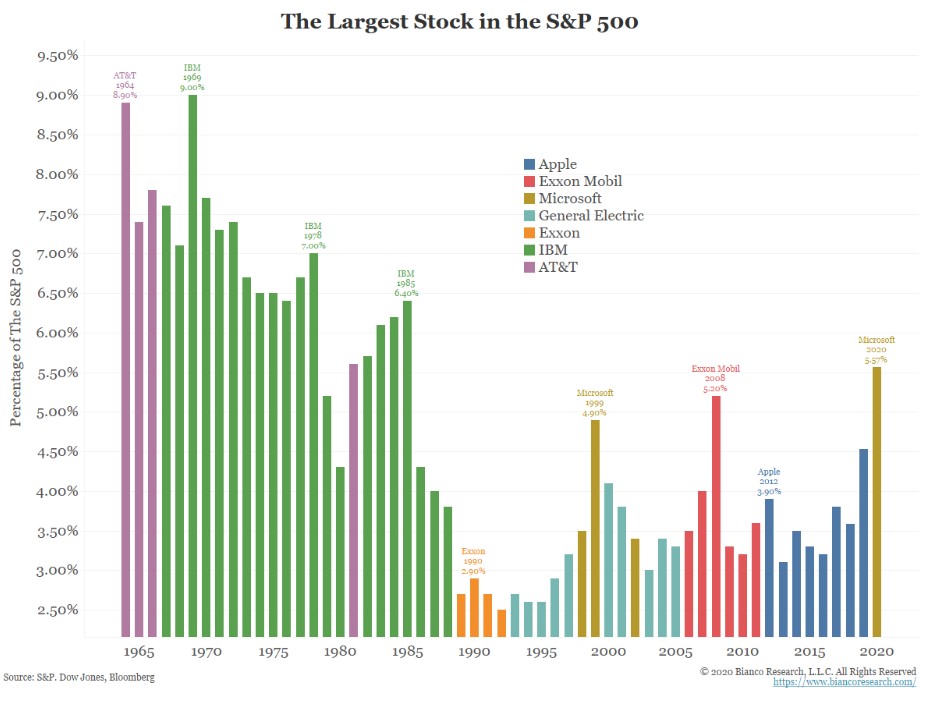

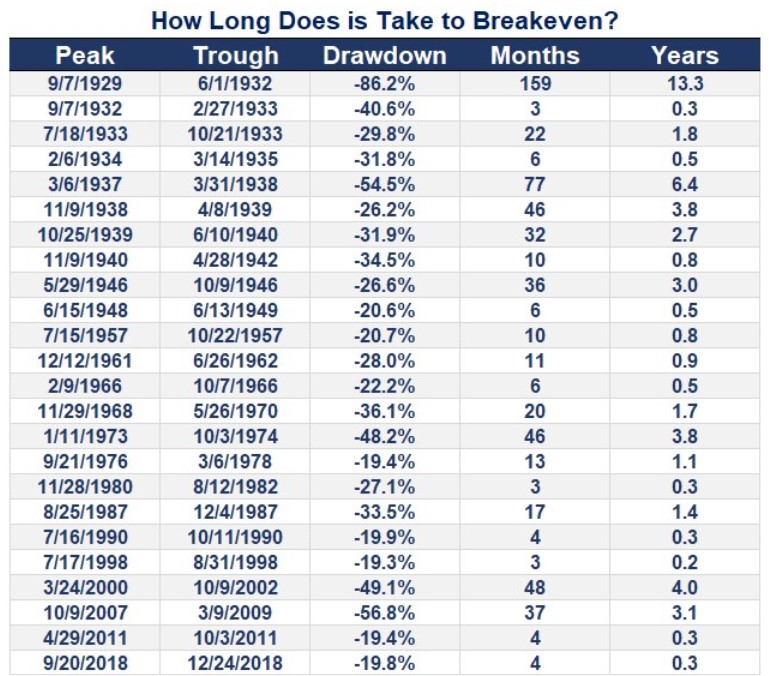

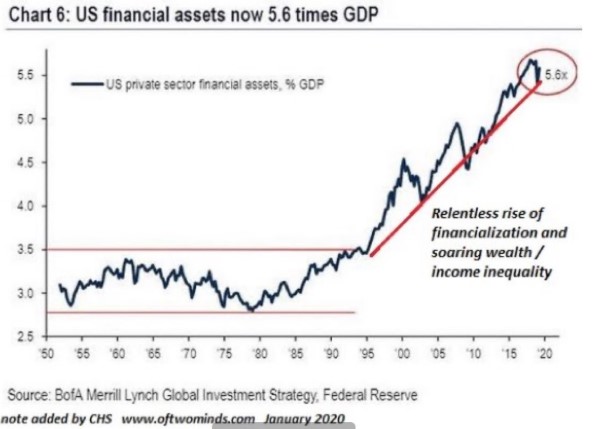

How the energy sector fell from prominence.

What are your options for putting cash to work during a bear market?

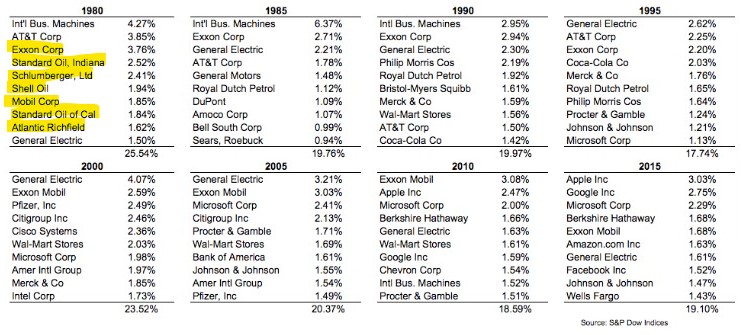

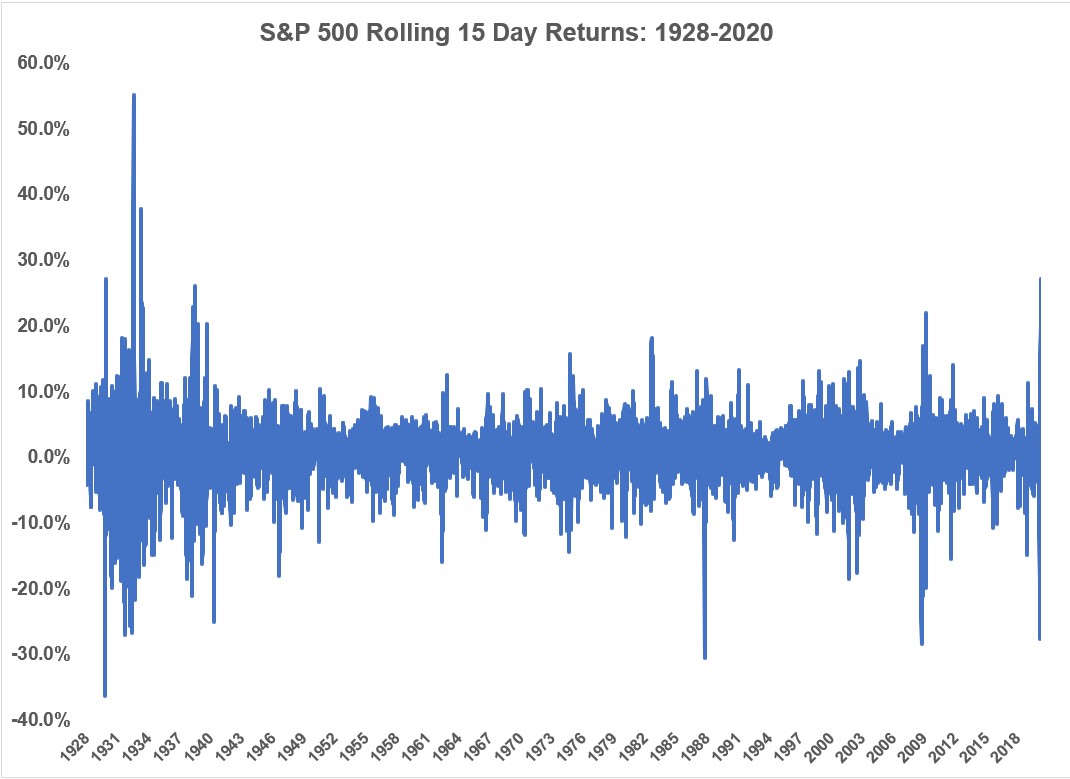

This market is looking more and more like the 1930s.

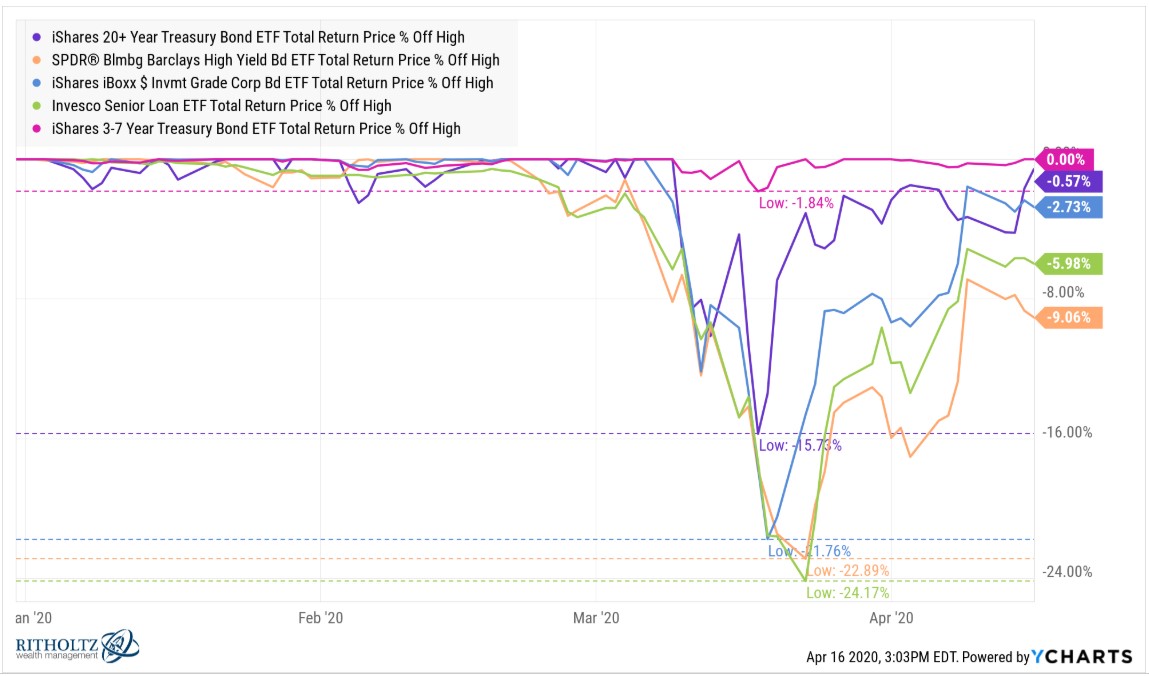

Risk and return when chasing yield.

Show number 3 this week. Thank you for sticking with us. We discuss: Will we get inflation or deflation from this crisis? When will you feel safe to fly again? How about a restaurant? Why life is going to be weird for a while The economy is going to be operating at partial capacity for…

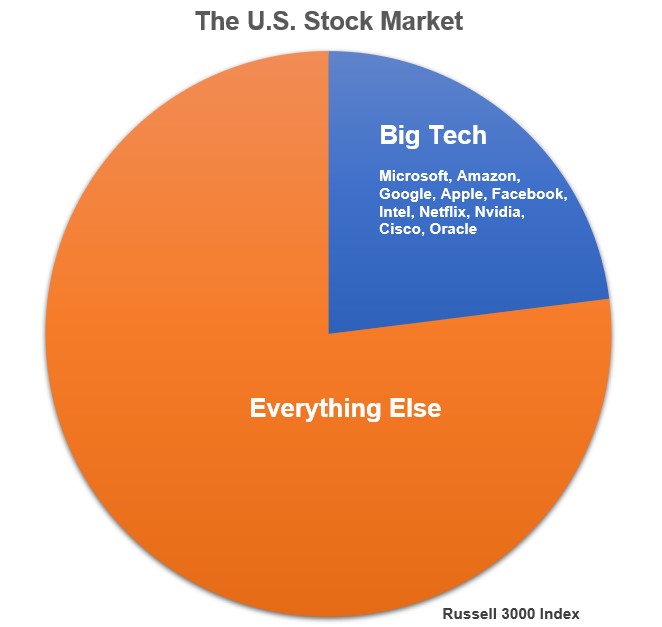

Why tech is the most important sector in the stock market right now.

Some thoughts on personal finances during the corona crisis.

This week’s Animal Spirits with Michael & Ben is supported by YCharts: Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service We discuss: When will people feel comfortable going back to Disney? Companies are borrowing like crazy Why the anger from Main Street is justified Why stories stick with…

Finding the right benchmarks in life.